SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Countrywide Financial Corp sold 'VIP' loans to members of congress in exchange for influence in Washington according to a report released on Thursday by the U.S. House and Government Oversight Committee, Associated Press reports.

In an ongoing bid to kill any legislation that could hurt the company's profits, Countrywide granted hundreds of loans between 1991 and 2008 through the VIP program, which included reduced interest rates and discounted fees, to lawmakers, their staff, top government officials and executives of government-controlled mortgage company Fannie Mae, according to the committee's report.

"The VIP loan program was a tool used by Countrywide to build goodwill with lawmakers and other individuals positioned to benefit the company," the report states.

The central findings in the report were also revealed by news reports directly after the crash, but the three-year committee investigation now shows the vast extent of the VIP program, nicknamed "Friends of Angelo" for the company's chief executive Angelo Mozilo, how it came into existence and how it eventually became one of the biggest scandals of the recession, reports Talking Points Memo.

Countrywide, acquired by Bank of America Corp in 2008, was a major player in the mortgage business during the housing boom leading up to the mortgage crisis, Reuters reports. The company and its chief executive, Angelo Mozilo, were well known for the risky lending practices which lead to the housing market crash.

The report, obtained by the Associated Press, shows how the discounts were not only aimed at gaining influence for Countrywide but also were used to help other mortgage giants.

"In the years that led up to the 2007 housing market decline, Countrywide VIPs were positioned to affect dozens of pieces of legislation that would have reformed Fannie" and its rival Freddie Mac, the committee said.

* * *

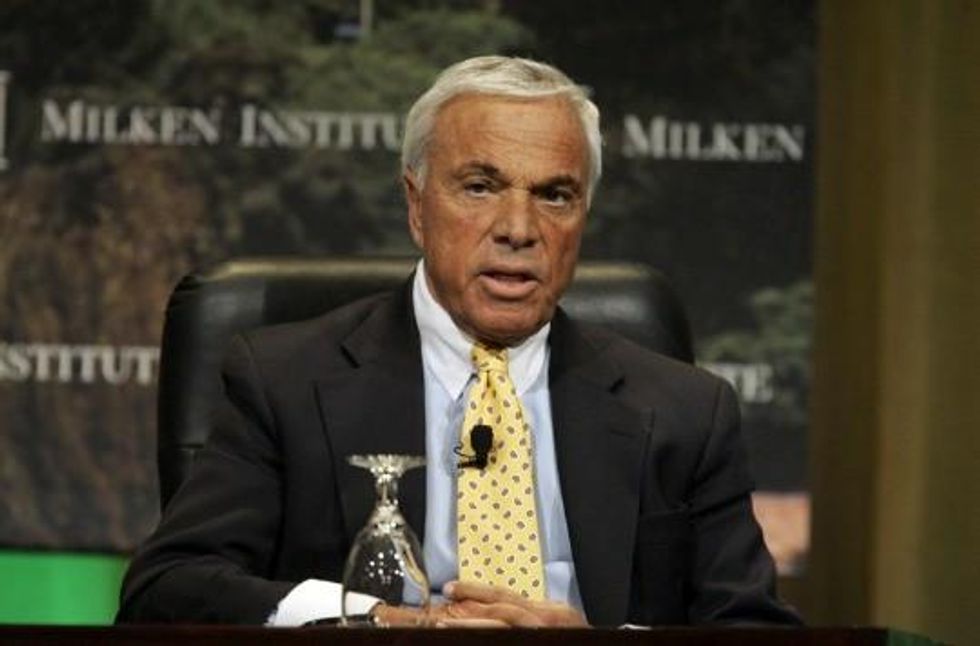

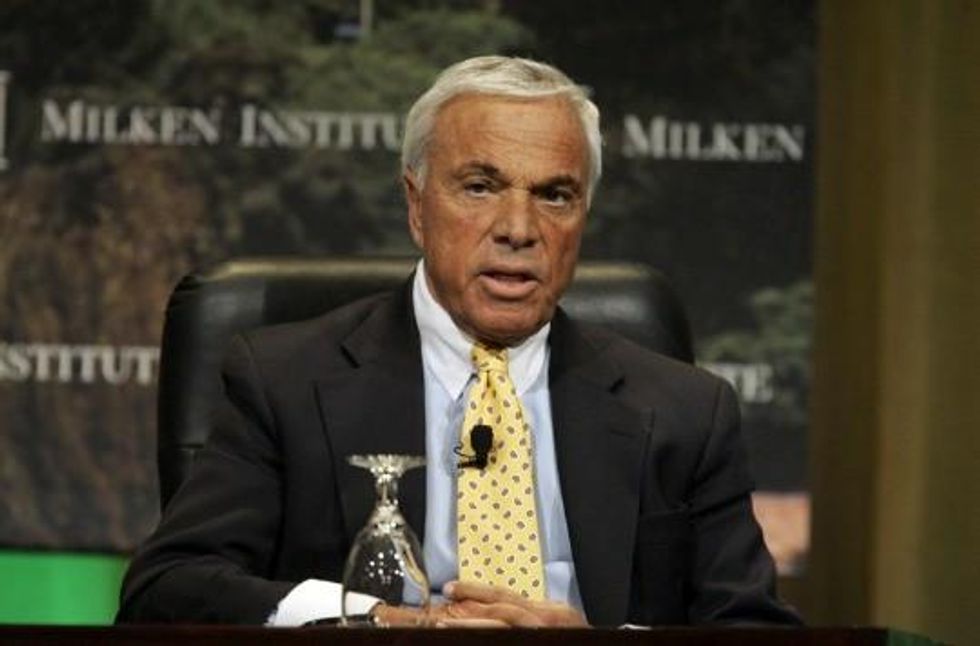

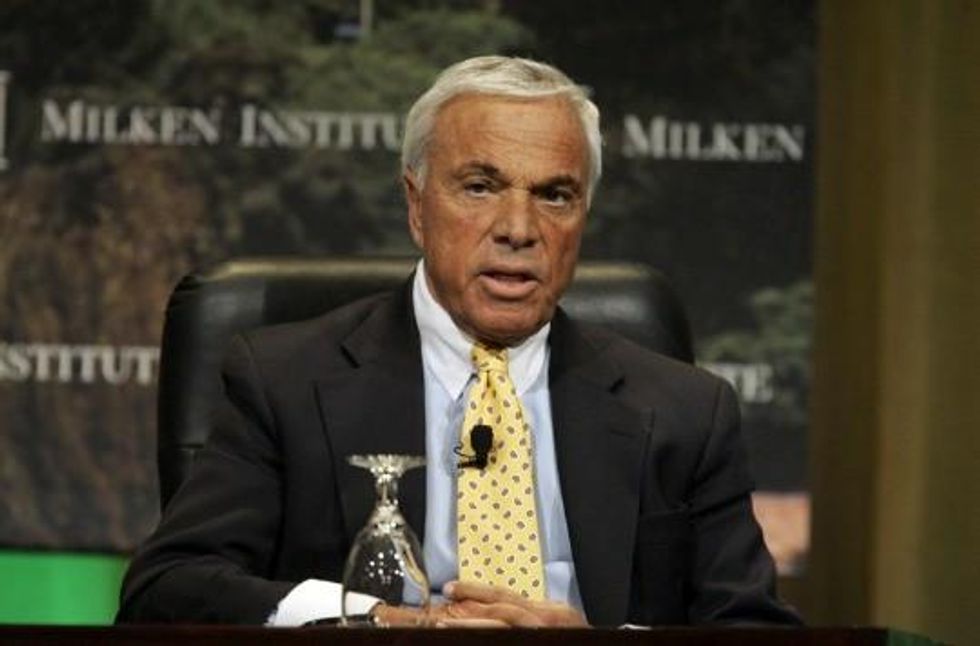

Countrywide's chief executive Angelo Mozilo (Photo: AP)

# # #

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Countrywide Financial Corp sold 'VIP' loans to members of congress in exchange for influence in Washington according to a report released on Thursday by the U.S. House and Government Oversight Committee, Associated Press reports.

In an ongoing bid to kill any legislation that could hurt the company's profits, Countrywide granted hundreds of loans between 1991 and 2008 through the VIP program, which included reduced interest rates and discounted fees, to lawmakers, their staff, top government officials and executives of government-controlled mortgage company Fannie Mae, according to the committee's report.

"The VIP loan program was a tool used by Countrywide to build goodwill with lawmakers and other individuals positioned to benefit the company," the report states.

The central findings in the report were also revealed by news reports directly after the crash, but the three-year committee investigation now shows the vast extent of the VIP program, nicknamed "Friends of Angelo" for the company's chief executive Angelo Mozilo, how it came into existence and how it eventually became one of the biggest scandals of the recession, reports Talking Points Memo.

Countrywide, acquired by Bank of America Corp in 2008, was a major player in the mortgage business during the housing boom leading up to the mortgage crisis, Reuters reports. The company and its chief executive, Angelo Mozilo, were well known for the risky lending practices which lead to the housing market crash.

The report, obtained by the Associated Press, shows how the discounts were not only aimed at gaining influence for Countrywide but also were used to help other mortgage giants.

"In the years that led up to the 2007 housing market decline, Countrywide VIPs were positioned to affect dozens of pieces of legislation that would have reformed Fannie" and its rival Freddie Mac, the committee said.

* * *

Countrywide's chief executive Angelo Mozilo (Photo: AP)

# # #

Countrywide Financial Corp sold 'VIP' loans to members of congress in exchange for influence in Washington according to a report released on Thursday by the U.S. House and Government Oversight Committee, Associated Press reports.

In an ongoing bid to kill any legislation that could hurt the company's profits, Countrywide granted hundreds of loans between 1991 and 2008 through the VIP program, which included reduced interest rates and discounted fees, to lawmakers, their staff, top government officials and executives of government-controlled mortgage company Fannie Mae, according to the committee's report.

"The VIP loan program was a tool used by Countrywide to build goodwill with lawmakers and other individuals positioned to benefit the company," the report states.

The central findings in the report were also revealed by news reports directly after the crash, but the three-year committee investigation now shows the vast extent of the VIP program, nicknamed "Friends of Angelo" for the company's chief executive Angelo Mozilo, how it came into existence and how it eventually became one of the biggest scandals of the recession, reports Talking Points Memo.

Countrywide, acquired by Bank of America Corp in 2008, was a major player in the mortgage business during the housing boom leading up to the mortgage crisis, Reuters reports. The company and its chief executive, Angelo Mozilo, were well known for the risky lending practices which lead to the housing market crash.

The report, obtained by the Associated Press, shows how the discounts were not only aimed at gaining influence for Countrywide but also were used to help other mortgage giants.

"In the years that led up to the 2007 housing market decline, Countrywide VIPs were positioned to affect dozens of pieces of legislation that would have reformed Fannie" and its rival Freddie Mac, the committee said.

* * *

Countrywide's chief executive Angelo Mozilo (Photo: AP)

# # #