SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

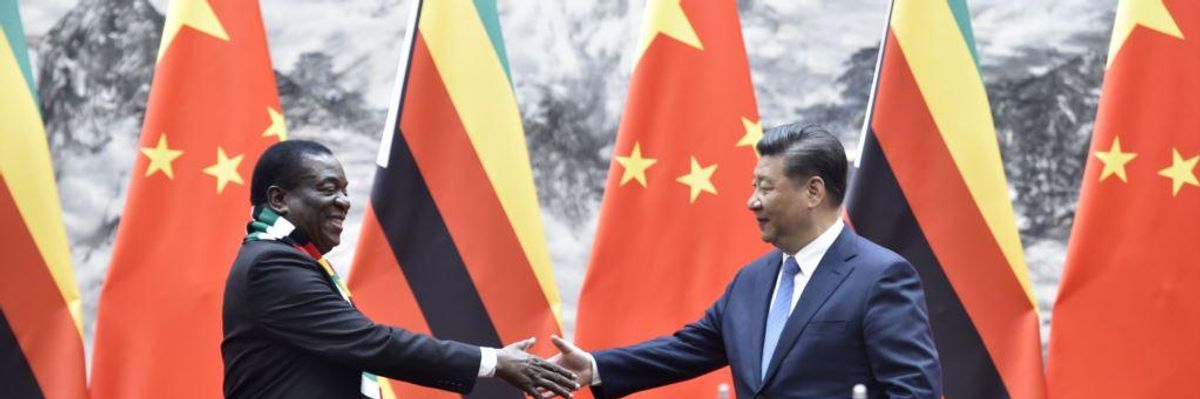

It's high time African governments start to implement policies that favor the well-being of their people first before pleasing the Money Masters. (Photo: AP)

Zimbabwean President Emmerson Mnangagwa has had to cut his holiday vacation short to try to resolve an escalating strike among doctors at public hospitals over low pay and medical supply shortages. Now entering its second month, the strike comes as the government pursues a short-sighted effort to improve its reputation among international creditors by slashing public spending.

After 37 years of former President Robert Mugabe's iron fist rule, Zimbabwe's government is now rolling out the welcome mat for foreign investors -- particularly for China. While President Trump has his "Make America Great Again" slogan, Mnangagwa, who became president of this southern African country in 2017, is using the theme "Zimbabwe is open for business."

What that means in policy terms is severe austerity measures that hit the poor hardest in a country already reeling from skyrocketing poverty and unemployment.

What that means in policy terms is severe austerity measures that hit the poor hardest in a country already reeling from skyrocketing poverty and unemployment. And if the experiences of other countries are any guide, this approach will reduce, rather than increase the country's ability to repay foreign debts or resolve its current financial crisis.

In November, Zimbabwe's finance minister, Mthuli Ncube, announced the annual budget, which he summarized with the dissonant phrase "austerity for prosperity." He began his speech by quoting the 19th century British philosopher John Stuart Mill: "I have learned to seek my happiness by limiting my desires, rather than in attempting to satisfy them." This was an attempt to build rationale for cutting expenditure on most sectors of the economy.

Even prior to his speech, Ncube had begun implementing austerity, with his most unpopular move being the imposition of a 2 percent tax on electronic money transactions. Almost every Zimbabwean pays with mobile money, debit card, or by bank transfer because of a cash shortage tied to a spiraling trade deficit.

Ncube, just like most African policymakers who have gone the austerity route, believes that this will attract foreign investment, particularly from China, which is now considered a savior of Africa. This, he hopes, will help alleviate the financial crisis and open the market for international trade relations that will bring a much-needed foreign currency injection to boost failing local industries.

Small African countries like Zimbabwe risk being entangled in China's debt trap -- owing more than they can pay back in reasonable time.

Since 2010, China has invested US$10 billion in Zimbabwe, which is a meager slice of the US$230 billion invested in the rest of sub-Saharan Africa in the same period. According to the International Monetary Fund, Zimbabwe has one of the world's most fragile economies (probably the worst for a country without any wars or devastating natural disasters). It has external debts of US$9 billion -- more than half the size of the nation's GDP -- and needs more than US$15 billion for an immediate economic revival.

With western countries and investors wary of investing in Zimbabwe without massive restrictions and pre-conditions that the country looks unlikely to meet, China is the only global powerhouse willing to throw a bone, supposedly with "no strings attached."

Last year, a meeting between Mnangagwa and China's President Xi Jinping ended in a promise to write off Zimbabwe's debt to China, which had been accrued under former President Mugabe's rule. With the recent announcement by Xi Jinping that China will invest US$60 billion in Africa, one can begin to connect the dots that Ncube's fiscal policy is a clean-up act to attract more loans and investment by showing a commitment to paying back the money.

In fact, this is a game being played by almost all African nations. The Scramble for China is on, with countries competing for the biggest slice of China's cake. Last September twice as many African leaders attended the China-Africa cooperation summit in Beijing as the last UN general assembly.

Austerity policies reek of the neo-liberalism that the World Bank and IMF forced upon global south countries in the early 1980s in the form of structural adjustments and unequal free market policies.

The austerity measures are a calculated display by the government to show that Zimbabwe, under Mnangagwa's leadership, is worthy of getting a bigger slice of the Chinese pie because their money will be used efficiently, and this time debts will be paid. But, as several governmental bodies, development organizations, and economic analysts have already warned, small African countries like Zimbabwe risk being entangled in China's debt trap -- owing more than they can pay back in reasonable time.

Some of these warnings are coming from the United States and the EU, which clearly feel threatened by China's growing influence in Africa. But China's role does raise serious questions with not so clear answers. How will China protect its investment? How much will China be involved in ensuring a return on its investment? To what lengths and at whose expense (the public or the government - the rich or the poor), will countries like Zimbabwe go to try and pay back the debt? And with the growing unease, particularly from global north countries, that China is trying to export its labor-intensive industry to Africa, how will these countries protect their sovereignty in the process?

Austerity policies reek of the neo-liberalism that the World Bank and IMF forced upon global south countries in the early 1980s in the form of structural adjustments and unequal free market policies. In fact, Ncube has quoted the late UK Prime Minister Margaret Thatcher, who saw her neoliberal economic policies as the only path, often saying "There Is No Alternative" (TINA).

Small sovereign nations like Zimbabwe need to look at other African countries that have tried the same policies and failed. A wave of anti-austerity protests earlier this year should serve as a warning of how devastating these unpopular policies can be. Protests have resulted in arbitrary detentions in Sudan, violent clashes in Tunisia, and political turmoil in South Africa, Egypt, Kenya, and Gabon.

Yanis Varoufakis, the former Greek minister of finance, knows from his own country's experience that these measures are self-defeating as they not only depress national income but also the government's revenue, therefore making the nation suffer rather than prosper. He calls austerity an "assault on the poor."

It's high time African governments start to implement policies that favor the well-being of their people first before pleasing the Money Masters. An economy that does not improve the lives of its citizens is a poor and failing economy.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Zimbabwean President Emmerson Mnangagwa has had to cut his holiday vacation short to try to resolve an escalating strike among doctors at public hospitals over low pay and medical supply shortages. Now entering its second month, the strike comes as the government pursues a short-sighted effort to improve its reputation among international creditors by slashing public spending.

After 37 years of former President Robert Mugabe's iron fist rule, Zimbabwe's government is now rolling out the welcome mat for foreign investors -- particularly for China. While President Trump has his "Make America Great Again" slogan, Mnangagwa, who became president of this southern African country in 2017, is using the theme "Zimbabwe is open for business."

What that means in policy terms is severe austerity measures that hit the poor hardest in a country already reeling from skyrocketing poverty and unemployment.

What that means in policy terms is severe austerity measures that hit the poor hardest in a country already reeling from skyrocketing poverty and unemployment. And if the experiences of other countries are any guide, this approach will reduce, rather than increase the country's ability to repay foreign debts or resolve its current financial crisis.

In November, Zimbabwe's finance minister, Mthuli Ncube, announced the annual budget, which he summarized with the dissonant phrase "austerity for prosperity." He began his speech by quoting the 19th century British philosopher John Stuart Mill: "I have learned to seek my happiness by limiting my desires, rather than in attempting to satisfy them." This was an attempt to build rationale for cutting expenditure on most sectors of the economy.

Even prior to his speech, Ncube had begun implementing austerity, with his most unpopular move being the imposition of a 2 percent tax on electronic money transactions. Almost every Zimbabwean pays with mobile money, debit card, or by bank transfer because of a cash shortage tied to a spiraling trade deficit.

Ncube, just like most African policymakers who have gone the austerity route, believes that this will attract foreign investment, particularly from China, which is now considered a savior of Africa. This, he hopes, will help alleviate the financial crisis and open the market for international trade relations that will bring a much-needed foreign currency injection to boost failing local industries.

Small African countries like Zimbabwe risk being entangled in China's debt trap -- owing more than they can pay back in reasonable time.

Since 2010, China has invested US$10 billion in Zimbabwe, which is a meager slice of the US$230 billion invested in the rest of sub-Saharan Africa in the same period. According to the International Monetary Fund, Zimbabwe has one of the world's most fragile economies (probably the worst for a country without any wars or devastating natural disasters). It has external debts of US$9 billion -- more than half the size of the nation's GDP -- and needs more than US$15 billion for an immediate economic revival.

With western countries and investors wary of investing in Zimbabwe without massive restrictions and pre-conditions that the country looks unlikely to meet, China is the only global powerhouse willing to throw a bone, supposedly with "no strings attached."

Last year, a meeting between Mnangagwa and China's President Xi Jinping ended in a promise to write off Zimbabwe's debt to China, which had been accrued under former President Mugabe's rule. With the recent announcement by Xi Jinping that China will invest US$60 billion in Africa, one can begin to connect the dots that Ncube's fiscal policy is a clean-up act to attract more loans and investment by showing a commitment to paying back the money.

In fact, this is a game being played by almost all African nations. The Scramble for China is on, with countries competing for the biggest slice of China's cake. Last September twice as many African leaders attended the China-Africa cooperation summit in Beijing as the last UN general assembly.

Austerity policies reek of the neo-liberalism that the World Bank and IMF forced upon global south countries in the early 1980s in the form of structural adjustments and unequal free market policies.

The austerity measures are a calculated display by the government to show that Zimbabwe, under Mnangagwa's leadership, is worthy of getting a bigger slice of the Chinese pie because their money will be used efficiently, and this time debts will be paid. But, as several governmental bodies, development organizations, and economic analysts have already warned, small African countries like Zimbabwe risk being entangled in China's debt trap -- owing more than they can pay back in reasonable time.

Some of these warnings are coming from the United States and the EU, which clearly feel threatened by China's growing influence in Africa. But China's role does raise serious questions with not so clear answers. How will China protect its investment? How much will China be involved in ensuring a return on its investment? To what lengths and at whose expense (the public or the government - the rich or the poor), will countries like Zimbabwe go to try and pay back the debt? And with the growing unease, particularly from global north countries, that China is trying to export its labor-intensive industry to Africa, how will these countries protect their sovereignty in the process?

Austerity policies reek of the neo-liberalism that the World Bank and IMF forced upon global south countries in the early 1980s in the form of structural adjustments and unequal free market policies. In fact, Ncube has quoted the late UK Prime Minister Margaret Thatcher, who saw her neoliberal economic policies as the only path, often saying "There Is No Alternative" (TINA).

Small sovereign nations like Zimbabwe need to look at other African countries that have tried the same policies and failed. A wave of anti-austerity protests earlier this year should serve as a warning of how devastating these unpopular policies can be. Protests have resulted in arbitrary detentions in Sudan, violent clashes in Tunisia, and political turmoil in South Africa, Egypt, Kenya, and Gabon.

Yanis Varoufakis, the former Greek minister of finance, knows from his own country's experience that these measures are self-defeating as they not only depress national income but also the government's revenue, therefore making the nation suffer rather than prosper. He calls austerity an "assault on the poor."

It's high time African governments start to implement policies that favor the well-being of their people first before pleasing the Money Masters. An economy that does not improve the lives of its citizens is a poor and failing economy.

Zimbabwean President Emmerson Mnangagwa has had to cut his holiday vacation short to try to resolve an escalating strike among doctors at public hospitals over low pay and medical supply shortages. Now entering its second month, the strike comes as the government pursues a short-sighted effort to improve its reputation among international creditors by slashing public spending.

After 37 years of former President Robert Mugabe's iron fist rule, Zimbabwe's government is now rolling out the welcome mat for foreign investors -- particularly for China. While President Trump has his "Make America Great Again" slogan, Mnangagwa, who became president of this southern African country in 2017, is using the theme "Zimbabwe is open for business."

What that means in policy terms is severe austerity measures that hit the poor hardest in a country already reeling from skyrocketing poverty and unemployment.

What that means in policy terms is severe austerity measures that hit the poor hardest in a country already reeling from skyrocketing poverty and unemployment. And if the experiences of other countries are any guide, this approach will reduce, rather than increase the country's ability to repay foreign debts or resolve its current financial crisis.

In November, Zimbabwe's finance minister, Mthuli Ncube, announced the annual budget, which he summarized with the dissonant phrase "austerity for prosperity." He began his speech by quoting the 19th century British philosopher John Stuart Mill: "I have learned to seek my happiness by limiting my desires, rather than in attempting to satisfy them." This was an attempt to build rationale for cutting expenditure on most sectors of the economy.

Even prior to his speech, Ncube had begun implementing austerity, with his most unpopular move being the imposition of a 2 percent tax on electronic money transactions. Almost every Zimbabwean pays with mobile money, debit card, or by bank transfer because of a cash shortage tied to a spiraling trade deficit.

Ncube, just like most African policymakers who have gone the austerity route, believes that this will attract foreign investment, particularly from China, which is now considered a savior of Africa. This, he hopes, will help alleviate the financial crisis and open the market for international trade relations that will bring a much-needed foreign currency injection to boost failing local industries.

Small African countries like Zimbabwe risk being entangled in China's debt trap -- owing more than they can pay back in reasonable time.

Since 2010, China has invested US$10 billion in Zimbabwe, which is a meager slice of the US$230 billion invested in the rest of sub-Saharan Africa in the same period. According to the International Monetary Fund, Zimbabwe has one of the world's most fragile economies (probably the worst for a country without any wars or devastating natural disasters). It has external debts of US$9 billion -- more than half the size of the nation's GDP -- and needs more than US$15 billion for an immediate economic revival.

With western countries and investors wary of investing in Zimbabwe without massive restrictions and pre-conditions that the country looks unlikely to meet, China is the only global powerhouse willing to throw a bone, supposedly with "no strings attached."

Last year, a meeting between Mnangagwa and China's President Xi Jinping ended in a promise to write off Zimbabwe's debt to China, which had been accrued under former President Mugabe's rule. With the recent announcement by Xi Jinping that China will invest US$60 billion in Africa, one can begin to connect the dots that Ncube's fiscal policy is a clean-up act to attract more loans and investment by showing a commitment to paying back the money.

In fact, this is a game being played by almost all African nations. The Scramble for China is on, with countries competing for the biggest slice of China's cake. Last September twice as many African leaders attended the China-Africa cooperation summit in Beijing as the last UN general assembly.

Austerity policies reek of the neo-liberalism that the World Bank and IMF forced upon global south countries in the early 1980s in the form of structural adjustments and unequal free market policies.

The austerity measures are a calculated display by the government to show that Zimbabwe, under Mnangagwa's leadership, is worthy of getting a bigger slice of the Chinese pie because their money will be used efficiently, and this time debts will be paid. But, as several governmental bodies, development organizations, and economic analysts have already warned, small African countries like Zimbabwe risk being entangled in China's debt trap -- owing more than they can pay back in reasonable time.

Some of these warnings are coming from the United States and the EU, which clearly feel threatened by China's growing influence in Africa. But China's role does raise serious questions with not so clear answers. How will China protect its investment? How much will China be involved in ensuring a return on its investment? To what lengths and at whose expense (the public or the government - the rich or the poor), will countries like Zimbabwe go to try and pay back the debt? And with the growing unease, particularly from global north countries, that China is trying to export its labor-intensive industry to Africa, how will these countries protect their sovereignty in the process?

Austerity policies reek of the neo-liberalism that the World Bank and IMF forced upon global south countries in the early 1980s in the form of structural adjustments and unequal free market policies. In fact, Ncube has quoted the late UK Prime Minister Margaret Thatcher, who saw her neoliberal economic policies as the only path, often saying "There Is No Alternative" (TINA).

Small sovereign nations like Zimbabwe need to look at other African countries that have tried the same policies and failed. A wave of anti-austerity protests earlier this year should serve as a warning of how devastating these unpopular policies can be. Protests have resulted in arbitrary detentions in Sudan, violent clashes in Tunisia, and political turmoil in South Africa, Egypt, Kenya, and Gabon.

Yanis Varoufakis, the former Greek minister of finance, knows from his own country's experience that these measures are self-defeating as they not only depress national income but also the government's revenue, therefore making the nation suffer rather than prosper. He calls austerity an "assault on the poor."

It's high time African governments start to implement policies that favor the well-being of their people first before pleasing the Money Masters. An economy that does not improve the lives of its citizens is a poor and failing economy.