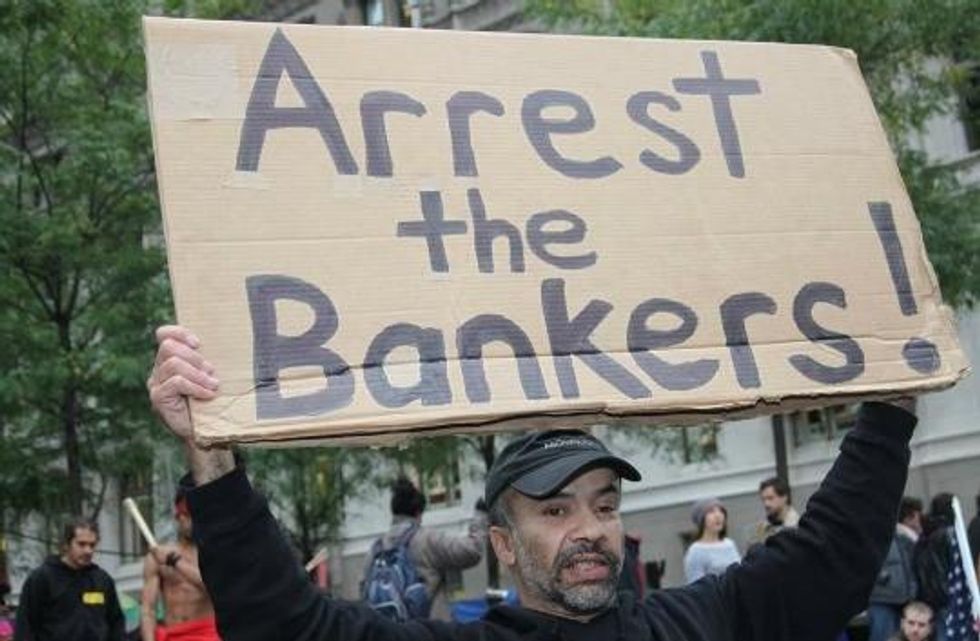

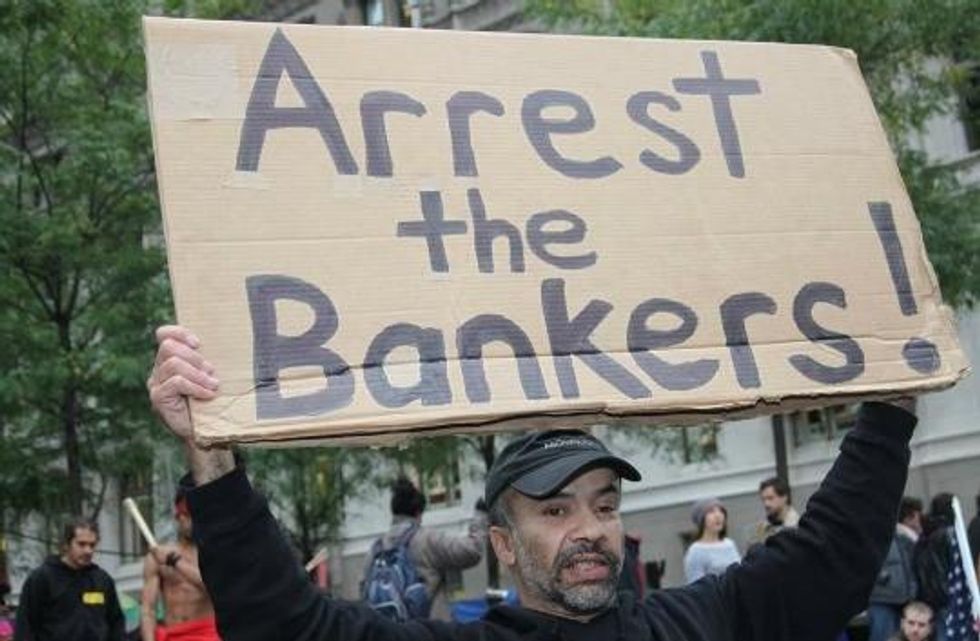

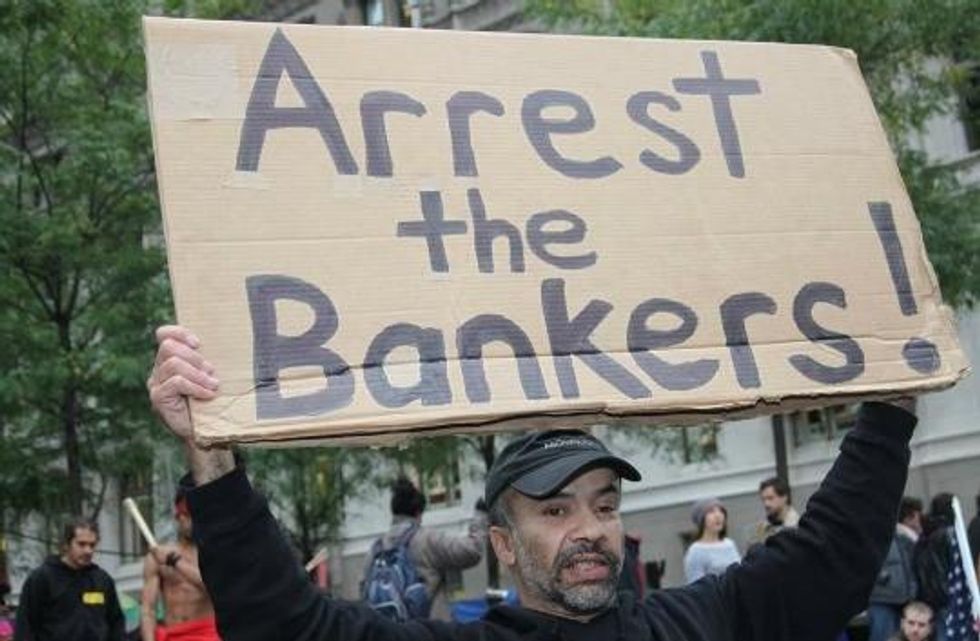

As 'Statute of Limitations' Approaches, Wall Street Crimes of 2008 Go Unpunished

With time running out, federal agencies show no urgency in holding firms or executives to account

Federal laws require the SEC to file official charges within five years of the alleged crimes due to a statute of limitations. Officials at SEC, according to the Wall Street Journal, are now scrambling to file lawsuits before the five-year time limit runs out.

In one example, experts believe that the SEC should file a civil lawsuit against bankers involved in the high profile 'Delphinus deal' no later than next Thursday. Delphinus, a $1.6 billion deal, was a subprime mortgage scam which collapsed within months during 2007 and was a major player in the widespread financial collapse.

A criminal investigation into that deal began months ago; however, prosecutors have yet to file charges.

The failure of the SEC to file charges and allow these crimes to go unchallenged "feeds the public sense of cynicism," Arthur Wilmarth, a law professor at George Washington University and consultant to the Financial Crisis Inquiry Commission, told the Journal.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Federal laws require the SEC to file official charges within five years of the alleged crimes due to a statute of limitations. Officials at SEC, according to the Wall Street Journal, are now scrambling to file lawsuits before the five-year time limit runs out.

In one example, experts believe that the SEC should file a civil lawsuit against bankers involved in the high profile 'Delphinus deal' no later than next Thursday. Delphinus, a $1.6 billion deal, was a subprime mortgage scam which collapsed within months during 2007 and was a major player in the widespread financial collapse.

A criminal investigation into that deal began months ago; however, prosecutors have yet to file charges.

The failure of the SEC to file charges and allow these crimes to go unchallenged "feeds the public sense of cynicism," Arthur Wilmarth, a law professor at George Washington University and consultant to the Financial Crisis Inquiry Commission, told the Journal.

Federal laws require the SEC to file official charges within five years of the alleged crimes due to a statute of limitations. Officials at SEC, according to the Wall Street Journal, are now scrambling to file lawsuits before the five-year time limit runs out.

In one example, experts believe that the SEC should file a civil lawsuit against bankers involved in the high profile 'Delphinus deal' no later than next Thursday. Delphinus, a $1.6 billion deal, was a subprime mortgage scam which collapsed within months during 2007 and was a major player in the widespread financial collapse.

A criminal investigation into that deal began months ago; however, prosecutors have yet to file charges.

The failure of the SEC to file charges and allow these crimes to go unchallenged "feeds the public sense of cynicism," Arthur Wilmarth, a law professor at George Washington University and consultant to the Financial Crisis Inquiry Commission, told the Journal.