Trump-Appointed Judge Strikes Down CFPB Rule That Would Bar Medical Debt From Credit Reports

"This decision will hurt people's financial futures, including their ability to buy a home, care for their families, or even get a job," said the president and CEO of the nonprofit Undue Medical Debt.

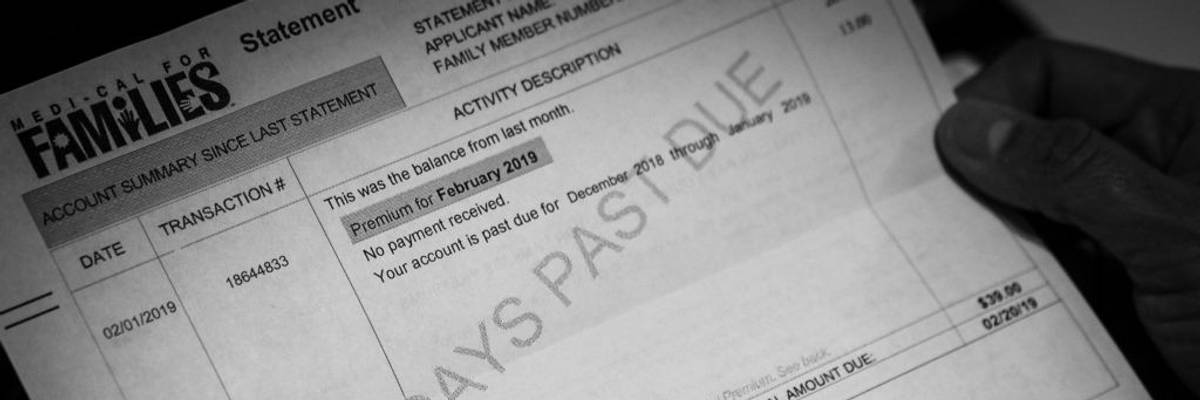

A Trump-appointed judge axed a Biden-era rule on Friday that would have removed medical debt from credit reports and barred lenders from using certain medical information in loan decisions.

The rule, enacted under the authority of the Fair Credit Reporting Act, would have removed an estimated $49 billion in medical bills from the credit reports of about 15 million people.

But after a lawsuit brought by two industry groups with the support of Republicans in Congress who attempted to block it, Judge Sean Jordan of the U.S. District Court of Texas' Eastern District ruled that the Consumer Financial Protection Bureau (CFPB) had exceeded its authority in introducing the rule.

According to the CFPB, those with medical debt on their credit reports would have received a 20-point boost to their credit scores on average as a result of the rule. It would have led to an estimated 22,000 more mortgages being approved for people struggling with medical debt.

According to a report by the Peterson Center on Healthcare and KFF last year, roughly 1 in 12 adults has over $250 in unpaid medical debt.

"People who get sick shouldn't have their financial future upended," said CFPB Director Rohit Chopra at the time of the rule's passage in January 2025. "The CFPB's final rule will close a special carveout that has allowed debt collectors to abuse the credit reporting system to coerce people into paying medical bills they may not even owe."

The consumer reports industry lobbied furiously against the measure. Two industry groups—the Consumer Data Industry Association and the Cornerstone Credit Union League—brought the lawsuit before Judge Jordan. Meanwhile, reporting from Accountable.US in March revealed that Republicans on the House Financial Services Committee accepted a combined $867,000 from trade groups opposed to the rule.

Using the same talking points as the industry, they then attempted to block the rule, arguing that it would "weaken the accuracy and completeness of consumer credit reports."

However, according to research by the CFPB, medical debt on credit reports often has no bearing on a person's ability to pay back other loans.

Medical bills also frequently contain mistakes. According to a survey by the Commonwealth Fund last year, more than 45% of respondents were billed for a service they thought was covered by insurance. The trade magazine Becker’s Hospital Review, meanwhile, has estimated that 80% of medical bills contain errors that inflate costs.

"Medical debt unjustly damages the credit scores of millions, limiting their ability to obtain affordable credit, rent safe housing, or even get a job," said the National Consumer Law Center after the rule was introduced.

Now, as a result of its being struck down, the 15 million Americans who have medical debt on their credit reports will see an average of $3,200 remaining on their reports that would have otherwise been erased.

"The facts are clear: Medical debt is not predictive of creditworthiness," said Allison Sesso, the president and CEO of the nonprofit Undue Medical Debt, on Monday. "This decision will hurt people’s financial futures, including their ability to buy a home, care for their families, or even get a job—all because they got sick, injured, or were born with a chronic condition through no fault of their own. It will also further decrease their willingness to get the care they need."

The ruling also marks the latest attack by Republicans on the CFPB. In February, the Trump administration attempted to unilaterally and illegally shut down the consumer watchdog agency. His effort to dismantle it was later blocked by a federal judge.

Since its creation in 2011, the CFPB has relieved $21 billion worth of debt for nearly 200 million Americans. It recouped that money from powerful financial institutions and credit card companies that had engaged in predatory practices and saddled Americans with junk fees.

But by cracking down on corporate abuses, it became the bane of Republican lawmakers and their corporate donors. Many top Trump donors sought to kill the CFPB because it was coming after the actions of their companies.

Elon Musk's company Tesla was facing scrutiny over its auto loan policies, which had received hundreds of complaints from customers. His social media company, X, was also being examined for its payment policies.

Another top Trump donor, investor Marc Andreesen, launched a broadside against the bureau when it ordered a payday lending company he'd invested in to pay tens of millions worth of fines for engaging in predatory lending.

"Judge Sean Jordan, a Trump-appointed judge, joined congressional Republicans in making it easier for the Trump administration to raise costs on millions of Americans," said Accountable.US executive director Tony Carrk.

"Not only are they dismantling healthcare for 17 million through their big, ugly betrayal, but they're dooming millions more with low credit scores due to illness and injury," he continued. "Republicans are holding a grudge against the CFPB, and it's costing Americans money."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

A Trump-appointed judge axed a Biden-era rule on Friday that would have removed medical debt from credit reports and barred lenders from using certain medical information in loan decisions.

The rule, enacted under the authority of the Fair Credit Reporting Act, would have removed an estimated $49 billion in medical bills from the credit reports of about 15 million people.

But after a lawsuit brought by two industry groups with the support of Republicans in Congress who attempted to block it, Judge Sean Jordan of the U.S. District Court of Texas' Eastern District ruled that the Consumer Financial Protection Bureau (CFPB) had exceeded its authority in introducing the rule.

According to the CFPB, those with medical debt on their credit reports would have received a 20-point boost to their credit scores on average as a result of the rule. It would have led to an estimated 22,000 more mortgages being approved for people struggling with medical debt.

According to a report by the Peterson Center on Healthcare and KFF last year, roughly 1 in 12 adults has over $250 in unpaid medical debt.

"People who get sick shouldn't have their financial future upended," said CFPB Director Rohit Chopra at the time of the rule's passage in January 2025. "The CFPB's final rule will close a special carveout that has allowed debt collectors to abuse the credit reporting system to coerce people into paying medical bills they may not even owe."

The consumer reports industry lobbied furiously against the measure. Two industry groups—the Consumer Data Industry Association and the Cornerstone Credit Union League—brought the lawsuit before Judge Jordan. Meanwhile, reporting from Accountable.US in March revealed that Republicans on the House Financial Services Committee accepted a combined $867,000 from trade groups opposed to the rule.

Using the same talking points as the industry, they then attempted to block the rule, arguing that it would "weaken the accuracy and completeness of consumer credit reports."

However, according to research by the CFPB, medical debt on credit reports often has no bearing on a person's ability to pay back other loans.

Medical bills also frequently contain mistakes. According to a survey by the Commonwealth Fund last year, more than 45% of respondents were billed for a service they thought was covered by insurance. The trade magazine Becker’s Hospital Review, meanwhile, has estimated that 80% of medical bills contain errors that inflate costs.

"Medical debt unjustly damages the credit scores of millions, limiting their ability to obtain affordable credit, rent safe housing, or even get a job," said the National Consumer Law Center after the rule was introduced.

Now, as a result of its being struck down, the 15 million Americans who have medical debt on their credit reports will see an average of $3,200 remaining on their reports that would have otherwise been erased.

"The facts are clear: Medical debt is not predictive of creditworthiness," said Allison Sesso, the president and CEO of the nonprofit Undue Medical Debt, on Monday. "This decision will hurt people’s financial futures, including their ability to buy a home, care for their families, or even get a job—all because they got sick, injured, or were born with a chronic condition through no fault of their own. It will also further decrease their willingness to get the care they need."

The ruling also marks the latest attack by Republicans on the CFPB. In February, the Trump administration attempted to unilaterally and illegally shut down the consumer watchdog agency. His effort to dismantle it was later blocked by a federal judge.

Since its creation in 2011, the CFPB has relieved $21 billion worth of debt for nearly 200 million Americans. It recouped that money from powerful financial institutions and credit card companies that had engaged in predatory practices and saddled Americans with junk fees.

But by cracking down on corporate abuses, it became the bane of Republican lawmakers and their corporate donors. Many top Trump donors sought to kill the CFPB because it was coming after the actions of their companies.

Elon Musk's company Tesla was facing scrutiny over its auto loan policies, which had received hundreds of complaints from customers. His social media company, X, was also being examined for its payment policies.

Another top Trump donor, investor Marc Andreesen, launched a broadside against the bureau when it ordered a payday lending company he'd invested in to pay tens of millions worth of fines for engaging in predatory lending.

"Judge Sean Jordan, a Trump-appointed judge, joined congressional Republicans in making it easier for the Trump administration to raise costs on millions of Americans," said Accountable.US executive director Tony Carrk.

"Not only are they dismantling healthcare for 17 million through their big, ugly betrayal, but they're dooming millions more with low credit scores due to illness and injury," he continued. "Republicans are holding a grudge against the CFPB, and it's costing Americans money."

- Opinion | The Quiet Shuttering of a Main Street Lending Program Will Make Inequality Worse | Common Dreams ›

- Trump CFPB Moves to Bar States From Wiping Medical Debt Off Credit Reports | Common Dreams ›

A Trump-appointed judge axed a Biden-era rule on Friday that would have removed medical debt from credit reports and barred lenders from using certain medical information in loan decisions.

The rule, enacted under the authority of the Fair Credit Reporting Act, would have removed an estimated $49 billion in medical bills from the credit reports of about 15 million people.

But after a lawsuit brought by two industry groups with the support of Republicans in Congress who attempted to block it, Judge Sean Jordan of the U.S. District Court of Texas' Eastern District ruled that the Consumer Financial Protection Bureau (CFPB) had exceeded its authority in introducing the rule.

According to the CFPB, those with medical debt on their credit reports would have received a 20-point boost to their credit scores on average as a result of the rule. It would have led to an estimated 22,000 more mortgages being approved for people struggling with medical debt.

According to a report by the Peterson Center on Healthcare and KFF last year, roughly 1 in 12 adults has over $250 in unpaid medical debt.

"People who get sick shouldn't have their financial future upended," said CFPB Director Rohit Chopra at the time of the rule's passage in January 2025. "The CFPB's final rule will close a special carveout that has allowed debt collectors to abuse the credit reporting system to coerce people into paying medical bills they may not even owe."

The consumer reports industry lobbied furiously against the measure. Two industry groups—the Consumer Data Industry Association and the Cornerstone Credit Union League—brought the lawsuit before Judge Jordan. Meanwhile, reporting from Accountable.US in March revealed that Republicans on the House Financial Services Committee accepted a combined $867,000 from trade groups opposed to the rule.

Using the same talking points as the industry, they then attempted to block the rule, arguing that it would "weaken the accuracy and completeness of consumer credit reports."

However, according to research by the CFPB, medical debt on credit reports often has no bearing on a person's ability to pay back other loans.

Medical bills also frequently contain mistakes. According to a survey by the Commonwealth Fund last year, more than 45% of respondents were billed for a service they thought was covered by insurance. The trade magazine Becker’s Hospital Review, meanwhile, has estimated that 80% of medical bills contain errors that inflate costs.

"Medical debt unjustly damages the credit scores of millions, limiting their ability to obtain affordable credit, rent safe housing, or even get a job," said the National Consumer Law Center after the rule was introduced.

Now, as a result of its being struck down, the 15 million Americans who have medical debt on their credit reports will see an average of $3,200 remaining on their reports that would have otherwise been erased.

"The facts are clear: Medical debt is not predictive of creditworthiness," said Allison Sesso, the president and CEO of the nonprofit Undue Medical Debt, on Monday. "This decision will hurt people’s financial futures, including their ability to buy a home, care for their families, or even get a job—all because they got sick, injured, or were born with a chronic condition through no fault of their own. It will also further decrease their willingness to get the care they need."

The ruling also marks the latest attack by Republicans on the CFPB. In February, the Trump administration attempted to unilaterally and illegally shut down the consumer watchdog agency. His effort to dismantle it was later blocked by a federal judge.

Since its creation in 2011, the CFPB has relieved $21 billion worth of debt for nearly 200 million Americans. It recouped that money from powerful financial institutions and credit card companies that had engaged in predatory practices and saddled Americans with junk fees.

But by cracking down on corporate abuses, it became the bane of Republican lawmakers and their corporate donors. Many top Trump donors sought to kill the CFPB because it was coming after the actions of their companies.

Elon Musk's company Tesla was facing scrutiny over its auto loan policies, which had received hundreds of complaints from customers. His social media company, X, was also being examined for its payment policies.

Another top Trump donor, investor Marc Andreesen, launched a broadside against the bureau when it ordered a payday lending company he'd invested in to pay tens of millions worth of fines for engaging in predatory lending.

"Judge Sean Jordan, a Trump-appointed judge, joined congressional Republicans in making it easier for the Trump administration to raise costs on millions of Americans," said Accountable.US executive director Tony Carrk.

"Not only are they dismantling healthcare for 17 million through their big, ugly betrayal, but they're dooming millions more with low credit scores due to illness and injury," he continued. "Republicans are holding a grudge against the CFPB, and it's costing Americans money."

- Opinion | The Quiet Shuttering of a Main Street Lending Program Will Make Inequality Worse | Common Dreams ›

- Trump CFPB Moves to Bar States From Wiping Medical Debt Off Credit Reports | Common Dreams ›