One of the reasons that Saudi Arabia's plans for an Initial Public Offering (IPO) on its ARAMCO oil have not actually materialized is that investors are not dummies. Saudi Arabia's oil is an asset with no future value, and the future in which its price collapses is nearer than the oil companies think. (I would argue that if you figure in the cost of coming climate lawsuits, oil already has a negative value, but is certainly already worthless).

A new report by Carbon Trackers gives us some key metrics.

A million electric vehicles on the road reduces demand for petroleum by roughly 16,666 barrels a day.

The world is now producing about 99 million barrels a day, but the price per barrel fluctuates wildly depending on demand swings of as few as 2 million barrels a day. In 2014, for instance, China's annual rate of economic growth seemed set for a long term reduction from 10 percent a year to 6 percent a year, a result of a maturing economy. That reduction and its ripple effects through the world economy contributed to a fall in demand for oil of about 2 million barrels a day, which caused the price to plummet from a high of $110 a barrel to less than $50 a barrel.

A serial process goes 1, 2, 3, 4, 5 ... etc. An exponential process goes 1, 2, 4, 16, 32, 64, 128 . . . etc. Electric car adoption will be exponential, not serial. China sold 680,000 electric vehicles last year. But by 2020 it hopes to be selling 2 million a year, and then to go on up from there. That is, China alone will likely put more electric vehicles on the road than the oil companies expect the entire world to, by 2030. I also think analysts underestimate India's drive to a national electric vehicle fleet, in part driven by the urban politics of air pollution in cities like Delhi and Mumbai. Europe will buy about 300,000 EV passenger cars this year, up 40% from last, and new, ambitious European carbon goals will almost certainly cause that market rapidly to take off. A key turning point will come when EVs are actually cheaper with regard to sticker price than internal combustion cars- possibly as soon as 2023. This milestone has already been reached in Norway as a result of tax policy, and the results are clear.

Carbon Tracker points out that internal combustion engines will also become much more energy efficient over the next decade, another way in which petroleum demand will be depressed.

So every 60 million electric vehicles on the road causes oil demand to fall by 1 mn. barrels per day. And Carbon Tracker (which collaborates with King's College London) estimates that by 2027 or so there will be 120 million EVs on the road. They note that the automobile companies vastly underestimate the speed with which consumers will turn to EVs.

The process is already well under way. The International Energy Agency says,

"Over 1 million electric cars were sold in 2017 - a new record - with more than half of global sales in China. The total number of electric cars on the road surpassed 3 million worldwide, an expansion of over 50% from 2016."

Let me put this in perspective. A lot of trouble has been caused between Baghdad and Erbil over Norwegian development of Iraqi Kurdistan oil fields, which were licensed initially without reference to Baghdad. A Texas judge even refused to let Kurdistan offload its oil in the US because of Iraq's objections. One of the fields at issue is Peshkabir, which produces 16,000 barrels a day of petroleum.

If we use Carbon Tracker's estimates, it means that just in 2017 alone, enough EVs were sold to make the Peshkabir field redundant.

And at 3 million EVs now on the road, world demand has been reduced already by 50,000 barrels a day, enough to make redundant the initial production of 50,000 barrels a day by Brazil's offshore environmental boondoggle, the undersea Libra field. To take 2 million barrels a day off the market, EV sales just have be be exponential this way, with 2017 being 1:

1, 2, 4, 16, 32, 64, 128.

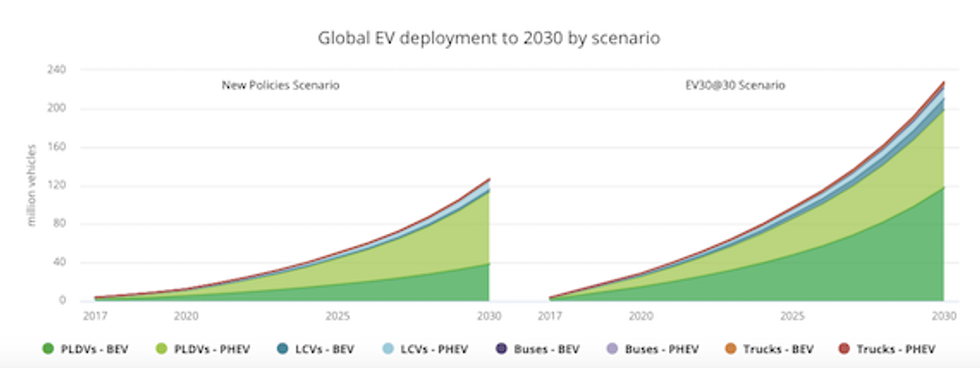

This progression is unrealistic as such. But add in 4 or five more years and it is perfectly plausible. The IEA expects 120 million EVs on the road by 2030, and points out that if government regulation mandates them, the number could be twice that by that year.

My guess is that as more catastrophes like the 2017 hurricane season or the current worldwide heat wave (which is killing hundreds of people) accumulate, there will be enormous public pressure during the coming decade on governments to mandate EVs and to put in the infrastructure to fuel them from wind and solar.

After 2027 (or maybe even 2025, only 7 years from now), the number of EVs will rapidly accelerate, as virtually all new vehicles bought will be electric (an effect of rapidly falling battery and other component costs and of the fuel for electric cars being essentially free; you can power one off your rooftop solar array).

So, we now have a pretty solid estimate for the beginning of the end of oil: 2030 at the latest. After that, it is a long or short spiral down to a cost set by the world need for hydrocarbon-based fertilizer and other lesser uses of oil (none of which come near to generating volume and prices similar to gasoline for automobiles).

The end of oil will be huge for US politics, economy and foreign policy. Stay tuned.

And if your retirement fund has a significant position in Big Oil, get out of it.