SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

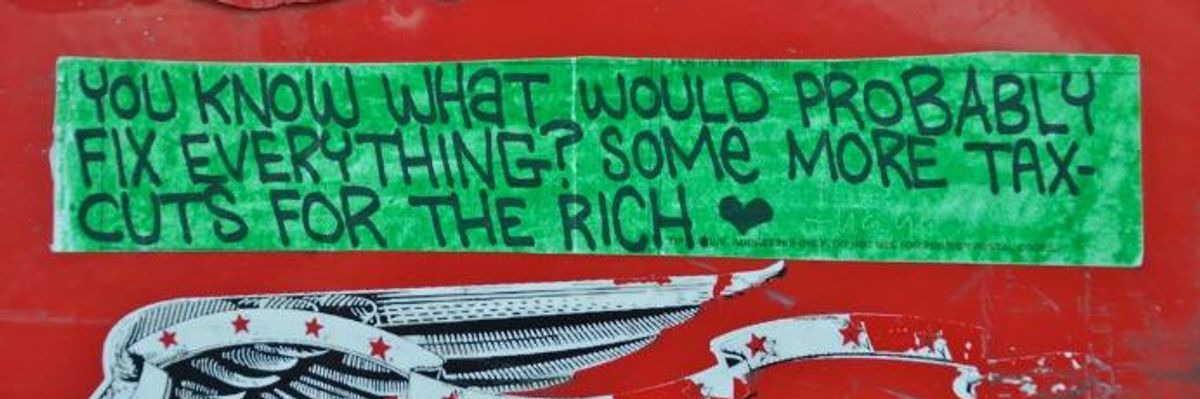

A snarky sign seen in San Francisco. (Photo: Steve Rhodes/flickr/cc)

Okay, I'm going to plead guilty to playing lawyer without a license. The NYT reports that the Trump administration is proposing to unilaterally (as in no congressional action) change the way that capital gains are calculated for tax purposes.

The plan is to allow people to index capital gains for inflation. For example, under current law, if you bought 100 shares of stock for $100 per share ten years ago, and sell the shares today for $200, you would pay the capital gains tax on the full difference of $10,000. (100* $200 = $20,000, 100* $100 = $10,000. $20,000 minus $10,000 = $10,000)

Under the Trump administration's plan, you would be able to adjust the original $10,000 purchase for the inflation in the last decade. Let's say that the inflation over this period has been a total of 20 percent. This means that instead of deducting $10,000 from the current sale price to calculation your gain you would deduct $12,000. This would leave a taxable gain of $8,000 instead of $10,000.

In this case it means a 20 percent reduction in the tax rate on capital gains. The reduction would be greater for longer held assets and less for assets held a short period of time.

In case there is any doubt, almost all of the savings would go to rich people. The article cites an analysis showing that 97 percent of the savings would go to the top 10 percent of the population and more than two thirds would go to the richest 0.1 percent.

And, just to be clear, don't be foolish enough to think this is about helping the middle class Joe and Jane with their 401(k)s. These suckers have the capital gains in their 401(k)s taxed as ordinary income. They won't be helped one iota by this change in the tax law. As the Republican motto goes, "tax cuts are for rich people."

Now for my cheap legal thoughts. Congress has repeatedly changed the tax code with the understanding that a capital gain was defined as the difference between the selling price of an asset and the purchase price. This is one reason why the tax rate on capital gains is so much lower than the tax rate on wage income. (The top tax rate on capital gains is 20 percent, compared to 37.0 percent on wage income.)

In effect, the Trump administration would be saying that Congress didn't know what it was doing when it was setting capital gains tax rates. That they actually meant for the gains to be indexed to inflation, it was just some weird misunderstanding that persisted for all these decades that caused capital gains to be measured by just taking actual purchase price.

I suppose this would be surprising, but given the open contempt that the Trump administration routinely shows for the rule of law, inventing a huge tax break for the richest people in the country is pretty much what we have come to expect. After all, if they didn't get to lie, cheat, and steal, how could rich people get by on today's rapidly changing economy?

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Okay, I'm going to plead guilty to playing lawyer without a license. The NYT reports that the Trump administration is proposing to unilaterally (as in no congressional action) change the way that capital gains are calculated for tax purposes.

The plan is to allow people to index capital gains for inflation. For example, under current law, if you bought 100 shares of stock for $100 per share ten years ago, and sell the shares today for $200, you would pay the capital gains tax on the full difference of $10,000. (100* $200 = $20,000, 100* $100 = $10,000. $20,000 minus $10,000 = $10,000)

Under the Trump administration's plan, you would be able to adjust the original $10,000 purchase for the inflation in the last decade. Let's say that the inflation over this period has been a total of 20 percent. This means that instead of deducting $10,000 from the current sale price to calculation your gain you would deduct $12,000. This would leave a taxable gain of $8,000 instead of $10,000.

In this case it means a 20 percent reduction in the tax rate on capital gains. The reduction would be greater for longer held assets and less for assets held a short period of time.

In case there is any doubt, almost all of the savings would go to rich people. The article cites an analysis showing that 97 percent of the savings would go to the top 10 percent of the population and more than two thirds would go to the richest 0.1 percent.

And, just to be clear, don't be foolish enough to think this is about helping the middle class Joe and Jane with their 401(k)s. These suckers have the capital gains in their 401(k)s taxed as ordinary income. They won't be helped one iota by this change in the tax law. As the Republican motto goes, "tax cuts are for rich people."

Now for my cheap legal thoughts. Congress has repeatedly changed the tax code with the understanding that a capital gain was defined as the difference between the selling price of an asset and the purchase price. This is one reason why the tax rate on capital gains is so much lower than the tax rate on wage income. (The top tax rate on capital gains is 20 percent, compared to 37.0 percent on wage income.)

In effect, the Trump administration would be saying that Congress didn't know what it was doing when it was setting capital gains tax rates. That they actually meant for the gains to be indexed to inflation, it was just some weird misunderstanding that persisted for all these decades that caused capital gains to be measured by just taking actual purchase price.

I suppose this would be surprising, but given the open contempt that the Trump administration routinely shows for the rule of law, inventing a huge tax break for the richest people in the country is pretty much what we have come to expect. After all, if they didn't get to lie, cheat, and steal, how could rich people get by on today's rapidly changing economy?

Okay, I'm going to plead guilty to playing lawyer without a license. The NYT reports that the Trump administration is proposing to unilaterally (as in no congressional action) change the way that capital gains are calculated for tax purposes.

The plan is to allow people to index capital gains for inflation. For example, under current law, if you bought 100 shares of stock for $100 per share ten years ago, and sell the shares today for $200, you would pay the capital gains tax on the full difference of $10,000. (100* $200 = $20,000, 100* $100 = $10,000. $20,000 minus $10,000 = $10,000)

Under the Trump administration's plan, you would be able to adjust the original $10,000 purchase for the inflation in the last decade. Let's say that the inflation over this period has been a total of 20 percent. This means that instead of deducting $10,000 from the current sale price to calculation your gain you would deduct $12,000. This would leave a taxable gain of $8,000 instead of $10,000.

In this case it means a 20 percent reduction in the tax rate on capital gains. The reduction would be greater for longer held assets and less for assets held a short period of time.

In case there is any doubt, almost all of the savings would go to rich people. The article cites an analysis showing that 97 percent of the savings would go to the top 10 percent of the population and more than two thirds would go to the richest 0.1 percent.

And, just to be clear, don't be foolish enough to think this is about helping the middle class Joe and Jane with their 401(k)s. These suckers have the capital gains in their 401(k)s taxed as ordinary income. They won't be helped one iota by this change in the tax law. As the Republican motto goes, "tax cuts are for rich people."

Now for my cheap legal thoughts. Congress has repeatedly changed the tax code with the understanding that a capital gain was defined as the difference between the selling price of an asset and the purchase price. This is one reason why the tax rate on capital gains is so much lower than the tax rate on wage income. (The top tax rate on capital gains is 20 percent, compared to 37.0 percent on wage income.)

In effect, the Trump administration would be saying that Congress didn't know what it was doing when it was setting capital gains tax rates. That they actually meant for the gains to be indexed to inflation, it was just some weird misunderstanding that persisted for all these decades that caused capital gains to be measured by just taking actual purchase price.

I suppose this would be surprising, but given the open contempt that the Trump administration routinely shows for the rule of law, inventing a huge tax break for the richest people in the country is pretty much what we have come to expect. After all, if they didn't get to lie, cheat, and steal, how could rich people get by on today's rapidly changing economy?