SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

House Speaker Paul Ryan has made a key Republican motive for pushing ahead with the House GOP health plan explicit in recent interviews:[1] passing the health package first facilitates deeper tax cuts for the wealthy and corporations in subsequent tax legislation.

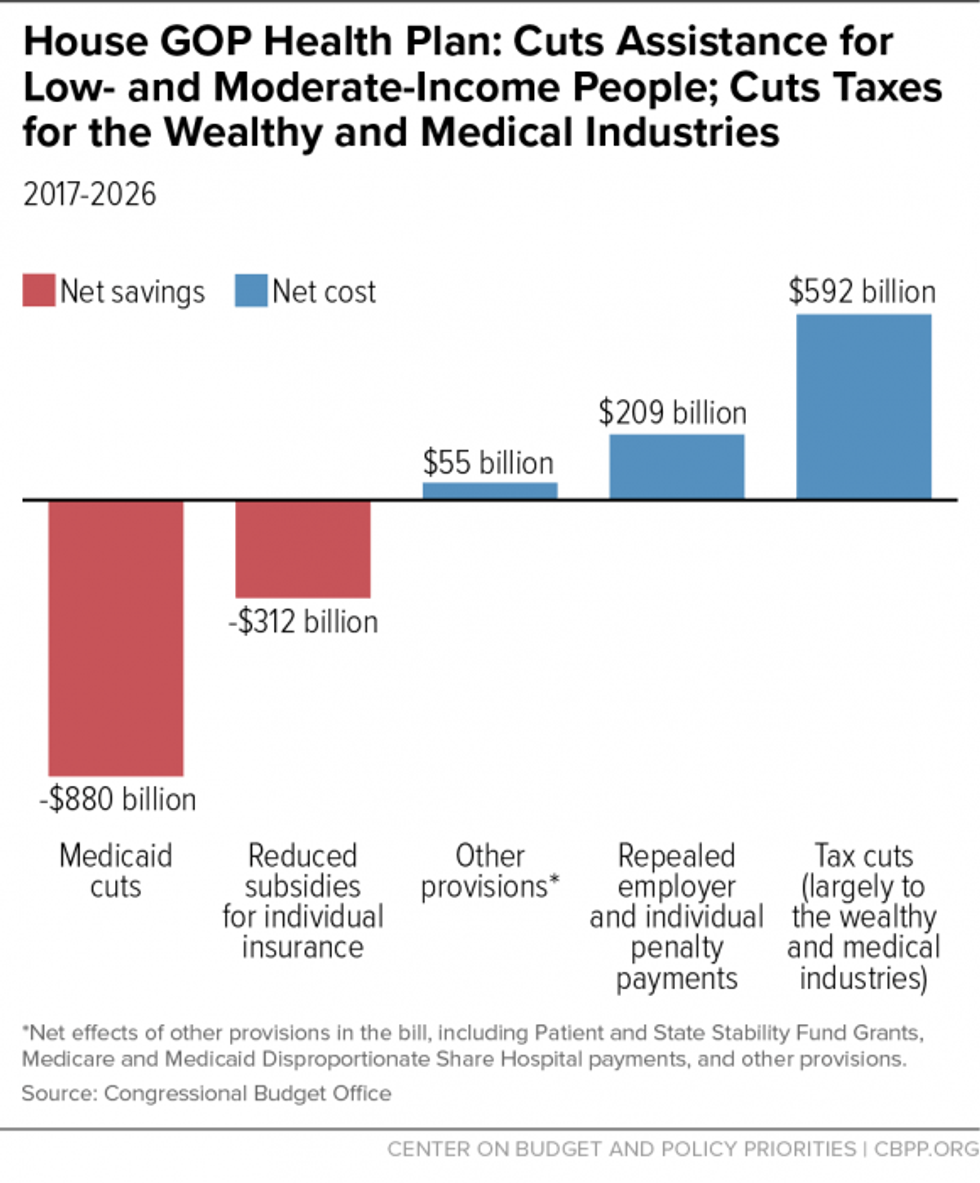

Because these tax cuts are in the health bill, Republicans can, in their tax bill later this year, make much deeper cuts in tax rates.That's because the House GOP health plan reduces revenues by nearly $900 billion over the decade, according to the Congressional Budget Office (CBO), including $592 billion in tax cuts largely for the wealthy. Passing these tax cuts now as part of a health package allows the GOP to offset their cost through cuts to health care spending -- particularly in Medicaid, which CBO estimates the House health care bill cuts by $880 billion over ten years. If these tax cuts were part of tax reform legislation rather than being in the health bill, Republican leaders would have to offset their cost on the tax side to maintain revenue neutrality, as they have said they would do, limiting how sharply they can cut tax rates.

Instead, because these tax cuts are in the health bill, Republicans can, in writing their tax bill later this year, make much deeper cuts in tax rates -- particularly for corporations -- than they otherwise could do. As Ryan explained in a recent interview with Maria Bartiromo:[2]

RYAN: [...] And so yes, it is important that we get this [the health plan] done so that we can do tax reform. Because this bill also takes out about $900 billion in tax increases, the Obamacare tax increases are taken out which makes it $900 billion easier to reform the tax code afterwards... That's why this is really important.

BARTIROMO: Look, some people see this as a bigger tax cut than anything obviously. Because you're taking out certain taxes--

RYAN: It's about a trillion dollar tax cut. This is about a trillion dollar tax cut.

BARTIROMO: And I get that. But wouldn't it have been easier to tax reform first [....]

RYAN: Because it's one of the highest priorities we have. Our committees, frankly, weren't ready to be able to write tax reform in this space of time. They're getting ready now. They're still working on it. And more importantly, it would have been a trillion dollars more difficult to do tax reform had we done that first. That's a big deal.

A trillion dollars, just to give you, in your mind a perspective, that's 10 percentage points on rates for businesses. So our blueprint, the House blueprint,[3] it takes the corporate rate from 35 to 20; a trillion dollars is the 20 to 30 difference. This is how big that is. And so taking tax reform with a bigger trillion dollar number in it makes it really hard to do. That's why doing this first makes tax reform that much easier to accomplish.

House Republicans intend to enact both their health and tax packages using a special budget process called "reconciliation."[4] The key advantage is that reconciliation bills cannot be filibustered in the Senate and so can pass with a simple majority vote, allowing Republicans to pass their health and tax packages without needing the support of a single Democrat. But reconciliation bills must meet certain criteria, including that they not increase the deficit after the ten-year budget "window." The House GOP health plan meets this standard because it pays for its revenue losses with deep cuts to health coverage for low- and moderate-income families, especially Medicaid. (See Figure 1.) This would have devastating consequences: 24 million more Americans would be uninsured in 2026, CBO estimates.[5]

If Republicans propose tax reform through reconciliation, that bill, too, will have to meet the test of not increasing the deficit after ten years. Passing health legislation first makes this "easier," because if the tax cuts for the wealthy in the House GOP's health package were instead in tax reform, they would need to be paid for with other provisions -- such as cuts to tax deductions and other tax breaks that heavily benefit the well-off -- to avoid increasing the deficit in the long run.[6] But if lawmakers enact and pay for these large tax cuts before tax reform -- with Medicaid cuts, in the case of the House plan -- they won't have to pay for their long-run cost in tax reform. And as Ryan notes, by cutting taxes sharply through health legislation and not having to pay for those tax cuts in tax reform, Republicans could cut corporate tax rates by something like an additional 10 percentage points.

This sleight of hand matters not only for budget rules. It also avoids the appearance that Republicans are cutting Medicaid to finance corporate tax rate cuts. Yet the maneuvering does not change the consequences of these policies: House Republican leaders' cuts to Medicaid and other health coverage provisions will leave 24 million more people uninsured, and most of the proceeds from these cutbacks will be used to finance billions of dollars in tax cuts for the wealthy in the health legislation and, ultimately, to make possible deeper tax cuts for large, profitable corporations.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

House Speaker Paul Ryan has made a key Republican motive for pushing ahead with the House GOP health plan explicit in recent interviews:[1] passing the health package first facilitates deeper tax cuts for the wealthy and corporations in subsequent tax legislation.

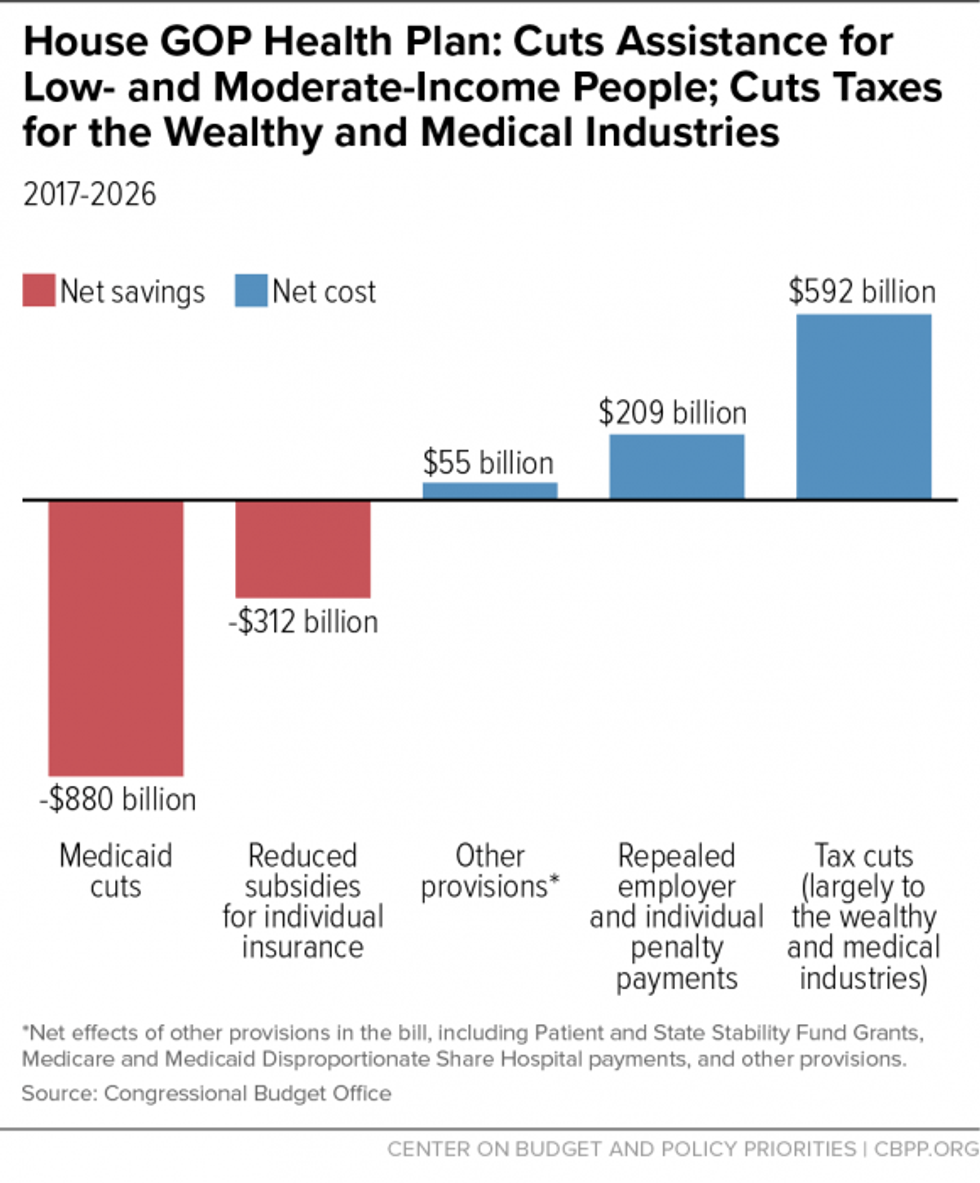

Because these tax cuts are in the health bill, Republicans can, in their tax bill later this year, make much deeper cuts in tax rates.That's because the House GOP health plan reduces revenues by nearly $900 billion over the decade, according to the Congressional Budget Office (CBO), including $592 billion in tax cuts largely for the wealthy. Passing these tax cuts now as part of a health package allows the GOP to offset their cost through cuts to health care spending -- particularly in Medicaid, which CBO estimates the House health care bill cuts by $880 billion over ten years. If these tax cuts were part of tax reform legislation rather than being in the health bill, Republican leaders would have to offset their cost on the tax side to maintain revenue neutrality, as they have said they would do, limiting how sharply they can cut tax rates.

Instead, because these tax cuts are in the health bill, Republicans can, in writing their tax bill later this year, make much deeper cuts in tax rates -- particularly for corporations -- than they otherwise could do. As Ryan explained in a recent interview with Maria Bartiromo:[2]

RYAN: [...] And so yes, it is important that we get this [the health plan] done so that we can do tax reform. Because this bill also takes out about $900 billion in tax increases, the Obamacare tax increases are taken out which makes it $900 billion easier to reform the tax code afterwards... That's why this is really important.

BARTIROMO: Look, some people see this as a bigger tax cut than anything obviously. Because you're taking out certain taxes--

RYAN: It's about a trillion dollar tax cut. This is about a trillion dollar tax cut.

BARTIROMO: And I get that. But wouldn't it have been easier to tax reform first [....]

RYAN: Because it's one of the highest priorities we have. Our committees, frankly, weren't ready to be able to write tax reform in this space of time. They're getting ready now. They're still working on it. And more importantly, it would have been a trillion dollars more difficult to do tax reform had we done that first. That's a big deal.

A trillion dollars, just to give you, in your mind a perspective, that's 10 percentage points on rates for businesses. So our blueprint, the House blueprint,[3] it takes the corporate rate from 35 to 20; a trillion dollars is the 20 to 30 difference. This is how big that is. And so taking tax reform with a bigger trillion dollar number in it makes it really hard to do. That's why doing this first makes tax reform that much easier to accomplish.

House Republicans intend to enact both their health and tax packages using a special budget process called "reconciliation."[4] The key advantage is that reconciliation bills cannot be filibustered in the Senate and so can pass with a simple majority vote, allowing Republicans to pass their health and tax packages without needing the support of a single Democrat. But reconciliation bills must meet certain criteria, including that they not increase the deficit after the ten-year budget "window." The House GOP health plan meets this standard because it pays for its revenue losses with deep cuts to health coverage for low- and moderate-income families, especially Medicaid. (See Figure 1.) This would have devastating consequences: 24 million more Americans would be uninsured in 2026, CBO estimates.[5]

If Republicans propose tax reform through reconciliation, that bill, too, will have to meet the test of not increasing the deficit after ten years. Passing health legislation first makes this "easier," because if the tax cuts for the wealthy in the House GOP's health package were instead in tax reform, they would need to be paid for with other provisions -- such as cuts to tax deductions and other tax breaks that heavily benefit the well-off -- to avoid increasing the deficit in the long run.[6] But if lawmakers enact and pay for these large tax cuts before tax reform -- with Medicaid cuts, in the case of the House plan -- they won't have to pay for their long-run cost in tax reform. And as Ryan notes, by cutting taxes sharply through health legislation and not having to pay for those tax cuts in tax reform, Republicans could cut corporate tax rates by something like an additional 10 percentage points.

This sleight of hand matters not only for budget rules. It also avoids the appearance that Republicans are cutting Medicaid to finance corporate tax rate cuts. Yet the maneuvering does not change the consequences of these policies: House Republican leaders' cuts to Medicaid and other health coverage provisions will leave 24 million more people uninsured, and most of the proceeds from these cutbacks will be used to finance billions of dollars in tax cuts for the wealthy in the health legislation and, ultimately, to make possible deeper tax cuts for large, profitable corporations.

House Speaker Paul Ryan has made a key Republican motive for pushing ahead with the House GOP health plan explicit in recent interviews:[1] passing the health package first facilitates deeper tax cuts for the wealthy and corporations in subsequent tax legislation.

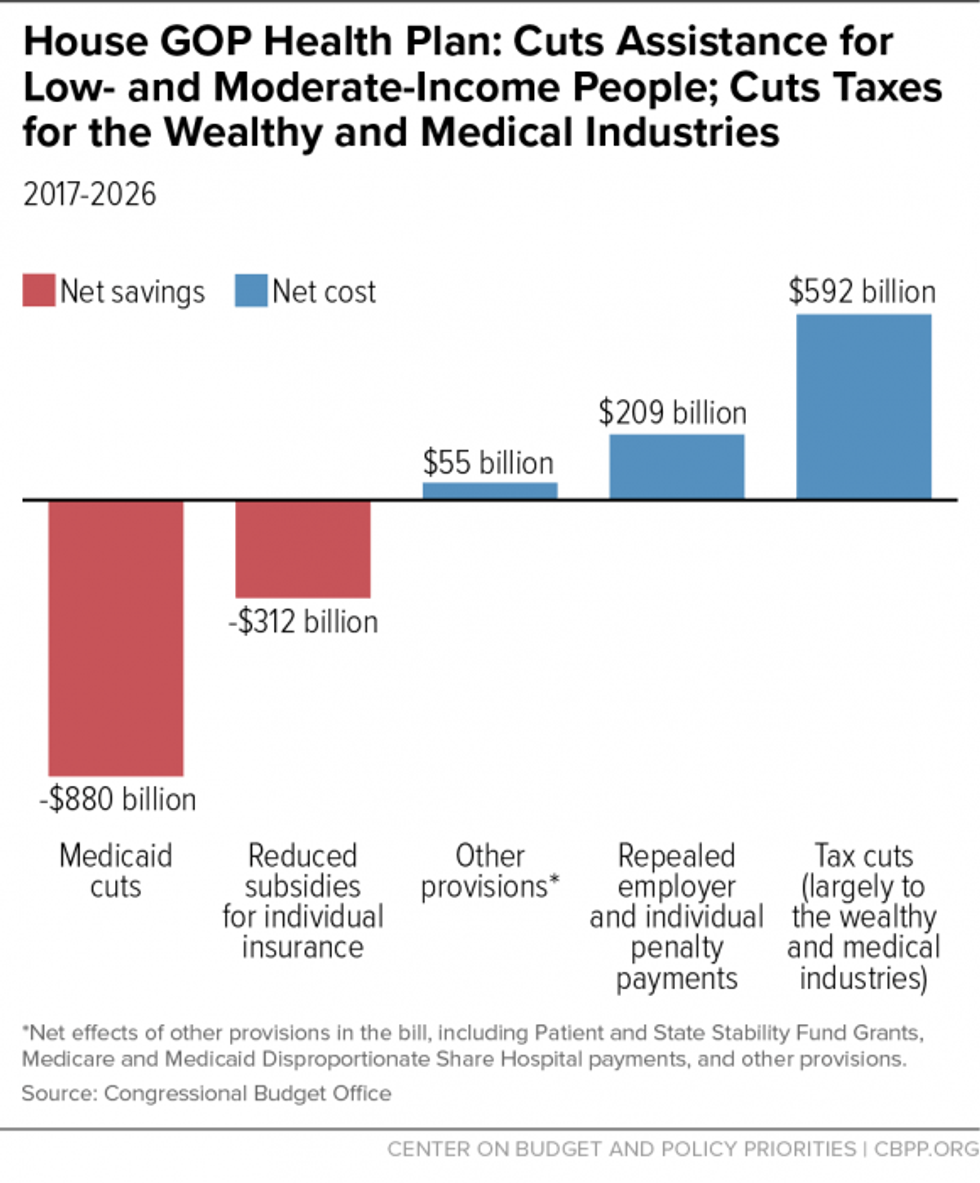

Because these tax cuts are in the health bill, Republicans can, in their tax bill later this year, make much deeper cuts in tax rates.That's because the House GOP health plan reduces revenues by nearly $900 billion over the decade, according to the Congressional Budget Office (CBO), including $592 billion in tax cuts largely for the wealthy. Passing these tax cuts now as part of a health package allows the GOP to offset their cost through cuts to health care spending -- particularly in Medicaid, which CBO estimates the House health care bill cuts by $880 billion over ten years. If these tax cuts were part of tax reform legislation rather than being in the health bill, Republican leaders would have to offset their cost on the tax side to maintain revenue neutrality, as they have said they would do, limiting how sharply they can cut tax rates.

Instead, because these tax cuts are in the health bill, Republicans can, in writing their tax bill later this year, make much deeper cuts in tax rates -- particularly for corporations -- than they otherwise could do. As Ryan explained in a recent interview with Maria Bartiromo:[2]

RYAN: [...] And so yes, it is important that we get this [the health plan] done so that we can do tax reform. Because this bill also takes out about $900 billion in tax increases, the Obamacare tax increases are taken out which makes it $900 billion easier to reform the tax code afterwards... That's why this is really important.

BARTIROMO: Look, some people see this as a bigger tax cut than anything obviously. Because you're taking out certain taxes--

RYAN: It's about a trillion dollar tax cut. This is about a trillion dollar tax cut.

BARTIROMO: And I get that. But wouldn't it have been easier to tax reform first [....]

RYAN: Because it's one of the highest priorities we have. Our committees, frankly, weren't ready to be able to write tax reform in this space of time. They're getting ready now. They're still working on it. And more importantly, it would have been a trillion dollars more difficult to do tax reform had we done that first. That's a big deal.

A trillion dollars, just to give you, in your mind a perspective, that's 10 percentage points on rates for businesses. So our blueprint, the House blueprint,[3] it takes the corporate rate from 35 to 20; a trillion dollars is the 20 to 30 difference. This is how big that is. And so taking tax reform with a bigger trillion dollar number in it makes it really hard to do. That's why doing this first makes tax reform that much easier to accomplish.

House Republicans intend to enact both their health and tax packages using a special budget process called "reconciliation."[4] The key advantage is that reconciliation bills cannot be filibustered in the Senate and so can pass with a simple majority vote, allowing Republicans to pass their health and tax packages without needing the support of a single Democrat. But reconciliation bills must meet certain criteria, including that they not increase the deficit after the ten-year budget "window." The House GOP health plan meets this standard because it pays for its revenue losses with deep cuts to health coverage for low- and moderate-income families, especially Medicaid. (See Figure 1.) This would have devastating consequences: 24 million more Americans would be uninsured in 2026, CBO estimates.[5]

If Republicans propose tax reform through reconciliation, that bill, too, will have to meet the test of not increasing the deficit after ten years. Passing health legislation first makes this "easier," because if the tax cuts for the wealthy in the House GOP's health package were instead in tax reform, they would need to be paid for with other provisions -- such as cuts to tax deductions and other tax breaks that heavily benefit the well-off -- to avoid increasing the deficit in the long run.[6] But if lawmakers enact and pay for these large tax cuts before tax reform -- with Medicaid cuts, in the case of the House plan -- they won't have to pay for their long-run cost in tax reform. And as Ryan notes, by cutting taxes sharply through health legislation and not having to pay for those tax cuts in tax reform, Republicans could cut corporate tax rates by something like an additional 10 percentage points.

This sleight of hand matters not only for budget rules. It also avoids the appearance that Republicans are cutting Medicaid to finance corporate tax rate cuts. Yet the maneuvering does not change the consequences of these policies: House Republican leaders' cuts to Medicaid and other health coverage provisions will leave 24 million more people uninsured, and most of the proceeds from these cutbacks will be used to finance billions of dollars in tax cuts for the wealthy in the health legislation and, ultimately, to make possible deeper tax cuts for large, profitable corporations.