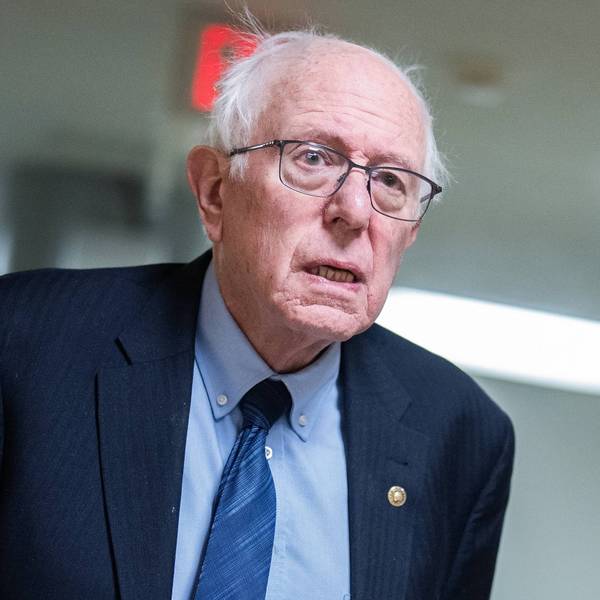

News that the U.S. semiconductor giants Intel and Micron are slashing manufacturing investments despite the recent passage of a major subsidies bill drew the ire of Sen. Bernie Sanders, the Senate's most outspoken critic of industry handouts in the CHIPS and Science Act.

"This is what a rigged economy looks like," Sanders (I-Vt.) said Wednesday. "On the same day a bill was signed into law to give a $76 billion blank check to microchip companies, Intel announced it will be cutting back on plans to increase jobs by $4 billion while increasing dividends for its wealthy shareholders."

The Vermont senator was referring to Intel's move to cut spending on manufacturing plant buildouts and other investments by $4 billion in the coming months--even as it continues to pay a sizable dividend.

"We paid dividends of $1.5 billion, a 5% increase year-over-year, and remain committed to growing the dividend over time," David Zinsner, Intel's chief financial officer, said during the company's second-quarter earnings call late last month.

Led by lavishly compensated CEO Pat Gelsinger, Intel lobbied aggressively for the CHIPS and Science Act, threatening to move more of its operations outside the U.S. if the subsidies bill wasn't approved. President Joe Biden signed the measure into law last week after it passed both chambers of Congress with overwhelming bipartisan support.

Sanders, the chair of the Senate Budget Committee, was the only member of the Senate Democratic caucus to vote no.

Micron, for its part, said last week that it plans to "cut its capital spending 'meaningfully' next year" in response to worsening conditions in the chip industry and the global economy, the Financial Times reported.

The company's announcement came a day after it hailed passage of the CHIPS and Science Act and vowed to make good use of the law's "grants and credits."

Overall, the newly enacted law includes $52 billion in taxpayer subsidies and a $24 billion investment tax credit for the semiconductor industry.

In several speeches on the Senate floor ahead of the measure's final passage, Sanders blasted the legislation as "corporate welfare" and proposed amendments aimed at ensuring companies wouldn't use the taxpayer funds to reward shareholders, bust unions, and offshore more jobs.

Democrats and Republicans rejected the senator's proposed changes.

"The five biggest semiconductor companies that will likely receive the lion's share of this taxpayer handout--Intel, Texas Instruments, Micron Technology, Global Foundries, and Samsung--made $70 billion in profits last year," Sanders said in a July speech. "Does it sound like these companies really need corporate welfare?"