SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

The new mantra of the Republican Party is the old mantra --

regulation is a "job killer." It is certainly possible to have

regulations kill jobs, and when I was a financial regulator I was a

leader in cutting away many dumb requirements. But we have just

experienced the epic ability of the anti-regulators to kill well over

ten million jobs. Why then is there not a single word from the new House

leadership about investigations to determine how the anti-regulators

did their damage? Why is there no plan to investigate the fields in

which inadequate regulation most endangers jobs? While we're at it, why

not investigate the areas in which inadequate regulation allows firms to

maim and kill. This column addresses only financial regulation.

Deregulation, desupervision, and de facto decriminalization (the

three "des") created the criminogenic environment that drove the modern

U.S. financial crises. The three "des" were essential to create the

epidemics of accounting control fraud that hyper-inflated the bubble

that triggered the Great Recession. "Job killing" is a combination of

two factors -- increased job losses and decreased job creation. I'll

focus solely on private sector jobs -- but the recession has also been

devastating in terms of the loss of state and local governmental jobs.

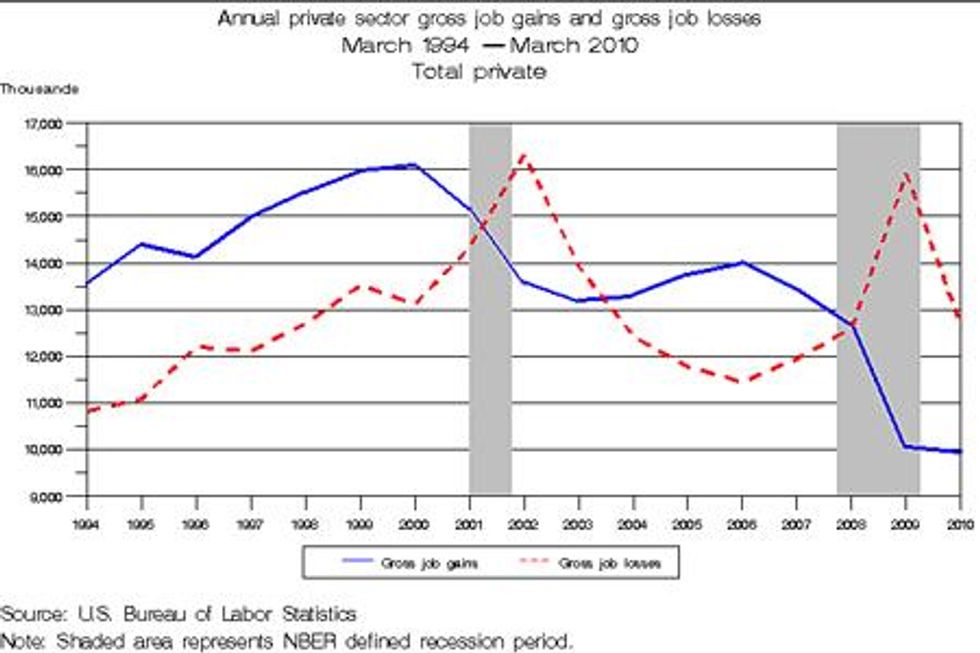

From 1996-2000, for example, annual private sector gross job

increases rose from roughly 14 million to 16 million while annual

private sector gross job losses increased from 12 to 13 million. The

annual net job increases in those years, therefore, rose from two

million to three million. Over that five year period, the net increase

in private sector jobs was over 10 million. One common rule of thumb is

that the economy needs to produce an annual net increase of about 1.5

million jobs to employ new entrants to our workforce, so the growth rate

in this era was large enough to make the unemployment and poverty rates

fall significantly.

The Great Recession (which officially began in the third quarter of

2007) shows why the anti-regulators are the premier job killers in

America. Annual private sector gross job losses rose from roughly 12.5

to a peak of 16 million and gross private sector job gains fell from

approximately 13 to 10 million. As late as March 2010, after the

official end of the Great Recession, the annualized net job loss in the

private sector was approximately three million (that job loss has now

turned around, but the increases are far too small).

Again, we need net gains of roughly 1.5 million jobs to accommodate

new workers, so the total net job losses plus the loss of essential job

growth was well over 10 million during the Great Recession. These

numbers, again, do not include the large job losses of state and local

government workers, the dramatic rise in underemployment, the sharp rise

in far longer-term unemployment, and the salary/wage (and job

satisfaction) losses that many workers had to take to find a new,

typically inferior, job after they lost their job. It also ignores the

rise in poverty, particularly the scandalous increase in children living

in poverty.

The Great Recession was triggered by the collapse of the real estate

bubble epidemic of mortgage fraud by lenders that hyper-inflated that

bubble. That epidemic could not have happened without the appointment of

anti-regulators to key leadership positions. The epidemic of mortgage

fraud was centered on loans that the lending industry (behind closed

doors) referred to as "liar's" loans -- so any regulatory leader who was

not an anti-regulatory ideologue would (as we did in the early 1990s

during the first wave of liar's loans in California) have ordered banks

not to make these pervasively fraudulent loans.

One of the problems was the existence of a "regulatory black hole" --

most of the nonprime loans were made by lenders not regulated by the

federal government. That black hole, however, conceals two broader

federal anti-regulatory problems. The federal regulators actively made

the black hole more severe by preempting state efforts to protect the

public from predatory and fraudulent loans. Greenspan and Bernanke are

particularly culpable. In addition to joining the jihad state

regulation, the Fed had unique federal regulatory authority under HOEPA

(enacted in 1994) to fill the black hole and regulate any housing lender

(authority that Bernanke finally used, after liar's loans had ended, in

response to Congressional criticism). The Fed also had direct evidence

of the frauds and abuses in nonprime lending because Congress mandated

that the Fed hold hearings on predatory lending.

The S&L debacle, the Enron era frauds, and the current crisis

were all driven by accounting control fraud. The three "des" are

critical factors in creating the criminogenic environments that drive

these epidemics of accounting control fraud. The regulators are the

"cops on the beat" when it comes to stopping accounting control fraud.

If they are made ineffective by the three "des" then cheaters gain a

competitive advantage over honest firms. This makes markets perverse and

causes recurrent crises.

From roughly 1999 to the present, three administrations have

displayed hostility to vigorous regulation and have appointed regulatory

leaders largely on the basis of their opposition to vigorous

regulation. When these administrations occasionally blundered and

appointed, or inherited, regulatory leaders that believed in regulating

the administration attacked the regulators. In the financial regulatory

sphere, recent examples include Arthur Levitt and William Donaldson

(SEC), Brooksley Born (CFTC), and Sheila Bair (FDIC).

Similarly, the bankers used Congress to extort the Financial

Accounting Standards Board (FASB) into trashing the accounting rules so

that the banks no longer had to recognize their losses. The twin

purposes of that bit of successful thuggery were to evade the mandate of

the Prompt Corrective Action (PCA) law and to allow banks to pretend

that they were solvent and profitable so that they could continue to pay

enormous bonuses to their senior officials based on the fictional

"income" and "net worth" produced by the scam accounting. (Not

recognizing one's losses increases dollar-for-dollar reported, but

fictional, net worth and gross income.)

When members of Congress (mostly Democrats) sought to intimidate us

into not taking enforcement actions against the fraudulent S&Ls we

blew the whistle. Congress investigated Speaker Wright and the "Keating

Five" in response. I testified in both investigations. Why is the new

House leadership announcing its intent to give a free pass to the

accounting control frauds, their political patrons, and the

anti-regulators that created the criminogenic environment that

hyper-inflated the financial bubble that triggered the Great Recession

and caused such a loss of integrity?

The anti-regulators subverted the rule of law and allowed elite

frauds to loot with impunity. Why isn't the new House leadership

investigating that disgrace as one of their top priorities? Why is the

new House leadership so eager to repeat the job killing mistakes of

taking the regulatory cops off their beat?

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The new mantra of the Republican Party is the old mantra --

regulation is a "job killer." It is certainly possible to have

regulations kill jobs, and when I was a financial regulator I was a

leader in cutting away many dumb requirements. But we have just

experienced the epic ability of the anti-regulators to kill well over

ten million jobs. Why then is there not a single word from the new House

leadership about investigations to determine how the anti-regulators

did their damage? Why is there no plan to investigate the fields in

which inadequate regulation most endangers jobs? While we're at it, why

not investigate the areas in which inadequate regulation allows firms to

maim and kill. This column addresses only financial regulation.

Deregulation, desupervision, and de facto decriminalization (the

three "des") created the criminogenic environment that drove the modern

U.S. financial crises. The three "des" were essential to create the

epidemics of accounting control fraud that hyper-inflated the bubble

that triggered the Great Recession. "Job killing" is a combination of

two factors -- increased job losses and decreased job creation. I'll

focus solely on private sector jobs -- but the recession has also been

devastating in terms of the loss of state and local governmental jobs.

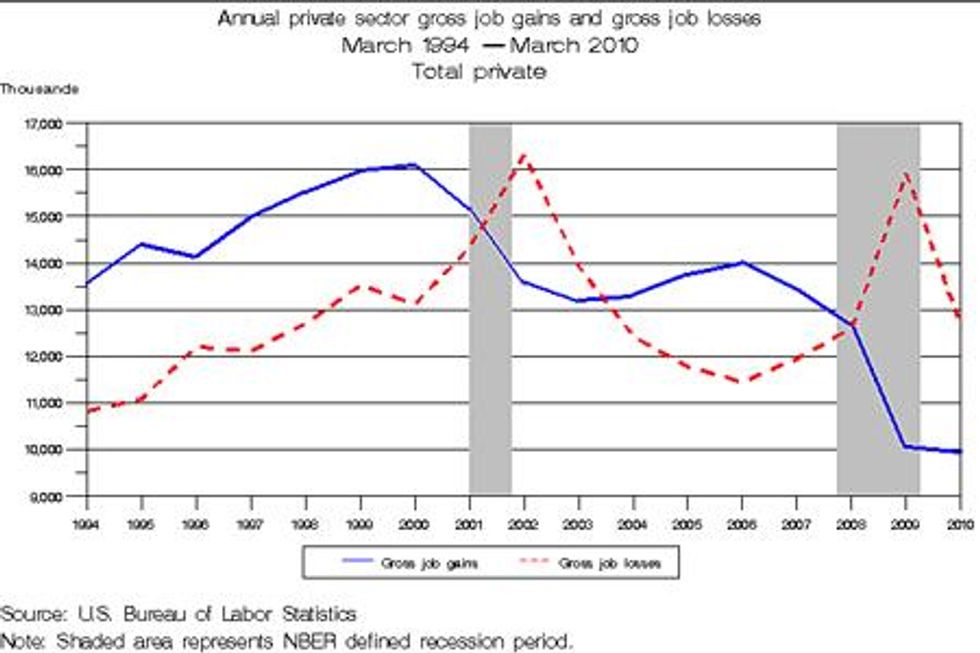

From 1996-2000, for example, annual private sector gross job

increases rose from roughly 14 million to 16 million while annual

private sector gross job losses increased from 12 to 13 million. The

annual net job increases in those years, therefore, rose from two

million to three million. Over that five year period, the net increase

in private sector jobs was over 10 million. One common rule of thumb is

that the economy needs to produce an annual net increase of about 1.5

million jobs to employ new entrants to our workforce, so the growth rate

in this era was large enough to make the unemployment and poverty rates

fall significantly.

The Great Recession (which officially began in the third quarter of

2007) shows why the anti-regulators are the premier job killers in

America. Annual private sector gross job losses rose from roughly 12.5

to a peak of 16 million and gross private sector job gains fell from

approximately 13 to 10 million. As late as March 2010, after the

official end of the Great Recession, the annualized net job loss in the

private sector was approximately three million (that job loss has now

turned around, but the increases are far too small).

Again, we need net gains of roughly 1.5 million jobs to accommodate

new workers, so the total net job losses plus the loss of essential job

growth was well over 10 million during the Great Recession. These

numbers, again, do not include the large job losses of state and local

government workers, the dramatic rise in underemployment, the sharp rise

in far longer-term unemployment, and the salary/wage (and job

satisfaction) losses that many workers had to take to find a new,

typically inferior, job after they lost their job. It also ignores the

rise in poverty, particularly the scandalous increase in children living

in poverty.

The Great Recession was triggered by the collapse of the real estate

bubble epidemic of mortgage fraud by lenders that hyper-inflated that

bubble. That epidemic could not have happened without the appointment of

anti-regulators to key leadership positions. The epidemic of mortgage

fraud was centered on loans that the lending industry (behind closed

doors) referred to as "liar's" loans -- so any regulatory leader who was

not an anti-regulatory ideologue would (as we did in the early 1990s

during the first wave of liar's loans in California) have ordered banks

not to make these pervasively fraudulent loans.

One of the problems was the existence of a "regulatory black hole" --

most of the nonprime loans were made by lenders not regulated by the

federal government. That black hole, however, conceals two broader

federal anti-regulatory problems. The federal regulators actively made

the black hole more severe by preempting state efforts to protect the

public from predatory and fraudulent loans. Greenspan and Bernanke are

particularly culpable. In addition to joining the jihad state

regulation, the Fed had unique federal regulatory authority under HOEPA

(enacted in 1994) to fill the black hole and regulate any housing lender

(authority that Bernanke finally used, after liar's loans had ended, in

response to Congressional criticism). The Fed also had direct evidence

of the frauds and abuses in nonprime lending because Congress mandated

that the Fed hold hearings on predatory lending.

The S&L debacle, the Enron era frauds, and the current crisis

were all driven by accounting control fraud. The three "des" are

critical factors in creating the criminogenic environments that drive

these epidemics of accounting control fraud. The regulators are the

"cops on the beat" when it comes to stopping accounting control fraud.

If they are made ineffective by the three "des" then cheaters gain a

competitive advantage over honest firms. This makes markets perverse and

causes recurrent crises.

From roughly 1999 to the present, three administrations have

displayed hostility to vigorous regulation and have appointed regulatory

leaders largely on the basis of their opposition to vigorous

regulation. When these administrations occasionally blundered and

appointed, or inherited, regulatory leaders that believed in regulating

the administration attacked the regulators. In the financial regulatory

sphere, recent examples include Arthur Levitt and William Donaldson

(SEC), Brooksley Born (CFTC), and Sheila Bair (FDIC).

Similarly, the bankers used Congress to extort the Financial

Accounting Standards Board (FASB) into trashing the accounting rules so

that the banks no longer had to recognize their losses. The twin

purposes of that bit of successful thuggery were to evade the mandate of

the Prompt Corrective Action (PCA) law and to allow banks to pretend

that they were solvent and profitable so that they could continue to pay

enormous bonuses to their senior officials based on the fictional

"income" and "net worth" produced by the scam accounting. (Not

recognizing one's losses increases dollar-for-dollar reported, but

fictional, net worth and gross income.)

When members of Congress (mostly Democrats) sought to intimidate us

into not taking enforcement actions against the fraudulent S&Ls we

blew the whistle. Congress investigated Speaker Wright and the "Keating

Five" in response. I testified in both investigations. Why is the new

House leadership announcing its intent to give a free pass to the

accounting control frauds, their political patrons, and the

anti-regulators that created the criminogenic environment that

hyper-inflated the financial bubble that triggered the Great Recession

and caused such a loss of integrity?

The anti-regulators subverted the rule of law and allowed elite

frauds to loot with impunity. Why isn't the new House leadership

investigating that disgrace as one of their top priorities? Why is the

new House leadership so eager to repeat the job killing mistakes of

taking the regulatory cops off their beat?

The new mantra of the Republican Party is the old mantra --

regulation is a "job killer." It is certainly possible to have

regulations kill jobs, and when I was a financial regulator I was a

leader in cutting away many dumb requirements. But we have just

experienced the epic ability of the anti-regulators to kill well over

ten million jobs. Why then is there not a single word from the new House

leadership about investigations to determine how the anti-regulators

did their damage? Why is there no plan to investigate the fields in

which inadequate regulation most endangers jobs? While we're at it, why

not investigate the areas in which inadequate regulation allows firms to

maim and kill. This column addresses only financial regulation.

Deregulation, desupervision, and de facto decriminalization (the

three "des") created the criminogenic environment that drove the modern

U.S. financial crises. The three "des" were essential to create the

epidemics of accounting control fraud that hyper-inflated the bubble

that triggered the Great Recession. "Job killing" is a combination of

two factors -- increased job losses and decreased job creation. I'll

focus solely on private sector jobs -- but the recession has also been

devastating in terms of the loss of state and local governmental jobs.

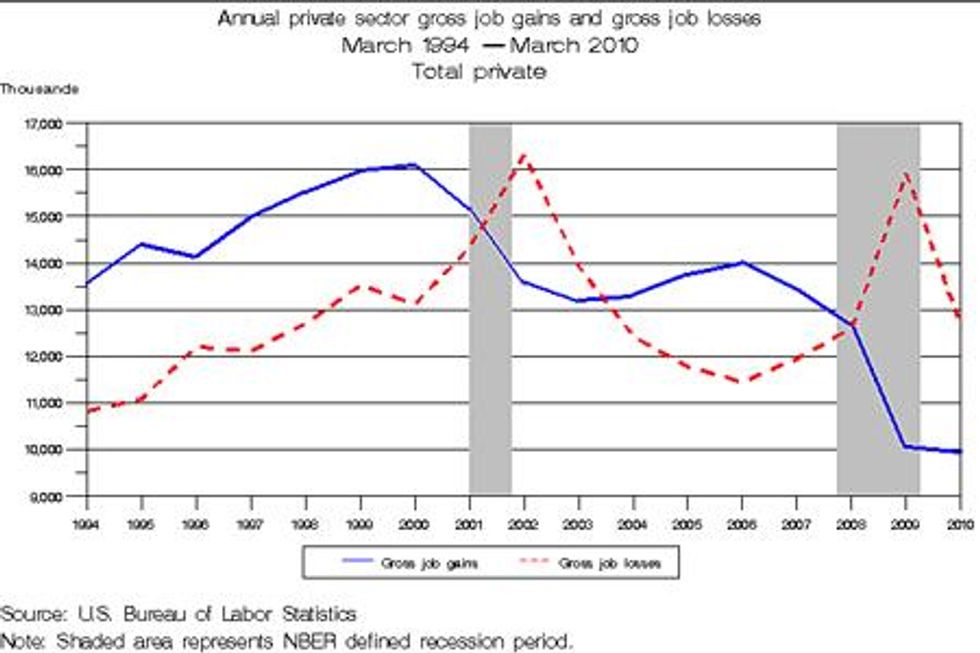

From 1996-2000, for example, annual private sector gross job

increases rose from roughly 14 million to 16 million while annual

private sector gross job losses increased from 12 to 13 million. The

annual net job increases in those years, therefore, rose from two

million to three million. Over that five year period, the net increase

in private sector jobs was over 10 million. One common rule of thumb is

that the economy needs to produce an annual net increase of about 1.5

million jobs to employ new entrants to our workforce, so the growth rate

in this era was large enough to make the unemployment and poverty rates

fall significantly.

The Great Recession (which officially began in the third quarter of

2007) shows why the anti-regulators are the premier job killers in

America. Annual private sector gross job losses rose from roughly 12.5

to a peak of 16 million and gross private sector job gains fell from

approximately 13 to 10 million. As late as March 2010, after the

official end of the Great Recession, the annualized net job loss in the

private sector was approximately three million (that job loss has now

turned around, but the increases are far too small).

Again, we need net gains of roughly 1.5 million jobs to accommodate

new workers, so the total net job losses plus the loss of essential job

growth was well over 10 million during the Great Recession. These

numbers, again, do not include the large job losses of state and local

government workers, the dramatic rise in underemployment, the sharp rise

in far longer-term unemployment, and the salary/wage (and job

satisfaction) losses that many workers had to take to find a new,

typically inferior, job after they lost their job. It also ignores the

rise in poverty, particularly the scandalous increase in children living

in poverty.

The Great Recession was triggered by the collapse of the real estate

bubble epidemic of mortgage fraud by lenders that hyper-inflated that

bubble. That epidemic could not have happened without the appointment of

anti-regulators to key leadership positions. The epidemic of mortgage

fraud was centered on loans that the lending industry (behind closed

doors) referred to as "liar's" loans -- so any regulatory leader who was

not an anti-regulatory ideologue would (as we did in the early 1990s

during the first wave of liar's loans in California) have ordered banks

not to make these pervasively fraudulent loans.

One of the problems was the existence of a "regulatory black hole" --

most of the nonprime loans were made by lenders not regulated by the

federal government. That black hole, however, conceals two broader

federal anti-regulatory problems. The federal regulators actively made

the black hole more severe by preempting state efforts to protect the

public from predatory and fraudulent loans. Greenspan and Bernanke are

particularly culpable. In addition to joining the jihad state

regulation, the Fed had unique federal regulatory authority under HOEPA

(enacted in 1994) to fill the black hole and regulate any housing lender

(authority that Bernanke finally used, after liar's loans had ended, in

response to Congressional criticism). The Fed also had direct evidence

of the frauds and abuses in nonprime lending because Congress mandated

that the Fed hold hearings on predatory lending.

The S&L debacle, the Enron era frauds, and the current crisis

were all driven by accounting control fraud. The three "des" are

critical factors in creating the criminogenic environments that drive

these epidemics of accounting control fraud. The regulators are the

"cops on the beat" when it comes to stopping accounting control fraud.

If they are made ineffective by the three "des" then cheaters gain a

competitive advantage over honest firms. This makes markets perverse and

causes recurrent crises.

From roughly 1999 to the present, three administrations have

displayed hostility to vigorous regulation and have appointed regulatory

leaders largely on the basis of their opposition to vigorous

regulation. When these administrations occasionally blundered and

appointed, or inherited, regulatory leaders that believed in regulating

the administration attacked the regulators. In the financial regulatory

sphere, recent examples include Arthur Levitt and William Donaldson

(SEC), Brooksley Born (CFTC), and Sheila Bair (FDIC).

Similarly, the bankers used Congress to extort the Financial

Accounting Standards Board (FASB) into trashing the accounting rules so

that the banks no longer had to recognize their losses. The twin

purposes of that bit of successful thuggery were to evade the mandate of

the Prompt Corrective Action (PCA) law and to allow banks to pretend

that they were solvent and profitable so that they could continue to pay

enormous bonuses to their senior officials based on the fictional

"income" and "net worth" produced by the scam accounting. (Not

recognizing one's losses increases dollar-for-dollar reported, but

fictional, net worth and gross income.)

When members of Congress (mostly Democrats) sought to intimidate us

into not taking enforcement actions against the fraudulent S&Ls we

blew the whistle. Congress investigated Speaker Wright and the "Keating

Five" in response. I testified in both investigations. Why is the new

House leadership announcing its intent to give a free pass to the

accounting control frauds, their political patrons, and the

anti-regulators that created the criminogenic environment that

hyper-inflated the financial bubble that triggered the Great Recession

and caused such a loss of integrity?

The anti-regulators subverted the rule of law and allowed elite

frauds to loot with impunity. Why isn't the new House leadership

investigating that disgrace as one of their top priorities? Why is the

new House leadership so eager to repeat the job killing mistakes of

taking the regulatory cops off their beat?