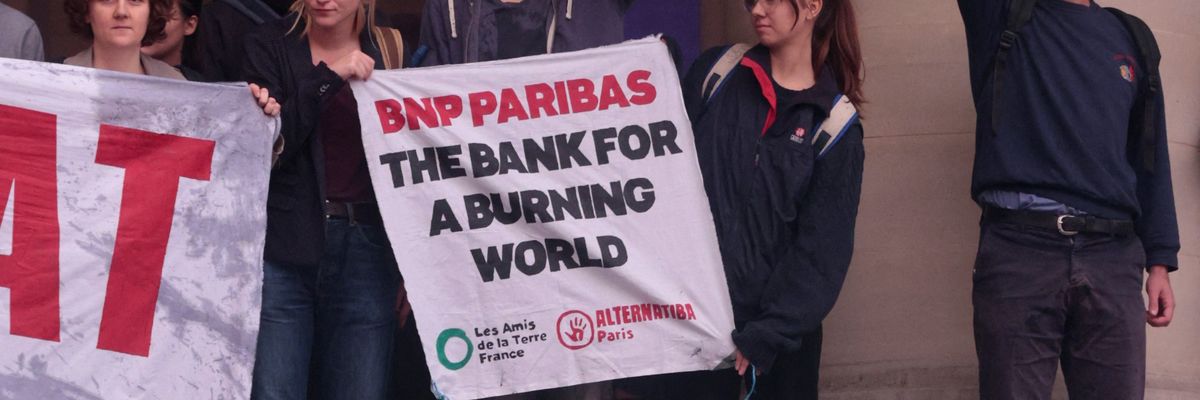

A trio of advocacy groups on Thursday launched the world's first climate lawsuit against a commercial bank, alleging that the Paris-based firm BNP Paribas is violating its legal obligations by continuing to finance planet-wrecking oil and gas development on a massive scale.

BNP Paribas, Europe's largest funder of fossil fuel expansion projects, "continues to write new blank checks to the largest fossil fuel companies without setting any conditions for an oil-free, gas-free ecological transition," said Alexandre Poidatz, an advocacy officer at Oxfam France, which joined Friends of the Earth France and Notre Affaire à Tous in filing the unprecedented lawsuit.

"With this lawsuit," Poidatz continued, "we would like to reiterate that our organizations are firmly resolved to see the judge reach a verdict that forces the bank to honor its promises."

The groups specifically accuse BNP Paribas of violating France's duty of vigilance law, which—according to a summary from the European Coalition for Corporate Justice—"establishes a legally binding obligation for parent companies to identify and prevent adverse human rights and environmental impacts resulting from their own activities, from activities of companies they control, and from activities of their subcontractors and suppliers, with whom they have an established commercial relationship."

In October, the three advocacy organizations formally warned BNP Paribas that they would take the company to court if it failed to bring its business practices into line with French law within three months.

The groups said Thursday that BNP Paribas has dismissed their call to immediately stop financing new fossil fuel projects, which are imperiling hopes of limiting planetary warming.

"BNP's reaction indicates that Europe's leading funder of fossil fuel development is rejecting our organizations' urgent request to stop supporting new oil and gas projects, even though this request is based on science and was recently reiterated by the United Nations secretary-general," the groups said, pointing to a press release the company issued last month.

Justine Ripoll, a campaigner with Notre Affaire à Tous, said in a statement Thursday that "the French duty of vigilance law imposes an obligation on multinationals in all sectors to take action to protect human rights and the environment, and to do so efficiently."

"The financial sector has a huge responsibility in our collective ability to comply with the Paris agreement," said Ripoll. "This first climate litigation against a commercial bank is undoubtedly the first of many around the world."

As Reuters reported Thursday, the climate coalition is modeling its legal action after a prominent 2021 case in which a Dutch court ordered Shell to slash its carbon emissions by 45% by 2030. Shell is appealing the decision.

BNP Paribas was Shell's top banker between 2016 and 2021, according to a recent report, providing the oil giant with $8 billion in fossil fuel financing during that period.

"BNP Paribas was the biggest banker of offshore oil and gas over the six-year period since the Paris agreement," the report found.