A visionary new report by a U.K.-based think tank proposes giving each British 25-year-old a PS10,000 ($13,519) "citizen's inheritance" to help redistribute wealth while offering young people a better chance to secure housing, pursue higher education, start businesses, and invest in pensions.

A New Generational Contract (pdf), a product of the Resolution Foundation's Intergenerational Commission, details policy proposals to address the mounting threat to what researchers call "the intergenerational contract," or "the principle that different generations provide support to each other across the different stages of their lives." In practice, this often means young and middle-aged adults care for children and the elderly.

"The intergenerational contract works because everyone puts in and everyone takes out," the report asserts. However, in the United Kingdom--and other advanced nations such as the United States--that contract is increasingly "under threat, with widespread concern that young adults may not achieve the progress their predecessors enjoyed" because "inequalities of income within generations are higher for younger people today than for their predecessors."

Among the report's most eye-catching proposals to combat the rising threat to the contract is the PS10,000 citizen's inheritance, "a restricted-use asset endowment to all young adults to support skills, entrepreneurship, housing, and pension saving." The goal would be to eventually make the inheritance available to British nationals at age 25, but the researchers envision a transition period that would include slightly older adults.

This scheme would be "funded by abolishing an unpopular and loophole-riddled inheritance tax and replacing it with a tax on recipients with a lower rate and fewer exemptions," Laura Gardiner, principal researcher at the Resolution Foundation, outlined in the New Statesman. "This isn't about fueling spending sprees: use of the citizen's inheritance would be restricted to where it is most needed."

"The effects would be profound," the report explains:

A PS10,000 boost today would at least double the wealth of more than six-in-ten adults in their late 20s. It would be enough for half the typical first-time buyer deposit in half the regions and nations of the U.K.; enough to fund a master's degree or significant retraining; and would add an estimated PS45,000 to retirement savings pots if immediately invested in a pension. And by bridging between rental deposits when people move for work, or adding to businesses start-up resources for those in recognised entrepreneurship schemes, it would support the kind of positive labor market risk-taking that is all too lacking for the young at present. Such an approach would represent a bold demonstration that the state's role in delivering the intergenerational contract can evolve for the 21st century.

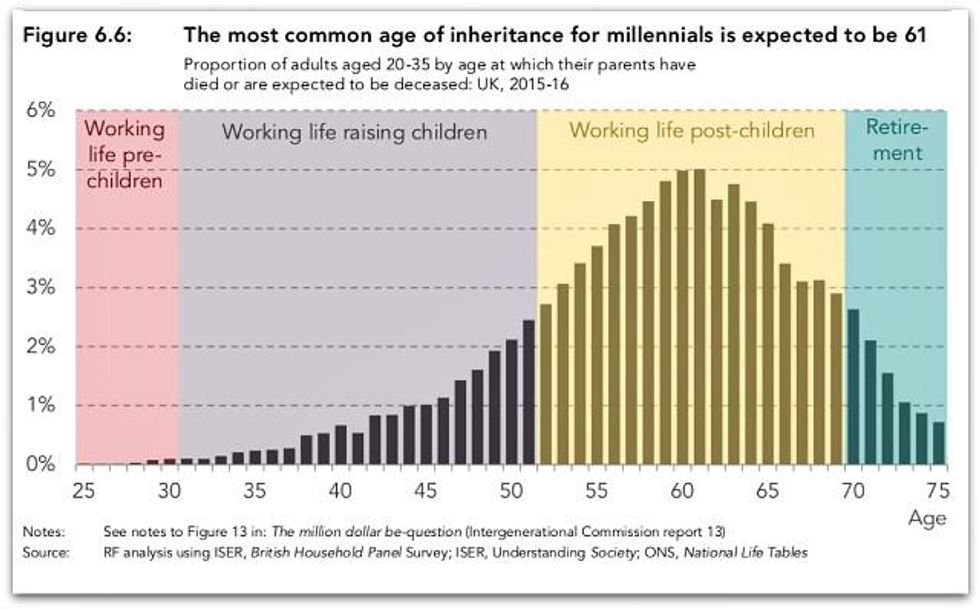

In addition to offering a lengthy list of policy proposals, the report found that many current young adults are financially worse off than those in older generations were at comparable ages not only because of income disparities but also because the young adults of today are increasingly acquiring inheritances from their older relatives at later ages--which makes it more difficult to cover necessary expenses or save for retirement.

Writing for the Guardian, Robert Booth predicts "the findings will be seized on by millennials (born 1981-2000) who believe they have been miscast as spendthrift hedonists who would rather splash out on artisan coffee and slices of avocado on toast than save for a house deposit."

"Having that amount of money at 25 would change your ability to afford a house. Maybe you could put it into a bond while you get the rest of the money together," 23-year-old Matilda Morgan told Booth. "What the older generation don't understand is that while the minimum wage helped people afford things for a while, that's not the case now. I gave up on buying a house a few years ago because I realized I would never afford it."