SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

While austerity hits everyday Americans, seemingly scarce tax dollars are being squeezed from their pockets to fund exorbitant CEO pay, according to a report released Thursday from the Institute for Policy Studies (IPS).

According to the thinktank's 19th consecutive Executive Excess report, The CEO Hands in Uncle Sam's Pocket, "Our nation's tax code has become a powerful enabler of bloated CEO pay."

For example, the report states that "26 U.S. corporations last year gave their CEO more than they paid in taxes to Uncle Sam." The CEOs at those corporations received a staggering $20.4 million in average total compensation -- a 23% increase above the previous year.

Among the CEOs detailed in IPS's report are these five who received more in compensation than their corporations paid in federal income tax:

| Name of CEO | Corporation | 2011 CEO Compensation | 2011 Federal Income Tax Bottom Line for Corporation |

| Vikram Pandit | Citigroup | $14.9 million | $144 million refund |

| Miles D. White | Abbott Laboratories | $19.0 million | $586 million refund |

| Randall Stephenson | AT&T | $18.7 million | $420 million refund |

| James McNerney | Boeing | $18.4 million | $605 million refund |

| Robert Benmosche | American International Group | $13.9 million | $208 million refund |

| Aubrey McClendon | Chesapeake Energy | $17.9 million | $13 million payment |

Corporations are also dodging taxes through the use of tax havens such as Cayman Islands and Bermuda through which "corporations can shift around profits, avoid accountability, and reduce tax obligations." The report found 537 tax-haven subsidiaries operating last year from the 26 corporations paying more in CEO compensation than in federal income taxes.

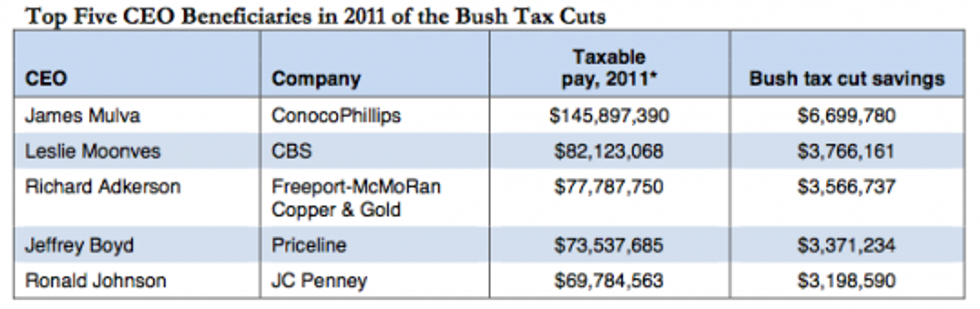

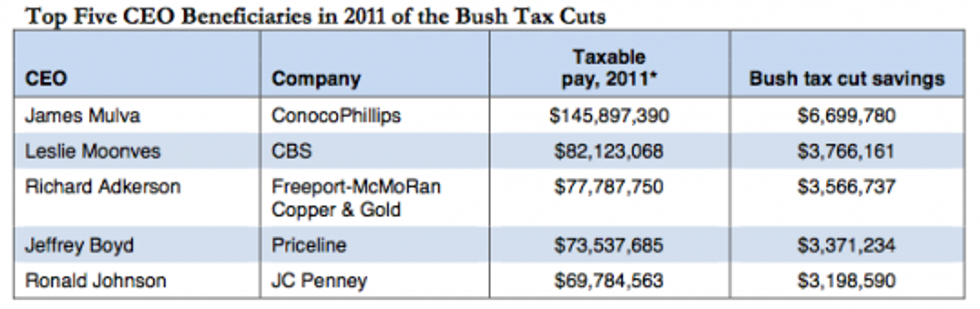

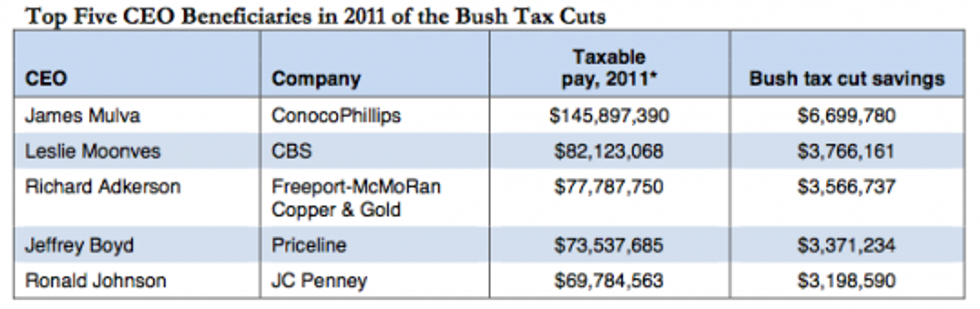

In addition to gaming the system to allow excessive CEO compensation, tax loopholes and the Bush tax cuts are allowing these corporations to save millions. The report states that the Bush tax cuts allowed 57 CEOs to save more than $1 million on their personal income tax bills. And the top five 2011 beneficiaries of the loophole that allows no limit on how much "performance-based" compensation corporations can deduct from their taxes "had a combined $232 million in deductible 'performance-based' pay. Absent this loophole, the tax bills for these companies would have jumped $81 million, or an average of more than $16 million per CEO." With the loophole, however, corporations are essentially incentivized to give CEOs high "performance-based" pay.

The chart from the report lists some of the CEOs making millions from the Bush tax cuts:

The four most direct tax subsidies for excessive executive pay is costing taxpayers $14.4 billion per year, the report states -- an amount that could be used to reinvigorate the public sector by providing services such as health care for 7,370,673 low-income children for one year, or VA medical care for 1,843,510 veterans for one year or 241,593 clean-energy jobs for one year.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

While austerity hits everyday Americans, seemingly scarce tax dollars are being squeezed from their pockets to fund exorbitant CEO pay, according to a report released Thursday from the Institute for Policy Studies (IPS).

According to the thinktank's 19th consecutive Executive Excess report, The CEO Hands in Uncle Sam's Pocket, "Our nation's tax code has become a powerful enabler of bloated CEO pay."

For example, the report states that "26 U.S. corporations last year gave their CEO more than they paid in taxes to Uncle Sam." The CEOs at those corporations received a staggering $20.4 million in average total compensation -- a 23% increase above the previous year.

Among the CEOs detailed in IPS's report are these five who received more in compensation than their corporations paid in federal income tax:

| Name of CEO | Corporation | 2011 CEO Compensation | 2011 Federal Income Tax Bottom Line for Corporation |

| Vikram Pandit | Citigroup | $14.9 million | $144 million refund |

| Miles D. White | Abbott Laboratories | $19.0 million | $586 million refund |

| Randall Stephenson | AT&T | $18.7 million | $420 million refund |

| James McNerney | Boeing | $18.4 million | $605 million refund |

| Robert Benmosche | American International Group | $13.9 million | $208 million refund |

| Aubrey McClendon | Chesapeake Energy | $17.9 million | $13 million payment |

Corporations are also dodging taxes through the use of tax havens such as Cayman Islands and Bermuda through which "corporations can shift around profits, avoid accountability, and reduce tax obligations." The report found 537 tax-haven subsidiaries operating last year from the 26 corporations paying more in CEO compensation than in federal income taxes.

In addition to gaming the system to allow excessive CEO compensation, tax loopholes and the Bush tax cuts are allowing these corporations to save millions. The report states that the Bush tax cuts allowed 57 CEOs to save more than $1 million on their personal income tax bills. And the top five 2011 beneficiaries of the loophole that allows no limit on how much "performance-based" compensation corporations can deduct from their taxes "had a combined $232 million in deductible 'performance-based' pay. Absent this loophole, the tax bills for these companies would have jumped $81 million, or an average of more than $16 million per CEO." With the loophole, however, corporations are essentially incentivized to give CEOs high "performance-based" pay.

The chart from the report lists some of the CEOs making millions from the Bush tax cuts:

The four most direct tax subsidies for excessive executive pay is costing taxpayers $14.4 billion per year, the report states -- an amount that could be used to reinvigorate the public sector by providing services such as health care for 7,370,673 low-income children for one year, or VA medical care for 1,843,510 veterans for one year or 241,593 clean-energy jobs for one year.

While austerity hits everyday Americans, seemingly scarce tax dollars are being squeezed from their pockets to fund exorbitant CEO pay, according to a report released Thursday from the Institute for Policy Studies (IPS).

According to the thinktank's 19th consecutive Executive Excess report, The CEO Hands in Uncle Sam's Pocket, "Our nation's tax code has become a powerful enabler of bloated CEO pay."

For example, the report states that "26 U.S. corporations last year gave their CEO more than they paid in taxes to Uncle Sam." The CEOs at those corporations received a staggering $20.4 million in average total compensation -- a 23% increase above the previous year.

Among the CEOs detailed in IPS's report are these five who received more in compensation than their corporations paid in federal income tax:

| Name of CEO | Corporation | 2011 CEO Compensation | 2011 Federal Income Tax Bottom Line for Corporation |

| Vikram Pandit | Citigroup | $14.9 million | $144 million refund |

| Miles D. White | Abbott Laboratories | $19.0 million | $586 million refund |

| Randall Stephenson | AT&T | $18.7 million | $420 million refund |

| James McNerney | Boeing | $18.4 million | $605 million refund |

| Robert Benmosche | American International Group | $13.9 million | $208 million refund |

| Aubrey McClendon | Chesapeake Energy | $17.9 million | $13 million payment |

Corporations are also dodging taxes through the use of tax havens such as Cayman Islands and Bermuda through which "corporations can shift around profits, avoid accountability, and reduce tax obligations." The report found 537 tax-haven subsidiaries operating last year from the 26 corporations paying more in CEO compensation than in federal income taxes.

In addition to gaming the system to allow excessive CEO compensation, tax loopholes and the Bush tax cuts are allowing these corporations to save millions. The report states that the Bush tax cuts allowed 57 CEOs to save more than $1 million on their personal income tax bills. And the top five 2011 beneficiaries of the loophole that allows no limit on how much "performance-based" compensation corporations can deduct from their taxes "had a combined $232 million in deductible 'performance-based' pay. Absent this loophole, the tax bills for these companies would have jumped $81 million, or an average of more than $16 million per CEO." With the loophole, however, corporations are essentially incentivized to give CEOs high "performance-based" pay.

The chart from the report lists some of the CEOs making millions from the Bush tax cuts:

The four most direct tax subsidies for excessive executive pay is costing taxpayers $14.4 billion per year, the report states -- an amount that could be used to reinvigorate the public sector by providing services such as health care for 7,370,673 low-income children for one year, or VA medical care for 1,843,510 veterans for one year or 241,593 clean-energy jobs for one year.