SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

The oil cartel, OPEC, has confirmed what has been obvious to many for months: US shale production is in deep, deep trouble as the fracking boom bursts in the face of low oil prices.

The cartel published its latest monthly oil market report yesterday revealing that it believes it is winning the price war it started with the US shale industry.

The report is seen as a must-read for people within the oil industry.

"In North America, there are signs that US production has started to respond to reduced investment and activity", says the report. "Indeed, all eyes are on how quickly US production falls."

The numbers speak for themselves as the US drilling rig count continued its decline this month, dropping 13 rigs to 662. The overall rig count is now down 864 units year on year.

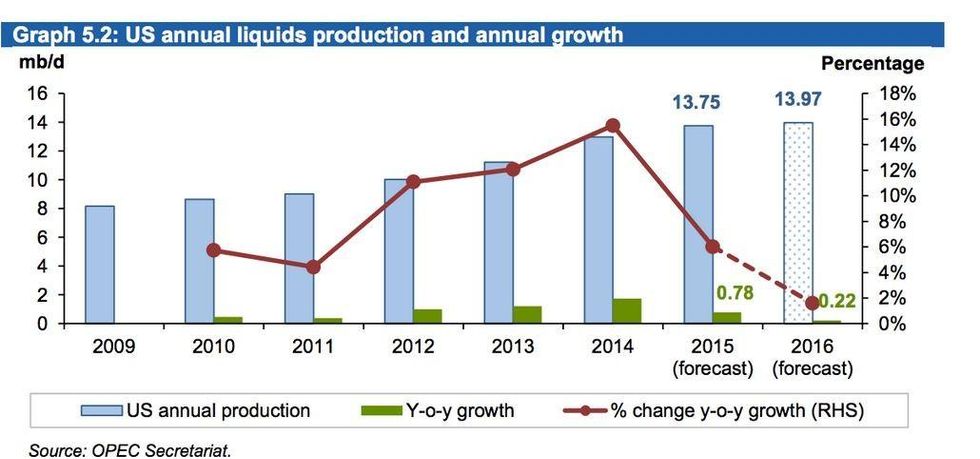

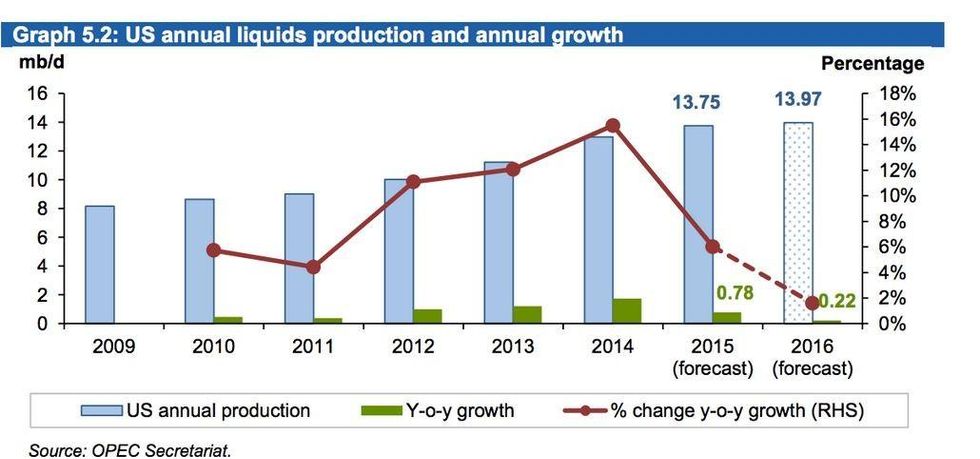

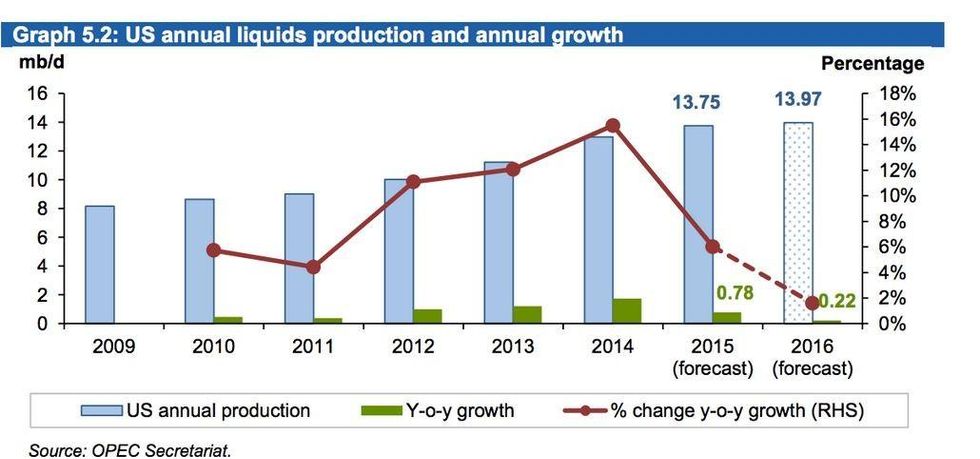

As if to re-iterate the point, OPEC cut its forecast for US production in 2015 by 100,000 barrels a day to 13.75 million, and is also revising downwards US shale production for next year by about 100,000 barrels a day, too.

OPEC's warning is the second in a number of days outlining the trouble facing the US fracking industry and comes hot on the heels of similar sentiments from the International Energy Agency (IEA) last week.

The IEA said "On the face of it, the Saudi-led OPEC strategy to defend market share regardless of price appears to be having the intended effect of driving out costly, 'inefficient' production."

The IEA outlined how "US oil production is likely to bear the brunt of an oil price decline that has already wiped half the value off" the main international oil contract.

It predicted that a rebound in production from US shale over the next few months was "elusive."

"This will be music to OPEC's ears", argues the OilVoice website: "There have been many that have doubted the OPEC strategy, and there are many that will continue to do so. Some observers even doubt the relevance of OPEC as an organization, given its reluctance to intervene and balance the market by reducing production."

However, due to declining shale, the IEA warned that the world faces the biggest drop in oil output in nearly a quarter century. This said, OPEC is predicting stronger than expected demand than previously forecast for its own oil next year, as US fracking companies continue to struggle with low costs.

So for now, at least, it looks like OPEC is winning the oil price war.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The oil cartel, OPEC, has confirmed what has been obvious to many for months: US shale production is in deep, deep trouble as the fracking boom bursts in the face of low oil prices.

The cartel published its latest monthly oil market report yesterday revealing that it believes it is winning the price war it started with the US shale industry.

The report is seen as a must-read for people within the oil industry.

"In North America, there are signs that US production has started to respond to reduced investment and activity", says the report. "Indeed, all eyes are on how quickly US production falls."

The numbers speak for themselves as the US drilling rig count continued its decline this month, dropping 13 rigs to 662. The overall rig count is now down 864 units year on year.

As if to re-iterate the point, OPEC cut its forecast for US production in 2015 by 100,000 barrels a day to 13.75 million, and is also revising downwards US shale production for next year by about 100,000 barrels a day, too.

OPEC's warning is the second in a number of days outlining the trouble facing the US fracking industry and comes hot on the heels of similar sentiments from the International Energy Agency (IEA) last week.

The IEA said "On the face of it, the Saudi-led OPEC strategy to defend market share regardless of price appears to be having the intended effect of driving out costly, 'inefficient' production."

The IEA outlined how "US oil production is likely to bear the brunt of an oil price decline that has already wiped half the value off" the main international oil contract.

It predicted that a rebound in production from US shale over the next few months was "elusive."

"This will be music to OPEC's ears", argues the OilVoice website: "There have been many that have doubted the OPEC strategy, and there are many that will continue to do so. Some observers even doubt the relevance of OPEC as an organization, given its reluctance to intervene and balance the market by reducing production."

However, due to declining shale, the IEA warned that the world faces the biggest drop in oil output in nearly a quarter century. This said, OPEC is predicting stronger than expected demand than previously forecast for its own oil next year, as US fracking companies continue to struggle with low costs.

So for now, at least, it looks like OPEC is winning the oil price war.

The oil cartel, OPEC, has confirmed what has been obvious to many for months: US shale production is in deep, deep trouble as the fracking boom bursts in the face of low oil prices.

The cartel published its latest monthly oil market report yesterday revealing that it believes it is winning the price war it started with the US shale industry.

The report is seen as a must-read for people within the oil industry.

"In North America, there are signs that US production has started to respond to reduced investment and activity", says the report. "Indeed, all eyes are on how quickly US production falls."

The numbers speak for themselves as the US drilling rig count continued its decline this month, dropping 13 rigs to 662. The overall rig count is now down 864 units year on year.

As if to re-iterate the point, OPEC cut its forecast for US production in 2015 by 100,000 barrels a day to 13.75 million, and is also revising downwards US shale production for next year by about 100,000 barrels a day, too.

OPEC's warning is the second in a number of days outlining the trouble facing the US fracking industry and comes hot on the heels of similar sentiments from the International Energy Agency (IEA) last week.

The IEA said "On the face of it, the Saudi-led OPEC strategy to defend market share regardless of price appears to be having the intended effect of driving out costly, 'inefficient' production."

The IEA outlined how "US oil production is likely to bear the brunt of an oil price decline that has already wiped half the value off" the main international oil contract.

It predicted that a rebound in production from US shale over the next few months was "elusive."

"This will be music to OPEC's ears", argues the OilVoice website: "There have been many that have doubted the OPEC strategy, and there are many that will continue to do so. Some observers even doubt the relevance of OPEC as an organization, given its reluctance to intervene and balance the market by reducing production."

However, due to declining shale, the IEA warned that the world faces the biggest drop in oil output in nearly a quarter century. This said, OPEC is predicting stronger than expected demand than previously forecast for its own oil next year, as US fracking companies continue to struggle with low costs.

So for now, at least, it looks like OPEC is winning the oil price war.