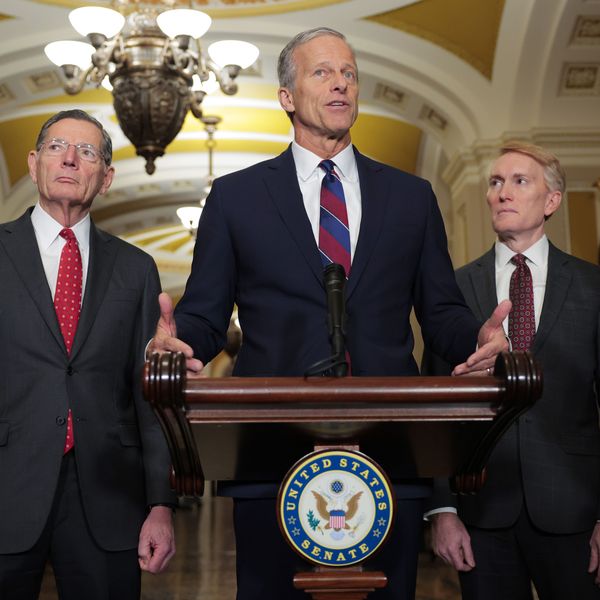

"Most heartbreaking of all, we know that the GOP tax plan, which is being rushed through even though it's the most comprehensive tax reform bill in decades, takes an ax to the American dream for many of our children." (Photo: Andre Delhaye/cc/flickr)

A Vote For This Tax Plan Is A Vote Against Women And Families

Economic inequality for women is a huge weakness for our nation, and the GOP proposed tax plans in the US House and Senate could turn that disaster into a national calamity.

Tax plans can be hard to decipher, but with each passing day, women and moms across the country understand more clearly how the GOP tax plans -- both the US Senate and the House versions -- will affect their families and our economy.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Tax plans can be hard to decipher, but with each passing day, women and moms across the country understand more clearly how the GOP tax plans -- both the US Senate and the House versions -- will affect their families and our economy.

Tax plans can be hard to decipher, but with each passing day, women and moms across the country understand more clearly how the GOP tax plans -- both the US Senate and the House versions -- will affect their families and our economy.