SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

According to the report, Fast Food CEOs Rake in Taxpayer-Subsidized Pay, published by the Institute for Policy Studies, current tax code allows corporations such as Taco Bell, KFC, Pizza Hut, and McDonald's "to deduct unlimited amounts from their income taxes for the cost of stock options, certain stock grants, and other forms of so-called 'performance pay' for top executives," meaning that the more corporations pay their top earners, the less they pay in federal taxes.

As IPS reports, over the past two years, CEOs of the top six publicly held fast food chains brought home over $183 million in deductible "performance pay," which in turn reduced their companies' taxes by an estimated $64 million.

As Sarah Anderson from IPS points out in an op-ed Monday, $64 million is enough to cover the average cost of food stamps for 40,000 American families for a year.

Fast food profits, in this way, come at the taxpayer's expense from two sides: while CEOs' paychecks expand and corporations pay less in taxes, those companies have simultaneously worked "to keep low-level workers' wages so low that many must rely on public assistance."

As another report from UC Berkeley recently showed, low-wage fast-food jobs currently cost the American public nearly $7 billion a year, as 52% of fast food workers, including those who work full-time, are payed so little they must rely on safety net programs including Medicaid, the Supplemental Nutrition Assistance Program, also known as food stamps, Temporary Assistance for Needy Families, the Children's Health Insurance Program, as well as Earned Income Tax Credit payments.

"What makes all this even more galling is that these fast food giants are pocketing massive taxpayer subsidies for their CEO pay while fighting to keep their workers' wages at rock bottom," writes Anderson.

"All of the big fast food corporations are members of the National Restaurant Association," Anderson writes, "which is aggressively working to block a raise in the federal minimum wage to a level that would let millions of fast food workers make ends meet without public support."

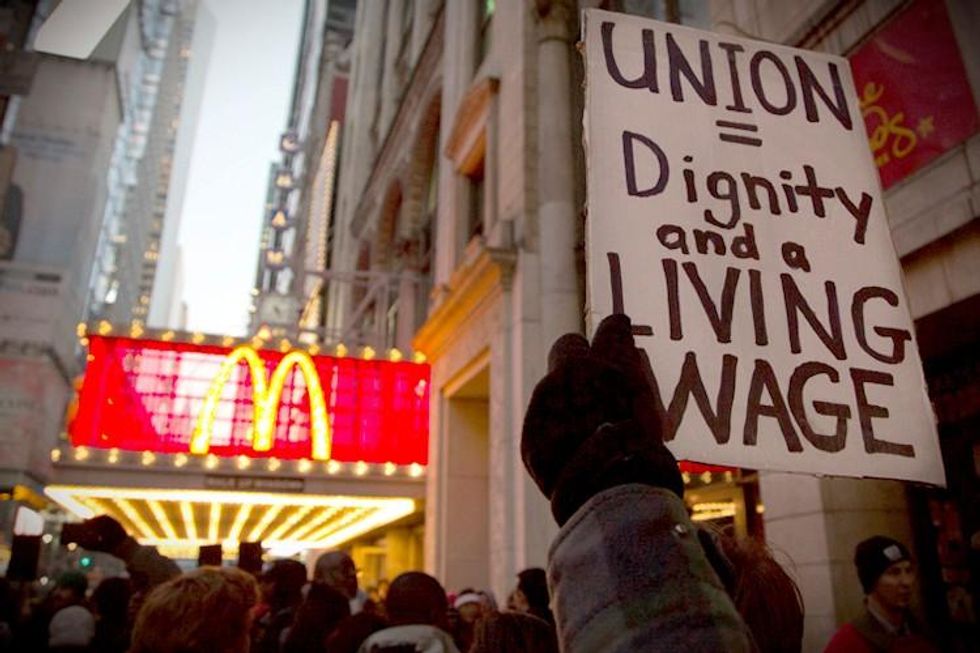

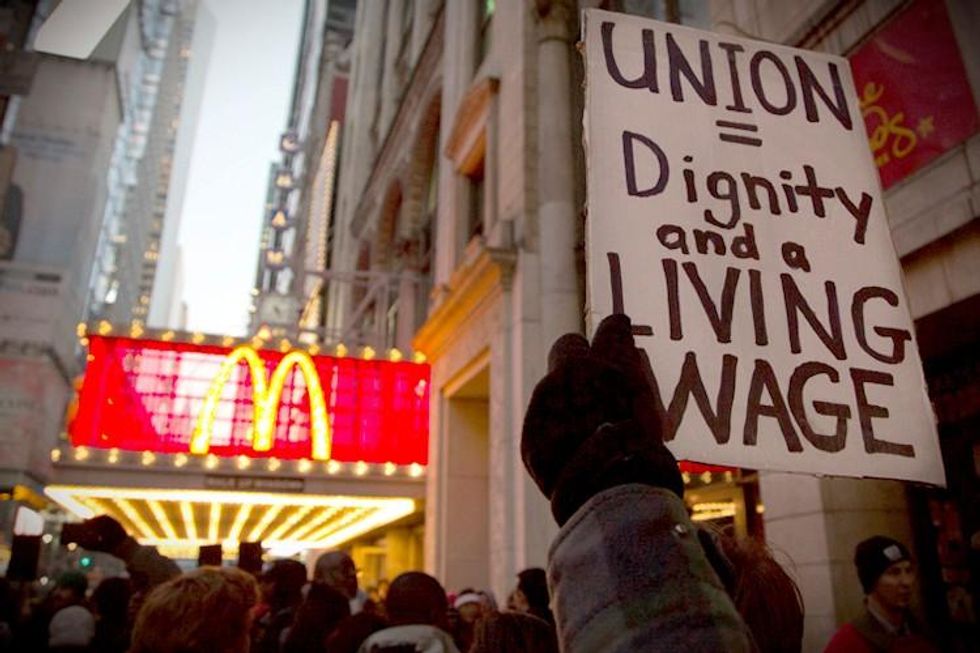

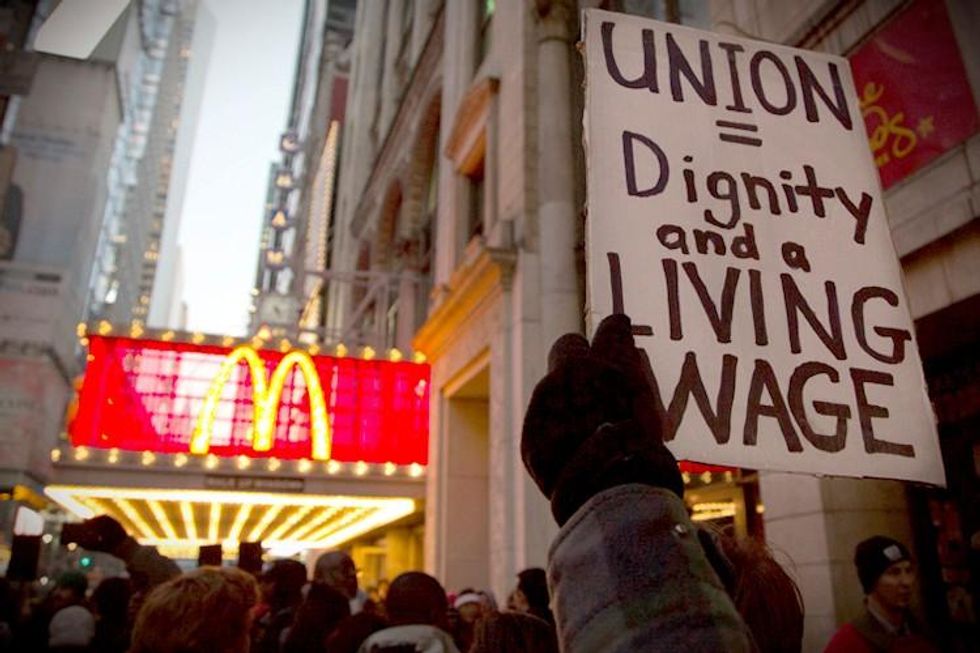

Meanwhile, across the country workers are fed up with low wages and have embarked on a series of local and national strikes against their fast food employers over the course of the past year.

On Thursday, fast food workers organized by groups Fast Food Forward and Fight for 15, with backing from unions such as the Service Employees International Union, will strike in one hundred cities across the U.S. at McDonald's, Wendy's and other fast-food restaurant locations, demanding a $15-an-hour wage.

_______________________

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Jacob Chamberlain is a former staff writer for Common Dreams. He is the author of Migrant Justice in the Age of Removal. His website is www.jacobpchamberlain.com.

According to the report, Fast Food CEOs Rake in Taxpayer-Subsidized Pay, published by the Institute for Policy Studies, current tax code allows corporations such as Taco Bell, KFC, Pizza Hut, and McDonald's "to deduct unlimited amounts from their income taxes for the cost of stock options, certain stock grants, and other forms of so-called 'performance pay' for top executives," meaning that the more corporations pay their top earners, the less they pay in federal taxes.

As IPS reports, over the past two years, CEOs of the top six publicly held fast food chains brought home over $183 million in deductible "performance pay," which in turn reduced their companies' taxes by an estimated $64 million.

As Sarah Anderson from IPS points out in an op-ed Monday, $64 million is enough to cover the average cost of food stamps for 40,000 American families for a year.

Fast food profits, in this way, come at the taxpayer's expense from two sides: while CEOs' paychecks expand and corporations pay less in taxes, those companies have simultaneously worked "to keep low-level workers' wages so low that many must rely on public assistance."

As another report from UC Berkeley recently showed, low-wage fast-food jobs currently cost the American public nearly $7 billion a year, as 52% of fast food workers, including those who work full-time, are payed so little they must rely on safety net programs including Medicaid, the Supplemental Nutrition Assistance Program, also known as food stamps, Temporary Assistance for Needy Families, the Children's Health Insurance Program, as well as Earned Income Tax Credit payments.

"What makes all this even more galling is that these fast food giants are pocketing massive taxpayer subsidies for their CEO pay while fighting to keep their workers' wages at rock bottom," writes Anderson.

"All of the big fast food corporations are members of the National Restaurant Association," Anderson writes, "which is aggressively working to block a raise in the federal minimum wage to a level that would let millions of fast food workers make ends meet without public support."

Meanwhile, across the country workers are fed up with low wages and have embarked on a series of local and national strikes against their fast food employers over the course of the past year.

On Thursday, fast food workers organized by groups Fast Food Forward and Fight for 15, with backing from unions such as the Service Employees International Union, will strike in one hundred cities across the U.S. at McDonald's, Wendy's and other fast-food restaurant locations, demanding a $15-an-hour wage.

_______________________

Jacob Chamberlain is a former staff writer for Common Dreams. He is the author of Migrant Justice in the Age of Removal. His website is www.jacobpchamberlain.com.

According to the report, Fast Food CEOs Rake in Taxpayer-Subsidized Pay, published by the Institute for Policy Studies, current tax code allows corporations such as Taco Bell, KFC, Pizza Hut, and McDonald's "to deduct unlimited amounts from their income taxes for the cost of stock options, certain stock grants, and other forms of so-called 'performance pay' for top executives," meaning that the more corporations pay their top earners, the less they pay in federal taxes.

As IPS reports, over the past two years, CEOs of the top six publicly held fast food chains brought home over $183 million in deductible "performance pay," which in turn reduced their companies' taxes by an estimated $64 million.

As Sarah Anderson from IPS points out in an op-ed Monday, $64 million is enough to cover the average cost of food stamps for 40,000 American families for a year.

Fast food profits, in this way, come at the taxpayer's expense from two sides: while CEOs' paychecks expand and corporations pay less in taxes, those companies have simultaneously worked "to keep low-level workers' wages so low that many must rely on public assistance."

As another report from UC Berkeley recently showed, low-wage fast-food jobs currently cost the American public nearly $7 billion a year, as 52% of fast food workers, including those who work full-time, are payed so little they must rely on safety net programs including Medicaid, the Supplemental Nutrition Assistance Program, also known as food stamps, Temporary Assistance for Needy Families, the Children's Health Insurance Program, as well as Earned Income Tax Credit payments.

"What makes all this even more galling is that these fast food giants are pocketing massive taxpayer subsidies for their CEO pay while fighting to keep their workers' wages at rock bottom," writes Anderson.

"All of the big fast food corporations are members of the National Restaurant Association," Anderson writes, "which is aggressively working to block a raise in the federal minimum wage to a level that would let millions of fast food workers make ends meet without public support."

Meanwhile, across the country workers are fed up with low wages and have embarked on a series of local and national strikes against their fast food employers over the course of the past year.

On Thursday, fast food workers organized by groups Fast Food Forward and Fight for 15, with backing from unions such as the Service Employees International Union, will strike in one hundred cities across the U.S. at McDonald's, Wendy's and other fast-food restaurant locations, demanding a $15-an-hour wage.

_______________________