SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

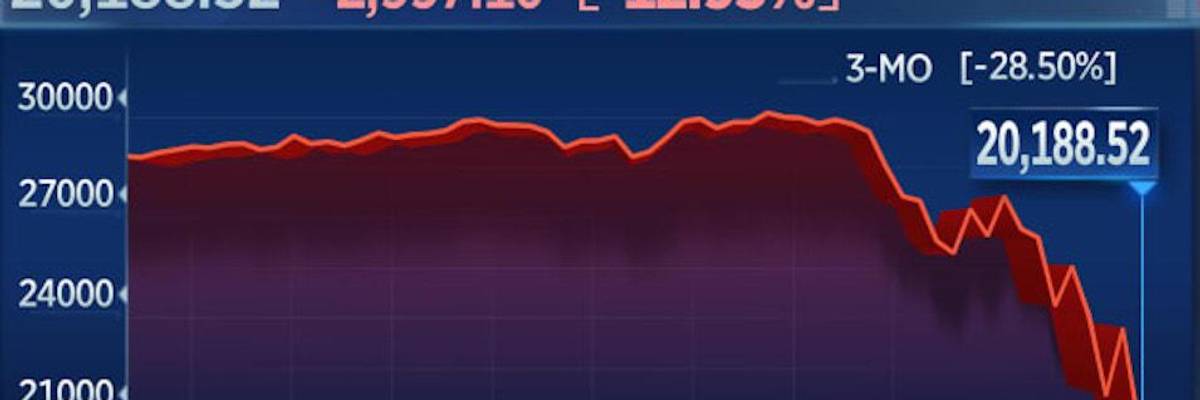

The Dow Jones Industrial Average plunged to a historic loss Monday. (image: CNBC/screenshot)

The Dow Jones Industrial Average fell nearly 3,000 points by the end of trading Monday as part of the stock market's 12.9% drop--its second worst one-day decline ever, after the "Black Monday" crash in 1987--on fears of continuing economic stoppage due to the coronavirus outbreak which has covered the planet.

"Who needs Disneyland when the stock market is currently the wildest ride on the planet," tweeted Media Matters researcher Nikki McCann Ramirez.

Monday's drop followed an attempt by the Federal Reserve to stabilize markets with an interest rate cut.

"The market will take care of itself," President Donald Trump said at a White House press conference Monday afternoon as the bell rang in New York.

At the beginning of trading Monday stocks fell so fast that they tripped the "circuit breaker," which suspends trading for 15 minutes to give markets a chance to recover from losses of 7%. The circuit breaker kicks on again at 13%.

"While the news continues to worsen and with the price action doing things we've only seen a handful of other times in the last century, it's nearly impossible to keep things in perspective," Instinet executive director Frank Cappelleri told CNBC.

The economic slowdown spurred by the coronavirus outbreak has already done major damage to the economies of China, South Korea, Japan, and the European Union. Investors fear the U.S. is next and told CNBC they were unlikely to jump back into the market until the disease had passed its peak.

"The market is at the mercy of the virus and at the mercy of whether the containment policies work," said Quincy Krosby, a Prudential Financial chief market strategist.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The Dow Jones Industrial Average fell nearly 3,000 points by the end of trading Monday as part of the stock market's 12.9% drop--its second worst one-day decline ever, after the "Black Monday" crash in 1987--on fears of continuing economic stoppage due to the coronavirus outbreak which has covered the planet.

"Who needs Disneyland when the stock market is currently the wildest ride on the planet," tweeted Media Matters researcher Nikki McCann Ramirez.

Monday's drop followed an attempt by the Federal Reserve to stabilize markets with an interest rate cut.

"The market will take care of itself," President Donald Trump said at a White House press conference Monday afternoon as the bell rang in New York.

At the beginning of trading Monday stocks fell so fast that they tripped the "circuit breaker," which suspends trading for 15 minutes to give markets a chance to recover from losses of 7%. The circuit breaker kicks on again at 13%.

"While the news continues to worsen and with the price action doing things we've only seen a handful of other times in the last century, it's nearly impossible to keep things in perspective," Instinet executive director Frank Cappelleri told CNBC.

The economic slowdown spurred by the coronavirus outbreak has already done major damage to the economies of China, South Korea, Japan, and the European Union. Investors fear the U.S. is next and told CNBC they were unlikely to jump back into the market until the disease had passed its peak.

"The market is at the mercy of the virus and at the mercy of whether the containment policies work," said Quincy Krosby, a Prudential Financial chief market strategist.

The Dow Jones Industrial Average fell nearly 3,000 points by the end of trading Monday as part of the stock market's 12.9% drop--its second worst one-day decline ever, after the "Black Monday" crash in 1987--on fears of continuing economic stoppage due to the coronavirus outbreak which has covered the planet.

"Who needs Disneyland when the stock market is currently the wildest ride on the planet," tweeted Media Matters researcher Nikki McCann Ramirez.

Monday's drop followed an attempt by the Federal Reserve to stabilize markets with an interest rate cut.

"The market will take care of itself," President Donald Trump said at a White House press conference Monday afternoon as the bell rang in New York.

At the beginning of trading Monday stocks fell so fast that they tripped the "circuit breaker," which suspends trading for 15 minutes to give markets a chance to recover from losses of 7%. The circuit breaker kicks on again at 13%.

"While the news continues to worsen and with the price action doing things we've only seen a handful of other times in the last century, it's nearly impossible to keep things in perspective," Instinet executive director Frank Cappelleri told CNBC.

The economic slowdown spurred by the coronavirus outbreak has already done major damage to the economies of China, South Korea, Japan, and the European Union. Investors fear the U.S. is next and told CNBC they were unlikely to jump back into the market until the disease had passed its peak.

"The market is at the mercy of the virus and at the mercy of whether the containment policies work," said Quincy Krosby, a Prudential Financial chief market strategist.