SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Sen. Rick Scott (R-Fla.) speaks during the Conservative Political Action Conference (CPAC) on February 26, 2022 in Orlando, Florida. (Photo: Joe Raedle/Getty Images)

The policy agenda that Republican Sen. Rick Scott of Florida unveiled last month--and has continued to promote despite mounting backlash--would hike annual taxes on the poorest 40% of people in the United States by $1,000 on average while not raising taxes on the richest 1% by a single penny.

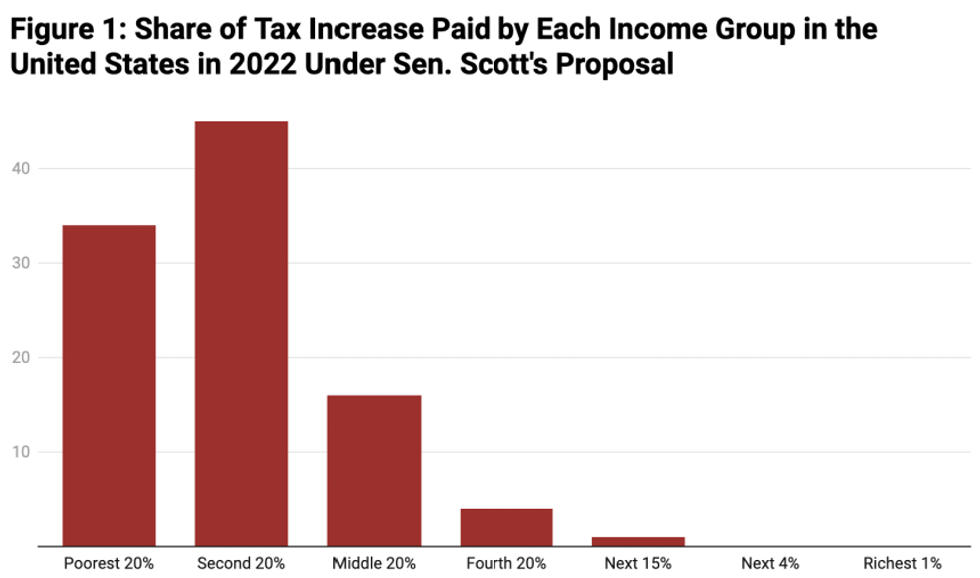

So concluded a state-by-state analysis of Scott's plan released Monday by the Institute on Taxation and Economic Policy (ITEP), which estimates that "the poorest fifth of Americans would pay 34% of the tax increase while the next fifth of Americans would pay 45% of the tax increase."

According to a summary of Scott's proposal--entitled "An 11-Point Plan to Rescue America"--every American who currently isn't required to pay federal income taxes would "pay some income tax to have skin in the game, even if a small amount."

Tens of millions of U.S. households don't owe federal income taxes each year, either because their annual incomes are below a certain threshold or they qualify for programs that offset their tax burdens.

To analyze the potential impact of the plan outlined by Scott--the chair of the National Republican Senatorial Committee--ITEP assumes it would "require federal income tax liability of at least $1."

"For some Americans, this would simply increase their tax liability from $0 to $1," ITEP notes. "But many others currently have negative federal income tax liability because they receive refundable tax credits like the Earned Income Tax Credit or the Child Tax Credit, which can result in a household receiving a check from the IRS."

The analysis continues:

These refundable tax credits are one feature of the federal personal income tax that makes it progressive. But Americans, including those who benefit from these tax credits, pay many other taxes that are not progressive, such as the federal payroll tax and state and local taxes, particularly property taxes and sales taxes...

The only possible interpretation of Sen. Scott's proposal is that everyone who has negative federal income tax liability under current law would instead have federal income tax liability of at least $1. The EITC and Child Tax Credit would no longer provide households with negative income tax liability, meaning no one would receive money from the IRS after they file their tax return. The most significant effects would be felt by the poorest 40% of Americans.

Overall, more than 35% of Americans would pay more in federal income taxes if Scott's plan were to be adopted, according to ITEP.

But, the policy organization notes, the top 1% wouldn't see their taxes rise at all under Scott's plan, which would also sunset "all federal legislation" after five years--a policy that would eliminate Social Security, Medicare, civil rights laws, and other measures unless Congress actively votes to reauthorize them.

While the Florida Republican's economic proposal targets poor households that aren't required to pay federal income taxes, it's not clear whether the plan would ensure that ultra-rich Americans who frequently dodge their tax obligations are forced to pay up in the future.

"There are a small number of uber-wealthy Americans who avoid federal income tax thanks to a series of loopholes that allow them to claim little to no income. If that was who Sen. Scott was talking about, we'd be cheering him on," the Patriotic Millionaires, an advocacy group that supports higher taxes on the wealthy, wrote in an email to supporters last month.

"Most people who don't pay any federal income taxes are exempt because they don't make enough money," the group continued. "These are people who are making just enough, or often not enough, to keep their families afloat. While in 2017 the GOP seemed happy to write a tax bill that gave 83% of the benefits to the top 1%, they now want to raise taxes on everyone else, even those who may live well below the poverty line."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The policy agenda that Republican Sen. Rick Scott of Florida unveiled last month--and has continued to promote despite mounting backlash--would hike annual taxes on the poorest 40% of people in the United States by $1,000 on average while not raising taxes on the richest 1% by a single penny.

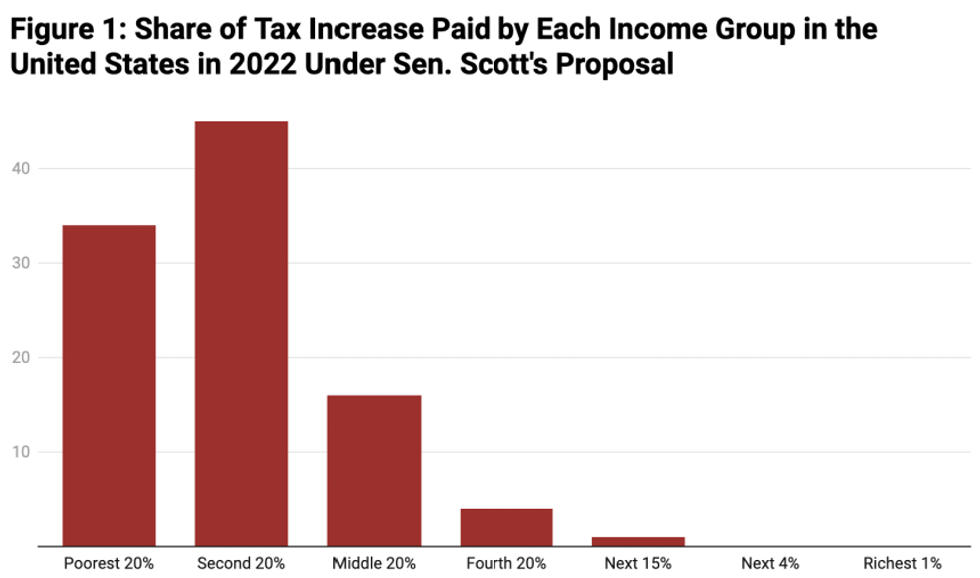

So concluded a state-by-state analysis of Scott's plan released Monday by the Institute on Taxation and Economic Policy (ITEP), which estimates that "the poorest fifth of Americans would pay 34% of the tax increase while the next fifth of Americans would pay 45% of the tax increase."

According to a summary of Scott's proposal--entitled "An 11-Point Plan to Rescue America"--every American who currently isn't required to pay federal income taxes would "pay some income tax to have skin in the game, even if a small amount."

Tens of millions of U.S. households don't owe federal income taxes each year, either because their annual incomes are below a certain threshold or they qualify for programs that offset their tax burdens.

To analyze the potential impact of the plan outlined by Scott--the chair of the National Republican Senatorial Committee--ITEP assumes it would "require federal income tax liability of at least $1."

"For some Americans, this would simply increase their tax liability from $0 to $1," ITEP notes. "But many others currently have negative federal income tax liability because they receive refundable tax credits like the Earned Income Tax Credit or the Child Tax Credit, which can result in a household receiving a check from the IRS."

The analysis continues:

These refundable tax credits are one feature of the federal personal income tax that makes it progressive. But Americans, including those who benefit from these tax credits, pay many other taxes that are not progressive, such as the federal payroll tax and state and local taxes, particularly property taxes and sales taxes...

The only possible interpretation of Sen. Scott's proposal is that everyone who has negative federal income tax liability under current law would instead have federal income tax liability of at least $1. The EITC and Child Tax Credit would no longer provide households with negative income tax liability, meaning no one would receive money from the IRS after they file their tax return. The most significant effects would be felt by the poorest 40% of Americans.

Overall, more than 35% of Americans would pay more in federal income taxes if Scott's plan were to be adopted, according to ITEP.

But, the policy organization notes, the top 1% wouldn't see their taxes rise at all under Scott's plan, which would also sunset "all federal legislation" after five years--a policy that would eliminate Social Security, Medicare, civil rights laws, and other measures unless Congress actively votes to reauthorize them.

While the Florida Republican's economic proposal targets poor households that aren't required to pay federal income taxes, it's not clear whether the plan would ensure that ultra-rich Americans who frequently dodge their tax obligations are forced to pay up in the future.

"There are a small number of uber-wealthy Americans who avoid federal income tax thanks to a series of loopholes that allow them to claim little to no income. If that was who Sen. Scott was talking about, we'd be cheering him on," the Patriotic Millionaires, an advocacy group that supports higher taxes on the wealthy, wrote in an email to supporters last month.

"Most people who don't pay any federal income taxes are exempt because they don't make enough money," the group continued. "These are people who are making just enough, or often not enough, to keep their families afloat. While in 2017 the GOP seemed happy to write a tax bill that gave 83% of the benefits to the top 1%, they now want to raise taxes on everyone else, even those who may live well below the poverty line."

The policy agenda that Republican Sen. Rick Scott of Florida unveiled last month--and has continued to promote despite mounting backlash--would hike annual taxes on the poorest 40% of people in the United States by $1,000 on average while not raising taxes on the richest 1% by a single penny.

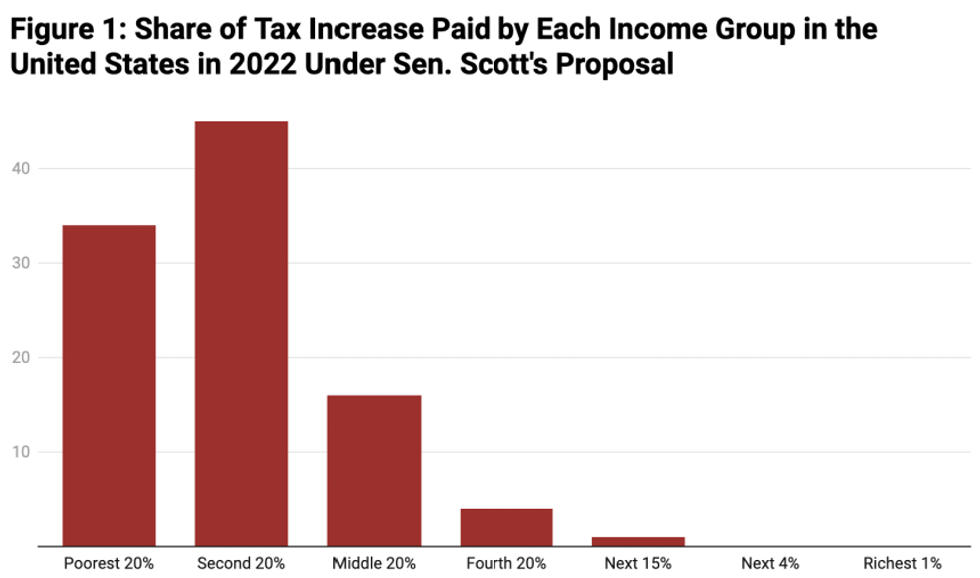

So concluded a state-by-state analysis of Scott's plan released Monday by the Institute on Taxation and Economic Policy (ITEP), which estimates that "the poorest fifth of Americans would pay 34% of the tax increase while the next fifth of Americans would pay 45% of the tax increase."

According to a summary of Scott's proposal--entitled "An 11-Point Plan to Rescue America"--every American who currently isn't required to pay federal income taxes would "pay some income tax to have skin in the game, even if a small amount."

Tens of millions of U.S. households don't owe federal income taxes each year, either because their annual incomes are below a certain threshold or they qualify for programs that offset their tax burdens.

To analyze the potential impact of the plan outlined by Scott--the chair of the National Republican Senatorial Committee--ITEP assumes it would "require federal income tax liability of at least $1."

"For some Americans, this would simply increase their tax liability from $0 to $1," ITEP notes. "But many others currently have negative federal income tax liability because they receive refundable tax credits like the Earned Income Tax Credit or the Child Tax Credit, which can result in a household receiving a check from the IRS."

The analysis continues:

These refundable tax credits are one feature of the federal personal income tax that makes it progressive. But Americans, including those who benefit from these tax credits, pay many other taxes that are not progressive, such as the federal payroll tax and state and local taxes, particularly property taxes and sales taxes...

The only possible interpretation of Sen. Scott's proposal is that everyone who has negative federal income tax liability under current law would instead have federal income tax liability of at least $1. The EITC and Child Tax Credit would no longer provide households with negative income tax liability, meaning no one would receive money from the IRS after they file their tax return. The most significant effects would be felt by the poorest 40% of Americans.

Overall, more than 35% of Americans would pay more in federal income taxes if Scott's plan were to be adopted, according to ITEP.

But, the policy organization notes, the top 1% wouldn't see their taxes rise at all under Scott's plan, which would also sunset "all federal legislation" after five years--a policy that would eliminate Social Security, Medicare, civil rights laws, and other measures unless Congress actively votes to reauthorize them.

While the Florida Republican's economic proposal targets poor households that aren't required to pay federal income taxes, it's not clear whether the plan would ensure that ultra-rich Americans who frequently dodge their tax obligations are forced to pay up in the future.

"There are a small number of uber-wealthy Americans who avoid federal income tax thanks to a series of loopholes that allow them to claim little to no income. If that was who Sen. Scott was talking about, we'd be cheering him on," the Patriotic Millionaires, an advocacy group that supports higher taxes on the wealthy, wrote in an email to supporters last month.

"Most people who don't pay any federal income taxes are exempt because they don't make enough money," the group continued. "These are people who are making just enough, or often not enough, to keep their families afloat. While in 2017 the GOP seemed happy to write a tax bill that gave 83% of the benefits to the top 1%, they now want to raise taxes on everyone else, even those who may live well below the poverty line."