SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

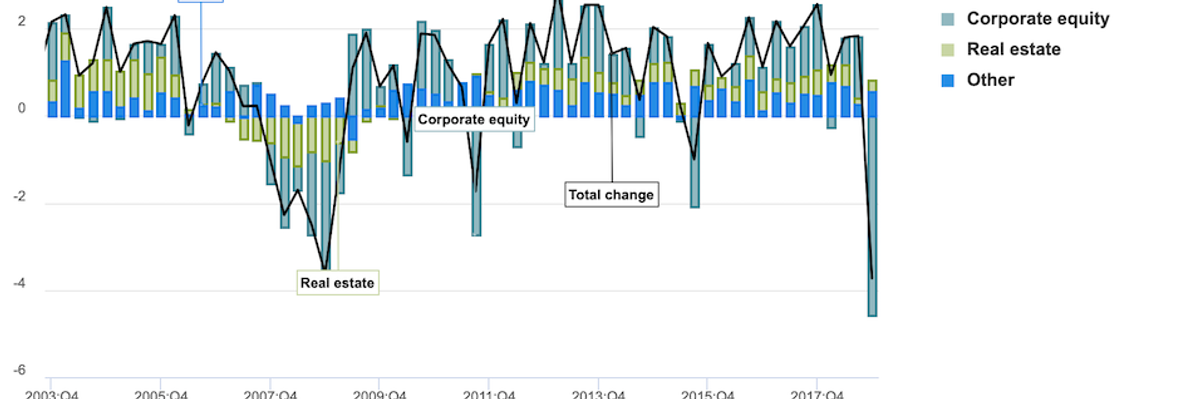

Data from the Fed showing the $4 trillion drop. (Photo: modifified screengrab, Federal Reserve)

Total American household net worth fell by $4 trillion at the end of 2018, sparking fears that the economy may be headed to a downturn.

Data from the Federal Reserve in its quarterly Flow of Funds report showed the decline. The drop was "the single largest quarterly dollar drop on record," according to a blog post on the data by The Big Picture's Barry Ritholtz.

"As a comparison, the U.S. bear market losses from 2007-2009 = $11 trillion dollars," wrote Ritholz.

Reuters reported Thursday that Fed officials fear the decline could lead to a drop in consumer spending and a corresponding contraction of economic growth for the U.S.

Dips in retail spending at the end of 2018, the report said, added to the fear.

Not everyone assumes the worst, however.

According to CNN, the pinch will be felt disproportionately by the wealthy--leaving most households clear of the impact.

The decline does not reflect the average household's balance sheet, since stock ownership is concentrated among the wealthy. Only 18.7% of Americans own stock directly, while about half are invested in the market through through employer-sponsored retirement accounts, according to Pew.

U.S. News and World Report's Andrew Soergel, in an analysis, said that despite the loss of $4 trillion, that decline was based in "a woeful Wall Street run to close out 2018," and that the economy was more likely to continue to grow than not.

Trade uncertainty and anticipation of future Federal Reserve interest rate hikes and monetary policy tightening largely weighed on investors at the end of the year. And although those risks haven't exactly dissipated as the U.S. approaches the end of the first quarter, markets have largely stabilized, and consumers don't seem to be much the worse for wear.

Soergel also pointed to consumer confidence and credit debt as indicators of a growing economy: "credit increases are generally associated with a relatively optimistic consumer whose spending contributes to economic growth."

Total consumer credit debt, however, indicates there may be more trouble ahead, especially since it just hit a familiar amount: $4 trillion.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Total American household net worth fell by $4 trillion at the end of 2018, sparking fears that the economy may be headed to a downturn.

Data from the Federal Reserve in its quarterly Flow of Funds report showed the decline. The drop was "the single largest quarterly dollar drop on record," according to a blog post on the data by The Big Picture's Barry Ritholtz.

"As a comparison, the U.S. bear market losses from 2007-2009 = $11 trillion dollars," wrote Ritholz.

Reuters reported Thursday that Fed officials fear the decline could lead to a drop in consumer spending and a corresponding contraction of economic growth for the U.S.

Dips in retail spending at the end of 2018, the report said, added to the fear.

Not everyone assumes the worst, however.

According to CNN, the pinch will be felt disproportionately by the wealthy--leaving most households clear of the impact.

The decline does not reflect the average household's balance sheet, since stock ownership is concentrated among the wealthy. Only 18.7% of Americans own stock directly, while about half are invested in the market through through employer-sponsored retirement accounts, according to Pew.

U.S. News and World Report's Andrew Soergel, in an analysis, said that despite the loss of $4 trillion, that decline was based in "a woeful Wall Street run to close out 2018," and that the economy was more likely to continue to grow than not.

Trade uncertainty and anticipation of future Federal Reserve interest rate hikes and monetary policy tightening largely weighed on investors at the end of the year. And although those risks haven't exactly dissipated as the U.S. approaches the end of the first quarter, markets have largely stabilized, and consumers don't seem to be much the worse for wear.

Soergel also pointed to consumer confidence and credit debt as indicators of a growing economy: "credit increases are generally associated with a relatively optimistic consumer whose spending contributes to economic growth."

Total consumer credit debt, however, indicates there may be more trouble ahead, especially since it just hit a familiar amount: $4 trillion.

Total American household net worth fell by $4 trillion at the end of 2018, sparking fears that the economy may be headed to a downturn.

Data from the Federal Reserve in its quarterly Flow of Funds report showed the decline. The drop was "the single largest quarterly dollar drop on record," according to a blog post on the data by The Big Picture's Barry Ritholtz.

"As a comparison, the U.S. bear market losses from 2007-2009 = $11 trillion dollars," wrote Ritholz.

Reuters reported Thursday that Fed officials fear the decline could lead to a drop in consumer spending and a corresponding contraction of economic growth for the U.S.

Dips in retail spending at the end of 2018, the report said, added to the fear.

Not everyone assumes the worst, however.

According to CNN, the pinch will be felt disproportionately by the wealthy--leaving most households clear of the impact.

The decline does not reflect the average household's balance sheet, since stock ownership is concentrated among the wealthy. Only 18.7% of Americans own stock directly, while about half are invested in the market through through employer-sponsored retirement accounts, according to Pew.

U.S. News and World Report's Andrew Soergel, in an analysis, said that despite the loss of $4 trillion, that decline was based in "a woeful Wall Street run to close out 2018," and that the economy was more likely to continue to grow than not.

Trade uncertainty and anticipation of future Federal Reserve interest rate hikes and monetary policy tightening largely weighed on investors at the end of the year. And although those risks haven't exactly dissipated as the U.S. approaches the end of the first quarter, markets have largely stabilized, and consumers don't seem to be much the worse for wear.

Soergel also pointed to consumer confidence and credit debt as indicators of a growing economy: "credit increases are generally associated with a relatively optimistic consumer whose spending contributes to economic growth."

Total consumer credit debt, however, indicates there may be more trouble ahead, especially since it just hit a familiar amount: $4 trillion.