SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

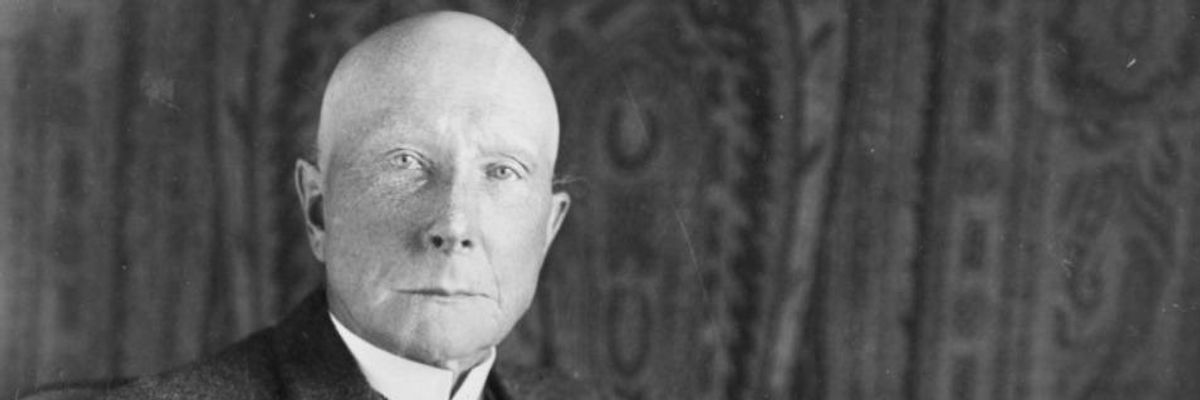

John D. Rockefeller built his fortune as the oil baron who built the Standard Oil empire. Now, some of the heirs to that substantial wealth are pledging to remove their holdings from fossil fuels and invest in a cleaner energy future. (Photo: Archive)

Prominent private philanthropies and charitable foundations, including one built from the oil fortune of John D. Rockefeller and Standard Oil, are announcing their intention to divest from fossil fuel holdings on Monday as they make clear statements that the threat of climate change and the irresponsible behavior of the oil, coal, and natural gas companies has fueled their decision.

The pledges from the group of endowments and individuals, which formed earlier this year as the Global Divest-Invest Coalition, will total $50 billion in assets that will be removed from the fossil fuel sector and placed in clean energy investments instead.

As the New York Times reports, "The family whose legendary wealth flowed from Standard Oil is planning to announce on Monday that its $860 million philanthropic organization, the Rockefeller Brothers Fund, is joining the divestment movement that began a couple years ago on college campuses."

The official announcement from the funds comes one day after an estimated 400,000 people marched through the streets of Manhattan demanding strong and immediate climate action and one day ahead of the UN Climate Summit, hosting world leaders from more than 125 nations, on Tuesday.

According to the Times:

The people who are selling shares of energy stocks are well aware that their actions are unlikely to have an immediate impact on the companies, given their enormous market capitalizations and cash flow.

Even so, some say they are taking action to align their assets with their environmental principles. Others want to shame companies that they believe are recklessly contributing to a warming planet. Still others say that the fight to limit climate change will lead to new regulations and disruptive new technologies that will make these companies an increasingly risky investment.

Ultimately, the activist investors say, their actions, like those of the anti-apartheid divestment fights of the 1980s, could help spur international debate, while the shift of investment funds to energy alternatives could lead to solutions to the carbon puzzle.

"This is a threshold moment," said Ellen Dorsey, executive director of the Wallace Global Fund, which has coordinated the effort to recruit foundations to the cause. "This movement has gone from a small activist band quickly into the mainstream."

Donald Trump’s attacks on democracy, justice, and a free press are escalating — putting everything we stand for at risk. We believe a better world is possible, but we can’t get there without your support. Common Dreams stands apart. We answer only to you — our readers, activists, and changemakers — not to billionaires or corporations. Our independence allows us to cover the vital stories that others won’t, spotlighting movements for peace, equality, and human rights. Right now, our work faces unprecedented challenges. Misinformation is spreading, journalists are under attack, and financial pressures are mounting. As a reader-supported, nonprofit newsroom, your support is crucial to keep this journalism alive. Whatever you can give — $10, $25, or $100 — helps us stay strong and responsive when the world needs us most. Together, we’ll continue to build the independent, courageous journalism our movement relies on. Thank you for being part of this community. |

Prominent private philanthropies and charitable foundations, including one built from the oil fortune of John D. Rockefeller and Standard Oil, are announcing their intention to divest from fossil fuel holdings on Monday as they make clear statements that the threat of climate change and the irresponsible behavior of the oil, coal, and natural gas companies has fueled their decision.

The pledges from the group of endowments and individuals, which formed earlier this year as the Global Divest-Invest Coalition, will total $50 billion in assets that will be removed from the fossil fuel sector and placed in clean energy investments instead.

As the New York Times reports, "The family whose legendary wealth flowed from Standard Oil is planning to announce on Monday that its $860 million philanthropic organization, the Rockefeller Brothers Fund, is joining the divestment movement that began a couple years ago on college campuses."

The official announcement from the funds comes one day after an estimated 400,000 people marched through the streets of Manhattan demanding strong and immediate climate action and one day ahead of the UN Climate Summit, hosting world leaders from more than 125 nations, on Tuesday.

According to the Times:

The people who are selling shares of energy stocks are well aware that their actions are unlikely to have an immediate impact on the companies, given their enormous market capitalizations and cash flow.

Even so, some say they are taking action to align their assets with their environmental principles. Others want to shame companies that they believe are recklessly contributing to a warming planet. Still others say that the fight to limit climate change will lead to new regulations and disruptive new technologies that will make these companies an increasingly risky investment.

Ultimately, the activist investors say, their actions, like those of the anti-apartheid divestment fights of the 1980s, could help spur international debate, while the shift of investment funds to energy alternatives could lead to solutions to the carbon puzzle.

"This is a threshold moment," said Ellen Dorsey, executive director of the Wallace Global Fund, which has coordinated the effort to recruit foundations to the cause. "This movement has gone from a small activist band quickly into the mainstream."

Prominent private philanthropies and charitable foundations, including one built from the oil fortune of John D. Rockefeller and Standard Oil, are announcing their intention to divest from fossil fuel holdings on Monday as they make clear statements that the threat of climate change and the irresponsible behavior of the oil, coal, and natural gas companies has fueled their decision.

The pledges from the group of endowments and individuals, which formed earlier this year as the Global Divest-Invest Coalition, will total $50 billion in assets that will be removed from the fossil fuel sector and placed in clean energy investments instead.

As the New York Times reports, "The family whose legendary wealth flowed from Standard Oil is planning to announce on Monday that its $860 million philanthropic organization, the Rockefeller Brothers Fund, is joining the divestment movement that began a couple years ago on college campuses."

The official announcement from the funds comes one day after an estimated 400,000 people marched through the streets of Manhattan demanding strong and immediate climate action and one day ahead of the UN Climate Summit, hosting world leaders from more than 125 nations, on Tuesday.

According to the Times:

The people who are selling shares of energy stocks are well aware that their actions are unlikely to have an immediate impact on the companies, given their enormous market capitalizations and cash flow.

Even so, some say they are taking action to align their assets with their environmental principles. Others want to shame companies that they believe are recklessly contributing to a warming planet. Still others say that the fight to limit climate change will lead to new regulations and disruptive new technologies that will make these companies an increasingly risky investment.

Ultimately, the activist investors say, their actions, like those of the anti-apartheid divestment fights of the 1980s, could help spur international debate, while the shift of investment funds to energy alternatives could lead to solutions to the carbon puzzle.

"This is a threshold moment," said Ellen Dorsey, executive director of the Wallace Global Fund, which has coordinated the effort to recruit foundations to the cause. "This movement has gone from a small activist band quickly into the mainstream."