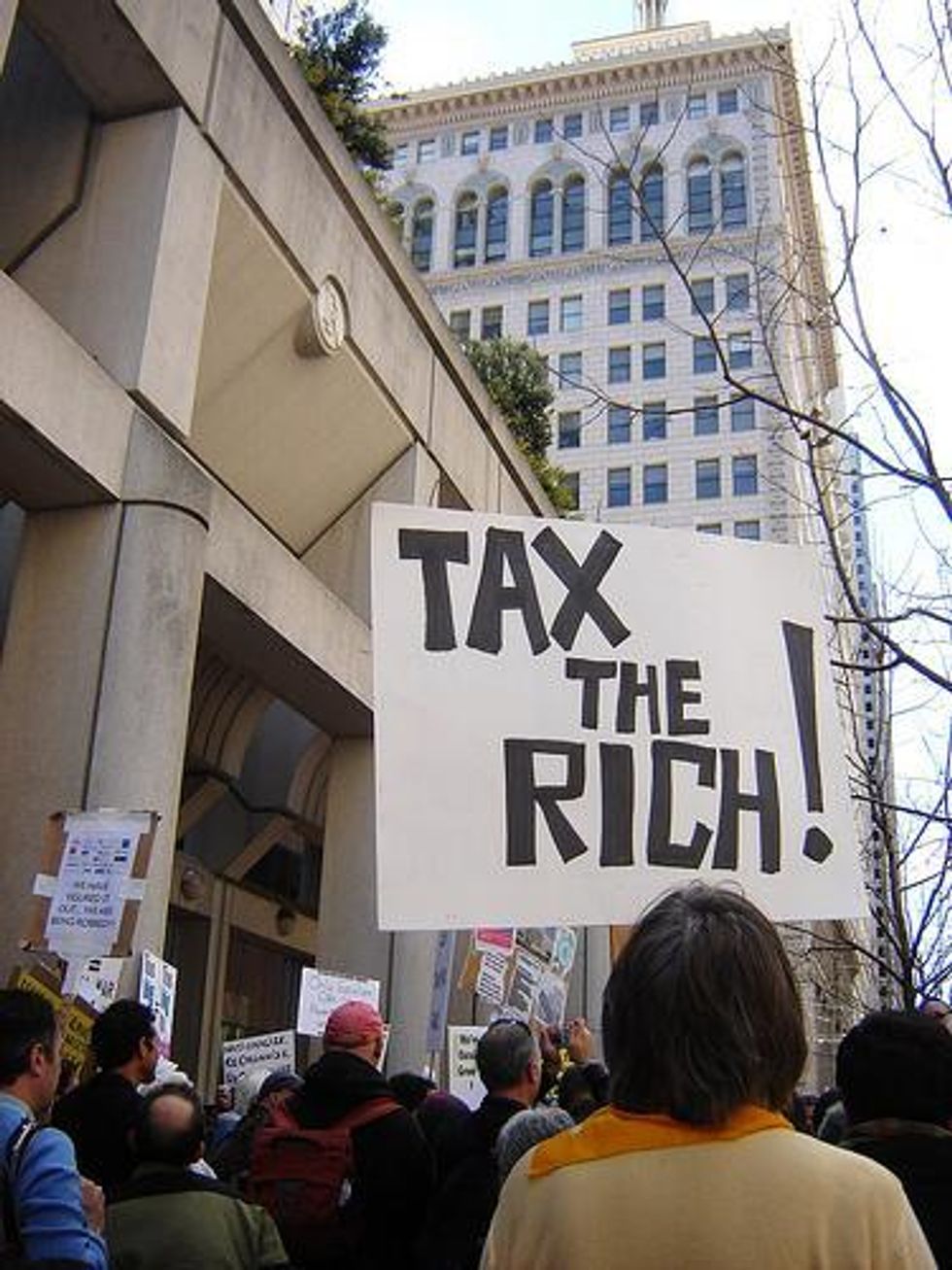

"The latest GOP tax plan is a slimy wet kiss for the wealthiest Americans." (Photo: Yuri Keegstra/Flickr/cc)

What Real Tax Reform Could Look Like

We don't actually have to cut taxes on the rich, slash services for everyone, and blow a hole in the deficit.

No matter our politics, most Americans have a beef with taxes. And it's no wonder.

Working class Americans pay a much greater share of their income than the wealthiest Americans, who get away with exploiting tax loopholes and paying less than their fair share to support public projects and government programs.

Our system is rigged to favor the richest, so tax reform is key to un-rigging the economy. But the latest GOP tax plan is a slimy wet kiss for the wealthiest Americans.

It doesn't even try to propose reforms -- it's literally just a giant giveaway to millionaires, billionaires, and wealthy corporations. The non-partisan Tax Policy Center estimates that 80 percent of the benefits in the new plan will go to the richest 1 percent, while nearly one in three working families would end up paying more.

In order to bankroll this "get-even-richer-even-quicker" scheme, Republicans in Congress are proposing cuts to vital services and programs like Social Security, Medicaid, and Medicare -- while still driving up the deficit by $1.5 trillion or more.

This isn't tax reform -- it's a rip-off scheme.

But what if Congress actually prioritized helping working families get a better deal on taxes?

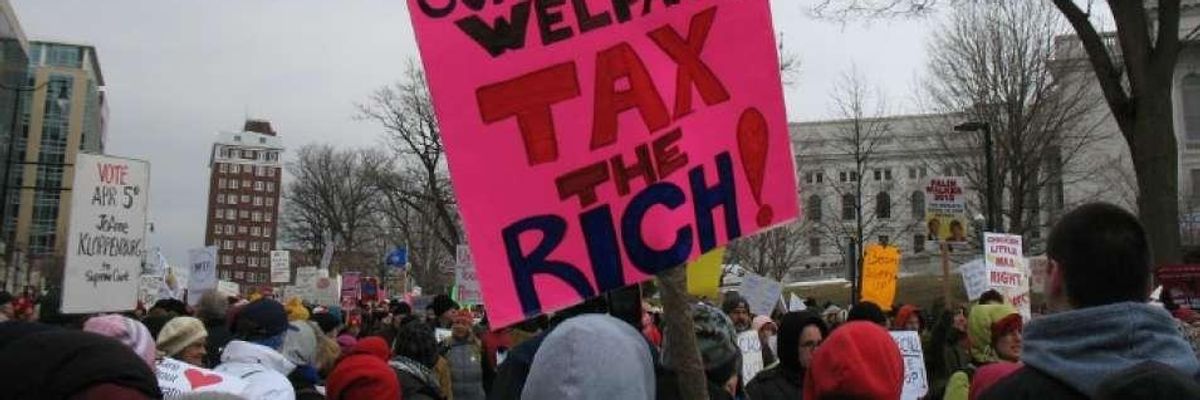

(bright strangely / Flickr)

On October 25,2017, the Congressional Progressive Caucus, the largest ideological caucus in Congress, released their new Progressive Principles for Tax Reform, a bold set of priorities that would put power back into the hands of ordinary taxpayers and working families, and put a stop to endless giveaways to the richest Americans and corporations.

It calls for badly needed fixes to the tax code, including: eliminating tax loopholes and tax shelters for corporations, enacting a tax on Wall Street speculation, abolishing tax incentives and rewards for businesses that offshore jobs, and removing $95 billion in special tax breaks for the top 1 percent.

The document demands that Congress instead prioritize spending that fuels economic opportunity, rewards hard work, and protects low-income families.

For example, it prioritizes the Earned Income Tax Credit, a tax credit for low-income and working class individuals and couples, particularly those with children.

It also advocates expanding other tax credits that benefit working families, such as the Making Work Pay Tax Credit, the Child and Dependent Care Credit, and the American Opportunity Tax Credit. Each of these uplifts working families, removes barriers to success, and reduces income inequality.

"We cannot afford to extend tax breaks for corporations or the wealthy that cripple our ability to invest in areas that expand economic growth, like infrastructure and education," the document says. "Tax reform must be done in a way that raises significant revenue, protects working families and the vulnerable, and requires corporations and the wealthy to pay a fair share."

Americans across the political spectrum are worried about jobs, wages, and our economy. These progressive tax priorities invest in growing the economy and reducing the deficit. They focus on supporting working families through measures like the Earned Income Tax Credit and the Child Tax Credit.

It's past time for our country to provide opportunities for working families to build a better future for themselves. It's time for the people who can actually afford to pay taxes to pay their fair share. It's time for us to un-rig the tax system so working families don't continue to pay the price for not being wealthy.

The Progressive Caucus's tax priorities are part of a bigger vision to uplift working families and create tools for prosperity.

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

No matter our politics, most Americans have a beef with taxes. And it's no wonder.

Working class Americans pay a much greater share of their income than the wealthiest Americans, who get away with exploiting tax loopholes and paying less than their fair share to support public projects and government programs.

Our system is rigged to favor the richest, so tax reform is key to un-rigging the economy. But the latest GOP tax plan is a slimy wet kiss for the wealthiest Americans.

It doesn't even try to propose reforms -- it's literally just a giant giveaway to millionaires, billionaires, and wealthy corporations. The non-partisan Tax Policy Center estimates that 80 percent of the benefits in the new plan will go to the richest 1 percent, while nearly one in three working families would end up paying more.

In order to bankroll this "get-even-richer-even-quicker" scheme, Republicans in Congress are proposing cuts to vital services and programs like Social Security, Medicaid, and Medicare -- while still driving up the deficit by $1.5 trillion or more.

This isn't tax reform -- it's a rip-off scheme.

But what if Congress actually prioritized helping working families get a better deal on taxes?

(bright strangely / Flickr)

On October 25,2017, the Congressional Progressive Caucus, the largest ideological caucus in Congress, released their new Progressive Principles for Tax Reform, a bold set of priorities that would put power back into the hands of ordinary taxpayers and working families, and put a stop to endless giveaways to the richest Americans and corporations.

It calls for badly needed fixes to the tax code, including: eliminating tax loopholes and tax shelters for corporations, enacting a tax on Wall Street speculation, abolishing tax incentives and rewards for businesses that offshore jobs, and removing $95 billion in special tax breaks for the top 1 percent.

The document demands that Congress instead prioritize spending that fuels economic opportunity, rewards hard work, and protects low-income families.

For example, it prioritizes the Earned Income Tax Credit, a tax credit for low-income and working class individuals and couples, particularly those with children.

It also advocates expanding other tax credits that benefit working families, such as the Making Work Pay Tax Credit, the Child and Dependent Care Credit, and the American Opportunity Tax Credit. Each of these uplifts working families, removes barriers to success, and reduces income inequality.

"We cannot afford to extend tax breaks for corporations or the wealthy that cripple our ability to invest in areas that expand economic growth, like infrastructure and education," the document says. "Tax reform must be done in a way that raises significant revenue, protects working families and the vulnerable, and requires corporations and the wealthy to pay a fair share."

Americans across the political spectrum are worried about jobs, wages, and our economy. These progressive tax priorities invest in growing the economy and reducing the deficit. They focus on supporting working families through measures like the Earned Income Tax Credit and the Child Tax Credit.

It's past time for our country to provide opportunities for working families to build a better future for themselves. It's time for the people who can actually afford to pay taxes to pay their fair share. It's time for us to un-rig the tax system so working families don't continue to pay the price for not being wealthy.

The Progressive Caucus's tax priorities are part of a bigger vision to uplift working families and create tools for prosperity.

No matter our politics, most Americans have a beef with taxes. And it's no wonder.

Working class Americans pay a much greater share of their income than the wealthiest Americans, who get away with exploiting tax loopholes and paying less than their fair share to support public projects and government programs.

Our system is rigged to favor the richest, so tax reform is key to un-rigging the economy. But the latest GOP tax plan is a slimy wet kiss for the wealthiest Americans.

It doesn't even try to propose reforms -- it's literally just a giant giveaway to millionaires, billionaires, and wealthy corporations. The non-partisan Tax Policy Center estimates that 80 percent of the benefits in the new plan will go to the richest 1 percent, while nearly one in three working families would end up paying more.

In order to bankroll this "get-even-richer-even-quicker" scheme, Republicans in Congress are proposing cuts to vital services and programs like Social Security, Medicaid, and Medicare -- while still driving up the deficit by $1.5 trillion or more.

This isn't tax reform -- it's a rip-off scheme.

But what if Congress actually prioritized helping working families get a better deal on taxes?

(bright strangely / Flickr)

On October 25,2017, the Congressional Progressive Caucus, the largest ideological caucus in Congress, released their new Progressive Principles for Tax Reform, a bold set of priorities that would put power back into the hands of ordinary taxpayers and working families, and put a stop to endless giveaways to the richest Americans and corporations.

It calls for badly needed fixes to the tax code, including: eliminating tax loopholes and tax shelters for corporations, enacting a tax on Wall Street speculation, abolishing tax incentives and rewards for businesses that offshore jobs, and removing $95 billion in special tax breaks for the top 1 percent.

The document demands that Congress instead prioritize spending that fuels economic opportunity, rewards hard work, and protects low-income families.

For example, it prioritizes the Earned Income Tax Credit, a tax credit for low-income and working class individuals and couples, particularly those with children.

It also advocates expanding other tax credits that benefit working families, such as the Making Work Pay Tax Credit, the Child and Dependent Care Credit, and the American Opportunity Tax Credit. Each of these uplifts working families, removes barriers to success, and reduces income inequality.

"We cannot afford to extend tax breaks for corporations or the wealthy that cripple our ability to invest in areas that expand economic growth, like infrastructure and education," the document says. "Tax reform must be done in a way that raises significant revenue, protects working families and the vulnerable, and requires corporations and the wealthy to pay a fair share."

Americans across the political spectrum are worried about jobs, wages, and our economy. These progressive tax priorities invest in growing the economy and reducing the deficit. They focus on supporting working families through measures like the Earned Income Tax Credit and the Child Tax Credit.

It's past time for our country to provide opportunities for working families to build a better future for themselves. It's time for the people who can actually afford to pay taxes to pay their fair share. It's time for us to un-rig the tax system so working families don't continue to pay the price for not being wealthy.

The Progressive Caucus's tax priorities are part of a bigger vision to uplift working families and create tools for prosperity.