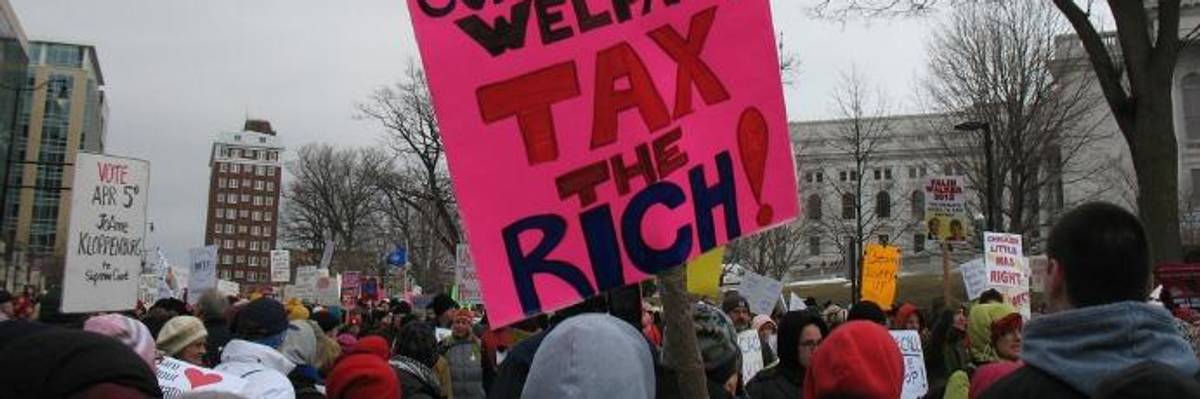

"We're facing a powerful array of forces that includes big corporations, the Koch Brothers, and anti-tax think tanks," says Frank Clemente, co-founder and director of Americans for Tax Fairness. (Photo: Yuri Keegstra/flickr/cc)

The Coming Tax Fight -- and Why We Need You!

We've now reached show-down time, says the director of the coalition rallying Americans against the Trump tax cut giveaway to Corporate America.

Are you ready to resist? With Donald Trump's August 30 tax cut speech in Springfield, Missouri, the great tax fight of 2017 has now begun. The Trump tax cut plan, the President blustered in Missouri, will raise wages and benefit America's working people.

"This speech was an extraordinary effort to obfuscate, fabricate, and create an alternative reality," says Frank Clemente, co-founder and director of Americans for Tax Fairness. "Trump has a big sales job: to make a tax cut that will mostly benefit Trump and his fellow billionaires appealing to his regular base."

The Americans for Tax Fairness coalition, founded in 2012, now represents over 425 national and state organizations and serves as the key advocacy umbrella organization on progressive tax reform. The coalition has been preparing for this moment all year.

Clemente has essentially been preparing his whole life. From campaigns to expand health care and reform the campaign finance system to serving as issues director for the 1988 Presidential campaign of the Rev. Jesse Jackson, Clemente has put in decades working for economic justice.

"I've been fighting corporate power in different ways all my life," he notes. "But I don't think we've gone up against a lobbying operation this size before."

"We're facing a powerful array of forces that includes big corporations, the Koch Brothers, and anti-tax think tanks," Clemente explains. "Low taxes and small government are at the heart and soul of entire GOP establishment agenda. They're going to put everything they have into this."

During the congressional battle earlier this year over health care, most big corporations and the very wealthy sat on the sidelines. They aren't sitting now.

"The big industry groups -- oil, big pharma, high tech -- they spend more money to lobby on tax policy than on anything else," says Clemente. "They'll be all in on this fight."

Can we can stop the worst aspects of this latest tax-cut money grab? Clemente thinks we can. He points to polls that show that only about 30 percent of the public strongly believes the trickle-down mythology that tax breaks for the rich and big corporations have a positive impact on the economy.

"The vast majority of Americans don't buy it," says Clemente. "They see how inequality has grown and that corporate profits are going through the roof. And Trump has completely undermined his personal credibility with most of the public."

The Republican coalition also stands divided.

"They don't agree over how to pay for these tax cuts," notes Clemente. "The deficit hawks don't believe tax cuts should add to the federal debt. The hard-liners want tax cuts, deficits be damned. And then there are a few sensible folks who worry about the impact on working families."

But even with these divisions, stopping tax-cut giveaways to the rich and the corporations they run will take all hands on deck.

"This will be harder to stop than the bad health care plan because the tradeoffs in health care were so direct, with 20 million people losing insurance," Clemente reflects. "But if you care about inequality, this is your fight. If you care about Social Security, education, nutrition, rebuilding roads and bridges, this is your fight. All these flow from tax revenue."

"If we lose this revenue now," he goes on, "we aren't going to be able to fund current levels of government nor will we be able to make investments over the next ten years to build an economy that works for everyone."

Politically speaking, in other words, we've reached showdown time.

"Tax cuts have become the crown jewel of their agenda," Clemente points out. "If we defeat the tax cuts, its all down hill for Trump and company."

American for Tax Fairness has created a campaign website for the coming tax fight. See StopTrumpTaxCuts.org and check out the Talking Points as part of preparing for back-fence conversations with neighbors and family.

ATF is also encouraging other grassroots strategies, including the "Not One Penny" movement. Founded by resistance efforts such as Indivisible and the Tax March, Not One Penny is a pledge against "tax cuts for millionaires, billionaires and wealthy corporations."

For more information on how to get involved, click to www.americansfortaxfairness.org.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Are you ready to resist? With Donald Trump's August 30 tax cut speech in Springfield, Missouri, the great tax fight of 2017 has now begun. The Trump tax cut plan, the President blustered in Missouri, will raise wages and benefit America's working people.

"This speech was an extraordinary effort to obfuscate, fabricate, and create an alternative reality," says Frank Clemente, co-founder and director of Americans for Tax Fairness. "Trump has a big sales job: to make a tax cut that will mostly benefit Trump and his fellow billionaires appealing to his regular base."

The Americans for Tax Fairness coalition, founded in 2012, now represents over 425 national and state organizations and serves as the key advocacy umbrella organization on progressive tax reform. The coalition has been preparing for this moment all year.

Clemente has essentially been preparing his whole life. From campaigns to expand health care and reform the campaign finance system to serving as issues director for the 1988 Presidential campaign of the Rev. Jesse Jackson, Clemente has put in decades working for economic justice.

"I've been fighting corporate power in different ways all my life," he notes. "But I don't think we've gone up against a lobbying operation this size before."

"We're facing a powerful array of forces that includes big corporations, the Koch Brothers, and anti-tax think tanks," Clemente explains. "Low taxes and small government are at the heart and soul of entire GOP establishment agenda. They're going to put everything they have into this."

During the congressional battle earlier this year over health care, most big corporations and the very wealthy sat on the sidelines. They aren't sitting now.

"The big industry groups -- oil, big pharma, high tech -- they spend more money to lobby on tax policy than on anything else," says Clemente. "They'll be all in on this fight."

Can we can stop the worst aspects of this latest tax-cut money grab? Clemente thinks we can. He points to polls that show that only about 30 percent of the public strongly believes the trickle-down mythology that tax breaks for the rich and big corporations have a positive impact on the economy.

"The vast majority of Americans don't buy it," says Clemente. "They see how inequality has grown and that corporate profits are going through the roof. And Trump has completely undermined his personal credibility with most of the public."

The Republican coalition also stands divided.

"They don't agree over how to pay for these tax cuts," notes Clemente. "The deficit hawks don't believe tax cuts should add to the federal debt. The hard-liners want tax cuts, deficits be damned. And then there are a few sensible folks who worry about the impact on working families."

But even with these divisions, stopping tax-cut giveaways to the rich and the corporations they run will take all hands on deck.

"This will be harder to stop than the bad health care plan because the tradeoffs in health care were so direct, with 20 million people losing insurance," Clemente reflects. "But if you care about inequality, this is your fight. If you care about Social Security, education, nutrition, rebuilding roads and bridges, this is your fight. All these flow from tax revenue."

"If we lose this revenue now," he goes on, "we aren't going to be able to fund current levels of government nor will we be able to make investments over the next ten years to build an economy that works for everyone."

Politically speaking, in other words, we've reached showdown time.

"Tax cuts have become the crown jewel of their agenda," Clemente points out. "If we defeat the tax cuts, its all down hill for Trump and company."

American for Tax Fairness has created a campaign website for the coming tax fight. See StopTrumpTaxCuts.org and check out the Talking Points as part of preparing for back-fence conversations with neighbors and family.

ATF is also encouraging other grassroots strategies, including the "Not One Penny" movement. Founded by resistance efforts such as Indivisible and the Tax March, Not One Penny is a pledge against "tax cuts for millionaires, billionaires and wealthy corporations."

For more information on how to get involved, click to www.americansfortaxfairness.org.

Are you ready to resist? With Donald Trump's August 30 tax cut speech in Springfield, Missouri, the great tax fight of 2017 has now begun. The Trump tax cut plan, the President blustered in Missouri, will raise wages and benefit America's working people.

"This speech was an extraordinary effort to obfuscate, fabricate, and create an alternative reality," says Frank Clemente, co-founder and director of Americans for Tax Fairness. "Trump has a big sales job: to make a tax cut that will mostly benefit Trump and his fellow billionaires appealing to his regular base."

The Americans for Tax Fairness coalition, founded in 2012, now represents over 425 national and state organizations and serves as the key advocacy umbrella organization on progressive tax reform. The coalition has been preparing for this moment all year.

Clemente has essentially been preparing his whole life. From campaigns to expand health care and reform the campaign finance system to serving as issues director for the 1988 Presidential campaign of the Rev. Jesse Jackson, Clemente has put in decades working for economic justice.

"I've been fighting corporate power in different ways all my life," he notes. "But I don't think we've gone up against a lobbying operation this size before."

"We're facing a powerful array of forces that includes big corporations, the Koch Brothers, and anti-tax think tanks," Clemente explains. "Low taxes and small government are at the heart and soul of entire GOP establishment agenda. They're going to put everything they have into this."

During the congressional battle earlier this year over health care, most big corporations and the very wealthy sat on the sidelines. They aren't sitting now.

"The big industry groups -- oil, big pharma, high tech -- they spend more money to lobby on tax policy than on anything else," says Clemente. "They'll be all in on this fight."

Can we can stop the worst aspects of this latest tax-cut money grab? Clemente thinks we can. He points to polls that show that only about 30 percent of the public strongly believes the trickle-down mythology that tax breaks for the rich and big corporations have a positive impact on the economy.

"The vast majority of Americans don't buy it," says Clemente. "They see how inequality has grown and that corporate profits are going through the roof. And Trump has completely undermined his personal credibility with most of the public."

The Republican coalition also stands divided.

"They don't agree over how to pay for these tax cuts," notes Clemente. "The deficit hawks don't believe tax cuts should add to the federal debt. The hard-liners want tax cuts, deficits be damned. And then there are a few sensible folks who worry about the impact on working families."

But even with these divisions, stopping tax-cut giveaways to the rich and the corporations they run will take all hands on deck.

"This will be harder to stop than the bad health care plan because the tradeoffs in health care were so direct, with 20 million people losing insurance," Clemente reflects. "But if you care about inequality, this is your fight. If you care about Social Security, education, nutrition, rebuilding roads and bridges, this is your fight. All these flow from tax revenue."

"If we lose this revenue now," he goes on, "we aren't going to be able to fund current levels of government nor will we be able to make investments over the next ten years to build an economy that works for everyone."

Politically speaking, in other words, we've reached showdown time.

"Tax cuts have become the crown jewel of their agenda," Clemente points out. "If we defeat the tax cuts, its all down hill for Trump and company."

American for Tax Fairness has created a campaign website for the coming tax fight. See StopTrumpTaxCuts.org and check out the Talking Points as part of preparing for back-fence conversations with neighbors and family.

ATF is also encouraging other grassroots strategies, including the "Not One Penny" movement. Founded by resistance efforts such as Indivisible and the Tax March, Not One Penny is a pledge against "tax cuts for millionaires, billionaires and wealthy corporations."

For more information on how to get involved, click to www.americansfortaxfairness.org.