SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

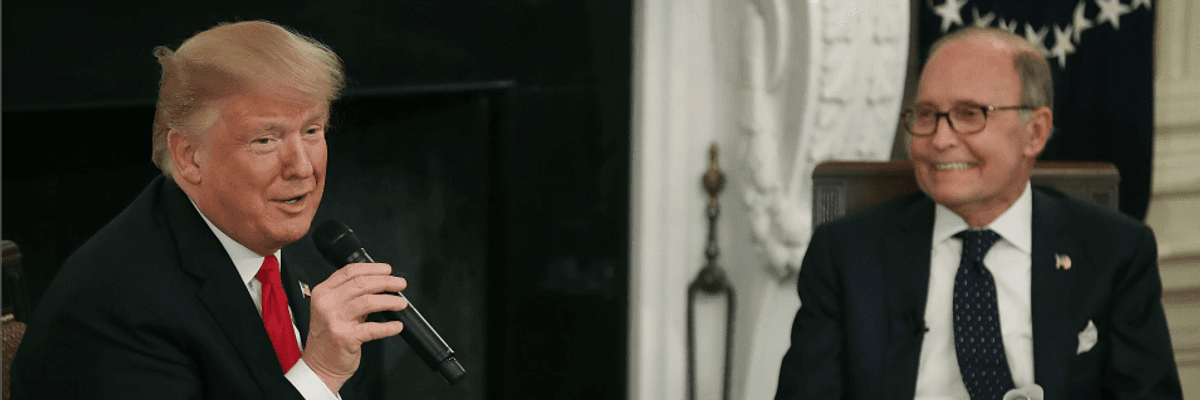

President Donald Trump speaks while flanked by Director of the National Economic Council Larry Kudlow during an event in the State Dining Room of the White House on October 31, 2018 in Washington, D.C. (Photo: Mark Wilson/Getty Images)

While continuing to publicly downplay warning signs that the U.S. economy is barreling toward a recession, the Trump White House is reportedly weighing a number of supposed stimulus measures, including more tax cuts for the rich and large corporations.

Politico reported late Tuesday that Trump officials are considering "a cut of an additional percentage point or two to the corporate tax rate," which the GOP tax law slashed from 35 percent to 21 percent in 2018.

"The American people are waking up to the damage he has done to our economy by waging senseless trade wars and handing out trillions in tax cuts to the wealthy and corporations."

--Robert Reich, former Labor Secretary

"That's on top of a potential payroll tax cut," the news outlet noted, "which the Obama administration had used to shore up the economy, and a move to index the capital gains rate to inflation, which potentially could be done through an executive order."

A payroll tax cut, which Trump on Tuesday confirmed he is considering, would temporarily boost workers' paychecks.

But, as the Washington Post reported Monday, depending on how it is designed, a payroll tax cut could "pull billions of dollars away from Social Security."

The other option Trump is considering, indexing capital gains to inflation via executive order, would primarily benefit wealthy investors. According to Chye-Ching Huang of the Center on Budget and Policy Priorities, 86 percent of the benefits would go to the top one percent.

The Trump administration has been mulling indexing capital gains to inflation through executive action since last year, despite warnings the move may be illegal. As Common Dreams reported last month, a group of more than 20 Republican senators, led by Sen. Ted Cruz (R-Texas), is urging the president to push ahead with the executive order.

"We have been talking about indexing for a long time," Trump told reporters Tuesday. "I can do it directly."

\u201cTrump tells WH pool he could index capital gains to inflation -- effectively a huge tax cut, primarily befalling the wealthy -- through executive action, without going through Congress. Here's what Trump's own AG Bill Barr said about that in 1992, the last time he was AG\u201d— Catherine Rampell (@Catherine Rampell) 1566327777

Journalist Matt O'Brien derided the White House's reported ideas to ward off a recession as handouts to the rich that would do little to stimulate the economy.

"Hilariously, two of Trump's ideas for stimulating the economy are 1) cutting the corporate tax rate a little more (after cutting it a lot didn't do much), and 2) indexing capital gains to inflation," O'Brien tweeted on Tuesday. "It's tax cuts for the rich all the way down."

Trump's reported plans to put more money in the pockets of the wealthiest Americans and large corporations come just a week after the Treasury bond yield curve inverted for the first time since the Wall Street crash of 2008. The inverted yield curve has preceeded every major economic downturn over the past 50 years.

Economists and other observers were quick to point to Trump's reckless trade war with China, the world's second-largest economy behind the U.S., as a key reason for recession fears. As Common Dreams reported last week, the Twitter hashtag #TrumpRecession went viral shortly following the inverted yield curve.

Former Labor Secretary Robert Reich tweeted Tuesday that "we already know about Trump's racism, xenophobia, and fear-mongering."

"Now," said Reich, "the American people are waking up to the damage he has done to our economy by waging senseless trade wars and handing out trillions in tax cuts to the wealthy and corporations."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

While continuing to publicly downplay warning signs that the U.S. economy is barreling toward a recession, the Trump White House is reportedly weighing a number of supposed stimulus measures, including more tax cuts for the rich and large corporations.

Politico reported late Tuesday that Trump officials are considering "a cut of an additional percentage point or two to the corporate tax rate," which the GOP tax law slashed from 35 percent to 21 percent in 2018.

"The American people are waking up to the damage he has done to our economy by waging senseless trade wars and handing out trillions in tax cuts to the wealthy and corporations."

--Robert Reich, former Labor Secretary

"That's on top of a potential payroll tax cut," the news outlet noted, "which the Obama administration had used to shore up the economy, and a move to index the capital gains rate to inflation, which potentially could be done through an executive order."

A payroll tax cut, which Trump on Tuesday confirmed he is considering, would temporarily boost workers' paychecks.

But, as the Washington Post reported Monday, depending on how it is designed, a payroll tax cut could "pull billions of dollars away from Social Security."

The other option Trump is considering, indexing capital gains to inflation via executive order, would primarily benefit wealthy investors. According to Chye-Ching Huang of the Center on Budget and Policy Priorities, 86 percent of the benefits would go to the top one percent.

The Trump administration has been mulling indexing capital gains to inflation through executive action since last year, despite warnings the move may be illegal. As Common Dreams reported last month, a group of more than 20 Republican senators, led by Sen. Ted Cruz (R-Texas), is urging the president to push ahead with the executive order.

"We have been talking about indexing for a long time," Trump told reporters Tuesday. "I can do it directly."

\u201cTrump tells WH pool he could index capital gains to inflation -- effectively a huge tax cut, primarily befalling the wealthy -- through executive action, without going through Congress. Here's what Trump's own AG Bill Barr said about that in 1992, the last time he was AG\u201d— Catherine Rampell (@Catherine Rampell) 1566327777

Journalist Matt O'Brien derided the White House's reported ideas to ward off a recession as handouts to the rich that would do little to stimulate the economy.

"Hilariously, two of Trump's ideas for stimulating the economy are 1) cutting the corporate tax rate a little more (after cutting it a lot didn't do much), and 2) indexing capital gains to inflation," O'Brien tweeted on Tuesday. "It's tax cuts for the rich all the way down."

Trump's reported plans to put more money in the pockets of the wealthiest Americans and large corporations come just a week after the Treasury bond yield curve inverted for the first time since the Wall Street crash of 2008. The inverted yield curve has preceeded every major economic downturn over the past 50 years.

Economists and other observers were quick to point to Trump's reckless trade war with China, the world's second-largest economy behind the U.S., as a key reason for recession fears. As Common Dreams reported last week, the Twitter hashtag #TrumpRecession went viral shortly following the inverted yield curve.

Former Labor Secretary Robert Reich tweeted Tuesday that "we already know about Trump's racism, xenophobia, and fear-mongering."

"Now," said Reich, "the American people are waking up to the damage he has done to our economy by waging senseless trade wars and handing out trillions in tax cuts to the wealthy and corporations."

While continuing to publicly downplay warning signs that the U.S. economy is barreling toward a recession, the Trump White House is reportedly weighing a number of supposed stimulus measures, including more tax cuts for the rich and large corporations.

Politico reported late Tuesday that Trump officials are considering "a cut of an additional percentage point or two to the corporate tax rate," which the GOP tax law slashed from 35 percent to 21 percent in 2018.

"The American people are waking up to the damage he has done to our economy by waging senseless trade wars and handing out trillions in tax cuts to the wealthy and corporations."

--Robert Reich, former Labor Secretary

"That's on top of a potential payroll tax cut," the news outlet noted, "which the Obama administration had used to shore up the economy, and a move to index the capital gains rate to inflation, which potentially could be done through an executive order."

A payroll tax cut, which Trump on Tuesday confirmed he is considering, would temporarily boost workers' paychecks.

But, as the Washington Post reported Monday, depending on how it is designed, a payroll tax cut could "pull billions of dollars away from Social Security."

The other option Trump is considering, indexing capital gains to inflation via executive order, would primarily benefit wealthy investors. According to Chye-Ching Huang of the Center on Budget and Policy Priorities, 86 percent of the benefits would go to the top one percent.

The Trump administration has been mulling indexing capital gains to inflation through executive action since last year, despite warnings the move may be illegal. As Common Dreams reported last month, a group of more than 20 Republican senators, led by Sen. Ted Cruz (R-Texas), is urging the president to push ahead with the executive order.

"We have been talking about indexing for a long time," Trump told reporters Tuesday. "I can do it directly."

\u201cTrump tells WH pool he could index capital gains to inflation -- effectively a huge tax cut, primarily befalling the wealthy -- through executive action, without going through Congress. Here's what Trump's own AG Bill Barr said about that in 1992, the last time he was AG\u201d— Catherine Rampell (@Catherine Rampell) 1566327777

Journalist Matt O'Brien derided the White House's reported ideas to ward off a recession as handouts to the rich that would do little to stimulate the economy.

"Hilariously, two of Trump's ideas for stimulating the economy are 1) cutting the corporate tax rate a little more (after cutting it a lot didn't do much), and 2) indexing capital gains to inflation," O'Brien tweeted on Tuesday. "It's tax cuts for the rich all the way down."

Trump's reported plans to put more money in the pockets of the wealthiest Americans and large corporations come just a week after the Treasury bond yield curve inverted for the first time since the Wall Street crash of 2008. The inverted yield curve has preceeded every major economic downturn over the past 50 years.

Economists and other observers were quick to point to Trump's reckless trade war with China, the world's second-largest economy behind the U.S., as a key reason for recession fears. As Common Dreams reported last week, the Twitter hashtag #TrumpRecession went viral shortly following the inverted yield curve.

Former Labor Secretary Robert Reich tweeted Tuesday that "we already know about Trump's racism, xenophobia, and fear-mongering."

"Now," said Reich, "the American people are waking up to the damage he has done to our economy by waging senseless trade wars and handing out trillions in tax cuts to the wealthy and corporations."