SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

In February of last year, the Center for American Progress (CAP) released a report titled The Effect of Rising Inequality on Social Security. The report shows how the increase in economic inequality in the U.S.

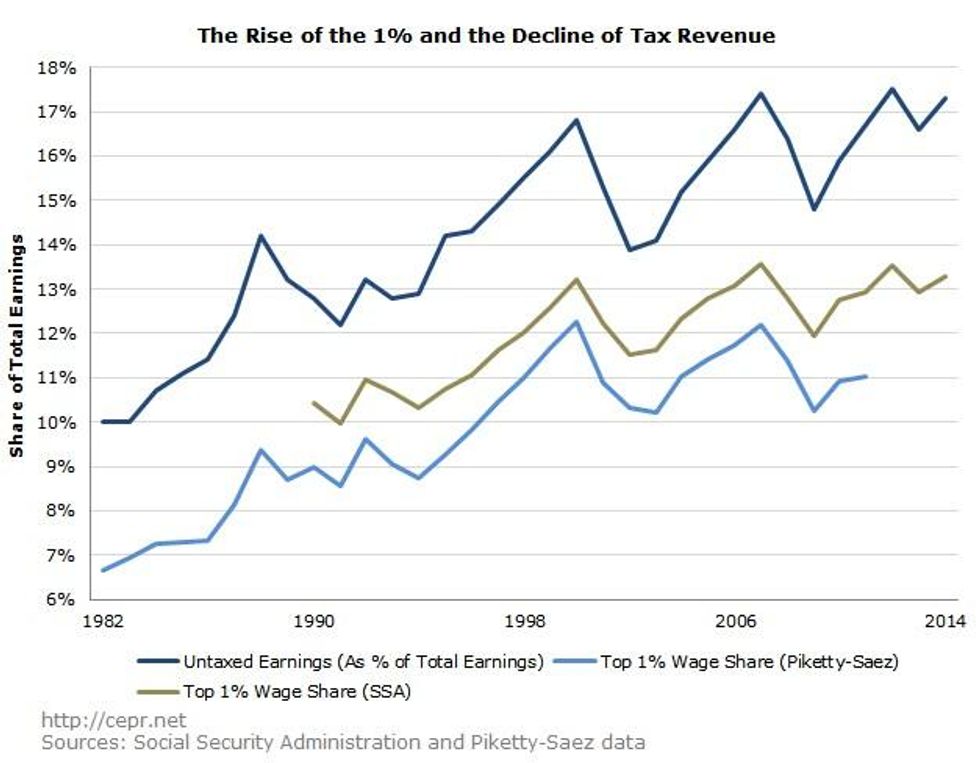

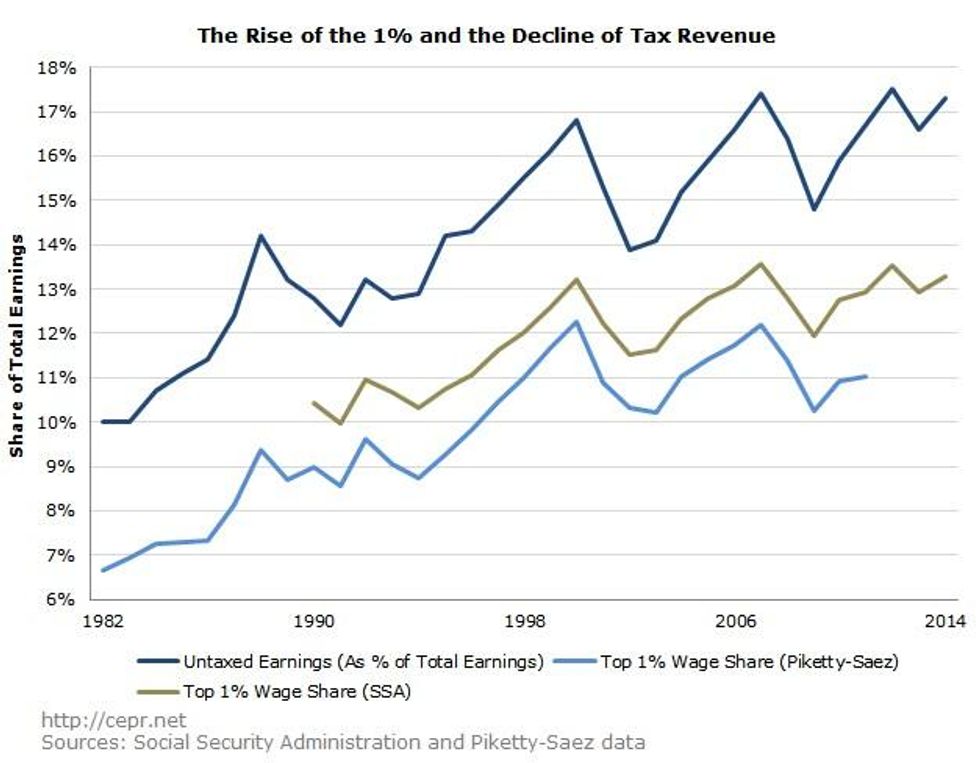

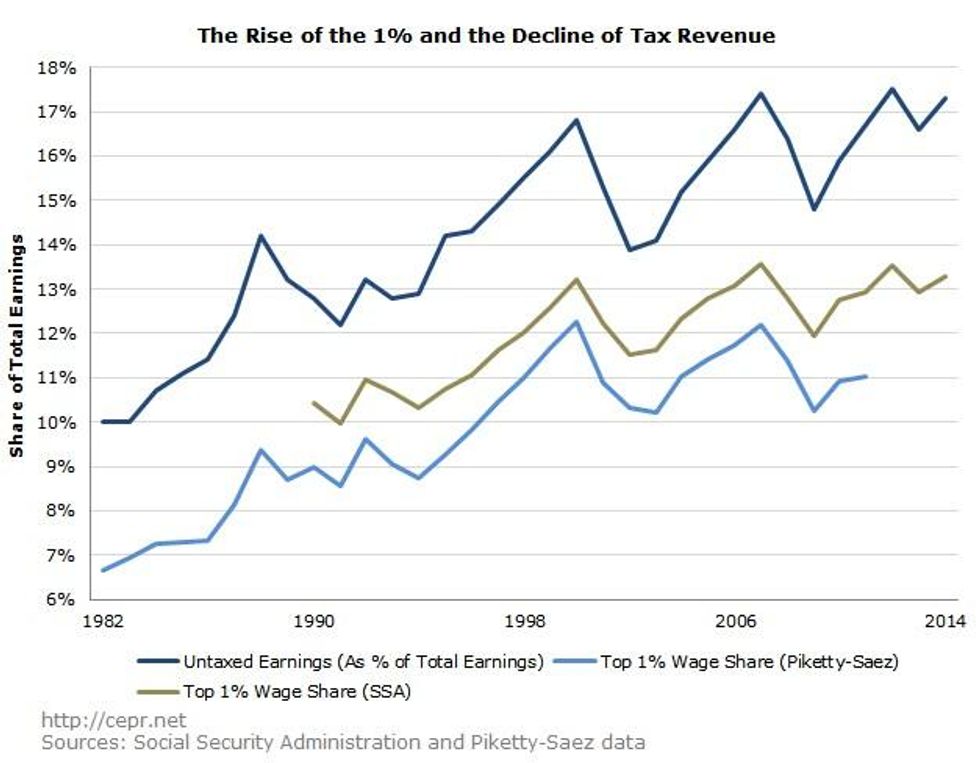

In February of last year, the Center for American Progress (CAP) released a report titled The Effect of Rising Inequality on Social Security. The report shows how the increase in economic inequality in the U.S. has led to deteriorating Social Security revenues, often to the tune of tens of billions of dollars a year. Earlier research by Dean Baker showed that the upward redistribution of wage income was responsible for 43.5 percent of the projected 75-year shortfall in Social Security funding as of 2013.

Social Security is funded through federal payroll taxes. These taxes are currently applied to the first $118,500 of a worker's wages; this means that only a portion of high-wage workers' earnings are subject to taxation. For example, a worker earning $237,000 a year will pay payroll taxes on just half his earnings in 2016; a worker earning a million dollars will pay payroll taxes on less than 12 percent of his earnings. By contrast, any worker making $118,500 or less will have all of his earnings held subject to taxation. This $118,500 "cap" rises in line with average wage growth every year.

In 1983, reforms to the Social Security program set the cap high enough to cover 90 percent of all wage income, in line with the percentage covered during the previous year. However, because the earnings of the highest-wage workers have been rising faster than average earnings, a growing portion of wage income has been escaping taxation. In particular, the top 1 percent of wage earners have seen their share of total earnings nearly double over the last three decades. It's clear that the growing share of earnings going to the top 1 percent has led to an increase in the share of wage income escaping payroll taxation:

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

In February of last year, the Center for American Progress (CAP) released a report titled The Effect of Rising Inequality on Social Security. The report shows how the increase in economic inequality in the U.S. has led to deteriorating Social Security revenues, often to the tune of tens of billions of dollars a year. Earlier research by Dean Baker showed that the upward redistribution of wage income was responsible for 43.5 percent of the projected 75-year shortfall in Social Security funding as of 2013.

Social Security is funded through federal payroll taxes. These taxes are currently applied to the first $118,500 of a worker's wages; this means that only a portion of high-wage workers' earnings are subject to taxation. For example, a worker earning $237,000 a year will pay payroll taxes on just half his earnings in 2016; a worker earning a million dollars will pay payroll taxes on less than 12 percent of his earnings. By contrast, any worker making $118,500 or less will have all of his earnings held subject to taxation. This $118,500 "cap" rises in line with average wage growth every year.

In 1983, reforms to the Social Security program set the cap high enough to cover 90 percent of all wage income, in line with the percentage covered during the previous year. However, because the earnings of the highest-wage workers have been rising faster than average earnings, a growing portion of wage income has been escaping taxation. In particular, the top 1 percent of wage earners have seen their share of total earnings nearly double over the last three decades. It's clear that the growing share of earnings going to the top 1 percent has led to an increase in the share of wage income escaping payroll taxation:

In February of last year, the Center for American Progress (CAP) released a report titled The Effect of Rising Inequality on Social Security. The report shows how the increase in economic inequality in the U.S. has led to deteriorating Social Security revenues, often to the tune of tens of billions of dollars a year. Earlier research by Dean Baker showed that the upward redistribution of wage income was responsible for 43.5 percent of the projected 75-year shortfall in Social Security funding as of 2013.

Social Security is funded through federal payroll taxes. These taxes are currently applied to the first $118,500 of a worker's wages; this means that only a portion of high-wage workers' earnings are subject to taxation. For example, a worker earning $237,000 a year will pay payroll taxes on just half his earnings in 2016; a worker earning a million dollars will pay payroll taxes on less than 12 percent of his earnings. By contrast, any worker making $118,500 or less will have all of his earnings held subject to taxation. This $118,500 "cap" rises in line with average wage growth every year.

In 1983, reforms to the Social Security program set the cap high enough to cover 90 percent of all wage income, in line with the percentage covered during the previous year. However, because the earnings of the highest-wage workers have been rising faster than average earnings, a growing portion of wage income has been escaping taxation. In particular, the top 1 percent of wage earners have seen their share of total earnings nearly double over the last three decades. It's clear that the growing share of earnings going to the top 1 percent has led to an increase in the share of wage income escaping payroll taxation: