SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

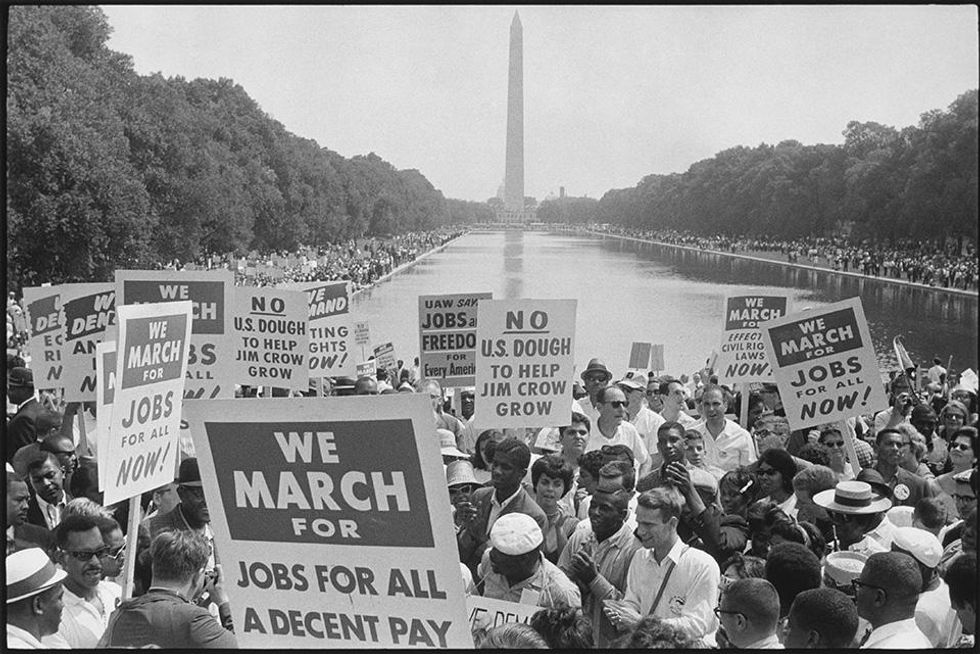

Dr. Martin Luther King and the quarter of a million others who marched with him to our nation's capital turned the tide toward greater equality through persistent organizing and tireless action.

In the decades that have followed, those struggling for justice are not the only ones who have rallied in Washington. CEOs from Wall Street and large corporations have of course been a powerful presence. They don't march to Washington but instead fly in corporate jets. They don't come with millions by their side, but rather with millions in their pockets. And they don't come to demand greater inclusion and opportunity for all, but for more tax breaks for their businesses, to be paid for by cuts to services provided to ordinary families.

One such group is Fix the Debt, a group of powerful CEOs lobbying for permanent tax cuts for the trillions of dollars they've stashed offshore, and for cuts to entitlement programs like Social Security.

Thankfully, these CEOs are not the only ones on the move this August. National People's Action (NPA), a powerful grassroots action group, has been calling attention to four powerful corporations in their Summer of the CEO Campaign. NPA has targeted the leaders of Bank of America, General Electric, Macy's and Verizon - all of whom are members of the Fix the Debt campaign.

These CEOs have nothing to lose by calling for a roll-back of Social Security benefits. They all have multi-million dollar corporate pensions to rely on when they retire. Take General Electric's CEO Jeffrey Immelt, whose $59.3 million GE retirement account could be converted into an annuity that would deliver him a $346,964 monthly retirement check starting at age 65.

Immelt is not alone in putting the gold in the golden years. With nearly $20 million in his corporate retirement plan, Macy's CEO Terry Lundgren will not need to rely on Social Security (or those Macy's discount coupons) when he retires.

Verizon CEO Lowell McAdam won't care about the price increases in his cell phone plan. He's got $9.8 million in his Verizon retirement account. And Bank of America CEO Brian Moynihan has no worries about his mortgage payment, with $8.4 million in his retirement stash.

Washington policymakers have become too focused on the millions of dollars brought by CEOs. They should pay more attention to groups like National People's Action. This year, as the Institute for Policy Studies celebrates our own 50th anniversary, we have named them as one of our "Top 50 Allies." We are proud to work with NPA and other social justice groups who remind us of this nation's proud history of people power overcoming the power of money.

Millions of people acting together can still beat millions of dollars.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

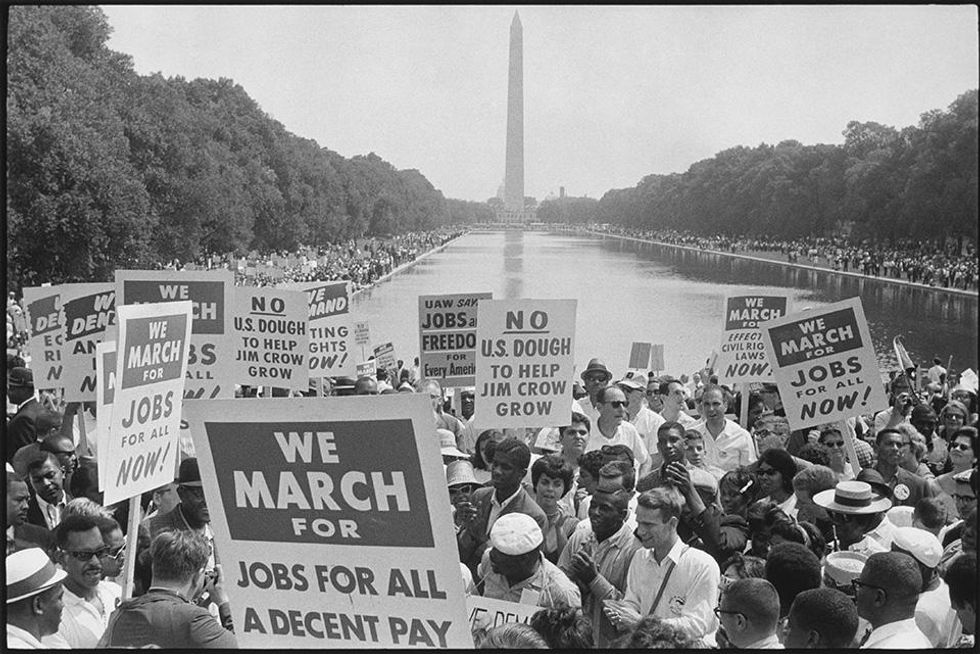

Dr. Martin Luther King and the quarter of a million others who marched with him to our nation's capital turned the tide toward greater equality through persistent organizing and tireless action.

In the decades that have followed, those struggling for justice are not the only ones who have rallied in Washington. CEOs from Wall Street and large corporations have of course been a powerful presence. They don't march to Washington but instead fly in corporate jets. They don't come with millions by their side, but rather with millions in their pockets. And they don't come to demand greater inclusion and opportunity for all, but for more tax breaks for their businesses, to be paid for by cuts to services provided to ordinary families.

One such group is Fix the Debt, a group of powerful CEOs lobbying for permanent tax cuts for the trillions of dollars they've stashed offshore, and for cuts to entitlement programs like Social Security.

Thankfully, these CEOs are not the only ones on the move this August. National People's Action (NPA), a powerful grassroots action group, has been calling attention to four powerful corporations in their Summer of the CEO Campaign. NPA has targeted the leaders of Bank of America, General Electric, Macy's and Verizon - all of whom are members of the Fix the Debt campaign.

These CEOs have nothing to lose by calling for a roll-back of Social Security benefits. They all have multi-million dollar corporate pensions to rely on when they retire. Take General Electric's CEO Jeffrey Immelt, whose $59.3 million GE retirement account could be converted into an annuity that would deliver him a $346,964 monthly retirement check starting at age 65.

Immelt is not alone in putting the gold in the golden years. With nearly $20 million in his corporate retirement plan, Macy's CEO Terry Lundgren will not need to rely on Social Security (or those Macy's discount coupons) when he retires.

Verizon CEO Lowell McAdam won't care about the price increases in his cell phone plan. He's got $9.8 million in his Verizon retirement account. And Bank of America CEO Brian Moynihan has no worries about his mortgage payment, with $8.4 million in his retirement stash.

Washington policymakers have become too focused on the millions of dollars brought by CEOs. They should pay more attention to groups like National People's Action. This year, as the Institute for Policy Studies celebrates our own 50th anniversary, we have named them as one of our "Top 50 Allies." We are proud to work with NPA and other social justice groups who remind us of this nation's proud history of people power overcoming the power of money.

Millions of people acting together can still beat millions of dollars.

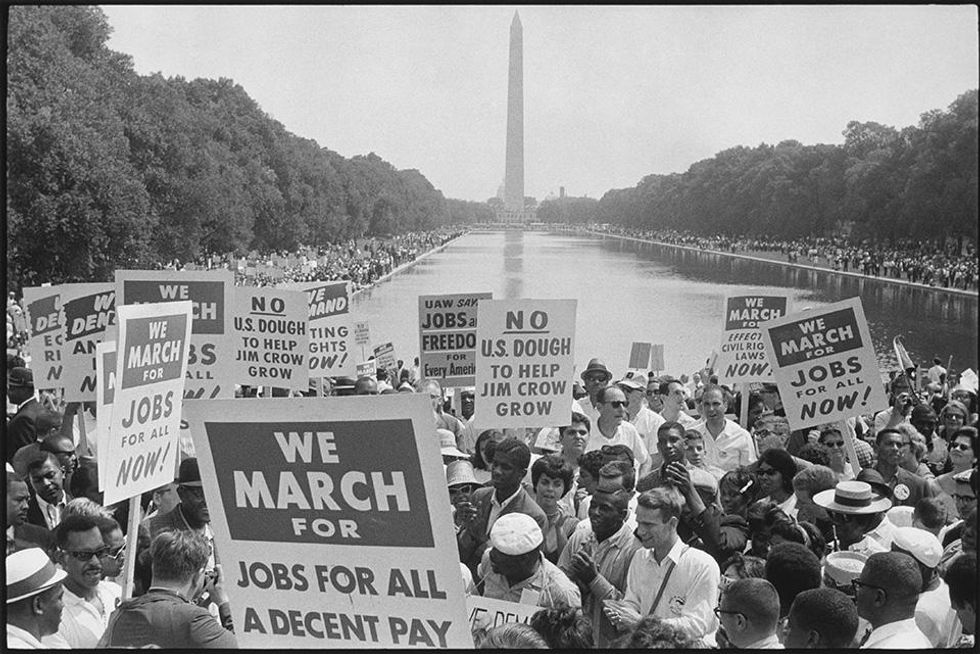

Dr. Martin Luther King and the quarter of a million others who marched with him to our nation's capital turned the tide toward greater equality through persistent organizing and tireless action.

In the decades that have followed, those struggling for justice are not the only ones who have rallied in Washington. CEOs from Wall Street and large corporations have of course been a powerful presence. They don't march to Washington but instead fly in corporate jets. They don't come with millions by their side, but rather with millions in their pockets. And they don't come to demand greater inclusion and opportunity for all, but for more tax breaks for their businesses, to be paid for by cuts to services provided to ordinary families.

One such group is Fix the Debt, a group of powerful CEOs lobbying for permanent tax cuts for the trillions of dollars they've stashed offshore, and for cuts to entitlement programs like Social Security.

Thankfully, these CEOs are not the only ones on the move this August. National People's Action (NPA), a powerful grassroots action group, has been calling attention to four powerful corporations in their Summer of the CEO Campaign. NPA has targeted the leaders of Bank of America, General Electric, Macy's and Verizon - all of whom are members of the Fix the Debt campaign.

These CEOs have nothing to lose by calling for a roll-back of Social Security benefits. They all have multi-million dollar corporate pensions to rely on when they retire. Take General Electric's CEO Jeffrey Immelt, whose $59.3 million GE retirement account could be converted into an annuity that would deliver him a $346,964 monthly retirement check starting at age 65.

Immelt is not alone in putting the gold in the golden years. With nearly $20 million in his corporate retirement plan, Macy's CEO Terry Lundgren will not need to rely on Social Security (or those Macy's discount coupons) when he retires.

Verizon CEO Lowell McAdam won't care about the price increases in his cell phone plan. He's got $9.8 million in his Verizon retirement account. And Bank of America CEO Brian Moynihan has no worries about his mortgage payment, with $8.4 million in his retirement stash.

Washington policymakers have become too focused on the millions of dollars brought by CEOs. They should pay more attention to groups like National People's Action. This year, as the Institute for Policy Studies celebrates our own 50th anniversary, we have named them as one of our "Top 50 Allies." We are proud to work with NPA and other social justice groups who remind us of this nation's proud history of people power overcoming the power of money.

Millions of people acting together can still beat millions of dollars.