SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

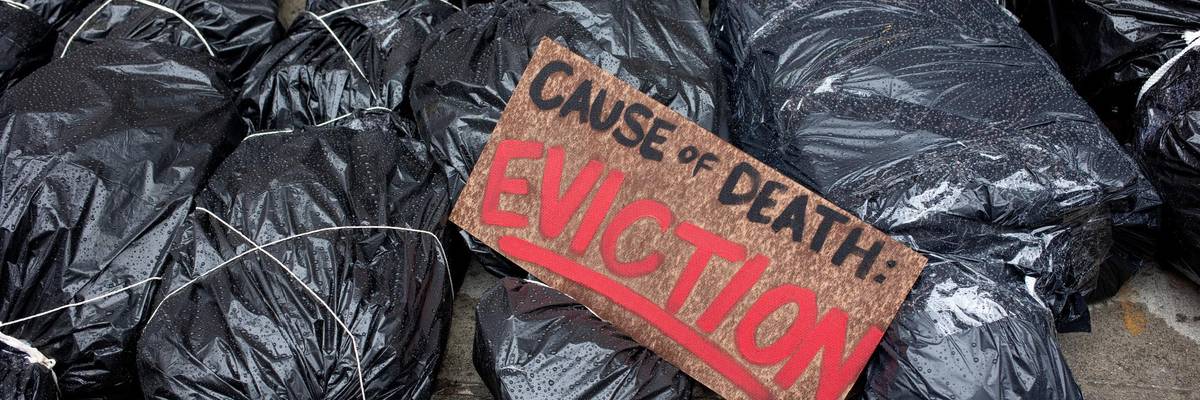

Tenant rights activists protesting inadequate relief for renters during the Covid-19 pandemic leave prop bodies outside the home of New York state Senator Brian Kavanagh on February 28, 2021 in the East Village neighborhood of New York City. (Photo: Andrew Lichtenstein/Corbis via Getty Images)

As the White House prepares for a U.S. Supreme Court order that could invalidate the new federal eviction moratorium, data released Wednesday revealed that state and local governments have disbursed just 11% of the funds that Congress allocated to help pay off debts accrued by renters during the Covid-19 pandemic.

"States... must immediately get these funds to renters with the urgency this crisis demands."

--Rep. Mondaire Jones

According to the U.S. Treasury Department, which oversees the Emergency Rental Assistance Program, only $1.7 billion was distributed in July. The New York Times reported that last month's amount "was a modest increase from the prior month, bringing the total aid disbursed thus far to about $5.1 billion." That's a small fraction of the $46.5 billion that Congress appropriated for rental assistance in two coronavirus relief packages passed in the last year.

"This is unacceptable," Rep. Mondaire Jones (D-N.Y.) said in response to the new figures. "We fought to extend the eviction moratorium to give states a chance to distribute these funds, but time is of the essence."

Just weeks ago, a group of progressive lawmakers led by Rep. Cori Bush (D-Mo.) held overnight rallies outside the Capitol to pressure President Joe Biden to extend the Centers for Disease Control and Prevention's nationwide eviction moratorium. While Biden let the previous CDC order lapse on July 31, sustained direct action pushed his administration to implement on August 3 a new, more limited 60-day ban on evictions to give state and local governments more time to distribute rent relief.

Jones said Wednesday that "states... must immediately get these funds to renters with the urgency this crisis demands."

The Times noted that the new data came as the Biden administration "mapped out policy contingencies if the Supreme Court strikes down the moratorium, which is the administration's principal safeguard for hundreds of thousands of low-income and working class tenants hit hardest by the pandemic." The White House anticipates a decision as soon as this week.

According to the Times, Treasury Department and White House officials said during a Tuesday night conference call that while some progress has been made this month, states are delivering rental aid at such a slow pace that an eviction surge is likely even if the high court allows the new ban to continue until its scheduled October 2 expiration date.

The newspaper added:

On Wednesday, the Treasury Department rolled out a slate of incremental changes intended to pressure states to move more quickly. But administration officials continue to blame the program's struggles on local officials, many of whom are reluctant to take advantage of the program's new fast-track application process, which allows tenants to self-certify their financial information.

In recent weeks, local officials have complained that moving too fast on aid applications could lead to errors, fraud, and audits; the White House has countered by telling them those risks are insignificant compared with a wave of evictions hitting tenants who did not get their aid quickly enough to keep a roof over their heads.

Journalist Brian Goldstone argued that the unwillingness of local agencies to expedite the allocation of funds, including by giving money directly to renters, means that "they trust landlords--but not tenants--to tell the truth."

The Times noted that many landlords "have rejected the federal aid, arguing that evicting nonpaying tenants is not only their right but the most effective way of ensuring their revenue is not interrupted in the future."

Matt Ford of The New Republic called the situation "a colossal failure of governance."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As the White House prepares for a U.S. Supreme Court order that could invalidate the new federal eviction moratorium, data released Wednesday revealed that state and local governments have disbursed just 11% of the funds that Congress allocated to help pay off debts accrued by renters during the Covid-19 pandemic.

"States... must immediately get these funds to renters with the urgency this crisis demands."

--Rep. Mondaire Jones

According to the U.S. Treasury Department, which oversees the Emergency Rental Assistance Program, only $1.7 billion was distributed in July. The New York Times reported that last month's amount "was a modest increase from the prior month, bringing the total aid disbursed thus far to about $5.1 billion." That's a small fraction of the $46.5 billion that Congress appropriated for rental assistance in two coronavirus relief packages passed in the last year.

"This is unacceptable," Rep. Mondaire Jones (D-N.Y.) said in response to the new figures. "We fought to extend the eviction moratorium to give states a chance to distribute these funds, but time is of the essence."

Just weeks ago, a group of progressive lawmakers led by Rep. Cori Bush (D-Mo.) held overnight rallies outside the Capitol to pressure President Joe Biden to extend the Centers for Disease Control and Prevention's nationwide eviction moratorium. While Biden let the previous CDC order lapse on July 31, sustained direct action pushed his administration to implement on August 3 a new, more limited 60-day ban on evictions to give state and local governments more time to distribute rent relief.

Jones said Wednesday that "states... must immediately get these funds to renters with the urgency this crisis demands."

The Times noted that the new data came as the Biden administration "mapped out policy contingencies if the Supreme Court strikes down the moratorium, which is the administration's principal safeguard for hundreds of thousands of low-income and working class tenants hit hardest by the pandemic." The White House anticipates a decision as soon as this week.

According to the Times, Treasury Department and White House officials said during a Tuesday night conference call that while some progress has been made this month, states are delivering rental aid at such a slow pace that an eviction surge is likely even if the high court allows the new ban to continue until its scheduled October 2 expiration date.

The newspaper added:

On Wednesday, the Treasury Department rolled out a slate of incremental changes intended to pressure states to move more quickly. But administration officials continue to blame the program's struggles on local officials, many of whom are reluctant to take advantage of the program's new fast-track application process, which allows tenants to self-certify their financial information.

In recent weeks, local officials have complained that moving too fast on aid applications could lead to errors, fraud, and audits; the White House has countered by telling them those risks are insignificant compared with a wave of evictions hitting tenants who did not get their aid quickly enough to keep a roof over their heads.

Journalist Brian Goldstone argued that the unwillingness of local agencies to expedite the allocation of funds, including by giving money directly to renters, means that "they trust landlords--but not tenants--to tell the truth."

The Times noted that many landlords "have rejected the federal aid, arguing that evicting nonpaying tenants is not only their right but the most effective way of ensuring their revenue is not interrupted in the future."

Matt Ford of The New Republic called the situation "a colossal failure of governance."

As the White House prepares for a U.S. Supreme Court order that could invalidate the new federal eviction moratorium, data released Wednesday revealed that state and local governments have disbursed just 11% of the funds that Congress allocated to help pay off debts accrued by renters during the Covid-19 pandemic.

"States... must immediately get these funds to renters with the urgency this crisis demands."

--Rep. Mondaire Jones

According to the U.S. Treasury Department, which oversees the Emergency Rental Assistance Program, only $1.7 billion was distributed in July. The New York Times reported that last month's amount "was a modest increase from the prior month, bringing the total aid disbursed thus far to about $5.1 billion." That's a small fraction of the $46.5 billion that Congress appropriated for rental assistance in two coronavirus relief packages passed in the last year.

"This is unacceptable," Rep. Mondaire Jones (D-N.Y.) said in response to the new figures. "We fought to extend the eviction moratorium to give states a chance to distribute these funds, but time is of the essence."

Just weeks ago, a group of progressive lawmakers led by Rep. Cori Bush (D-Mo.) held overnight rallies outside the Capitol to pressure President Joe Biden to extend the Centers for Disease Control and Prevention's nationwide eviction moratorium. While Biden let the previous CDC order lapse on July 31, sustained direct action pushed his administration to implement on August 3 a new, more limited 60-day ban on evictions to give state and local governments more time to distribute rent relief.

Jones said Wednesday that "states... must immediately get these funds to renters with the urgency this crisis demands."

The Times noted that the new data came as the Biden administration "mapped out policy contingencies if the Supreme Court strikes down the moratorium, which is the administration's principal safeguard for hundreds of thousands of low-income and working class tenants hit hardest by the pandemic." The White House anticipates a decision as soon as this week.

According to the Times, Treasury Department and White House officials said during a Tuesday night conference call that while some progress has been made this month, states are delivering rental aid at such a slow pace that an eviction surge is likely even if the high court allows the new ban to continue until its scheduled October 2 expiration date.

The newspaper added:

On Wednesday, the Treasury Department rolled out a slate of incremental changes intended to pressure states to move more quickly. But administration officials continue to blame the program's struggles on local officials, many of whom are reluctant to take advantage of the program's new fast-track application process, which allows tenants to self-certify their financial information.

In recent weeks, local officials have complained that moving too fast on aid applications could lead to errors, fraud, and audits; the White House has countered by telling them those risks are insignificant compared with a wave of evictions hitting tenants who did not get their aid quickly enough to keep a roof over their heads.

Journalist Brian Goldstone argued that the unwillingness of local agencies to expedite the allocation of funds, including by giving money directly to renters, means that "they trust landlords--but not tenants--to tell the truth."

The Times noted that many landlords "have rejected the federal aid, arguing that evicting nonpaying tenants is not only their right but the most effective way of ensuring their revenue is not interrupted in the future."

Matt Ford of The New Republic called the situation "a colossal failure of governance."