SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Amazon delivery drivers and dispatchers continue to strike at the company’s Palmdale, California, warehouse and delivery center on July 25, 2023.

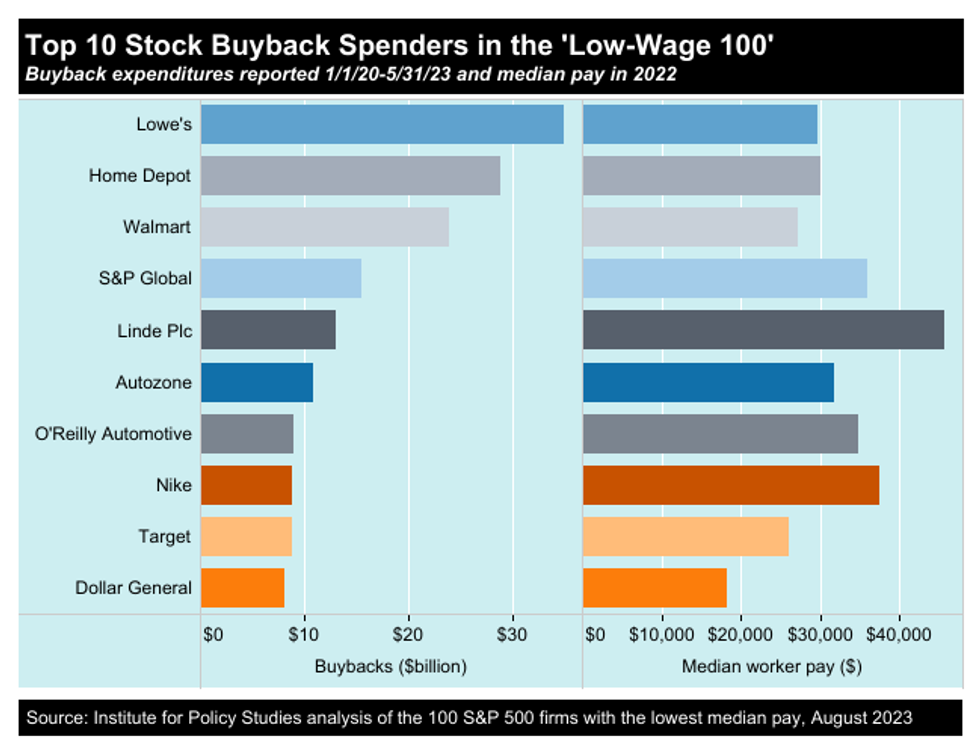

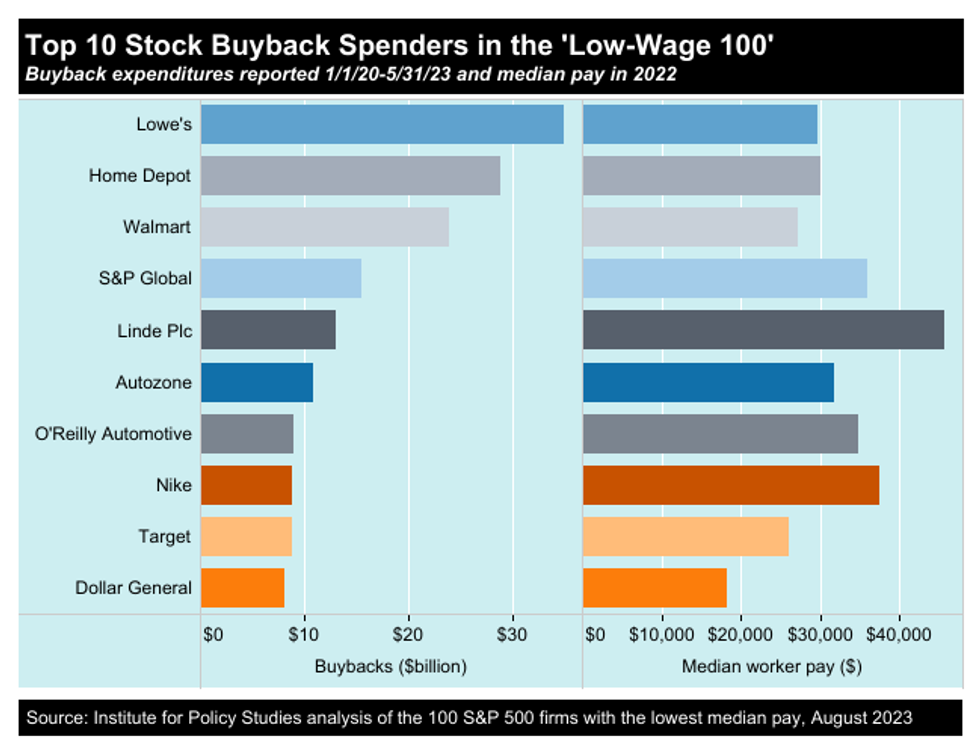

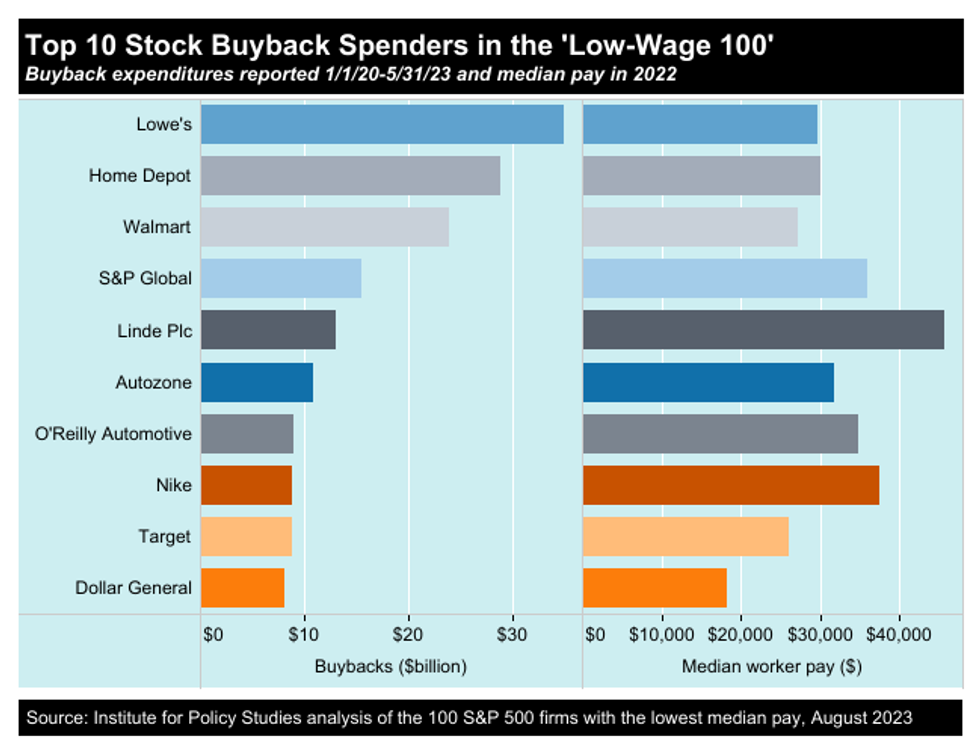

Between January 1, 2020, and May of this year, the 100 S&P 500 corporations with the lowest median worker pay reported a combined $341 billion in stock buyback spending.

In response to strikes and union organizing drives, corporate leaders routinely insist that they simply lack the wherewithal to raise employee pay. And yet top executives seem to have little trouble finding resources for enriching themselves and wealthy shareholders.

In 2021 and 2022, S&P 500 corporations spent record sums on stock buybacks, a maneuver that pumps up stock prices by reducing the supply on the open market. Since stock-based pay makes up the bulk of executive compensation, CEOs reap huge—and completely undeserved—windfalls.

CEOs could watch cat videos all day and still reap huge windfalls through stock buybacks.

A new Institute for Policy Studies report, Executive Excess 2023, reveals how these financial shenanigans have widened disparities at the 100 S&P 500 corporations with the lowest median worker pay, a group we’ve dubbed the “Low-Wage 100.”

Between January 1, 2020, and May of this year, these companies reported a combined $341 billion in stock buyback spending.

Lowe’s led the buybacks list, plowing nearly $35 billion into share repurchases over the past three and a half years. In 2022 alone, Lowe’s spent more than $14 billion on buybacks—enough to give every one of its 301,000 U.S. employees a $46,923 bonus.

The idea that the person in the corner office is hundreds of times more valuable than other employees is a myth—even if that person is not just watching cat videos.

I’m guessing rank-and-file Lowe’s employees, half of whom make less than $30,000 per year, could find more productive uses for that money.

During their stock buyback spree, Low-Wage 100 CEOs’ personal stock holdings increased more than three times as fast as their firms’ median worker pay. At the 65 buyback companies where the same person held the top job between 2019 and 2022, the Low-Wage 100 CEOs’ personal stock holdings soared 33% to an average of $184.7 million. Median pay at these firms rose only 10% to an average of $31,972.

FedEx founder and CEO Frederick Smith has the largest stockpile in the Low-Wage 100. With $3.6 billion in stock buybacks since January 2020, Smith’s personal stock holdings have grown 65% to more than $5 billion. By contrast, median pay for workers at the notoriously anti-union company fell by 20% to $39,177 during this period.

What makes all this even more upsetting? Taxpayers are actually supporting, through federal contracts, the buyback-fueled disparities at FedEx and 50 other Low-Wage 100 firms.

FedEx pocketed $6.2 billion in fiscal years 2020-2023 for mail services for the Veterans Administration and other agencies. The largest federal contractor in the Low-Wage 100 is another company known for union-busting—Amazon. Over the past few years, Amazon has pocketed more than $10 billion in web services deals from Uncle Sam while spending nearly $6 billion repurchasing their shares.

Fortunately, support is growing for solutions to our CEO pay problem.

Before 1982, stock buybacks were viewed as market manipulation and largely banned. President Joe Biden hasn’t yet called for reinstating that ban, but he did rail against buybacks in his State of the Union address this year and called for quadrupling a new 1% excise tax on share repurchases.

The Biden administration is also starting to use federal money going to corporations as a lever for change. In an important first step, the administration is giving preferential treatment in the awarding of new semiconductor manufacturing subsidies to companies that agree to give up buybacks. Now they should extend that policy to all corporations receiving taxpayer money.

Buybacks are not the only trick CEOs can use to inflate their own paychecks. Over my decades of research, I’ve documented how corporate leaders have used myriad shady means to hit personal jackpots, from cooking the books and moving executive bonus goalposts to creating housing bubbles and other reckless financial schemes.

To tackle this systemic problem, policymakers need to go bolder. Executive Excess 2023 offers an extensive menu of CEO pay reforms. One of the most innovative: tax penalties for companies with huge CEO-worker pay gaps. Two major cities—San Francisco and Portland, Oregon—are already generating significant revenue through such taxes. Seattle is now considering a similar approach.

The idea that the person in the corner office is hundreds of times more valuable than other employees is a myth—even if that person is not just watching cat videos. All employees contribute to the profits of a corporation, and our economy would be far healthier if the fruits of our labor were more equitably shared.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

In response to strikes and union organizing drives, corporate leaders routinely insist that they simply lack the wherewithal to raise employee pay. And yet top executives seem to have little trouble finding resources for enriching themselves and wealthy shareholders.

In 2021 and 2022, S&P 500 corporations spent record sums on stock buybacks, a maneuver that pumps up stock prices by reducing the supply on the open market. Since stock-based pay makes up the bulk of executive compensation, CEOs reap huge—and completely undeserved—windfalls.

CEOs could watch cat videos all day and still reap huge windfalls through stock buybacks.

A new Institute for Policy Studies report, Executive Excess 2023, reveals how these financial shenanigans have widened disparities at the 100 S&P 500 corporations with the lowest median worker pay, a group we’ve dubbed the “Low-Wage 100.”

Between January 1, 2020, and May of this year, these companies reported a combined $341 billion in stock buyback spending.

Lowe’s led the buybacks list, plowing nearly $35 billion into share repurchases over the past three and a half years. In 2022 alone, Lowe’s spent more than $14 billion on buybacks—enough to give every one of its 301,000 U.S. employees a $46,923 bonus.

The idea that the person in the corner office is hundreds of times more valuable than other employees is a myth—even if that person is not just watching cat videos.

I’m guessing rank-and-file Lowe’s employees, half of whom make less than $30,000 per year, could find more productive uses for that money.

During their stock buyback spree, Low-Wage 100 CEOs’ personal stock holdings increased more than three times as fast as their firms’ median worker pay. At the 65 buyback companies where the same person held the top job between 2019 and 2022, the Low-Wage 100 CEOs’ personal stock holdings soared 33% to an average of $184.7 million. Median pay at these firms rose only 10% to an average of $31,972.

FedEx founder and CEO Frederick Smith has the largest stockpile in the Low-Wage 100. With $3.6 billion in stock buybacks since January 2020, Smith’s personal stock holdings have grown 65% to more than $5 billion. By contrast, median pay for workers at the notoriously anti-union company fell by 20% to $39,177 during this period.

What makes all this even more upsetting? Taxpayers are actually supporting, through federal contracts, the buyback-fueled disparities at FedEx and 50 other Low-Wage 100 firms.

FedEx pocketed $6.2 billion in fiscal years 2020-2023 for mail services for the Veterans Administration and other agencies. The largest federal contractor in the Low-Wage 100 is another company known for union-busting—Amazon. Over the past few years, Amazon has pocketed more than $10 billion in web services deals from Uncle Sam while spending nearly $6 billion repurchasing their shares.

Fortunately, support is growing for solutions to our CEO pay problem.

Before 1982, stock buybacks were viewed as market manipulation and largely banned. President Joe Biden hasn’t yet called for reinstating that ban, but he did rail against buybacks in his State of the Union address this year and called for quadrupling a new 1% excise tax on share repurchases.

The Biden administration is also starting to use federal money going to corporations as a lever for change. In an important first step, the administration is giving preferential treatment in the awarding of new semiconductor manufacturing subsidies to companies that agree to give up buybacks. Now they should extend that policy to all corporations receiving taxpayer money.

Buybacks are not the only trick CEOs can use to inflate their own paychecks. Over my decades of research, I’ve documented how corporate leaders have used myriad shady means to hit personal jackpots, from cooking the books and moving executive bonus goalposts to creating housing bubbles and other reckless financial schemes.

To tackle this systemic problem, policymakers need to go bolder. Executive Excess 2023 offers an extensive menu of CEO pay reforms. One of the most innovative: tax penalties for companies with huge CEO-worker pay gaps. Two major cities—San Francisco and Portland, Oregon—are already generating significant revenue through such taxes. Seattle is now considering a similar approach.

The idea that the person in the corner office is hundreds of times more valuable than other employees is a myth—even if that person is not just watching cat videos. All employees contribute to the profits of a corporation, and our economy would be far healthier if the fruits of our labor were more equitably shared.

In response to strikes and union organizing drives, corporate leaders routinely insist that they simply lack the wherewithal to raise employee pay. And yet top executives seem to have little trouble finding resources for enriching themselves and wealthy shareholders.

In 2021 and 2022, S&P 500 corporations spent record sums on stock buybacks, a maneuver that pumps up stock prices by reducing the supply on the open market. Since stock-based pay makes up the bulk of executive compensation, CEOs reap huge—and completely undeserved—windfalls.

CEOs could watch cat videos all day and still reap huge windfalls through stock buybacks.

A new Institute for Policy Studies report, Executive Excess 2023, reveals how these financial shenanigans have widened disparities at the 100 S&P 500 corporations with the lowest median worker pay, a group we’ve dubbed the “Low-Wage 100.”

Between January 1, 2020, and May of this year, these companies reported a combined $341 billion in stock buyback spending.

Lowe’s led the buybacks list, plowing nearly $35 billion into share repurchases over the past three and a half years. In 2022 alone, Lowe’s spent more than $14 billion on buybacks—enough to give every one of its 301,000 U.S. employees a $46,923 bonus.

The idea that the person in the corner office is hundreds of times more valuable than other employees is a myth—even if that person is not just watching cat videos.

I’m guessing rank-and-file Lowe’s employees, half of whom make less than $30,000 per year, could find more productive uses for that money.

During their stock buyback spree, Low-Wage 100 CEOs’ personal stock holdings increased more than three times as fast as their firms’ median worker pay. At the 65 buyback companies where the same person held the top job between 2019 and 2022, the Low-Wage 100 CEOs’ personal stock holdings soared 33% to an average of $184.7 million. Median pay at these firms rose only 10% to an average of $31,972.

FedEx founder and CEO Frederick Smith has the largest stockpile in the Low-Wage 100. With $3.6 billion in stock buybacks since January 2020, Smith’s personal stock holdings have grown 65% to more than $5 billion. By contrast, median pay for workers at the notoriously anti-union company fell by 20% to $39,177 during this period.

What makes all this even more upsetting? Taxpayers are actually supporting, through federal contracts, the buyback-fueled disparities at FedEx and 50 other Low-Wage 100 firms.

FedEx pocketed $6.2 billion in fiscal years 2020-2023 for mail services for the Veterans Administration and other agencies. The largest federal contractor in the Low-Wage 100 is another company known for union-busting—Amazon. Over the past few years, Amazon has pocketed more than $10 billion in web services deals from Uncle Sam while spending nearly $6 billion repurchasing their shares.

Fortunately, support is growing for solutions to our CEO pay problem.

Before 1982, stock buybacks were viewed as market manipulation and largely banned. President Joe Biden hasn’t yet called for reinstating that ban, but he did rail against buybacks in his State of the Union address this year and called for quadrupling a new 1% excise tax on share repurchases.

The Biden administration is also starting to use federal money going to corporations as a lever for change. In an important first step, the administration is giving preferential treatment in the awarding of new semiconductor manufacturing subsidies to companies that agree to give up buybacks. Now they should extend that policy to all corporations receiving taxpayer money.

Buybacks are not the only trick CEOs can use to inflate their own paychecks. Over my decades of research, I’ve documented how corporate leaders have used myriad shady means to hit personal jackpots, from cooking the books and moving executive bonus goalposts to creating housing bubbles and other reckless financial schemes.

To tackle this systemic problem, policymakers need to go bolder. Executive Excess 2023 offers an extensive menu of CEO pay reforms. One of the most innovative: tax penalties for companies with huge CEO-worker pay gaps. Two major cities—San Francisco and Portland, Oregon—are already generating significant revenue through such taxes. Seattle is now considering a similar approach.

The idea that the person in the corner office is hundreds of times more valuable than other employees is a myth—even if that person is not just watching cat videos. All employees contribute to the profits of a corporation, and our economy would be far healthier if the fruits of our labor were more equitably shared.