SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

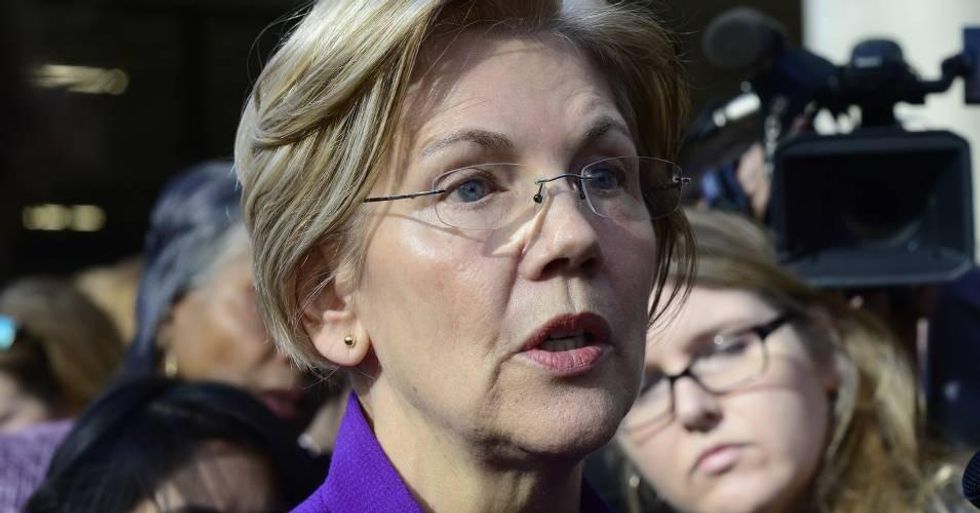

With the Senate voting on a Wall Street deregulation bill as early as Wednesday evening, U.S. Senator Elizabeth Warren (D-Mass.) marked today's 10-year anniversary of the financial crisis by unveiling new legislation that--in contrast to the "Bank Lobbyist Act"--aims to curb the fraud and greed of large financial institutions.

"The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients." --Sen. Elizabeth Warren"When Wall Street CEOs break the law, they should go to jail like anyone else. The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients," Warren declared in a statement.

Entitled "The Ending Too Big to Jail Act," the legislation (pdf) calls for three major changes to address the problem of financial executives not being held criminally responsible for the 2008 crisis. A fact-sheet laying out the proposals explains how they would:

Instead of passing the Bank Lobbyist Act, formally known as S. 2155, Warren said that "Congress should be marking the tenth anniversary of the financial crisis by strengthening rules on banks and bankers so Wall Street can never again get away with cheating Americans and crashing the economy."

Warren has been a vocal opponent of the deregulation bill--which the Congressional Budget Office (CBO) found would be a massive gift to some of the same Wall Street banks that led to the 2008 crash--and has also spoken out against her Democratic colleagues that are backing it.

Speaking on the Senate floor on Wednesday, Warren said that S. 2155 not only increases the chance for another financial meltdown, it has "landmines for American families." If it passes, she argued, the bill "guts protections for families that buy traditional and mobile homes and undermines our ability to enforce civil rights laws. And for what? So that banks that are already making record profits can tack on a little more to their bottom line?"

\u201cI\u2019m heading to the Senate floor one last time to try and convince the Senate to reject the #BankLobbyistAct. Watch live: https://t.co/qxIDkaHwkE\u201d— Elizabeth Warren (@Elizabeth Warren) 1521047661

"If the Senate is going to spend two weeks dealing with the big banks, we should be making the rules tougher, not weaker. Today, I introduced the Ending Too Big to Jail Act, which would help make sure big bank executives are hauled out of their corner offices in handcuffs the next time they break the law," she continued. "That would do more for America's working families than anything in this bill--and I'm going to fight to make it the law."

Donald Trump’s attacks on democracy, justice, and a free press are escalating — putting everything we stand for at risk. We believe a better world is possible, but we can’t get there without your support. Common Dreams stands apart. We answer only to you — our readers, activists, and changemakers — not to billionaires or corporations. Our independence allows us to cover the vital stories that others won’t, spotlighting movements for peace, equality, and human rights. Right now, our work faces unprecedented challenges. Misinformation is spreading, journalists are under attack, and financial pressures are mounting. As a reader-supported, nonprofit newsroom, your support is crucial to keep this journalism alive. Whatever you can give — $10, $25, or $100 — helps us stay strong and responsive when the world needs us most. Together, we’ll continue to build the independent, courageous journalism our movement relies on. Thank you for being part of this community. |

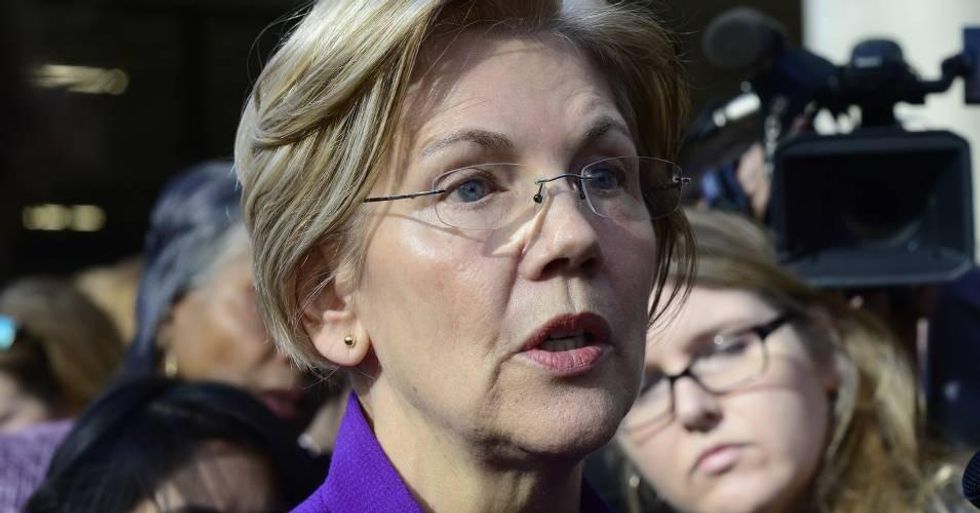

With the Senate voting on a Wall Street deregulation bill as early as Wednesday evening, U.S. Senator Elizabeth Warren (D-Mass.) marked today's 10-year anniversary of the financial crisis by unveiling new legislation that--in contrast to the "Bank Lobbyist Act"--aims to curb the fraud and greed of large financial institutions.

"The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients." --Sen. Elizabeth Warren"When Wall Street CEOs break the law, they should go to jail like anyone else. The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients," Warren declared in a statement.

Entitled "The Ending Too Big to Jail Act," the legislation (pdf) calls for three major changes to address the problem of financial executives not being held criminally responsible for the 2008 crisis. A fact-sheet laying out the proposals explains how they would:

Instead of passing the Bank Lobbyist Act, formally known as S. 2155, Warren said that "Congress should be marking the tenth anniversary of the financial crisis by strengthening rules on banks and bankers so Wall Street can never again get away with cheating Americans and crashing the economy."

Warren has been a vocal opponent of the deregulation bill--which the Congressional Budget Office (CBO) found would be a massive gift to some of the same Wall Street banks that led to the 2008 crash--and has also spoken out against her Democratic colleagues that are backing it.

Speaking on the Senate floor on Wednesday, Warren said that S. 2155 not only increases the chance for another financial meltdown, it has "landmines for American families." If it passes, she argued, the bill "guts protections for families that buy traditional and mobile homes and undermines our ability to enforce civil rights laws. And for what? So that banks that are already making record profits can tack on a little more to their bottom line?"

\u201cI\u2019m heading to the Senate floor one last time to try and convince the Senate to reject the #BankLobbyistAct. Watch live: https://t.co/qxIDkaHwkE\u201d— Elizabeth Warren (@Elizabeth Warren) 1521047661

"If the Senate is going to spend two weeks dealing with the big banks, we should be making the rules tougher, not weaker. Today, I introduced the Ending Too Big to Jail Act, which would help make sure big bank executives are hauled out of their corner offices in handcuffs the next time they break the law," she continued. "That would do more for America's working families than anything in this bill--and I'm going to fight to make it the law."

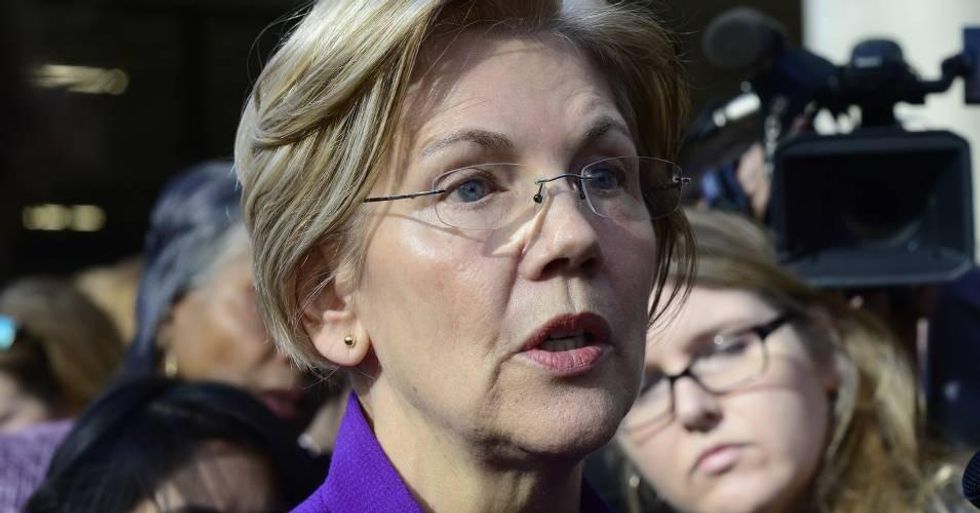

With the Senate voting on a Wall Street deregulation bill as early as Wednesday evening, U.S. Senator Elizabeth Warren (D-Mass.) marked today's 10-year anniversary of the financial crisis by unveiling new legislation that--in contrast to the "Bank Lobbyist Act"--aims to curb the fraud and greed of large financial institutions.

"The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients." --Sen. Elizabeth Warren"When Wall Street CEOs break the law, they should go to jail like anyone else. The fraud on Wall Street won't stop until executives know they will be hauled out in handcuffs for cheating their customers and clients," Warren declared in a statement.

Entitled "The Ending Too Big to Jail Act," the legislation (pdf) calls for three major changes to address the problem of financial executives not being held criminally responsible for the 2008 crisis. A fact-sheet laying out the proposals explains how they would:

Instead of passing the Bank Lobbyist Act, formally known as S. 2155, Warren said that "Congress should be marking the tenth anniversary of the financial crisis by strengthening rules on banks and bankers so Wall Street can never again get away with cheating Americans and crashing the economy."

Warren has been a vocal opponent of the deregulation bill--which the Congressional Budget Office (CBO) found would be a massive gift to some of the same Wall Street banks that led to the 2008 crash--and has also spoken out against her Democratic colleagues that are backing it.

Speaking on the Senate floor on Wednesday, Warren said that S. 2155 not only increases the chance for another financial meltdown, it has "landmines for American families." If it passes, she argued, the bill "guts protections for families that buy traditional and mobile homes and undermines our ability to enforce civil rights laws. And for what? So that banks that are already making record profits can tack on a little more to their bottom line?"

\u201cI\u2019m heading to the Senate floor one last time to try and convince the Senate to reject the #BankLobbyistAct. Watch live: https://t.co/qxIDkaHwkE\u201d— Elizabeth Warren (@Elizabeth Warren) 1521047661

"If the Senate is going to spend two weeks dealing with the big banks, we should be making the rules tougher, not weaker. Today, I introduced the Ending Too Big to Jail Act, which would help make sure big bank executives are hauled out of their corner offices in handcuffs the next time they break the law," she continued. "That would do more for America's working families than anything in this bill--and I'm going to fight to make it the law."