SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A new polls shows that the Republicans' proposed tax plan, which includes tax cuts for big businesses and wealthy individuals, is opposed by voters across the political spectrum. (Photo: Yuri Keegstra/Flickr/cc)

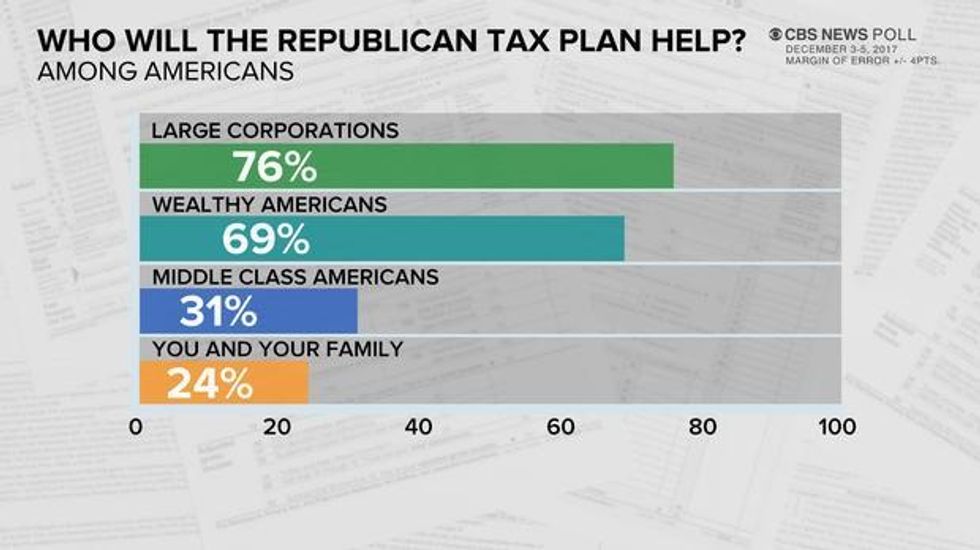

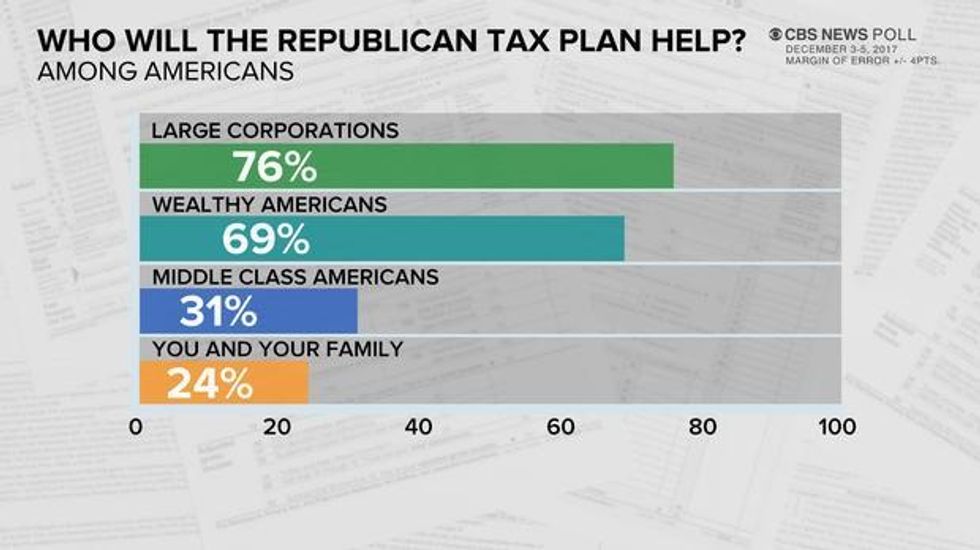

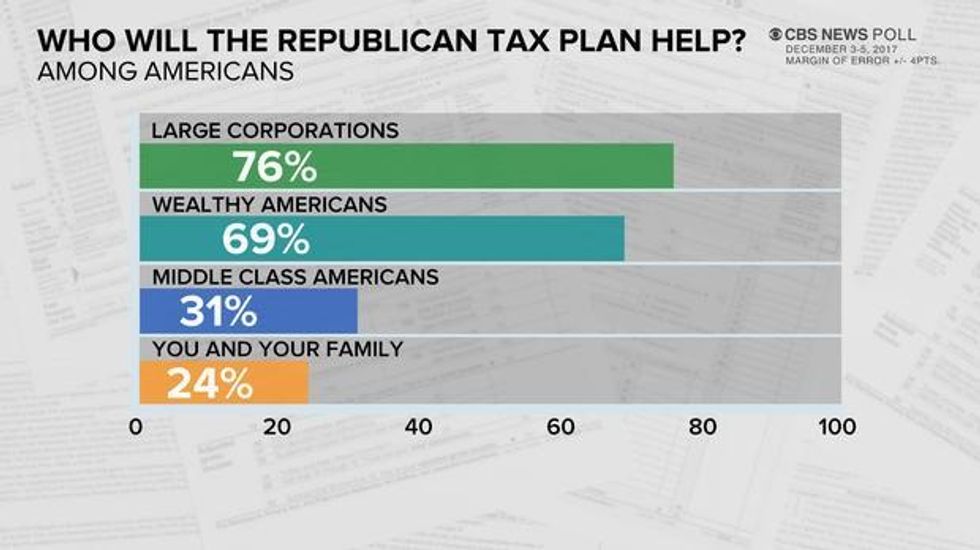

A CBS News poll published Thursday found that the GOP tax plan is widely opposed by Americans across the political spectrum, and even Republican voters believe the plan will primarily benefit large corporations and wealthy Americans, as critics and an analysis from the Congressional Budget Office (CBO) have warned amid national protests against the proposed legislation.

The new poll (pdf) found that the majority of Americans disapprove of the tax plan, and 76 percent--70 percent of Republicans, 86 percent of Democrats, and 73 percent of Independents--believe it will benefit large corporations. Additionally, 69 percent of respondents believe the plan is designed to help wealthy Americans, 66 percent believe it will help Wall Street investors, and 64 believe it will help large political donors.

Only a third of all respondents believe the plan will help small businesses and middle-class Americans, and improve the economy.

The findings reflect a Quinnipiac University poll released on Tuesday that found, as Common Dreams reported, that 53 percent of Americans disapprove of the plan, while just 29 percent support it.

A contentious component of the GOP tax plan has been lawmakers' efforts to target key provisions of the Affordable Care Act (ACA), the Obama-era law that governs the national healthcare system, and which Republicans have continuously sought to destroy through failed legislative attacks.

Both the House and Senate versions of the GOP tax bill propose repealing the ACA's individual mandate, which is meant to help keep the costs of health insurance low by requiring all Americans to maintain coverage or pay a tax penalty. The CBO estimates the repeal would cause 13 million people to lose their coverage over the next decade.

Of those survey, nearly 70 percent of respondents--62 percent of Republicans, 72 percent of Democrats, and 67 percent of Independents--said they think the ACA should be "kept separate" from the tax plan.

Additionally, 61 percent of total respondents reported they believe the plan will lead to cuts in benefits for Medicare and Social Security recipients. As Common Dreams reported Wednesday, Republican leaders have been vocal about using their tax plan to justify deep cuts to social programs, motivating progressive groups and activists to raise alarms about the coming "onslaught" against the federal safety net.

The Senate approved its version of the bill overnight on Saturday, but the two bodies of Congress must still reconcile their two versions in a conference committee that formed on Monday. Nine Republicans and five Democrats from the House have been named to the panel, and the Senate is expected to announce its panel members this week. GOP leaders aim to send a tax bill to the White House for final approval before the end of the year.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

A CBS News poll published Thursday found that the GOP tax plan is widely opposed by Americans across the political spectrum, and even Republican voters believe the plan will primarily benefit large corporations and wealthy Americans, as critics and an analysis from the Congressional Budget Office (CBO) have warned amid national protests against the proposed legislation.

The new poll (pdf) found that the majority of Americans disapprove of the tax plan, and 76 percent--70 percent of Republicans, 86 percent of Democrats, and 73 percent of Independents--believe it will benefit large corporations. Additionally, 69 percent of respondents believe the plan is designed to help wealthy Americans, 66 percent believe it will help Wall Street investors, and 64 believe it will help large political donors.

Only a third of all respondents believe the plan will help small businesses and middle-class Americans, and improve the economy.

The findings reflect a Quinnipiac University poll released on Tuesday that found, as Common Dreams reported, that 53 percent of Americans disapprove of the plan, while just 29 percent support it.

A contentious component of the GOP tax plan has been lawmakers' efforts to target key provisions of the Affordable Care Act (ACA), the Obama-era law that governs the national healthcare system, and which Republicans have continuously sought to destroy through failed legislative attacks.

Both the House and Senate versions of the GOP tax bill propose repealing the ACA's individual mandate, which is meant to help keep the costs of health insurance low by requiring all Americans to maintain coverage or pay a tax penalty. The CBO estimates the repeal would cause 13 million people to lose their coverage over the next decade.

Of those survey, nearly 70 percent of respondents--62 percent of Republicans, 72 percent of Democrats, and 67 percent of Independents--said they think the ACA should be "kept separate" from the tax plan.

Additionally, 61 percent of total respondents reported they believe the plan will lead to cuts in benefits for Medicare and Social Security recipients. As Common Dreams reported Wednesday, Republican leaders have been vocal about using their tax plan to justify deep cuts to social programs, motivating progressive groups and activists to raise alarms about the coming "onslaught" against the federal safety net.

The Senate approved its version of the bill overnight on Saturday, but the two bodies of Congress must still reconcile their two versions in a conference committee that formed on Monday. Nine Republicans and five Democrats from the House have been named to the panel, and the Senate is expected to announce its panel members this week. GOP leaders aim to send a tax bill to the White House for final approval before the end of the year.

A CBS News poll published Thursday found that the GOP tax plan is widely opposed by Americans across the political spectrum, and even Republican voters believe the plan will primarily benefit large corporations and wealthy Americans, as critics and an analysis from the Congressional Budget Office (CBO) have warned amid national protests against the proposed legislation.

The new poll (pdf) found that the majority of Americans disapprove of the tax plan, and 76 percent--70 percent of Republicans, 86 percent of Democrats, and 73 percent of Independents--believe it will benefit large corporations. Additionally, 69 percent of respondents believe the plan is designed to help wealthy Americans, 66 percent believe it will help Wall Street investors, and 64 believe it will help large political donors.

Only a third of all respondents believe the plan will help small businesses and middle-class Americans, and improve the economy.

The findings reflect a Quinnipiac University poll released on Tuesday that found, as Common Dreams reported, that 53 percent of Americans disapprove of the plan, while just 29 percent support it.

A contentious component of the GOP tax plan has been lawmakers' efforts to target key provisions of the Affordable Care Act (ACA), the Obama-era law that governs the national healthcare system, and which Republicans have continuously sought to destroy through failed legislative attacks.

Both the House and Senate versions of the GOP tax bill propose repealing the ACA's individual mandate, which is meant to help keep the costs of health insurance low by requiring all Americans to maintain coverage or pay a tax penalty. The CBO estimates the repeal would cause 13 million people to lose their coverage over the next decade.

Of those survey, nearly 70 percent of respondents--62 percent of Republicans, 72 percent of Democrats, and 67 percent of Independents--said they think the ACA should be "kept separate" from the tax plan.

Additionally, 61 percent of total respondents reported they believe the plan will lead to cuts in benefits for Medicare and Social Security recipients. As Common Dreams reported Wednesday, Republican leaders have been vocal about using their tax plan to justify deep cuts to social programs, motivating progressive groups and activists to raise alarms about the coming "onslaught" against the federal safety net.

The Senate approved its version of the bill overnight on Saturday, but the two bodies of Congress must still reconcile their two versions in a conference committee that formed on Monday. Nine Republicans and five Democrats from the House have been named to the panel, and the Senate is expected to announce its panel members this week. GOP leaders aim to send a tax bill to the White House for final approval before the end of the year.