Oil Companies Lose Again: Baltimore Climate Lawsuit Belongs in State Court, Fourth Circuit Affirms

Two Federal Appeals Courts Have Now Handed Major Losses to Fossil Fuel Companies After the U.S. Supreme Court Ordered Expanded Review of Big Oil’s Arguments for Federal Jurisdiction

The City of Baltimore's lawsuit seeking to hold major oil and gas companies -- including ExxonMobil, BP, Chevron, and Shell -- accountable for the cost of climate damages they knowingly caused should proceed in state court, the U.S. Court of Appeals for the Fourth Circuit ruled in a unanimous decision today.

"In this case, a municipality has decided to exclusively rely upon state-law claims to remedy its own climate-change injuries, which it perceives were caused, at least in part, by Defendants' fossil-fuel products and strategic misinformation campaign," the three judge panel ruled. "These claims do not belong in federal court."

The Fourth Circuit decision marks the second time this year that a federal appeals court has rejected arguments from the oil industry to move one of the growing number of climate liability lawsuits filed in state court to federal court following a 2021 U.S. Supreme Court ruling.

At least ten federal district courts have similarly ruled that climate accountability lawsuits filed in state court belong in state court -- "a batting average of .000" for the fossil fuel industry, in the words of one judge.

In response, Richard Wiles, president of the Center for Climate Integrity, released the following statement:

"This victory for the people of Baltimore shows that fossil fuel companies won't easily escape accountability for lying about their central role in the climate crisis and then sticking communities with the resulting bill.

"Once again, federal courts have rejected the oil and gas industry's attempts to evade justice in state court.

"Baltimore is now one important step closer to finally putting these polluters on trial to make them pay for the climate damages they knowingly caused."

Background:

The Fourth Circuit previously affirmed a lower court ruling to keep Baltimore's climate damages lawsuit in state court in 2020. But last year the U.S. Supreme Court ordered the Fourth Circuit and others to consider an expanded list of arguments the oil and gas defendants made in support of federal jurisdiction.

The Fourth Circuit's ruling today will also set a precedent for climate accountability lawsuits filed by Charleston, South Carolina, and Annapolis and Anne Arundel County, Maryland -- all three of which are within the Fourth Circuit.

In February, the U.S. Court of Appeals for the Tenth Circuit became the first federal appellate court to rule on the issue in 2022, rejecting an expanded number of arguments the fossil fuel companies made to move a lawsuit brought by several Colorado communities to federal court.

Five other federal circuit courts across the country are considering similar arguments from Exxon and other oil and gas companies, which have repeatedly lost efforts to move climate accountability lawsuits out of state court.

Since 2017, the attorneys general of Connecticut, Delaware, Massachusetts, Minnesota, Rhode Island, Vermont, and the District of Columbia, as well as 20 city and county governments in California, Colorado, Hawaii, Maryland, New Jersey, New York, South Carolina, and Washington, have filed lawsuits to hold major oil and gas companies accountable for deceiving the public about their products' role in climate change.

The Center for Climate Integrity (CCI) helps cities and states across the country hold corporate polluters accountable for the massive impacts of climate change.

(919) 307-6637House Dems 'Deeply Concerned' About Death in For-Profit ICE Processing Center

"While ICE claims he died of natural causes," said Reps. Delia Ramirez and Rashida Tlaib, "there have been numerous complaints from family members and advocates about inhumane conditions and inadequate medical care at North Lake."

A press release from US Immigration and Customs Enforcement on Wednesday regarding the death of an immigrant named Nenko Stanev Gantchev at one of the agency's facilities suggested ICE had provided a "safe, secure, and humane" environment—but considering numerous reports about medical neglect and abuse at immigrant detention centers in recent months, two Democratic lawmakers are demanding a full investigation into the man's death.

US Reps. Delia Ramirez (D-Ill.) and Rashida Tlaib (D-Mich.) called on the federal government to open "an immediate, transparent investigation into the circumstances of Mr. Gantchev’s death, including an investigation into reports from other detainees that he asked for medical assistance and did not receive it in time to save his life."

That kind of medical neglect has been reported at immigration detention facilities such as Florida's so-called "Alligator Alcatraz" and Krome North Service Processing Center and at detention centers run by for-profit companies like GEO Group—the corporation that runs North Lake Processing Center in Baldwin, Michigan, where Gantchev was found dead in his cell on Monday.

"We are deeply concerned about the death of Mr. Gantchev, an Illinois resident who was detained at the for-profit GEO Group’s North Lake Processing Center," said Ramirez and Tlaib. "While ICE claims he died of natural causes, the circumstances surrounding his death are not yet clear, and we know there have been numerous complaints from family members and advocates about inhumane conditions and inadequate medical care at North Lake."

Ten days before Gantchev's death, Tlaib conducted an oversight visit at the facility after receiving reports of cold temperatures, inadequate food, unsanitary facilities, and inmates having trouble accessing medical care.

“During this visit, we learned there have been multiple suicide attempts at the facility, including one in the last couple weeks, and heard that more medical staff are needed,” she said at the time. “No human being should be trapped in cages, forced to experience dehumanizing conditions, or separated from their family.”

North Lake was a juvenile detention facility in the 1990s, when the University of Michigan documented allegations of medical neglect and abuse. It later operated as a federal prison until 2022, when then-President Joe Biden prohibited private prison companies from running federal detention facilities. In June, GEO Group reopened the jail as an ICE facility.

A lawsuit filed in September by the ACLU of Michigan on behalf of an inmate at North Lake, Jose Contreras Cervantes, alleged that for nearly a month, staffers at the facility did not give him the chemotherapy pills he had been taking for leukemia.

Ramirez and Tlaib suggested that the past and current reports of abuse at the center, its operator's history, and ICE's record this year regarding detainee deaths left many open questions about how Gantchev died.

"To date, we are aware of at least 30 deaths at ICE detention centers this year, making 2025 the deadliest year for immigrants in ICE custody," the congresswomen said.

Gantchev was 56 and was from Bulgaria, and was arrested on a warrant by ICE agents in Chicago in September. He had previously been arrested in the 1990s and 2000s for theft, battery, and driving under the influence. He was granted lawful permanent residence in 2005, but the status was revoked in 2009 and an immigration judge ordered Gantchev's removal in 2023.

Christine Sauvé of the Michigan Immigrant Rights Center told MLive that in the immigration detention system, there has been “heightened cruelty under the Trump administration.”

“As this administration creates new barriers and releases fewer people, individuals are languishing in detention, often with delayed or inadequate medical care, while separated needlessly from their families,” Sauvé said.

Ramirez and Tlaib said that "the Trump administration’s attacks on our communities and immigrant neighbors must end."

"We will continue to provide oversight to hold ICE accountable," they said, "and protect our residents and communities.”

As Wage Growth Slows and Unemployment Rises, Trump Tax Cuts Deliver Big for Mega-Rich Retail CEOs

"At the same time prices have soared for consumers and retail workers remain stuck in low-wage jobs, big-store CEOs and shareholders have reaped higher profits and lower taxes."

As workers face slowing wage growth, a worsening cost-of-living crisis, and rising unemployment, the chief executives of top corporate retailers in the United States are reaping huge gains from the tax cuts that US President Donald Trump and congressional Republicans extended over the summer.

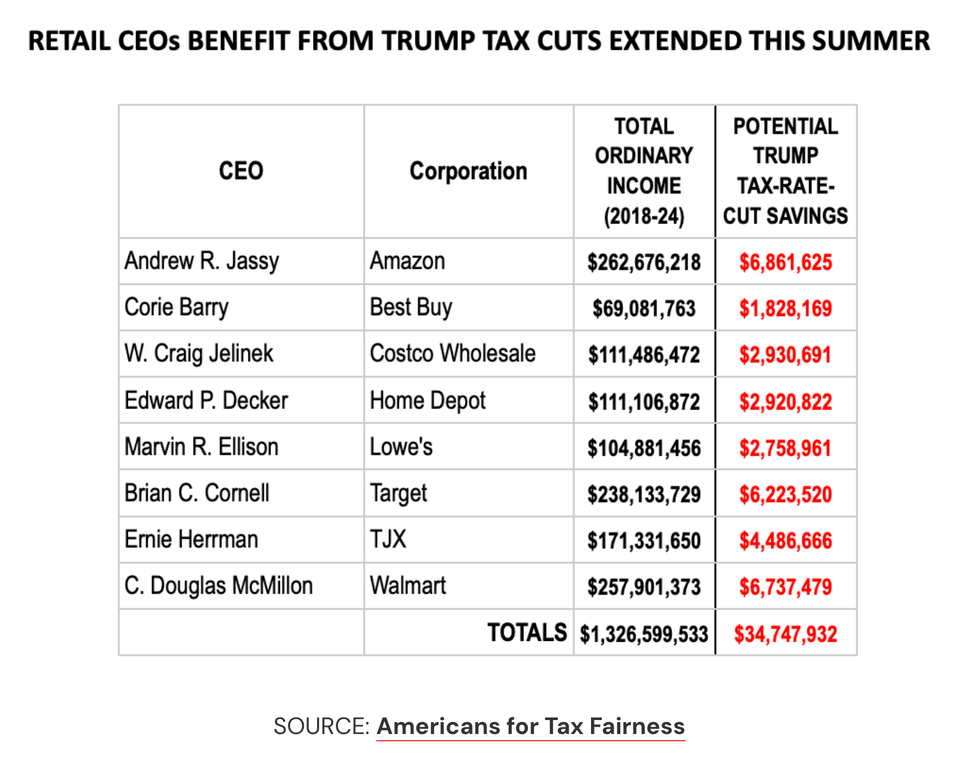

An analysis released Friday by the progressive advocacy group Americans for Tax Fairness (ATF) estimates that the CEOs of Amazon, Best Buy, Costco, Home Depot, Lowe's, Target, TJX, and Walmart have collectively saved close to $35 million on their individual tax returns in the seven years the Trump tax cuts have been in effect.

Thanks to the Trump-GOP tax law, which took effect in 2018, the companies examined in the analysis paid a tax rate of just 17.5% between 2018 and 2024—roughly half what they paid prior to the law's enactment.

"While at the same time prices have soared for consumers and retail workers remain stuck in low-wage jobs, big-store CEOs and shareholders have reaped higher profits and lower taxes," David Kass, ATF’s executive director, said in a statement. "If we want a system that alleviates economic stress on average Americans instead of exacerbating it during the holiday season, we need to raise taxes on corporations and the rich, invest in workers and families with expanded public services."

Workers at the major retailers haven't fared nearly as well. ATF noted that "the average worker at the eight stores was paid less than $32,000 in 2024."

"Amazon—the world’s largest retailer—refuses to even sit down with its employees who have formed a labor union for better pay, benefits, and working conditions," the group observed. "If Lowe’s had used the nearly $50 billion it spent on stock buybacks over the seven-year period to instead raise employee wages, its workers would have each been paid almost $200,000 more."

Across the US economy, workers are seeing wage growth stagnate amid elevated and still-rising prices, which are forcing many to skip meals and ration their medications to make ends meet.

The Labor Department said earlier this week that wage growth decelerated to 3.5% year over year—the slowest pace since before the Covid-19 pandemic. Unemployment, meanwhile, rose in November to the highest level in four years.

The ATF analysis came days after Trump delivered a lie-filled primetime speech defending his handling of the US economy as his approval ratings tanked, with American voters across party lines increasingly furious over the high costs of housing, groceries, healthcare, and other necessities.

During the speech, Trump vowed that Americans would soon "see the results of the largest tax cuts in American history."

But the richest people in the country are set to reap disproportionate benefits from the tax cuts. As Bloomberg reported earlier this week, "Many filers—particularly those who could most use the financial boost—may soon be disappointed."

"Wealthy taxpayers in high-tax states like California, New York, and New Jersey are the biggest winners," the outlet noted.

Dems Call to Investigate Commerce Secretary Boosting AI Data Centers That 'Enrich His Entire Family'

"Never in modern US history has the office intersected so broadly and deeply with the financial interests of the commerce secretary’s own family," according to the New York Times.

A group of Democratic lawmakers has called for the Commerce Department to investigate whether its billionaire secretary, Howard Lutnick, is improperly boosting artificial intelligence data centers that "stand to enrich his entire family."

The group of 25 House and Senate Democrats, led by Sen. Elizabeth Warren (D-Mass.) and Rep. Madeleine Dean (D-Pa.), sent a letter on Thursday urging the department's acting inspector general, Duane Townsend, to review whether Lutnick violated any part of the ethics agreement he signed following his nomination.

That agreement required him to divest his stake in the financial services firm Cantor Fitzgerald, which he had owned and led for decades. Cantor owns the Newmark Group, a real estate broker that facilitates leases for AI data centers.

Lutnick stepped down from his position as CEO in February, handing his financial stake in the company to his adult sons, Brandon and Kyle.

Though the transfer of his stake was supposed to happen in May, records show he did not do so until October, after receiving an ethics waiver from the Trump administration that allowed him to continue working on matters that could affect the company.

The lawmakers described some of these potential conflicts in the letter, many of which were revealed by a New York Times investigation last month:

Multiple press reports indicate that, in his capacity as head of the Commerce Department, Secretary Lutnick has helped boost AI data centers in ways that will likely enrich his own family. He has made public appearances promoting data center projects—including at least one that his family's company has worked on.

Furthermore, Secretary Lutnick has reportedly pressured foreign governments to invest in the US data center industry. For example, as part of a recent AI chips export deal with the United Arab Emirates (UAE), Secretary Lutnick reportedly pushed the UAE to "build data centers in America,” in exchange for the United States loosening export control restrictions on certain advanced chips. The Trump administration ultimately approved this deal, under which the Lutnick-backed Newmark Group is primed to profit from that Emirati investment.

Similarly, as part of another trade deal, Secretary Lutnick reportedly pushed South Korea to invest hundreds of billions of dollars in the United States. One startup vying for some of South Korea's investment has paid the Lutnick family's companies millions in fees to help it secure financing and land for its new data center.

Though businesspeople have often occupied the role of Commerce Secretary, the Times reported last month that "never in modern US history has the office intersected so broadly and deeply with the financial interests of the commerce secretary’s own family, according to interviews with ethics lawyers and historians."

According to the company's most recent quarterly earnings report, Newmark has completed more than $25 billion in data center deals over the past 12 months, resulting in its most lucrative year in the firm's history.

Citing evidence that the construction of AI data centers considerably spikes energy costs for consumers, the lawmakers said, "There is substantial public interest in ensuring that Secretary Lutnick is not violating federal ethics law to propel data centers that will be profitable for his family while making life more expensive for working Americans."