SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

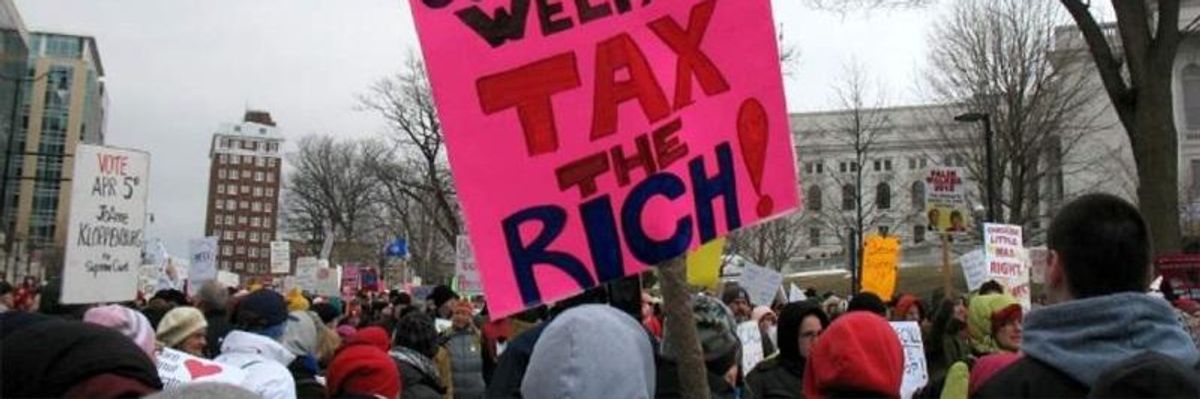

Careful analysis reveals a number of excellent arguments for the implementation of a Universal Basic Income (UBI). (Photo: Yuri Keegstra/Flickr/cc)

As 2022 comes to a close, it's time to reflect on the year behind us, and set goals for the year ahead. As state lawmakers, there's no shortage of dreams and aspirations we have for the communities we are honored to serve. But there is one New Year's Resolution that all states and political parties can get behind that would benefit all our constituents: ending corporate tax giveaways.

Working people are struggling to pay their bills, small businesses are fighting to keep their doors open, inflation remains high and public agencies are struggling to meet the needs of our communities.

Corporate tax giveaways come in various forms, including corporate incentives, subsidies, tax breaks, and tax loopholes. They are often written by and for the corporations that make the biggest campaign contributions or employ the most expensive roster of lobbyists, and often approved behind closed doors, via secret deals the public doesn't know about. While proponents claim they create and maintain jobs, years of data show that corporate tax giveaways are an expensive, inefficient and ineffective use of taxpayer dollars to create and maintain jobs.

In fact, research from the American Economic Liberties Project found that incentives disproportionately benefit big corporations, giving them an advantage over small, local businesses that don't receive the same level of state support. A 2015 study of incentives in 14 states found that 90 percent of the money went to large corporations. These unaccountable corporations continue to reap the profits from our tax dollars, while robbing the state of money needed for investments in services that everyday people need, like attainable housing, mass transportation, healthcare and early childhood education.

Unfortunately, state lawmakers across the country face a prisoners' dilemma. We feel forced to participate in corporate giveaways because nearly every state does. States are pitted against each other by multinational corporations seeking the biggest tax giveaways. As Good Jobs First reports, Kansas' $800M megadeal with Panasonic and Georgia's $1.5 subsidy package are just two examples, but these deals are everywhere. Negotiations are also often kept secret, keeping the public in the dark until the contract is signed. Without tax transparency, we don't even have the data to make informed decisions for our constituents.

These are policy choices, and state legislatures have the power to make a new choice in 2023. That's why we are proud to work with partner organizations like State Innovation Exchange (SiX), putting forward people-centered policy solutions. Policies that stop secret deals with corporate donors, repeal tax incentives that don't deliver on promises for workers, and ensure corporations play by the same rules we do, and actually pay the taxes they owe.

Working people are struggling to pay their bills, small businesses are fighting to keep their doors open, inflation remains high and public agencies are struggling to meet the needs of our communities. Our constituents have a right to a state that works for them, not unaccountable corporate donors. One of the ways we can do that is by eliminating wasteful corporate tax breaks that do nothing but pad the profits of politically influential corporations and instead use our tax dollars to invest in our communities. We're committed to this New Year's Resolution. We invite state lawmakers across the country to join us in this goal.

Donald Trump’s attacks on democracy, justice, and a free press are escalating — putting everything we stand for at risk. We believe a better world is possible, but we can’t get there without your support. Common Dreams stands apart. We answer only to you — our readers, activists, and changemakers — not to billionaires or corporations. Our independence allows us to cover the vital stories that others won’t, spotlighting movements for peace, equality, and human rights. Right now, our work faces unprecedented challenges. Misinformation is spreading, journalists are under attack, and financial pressures are mounting. As a reader-supported, nonprofit newsroom, your support is crucial to keep this journalism alive. Whatever you can give — $10, $25, or $100 — helps us stay strong and responsive when the world needs us most. Together, we’ll continue to build the independent, courageous journalism our movement relies on. Thank you for being part of this community. |

As 2022 comes to a close, it's time to reflect on the year behind us, and set goals for the year ahead. As state lawmakers, there's no shortage of dreams and aspirations we have for the communities we are honored to serve. But there is one New Year's Resolution that all states and political parties can get behind that would benefit all our constituents: ending corporate tax giveaways.

Working people are struggling to pay their bills, small businesses are fighting to keep their doors open, inflation remains high and public agencies are struggling to meet the needs of our communities.

Corporate tax giveaways come in various forms, including corporate incentives, subsidies, tax breaks, and tax loopholes. They are often written by and for the corporations that make the biggest campaign contributions or employ the most expensive roster of lobbyists, and often approved behind closed doors, via secret deals the public doesn't know about. While proponents claim they create and maintain jobs, years of data show that corporate tax giveaways are an expensive, inefficient and ineffective use of taxpayer dollars to create and maintain jobs.

In fact, research from the American Economic Liberties Project found that incentives disproportionately benefit big corporations, giving them an advantage over small, local businesses that don't receive the same level of state support. A 2015 study of incentives in 14 states found that 90 percent of the money went to large corporations. These unaccountable corporations continue to reap the profits from our tax dollars, while robbing the state of money needed for investments in services that everyday people need, like attainable housing, mass transportation, healthcare and early childhood education.

Unfortunately, state lawmakers across the country face a prisoners' dilemma. We feel forced to participate in corporate giveaways because nearly every state does. States are pitted against each other by multinational corporations seeking the biggest tax giveaways. As Good Jobs First reports, Kansas' $800M megadeal with Panasonic and Georgia's $1.5 subsidy package are just two examples, but these deals are everywhere. Negotiations are also often kept secret, keeping the public in the dark until the contract is signed. Without tax transparency, we don't even have the data to make informed decisions for our constituents.

These are policy choices, and state legislatures have the power to make a new choice in 2023. That's why we are proud to work with partner organizations like State Innovation Exchange (SiX), putting forward people-centered policy solutions. Policies that stop secret deals with corporate donors, repeal tax incentives that don't deliver on promises for workers, and ensure corporations play by the same rules we do, and actually pay the taxes they owe.

Working people are struggling to pay their bills, small businesses are fighting to keep their doors open, inflation remains high and public agencies are struggling to meet the needs of our communities. Our constituents have a right to a state that works for them, not unaccountable corporate donors. One of the ways we can do that is by eliminating wasteful corporate tax breaks that do nothing but pad the profits of politically influential corporations and instead use our tax dollars to invest in our communities. We're committed to this New Year's Resolution. We invite state lawmakers across the country to join us in this goal.

As 2022 comes to a close, it's time to reflect on the year behind us, and set goals for the year ahead. As state lawmakers, there's no shortage of dreams and aspirations we have for the communities we are honored to serve. But there is one New Year's Resolution that all states and political parties can get behind that would benefit all our constituents: ending corporate tax giveaways.

Working people are struggling to pay their bills, small businesses are fighting to keep their doors open, inflation remains high and public agencies are struggling to meet the needs of our communities.

Corporate tax giveaways come in various forms, including corporate incentives, subsidies, tax breaks, and tax loopholes. They are often written by and for the corporations that make the biggest campaign contributions or employ the most expensive roster of lobbyists, and often approved behind closed doors, via secret deals the public doesn't know about. While proponents claim they create and maintain jobs, years of data show that corporate tax giveaways are an expensive, inefficient and ineffective use of taxpayer dollars to create and maintain jobs.

In fact, research from the American Economic Liberties Project found that incentives disproportionately benefit big corporations, giving them an advantage over small, local businesses that don't receive the same level of state support. A 2015 study of incentives in 14 states found that 90 percent of the money went to large corporations. These unaccountable corporations continue to reap the profits from our tax dollars, while robbing the state of money needed for investments in services that everyday people need, like attainable housing, mass transportation, healthcare and early childhood education.

Unfortunately, state lawmakers across the country face a prisoners' dilemma. We feel forced to participate in corporate giveaways because nearly every state does. States are pitted against each other by multinational corporations seeking the biggest tax giveaways. As Good Jobs First reports, Kansas' $800M megadeal with Panasonic and Georgia's $1.5 subsidy package are just two examples, but these deals are everywhere. Negotiations are also often kept secret, keeping the public in the dark until the contract is signed. Without tax transparency, we don't even have the data to make informed decisions for our constituents.

These are policy choices, and state legislatures have the power to make a new choice in 2023. That's why we are proud to work with partner organizations like State Innovation Exchange (SiX), putting forward people-centered policy solutions. Policies that stop secret deals with corporate donors, repeal tax incentives that don't deliver on promises for workers, and ensure corporations play by the same rules we do, and actually pay the taxes they owe.

Working people are struggling to pay their bills, small businesses are fighting to keep their doors open, inflation remains high and public agencies are struggling to meet the needs of our communities. Our constituents have a right to a state that works for them, not unaccountable corporate donors. One of the ways we can do that is by eliminating wasteful corporate tax breaks that do nothing but pad the profits of politically influential corporations and instead use our tax dollars to invest in our communities. We're committed to this New Year's Resolution. We invite state lawmakers across the country to join us in this goal.