But the Rams also play for their corporate sponsors, which ironically include Shell Oil Products US, an affiliate of a multinational oil company that bears major responsibility for the conditions that set the stage for Los Angeles’ devastating fires.

Will mounting extreme weather disasters—and stadium damage projections—ever convince the L.A. Rams and other sports teams to sever their ties to the very companies responsible for the climate crisis?

The Rams are not alone in their choice of partnerships. More than 60 U.S. pro sports teams and at least three leagues have lucrative sponsorship deals with oil companies and electric and gas utilities that afford the companies a range of promotional perks, from building signage to uniform logos to facility naming rights, according to a survey conducted last fall by UCLA’s Emmett Institute on Climate Change and the Environment. Likewise, sports teams and leagues partner with banks and insurance companies that invest billions of dollars in coal, oil and gas companies, all to the detriment of public health and the environment.

With annual payrolls running as high as $240 million in the NFL, $300 million in the MLB, and $200 million in the NBA, it is not hard to understand why teams pursue corporate sponsorships.

Companies, meanwhile, sponsor teams and leagues to increase visibility and build public trust. According to a 2021 Nielsen “Trust in Advertising” study, 81 percent of consumers completely or somewhat trust brands that sponsor sport teams, second only to the trust they have for friends and family. By sponsoring a team, corporations increase the chance that fans will form the same bond with their brand that they have with the team.

Oil companies, gas and electric utilities, and the banks and insurance companies that finance them have yet another rationale for aligning with a team or a league: to distract the public from their unethical practices and portray themselves as public-spirited, good corporate citizens. It’s called sportswashing, a riff on the term greenwashing.

When Bank of America—which invested $33.68 billion in fossil fuel companies in 2023 alone—signed on as an official sponsor of the FIFA World Cup last year, the company’s chief marketing officer explained how it works. “The World Cup is religious for the fans, it’s an entirely different beast,” he said. “It allows us a very powerful place for the emotional connections to build the brand.” Having a strong brand, he added, can provide a “halo effect” for a company.

Making Shell Look Good

The Rams and Shell have been partners since 2018, but in October 2023 the Rams announced that the company signed a multiyear contract for an undisclosed sum to be the “exclusive fuel sponsor” of the team, SoFi Stadium and Hollywood Park, the mixed-use, under-construction district surrounding the stadium that is owned and operated by Rams CEO Stan Kroenke. Shell now offers gasoline discounts on game days and collaborates with the three organizations on community initiatives on health, STEAM (science, technology, engineering, the arts and mathematics) education, sustainability and other issues.

A home is engulfed in flames during the Eaton fire in the Altadena area of Los Angeles County, California on January 8, 2025. (Photo by Josh Edelson/AFP via Getty Images)

A home is engulfed in flames during the Eaton fire in the Altadena area of Los Angeles County, California on January 8, 2025. (Photo by Josh Edelson/AFP via Getty Images)

The Rams could not have picked a more inappropriate partner (except, perhaps, ExxonMobil). Shell a cosponsor of community health projects? It’s one of the top 20 air polluters in the country. A supporter of STEAM education? The first initial of that acronym stands for “science,” but Shell is still funding climate science disinformation, even though it was aware of the threat its products pose as far back as the 1950s. And a promoter of sustainability? Historically the company is the fourth-biggest investor-owned carbon polluter and the second-biggest since 2016, when the Paris climate agreement to cut emissions was signed.

In 2020, the company did adopt a number of goals to achieve net-zero emissions by 2050. Since then, however, it has backtracked, reneging on its pledge to cut oil production 1 to 2 percent annually through 2030, weakening its target of reducing emissions from 25 to 40 percent by 2030 to only 20 to 30 percent, and completely abandoning its goal of lowering the total “net carbon intensity” of its products (the emissions per unit of energy) 45 percent by 2035 due to “uncertainty in the pace of change in the energy transition.”

The Rams are not the only U.S. pro team, nor the only team in California, enabling sportswashing. Chevron sponsors the Los Angeles FC soccer team, Sacramento Kings and San Francisco Giants; Arco, owned by Marathon Petroleum, sponsors the L.A. Dodgers and Sacramento Kings; NRG Energy, an electric utility that sold off its renewable energy division years ago, sponsors the San Francisco 49ers; and Phillips 66, owner of Union 76 gas stations, also sponsors the Dodgers. Although the two NBA teams in Los Angeles do not have fossil fuel industry-related sponsors, ExxonMobil is an “official marketing partner” of the NBA, WNBA and NBA Development League in the United States and China.

Given California has been plagued by climate change-driven wildfires for years, one would hope that sports teams in the state would reconsider their fossil fuel industry sponsorships. Last August, more than 80 public interest groups, scientists and environmental advocates tried to get the Dodgers to do just that, calling on the team to cut its ties to Phillips 66. “Using tactics such as associating a beloved, trusted brand like the Dodgers with enterprises like [Union] 76,” they wrote in an open letter, “the fossil fuel industry has reinforced deceitful messages that ‘oil is our friend,’ and that ‘climate change isn’t so bad.’” Since it was first posted, more than 22,000 Dodgers fans have added their names to the letter, which urges the team to end its sponsorship deal with the oil company “immediately.” To date, they are still waiting for a response.

California state, county and city governments, meanwhile, are going after the perpetrators in court. Altogether they have launched nine lawsuits against Chevron, ExxonMobil and Shell to hold them accountable for deceiving the public and force them to pay climate change-related damages. The cities filing suit include Imperial Beach, Oakland, Richmond (home to a Chevron refinery), San Francisco and Santa Cruz. Five of the nine lawsuits also name Marathon Petroleum and Philips 66 as defendants.

State Farm a Good Neighbor?

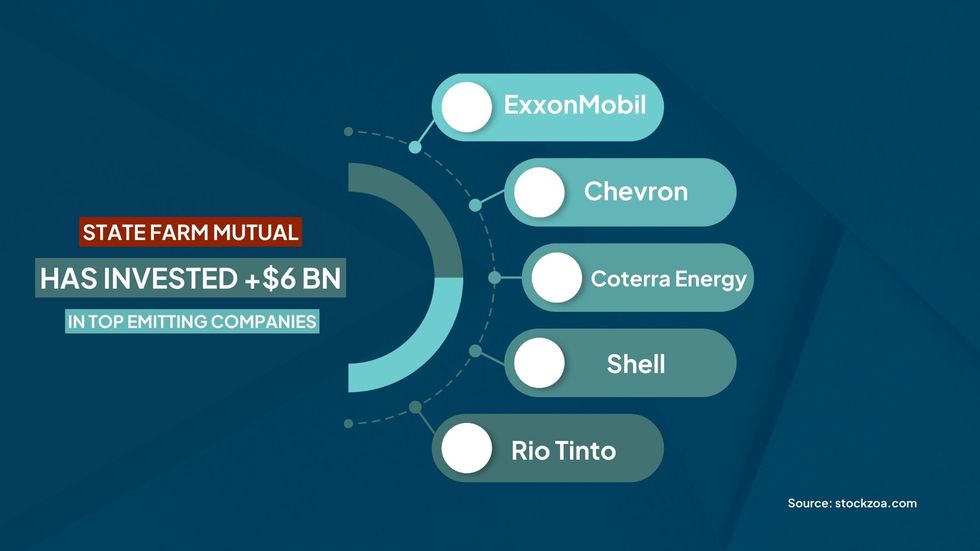

The UCLA survey only documented the links between pro sports teams and their leagues with oil and utility companies. Banks and insurance companies that finance fossil fuel projects also have sponsorship deals. For example, six of the 12 banks that invested the most in fossil fuel companies since the Paris climate agreement was signed in 2016—Bank of America, Barclays, Citigroup, JPMorgan Chase, Scotiabank and Wells Fargo—have each spent a small fortune on sports facility naming rights. Meanwhile, a review of the 30 NFL stadiums found that at least three are named for an insurance company with significant fossil fuel-related investments. One of those facilities is State Farm Stadium in Glendale, Arizona, where the Rams and Vikings played Monday night. The biggest home and auto insurer in the country, State Farm bought naming rights to the stadium in the fall of 2018 for an undisclosed sum.

Unlike all but one of its competitors, which have significantly cut back their investments in fossil fuel projects, State Farm has dramatically increased them, according to a September 2024 Wall Street Journal investigation. As of last May, the company held $20.6 billion in shares and bonds in 65 fossil fuel companies, including Chevron, ExxonMobil and Shell, according to a 2024 report by Urgewald, a German environmental group.

In May 2023, at the same time it was expanding its fossil fuel industry portfolio, State Farm stopped issuing new homeowner policies in California because of wildfire risks and ballooning construction costs. Less than a year later, it announced that it would not renew 30,000 homeowner policies and 42,000 policies for commercial apartments in the state. Some 1,600 of those policies covered homes in Pacific Palisades, the neighborhood just destroyed by the Palisades Fire.

State Farm’s “2023 Impact Report” states the obvious: “Being a good steward of our environmental resources just makes sense for everyone.” But for the company, that only means cutting its own carbon emissions, reducing waste at its facilities, and promoting paperless options for its customers. What about the impact of the billions of dollars the company invests in major carbon polluters? The report doesn’t mention it.

Stadiums at Risk

Hurricanes, snowstorms, and other severe events have forced the NFL to cancel preseason games and postpone and move regular season games in the past. But Monday night’s game in Arizona was the first time the NFL had to relocate a postseason game since 1936, when it moved the championship game between the Green Bay Packers and the Boston Redskins from Boston to New York because of low ticket sales.

What about the impact of the billions of dollars the company invests in major carbon polluters?

Going forward, the NFL and other sports leagues likely will have to move games more often, if not abandon facilities, because of climate change-related extreme weather events. A handful of events over the last two decades may signal what team owners should anticipate. They include:

- Hurricane Milton sweeping through Florida’s midsection last October, shredding the roof of the Tampa Bay Ray’s Tropicana Field in St. Petersburg and causing more than $55 million in damage. The Rays will have to play its 2025 season home games at the Yankees’ 11,000-seat spring training facility in Tampa.

- A massive snowstorm in December 2010 crushing the roof of the Minnesota Vikings’ Metrodome, costing $18 million to replace.

- Hurricane Katrina ripping the roof off of the New Orleans Saints’ Superdome in August 2005, costing more than $200 million to repair.

Several NFL stadiums are especially at risk, according to a report published last October by Climate X, a data analytics company. The report ranks the 30 NFL stadiums based on their vulnerability to such climate hazards as flooding, wildfires, extreme heat and storm surge, and compares projected damage over the next 25 years to each stadium’s current replacement value.

The three stadiums that face the greatest threat? MetLife Stadium, SoFi Stadium and State Farm Stadium, in that order.

The report projects that MetLife Stadium, the New Jersey home of the New York Giants and Jets, will suffer the highest total percentage loss of 184 percent of its current replacement value, with cumulative damages of more than $5.6 billion by 2050 due to its low elevation and exposure to surface flooding and storm surges. (Like State Farm, the MetLife insurance company has major fossil fuel investments. As of May 2024, it held $7.4 billion in stocks and bonds in more than 200 companies, including Chevron, ConocoPhillips, ExxonMobil and Shell.)

SoFi Stadium and State Farm Stadium, meanwhile, are both expected to sustain significant losses due to increased flooding and … wildfires. The Climate X report estimates that SoFi Stadium will incur a cumulative loss of 69 percent of its current replacement value with damages of $4.38 billion by 2050. State Farm Stadium, the third-most vulnerable facility, likely will experience a 39 percent total loss, with $965 million in cumulative damages.

Will mounting extreme weather disasters—and stadium damage projections—ever convince the L.A. Rams and other sports teams to sever their ties to the very companies responsible for the climate crisis?

Last summer, U.N. Secretary-General António Guterres castigated coal, oil and gas companies—which he dubbed the “godfathers of climate chaos”—for spreading disinformation and called for a worldwide ban on fossil fuel advertising. He also urged ad agencies to refuse fossil fuel clients and companies to stop taking their ads. So far, more than 1,000 advertising and public relations agencies worldwide have pledged to refuse working for fossil fuel companies, their trade associations, and their front groups.

It is past time for professional sports teams and leagues to do the same.

(Graphic: CIEL)

(Graphic: CIEL)

A home is engulfed in flames during the Eaton fire in the Altadena area of Los Angeles County, California on January 8, 2025. (Photo by Josh Edelson/AFP via Getty Images)

A home is engulfed in flames during the Eaton fire in the Altadena area of Los Angeles County, California on January 8, 2025. (Photo by Josh Edelson/AFP via Getty Images)