SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

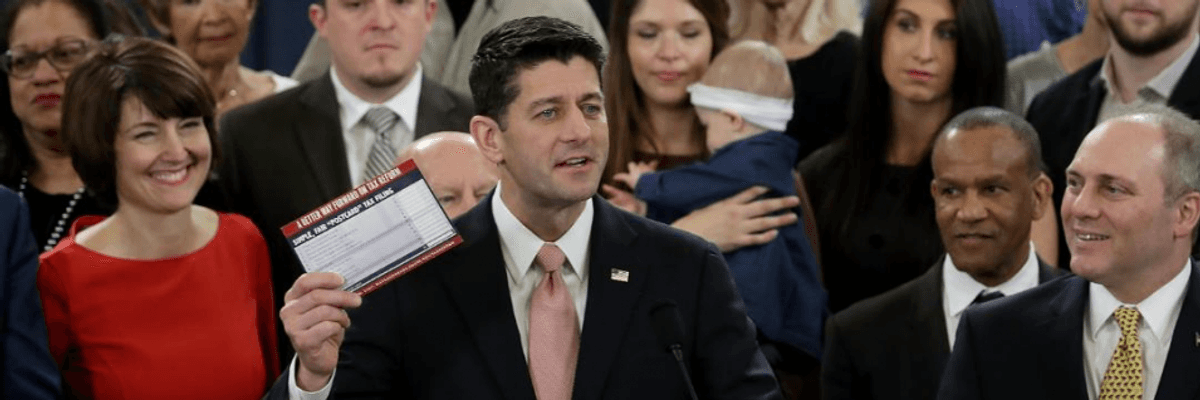

"Remarkably, this new data has gotten almost no attention from the media."(Photo: @srbija_eu/Twitter)

The Commerce Department released data on capital goods orders for January yesterday. As I noted, this is a hugely important early measure of the success of the Trump tax cuts. The ostensible rationale for the big cut in the corporate tax rate that was at the center of the tax cut is that it will lead to a flood of new investment.

Since the outlines of the tax cut had been known since September, businesses had plenty of time to plan how they would respond to lower tax rates. If lower rates really produce a flood of investment we should at least begin to see some sign in new orders once the tax cut was certain to pass.

The January report showed orders actually fell modestly for the second consecutive month. The drop occurs both including and excluding volatile aircraft orders. While this is far from conclusive, it is hard to reconcile with the view that lower taxes would lead to a flood of new investment.

Remarkably, this new data has gotten almost no attention from the media. Both the NYT and the Washington Post ran an AP story that just noted the drop in passing. Doesn't anyone care if the tax cut works?

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The Commerce Department released data on capital goods orders for January yesterday. As I noted, this is a hugely important early measure of the success of the Trump tax cuts. The ostensible rationale for the big cut in the corporate tax rate that was at the center of the tax cut is that it will lead to a flood of new investment.

Since the outlines of the tax cut had been known since September, businesses had plenty of time to plan how they would respond to lower tax rates. If lower rates really produce a flood of investment we should at least begin to see some sign in new orders once the tax cut was certain to pass.

The January report showed orders actually fell modestly for the second consecutive month. The drop occurs both including and excluding volatile aircraft orders. While this is far from conclusive, it is hard to reconcile with the view that lower taxes would lead to a flood of new investment.

Remarkably, this new data has gotten almost no attention from the media. Both the NYT and the Washington Post ran an AP story that just noted the drop in passing. Doesn't anyone care if the tax cut works?

The Commerce Department released data on capital goods orders for January yesterday. As I noted, this is a hugely important early measure of the success of the Trump tax cuts. The ostensible rationale for the big cut in the corporate tax rate that was at the center of the tax cut is that it will lead to a flood of new investment.

Since the outlines of the tax cut had been known since September, businesses had plenty of time to plan how they would respond to lower tax rates. If lower rates really produce a flood of investment we should at least begin to see some sign in new orders once the tax cut was certain to pass.

The January report showed orders actually fell modestly for the second consecutive month. The drop occurs both including and excluding volatile aircraft orders. While this is far from conclusive, it is hard to reconcile with the view that lower taxes would lead to a flood of new investment.

Remarkably, this new data has gotten almost no attention from the media. Both the NYT and the Washington Post ran an AP story that just noted the drop in passing. Doesn't anyone care if the tax cut works?