SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

President Donald Trump lies a lot--especially about the Republican tax plan--but during a Friday morning scrum with reporters on the White House lawn, Trump accidentally told the truth.

Asked about the GOP tax bill, which is expected to hit the floor of the House and Senate for a final vote early next week, Trump said: "I think we're doing very well, it's something that's going to be monumental. It will be the biggest tax increase--or tax cut--in the history of our country."

@marcorubio

-- Patriot Power (@Kakistocracy15) December 15, 2017

Oops BIGLY Freudian slip Trump:

"It will be the biggest tax increase...in the history of our country"#GOPTaxScam pic.twitter.com/L7PGo0VIuH

Even if it was just a slip of the tongue, Trump's characterization of the GOP tax bill as the "biggest tax increase" in American history is accurate, according to some analysts.

As The Intercept's Ryan Grim noted in an analysis earlier this month, the GOP tax bill is "routinely referred to as a $1.5 trillion tax cut. And, in some ways, that's true: On net, it would reduce the amount of taxes collected by the Treasury by about $1.5 trillion over 10 years."

However, "that figure masks the eye-popping scale and audacity of the GOP's rushed restructuring of the economy," Grim adds. "[The bill,] properly described, is two things: the largest tax cut--and also the biggest tax increase--in American history."

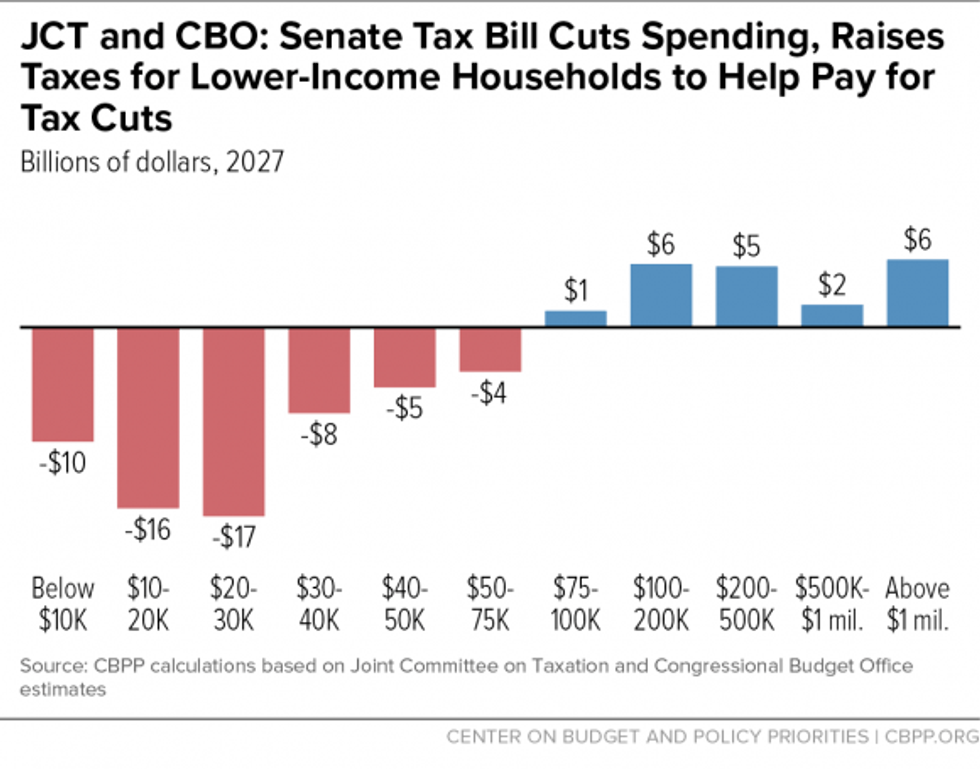

This tax increase, as research by the Center on Budget and Policy Priorities (CBPP) has found, would primarily be shouldered by low-income and middle class Americans. Additionally, while the GOP bill would give corporations permanent tax cuts, many of the cuts for middle class and low-income Americans would expire after a decade.

As Common Dreams reported on Wednesday, House and Senate Republicans reached a backroom "deal" that tilts the benefits of their bill even further toward the wealthiest Americans by reducing the top marginal tax rate from from 39.6 percent to 37 percent.

"Overall, in 2027--when only the corporate tax cuts, slower inflation measure, and individual mandate repeal would remain in place--the Senate bill would, on average, raise taxes or reduce federal expenditures for households with incomes below $75,000 by about $60 billion--while still giving large tax reductions (through its corporate tax cuts) to those at the top," noted CBPP's Chuck Marr.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

President Donald Trump lies a lot--especially about the Republican tax plan--but during a Friday morning scrum with reporters on the White House lawn, Trump accidentally told the truth.

Asked about the GOP tax bill, which is expected to hit the floor of the House and Senate for a final vote early next week, Trump said: "I think we're doing very well, it's something that's going to be monumental. It will be the biggest tax increase--or tax cut--in the history of our country."

@marcorubio

-- Patriot Power (@Kakistocracy15) December 15, 2017

Oops BIGLY Freudian slip Trump:

"It will be the biggest tax increase...in the history of our country"#GOPTaxScam pic.twitter.com/L7PGo0VIuH

Even if it was just a slip of the tongue, Trump's characterization of the GOP tax bill as the "biggest tax increase" in American history is accurate, according to some analysts.

As The Intercept's Ryan Grim noted in an analysis earlier this month, the GOP tax bill is "routinely referred to as a $1.5 trillion tax cut. And, in some ways, that's true: On net, it would reduce the amount of taxes collected by the Treasury by about $1.5 trillion over 10 years."

However, "that figure masks the eye-popping scale and audacity of the GOP's rushed restructuring of the economy," Grim adds. "[The bill,] properly described, is two things: the largest tax cut--and also the biggest tax increase--in American history."

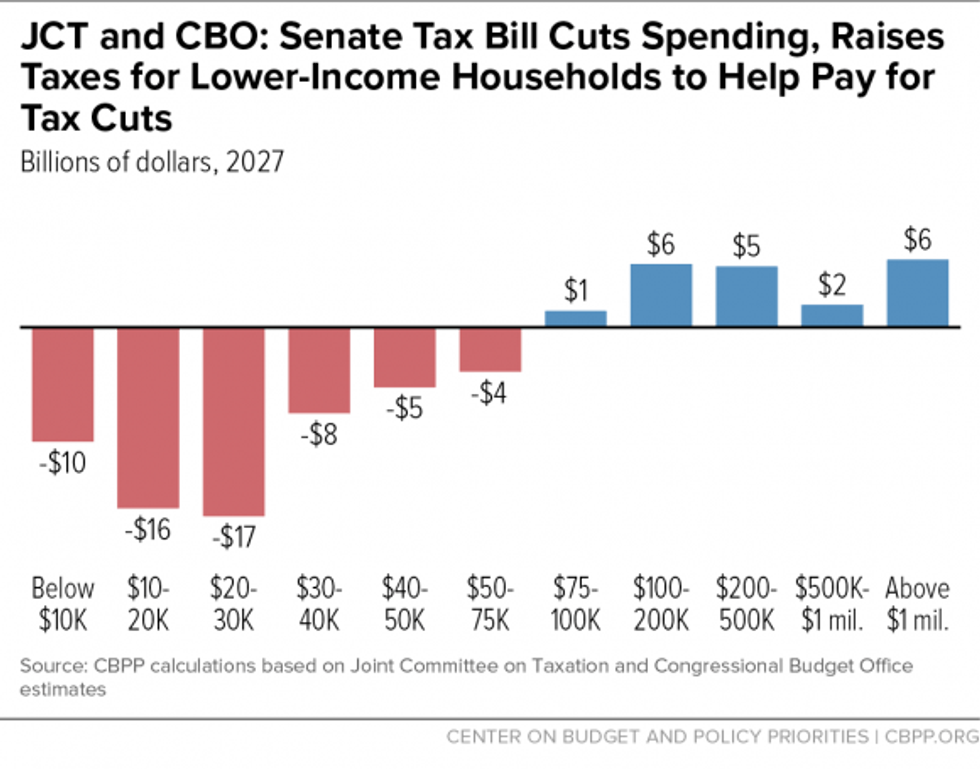

This tax increase, as research by the Center on Budget and Policy Priorities (CBPP) has found, would primarily be shouldered by low-income and middle class Americans. Additionally, while the GOP bill would give corporations permanent tax cuts, many of the cuts for middle class and low-income Americans would expire after a decade.

As Common Dreams reported on Wednesday, House and Senate Republicans reached a backroom "deal" that tilts the benefits of their bill even further toward the wealthiest Americans by reducing the top marginal tax rate from from 39.6 percent to 37 percent.

"Overall, in 2027--when only the corporate tax cuts, slower inflation measure, and individual mandate repeal would remain in place--the Senate bill would, on average, raise taxes or reduce federal expenditures for households with incomes below $75,000 by about $60 billion--while still giving large tax reductions (through its corporate tax cuts) to those at the top," noted CBPP's Chuck Marr.

President Donald Trump lies a lot--especially about the Republican tax plan--but during a Friday morning scrum with reporters on the White House lawn, Trump accidentally told the truth.

Asked about the GOP tax bill, which is expected to hit the floor of the House and Senate for a final vote early next week, Trump said: "I think we're doing very well, it's something that's going to be monumental. It will be the biggest tax increase--or tax cut--in the history of our country."

@marcorubio

-- Patriot Power (@Kakistocracy15) December 15, 2017

Oops BIGLY Freudian slip Trump:

"It will be the biggest tax increase...in the history of our country"#GOPTaxScam pic.twitter.com/L7PGo0VIuH

Even if it was just a slip of the tongue, Trump's characterization of the GOP tax bill as the "biggest tax increase" in American history is accurate, according to some analysts.

As The Intercept's Ryan Grim noted in an analysis earlier this month, the GOP tax bill is "routinely referred to as a $1.5 trillion tax cut. And, in some ways, that's true: On net, it would reduce the amount of taxes collected by the Treasury by about $1.5 trillion over 10 years."

However, "that figure masks the eye-popping scale and audacity of the GOP's rushed restructuring of the economy," Grim adds. "[The bill,] properly described, is two things: the largest tax cut--and also the biggest tax increase--in American history."

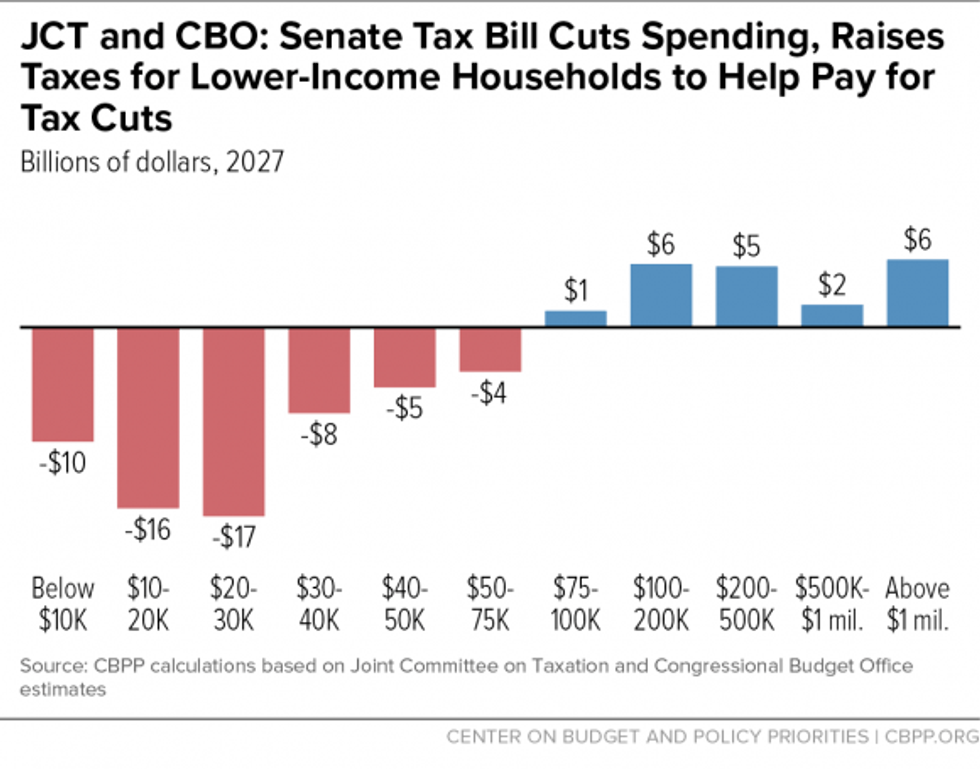

This tax increase, as research by the Center on Budget and Policy Priorities (CBPP) has found, would primarily be shouldered by low-income and middle class Americans. Additionally, while the GOP bill would give corporations permanent tax cuts, many of the cuts for middle class and low-income Americans would expire after a decade.

As Common Dreams reported on Wednesday, House and Senate Republicans reached a backroom "deal" that tilts the benefits of their bill even further toward the wealthiest Americans by reducing the top marginal tax rate from from 39.6 percent to 37 percent.

"Overall, in 2027--when only the corporate tax cuts, slower inflation measure, and individual mandate repeal would remain in place--the Senate bill would, on average, raise taxes or reduce federal expenditures for households with incomes below $75,000 by about $60 billion--while still giving large tax reductions (through its corporate tax cuts) to those at the top," noted CBPP's Chuck Marr.