SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

It's budget showdown time in Washington. With various tax increases and spending cuts set to kick in at the end of the year, the pressure is on for Republicans and Democrats to make a deal.

A major player in this hot debate is a new corporate coalition called "Fix the Debt." They've recruited more than 80 CEOs of America's most powerful corporations and raised $60 million for a big media and lobbying blitz.

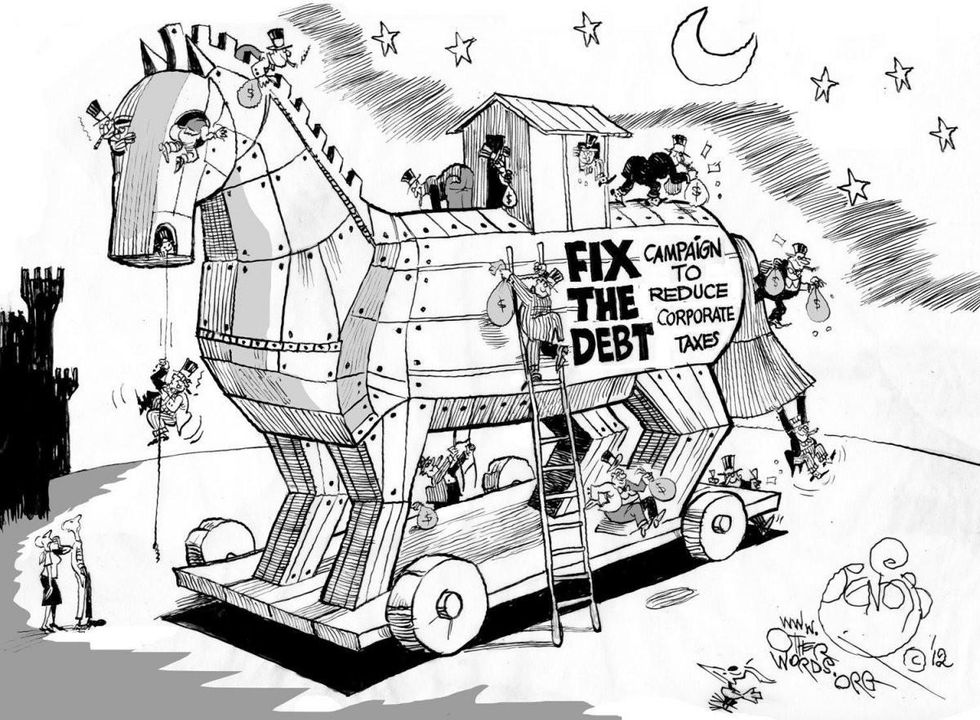

Their ads call for what appears to be a moderate agenda of balancing spending cuts with some tax increases in order to bring down the deficit and ensure a bright future for the United States. But a closer look suggests the Fix the Debt campaign is a Trojan Horse.

Behind their moderate slogans is an extreme agenda focused on further reducing corporate taxes and shifting the burden onto the poor and elderly.

Take a look, for example, at a slideshow presentation the campaign has prepared as a "CEO tool" for wooing supporters. You can check it out right on their web site. It says flat out that the so-called "fiscal cliff" is an opportunity to push for "considerably less" spending on Medicare and Medicaid. It also calls for a shift to a "territorial tax system," which would permanently exempt U.S. corporations' foreign income from U.S. taxes.

At the Institute for Policy Studies, we analyzed how much the Fix the Debt member corporations would have to gain from this particular corporate tax break. The results are staggering.

We focused on the 63 Fix the Debt member companies that are publicly held and therefore must report how much they've amassed in overseas profits. Combined, these firms stand to gain as much as $134 billion in tax windfalls if the territorial system is adopted. That's $134 billion that won't go towards fixing the debt. To put that figure in perspective, it would be enough to cover the salaries of two million elementary school teachers for a year.

One of the biggest potential winners from a territorial tax system is Microsoft, which could reap a savings of $19.4 billion on its $60.8 billion in accumulated foreign earnings.

Why does Microsoft have so much dough stashed overseas? A Senate investigation this year shed light on this question. They found that Microsoft takes the patents for software developed at its U.S. research facilities and registers them in tax haven countries. That way, when a U.S. customer buys a copy of Microsoft Office, a hefty chunk of the profits is recorded in no-tax zones.

Under current rules, Microsoft would have to pay U.S. taxes on such foreign earnings if they bring them back to the United States to invest or pay shareholder dividends. But under Fix the Debt's favored territorial system, they would be permanently exempted.

The Fix the Debt campaign's CEOs are attempting to portray themselves as the reasonable compromisers. Some of them have even offered to give up the Bush-era tax cuts for the rich in exchange for other parts of their agenda. But given the massive windfalls they could get from a shift to a territorial tax system and other corporate tax breaks, this is hardly surprising. If their companies save billions in tax dollars, corporate profits will soar -- and their CEO pay will skyrocket too.

Beware of this Trojan horse. These CEOs may try to conceal their tired old agenda of more corporate tax breaks in a patriotic package. But if they're serious about helping America, they wouldn't be trying to balance the budget on the backs of the most vulnerable.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

It's budget showdown time in Washington. With various tax increases and spending cuts set to kick in at the end of the year, the pressure is on for Republicans and Democrats to make a deal.

A major player in this hot debate is a new corporate coalition called "Fix the Debt." They've recruited more than 80 CEOs of America's most powerful corporations and raised $60 million for a big media and lobbying blitz.

Their ads call for what appears to be a moderate agenda of balancing spending cuts with some tax increases in order to bring down the deficit and ensure a bright future for the United States. But a closer look suggests the Fix the Debt campaign is a Trojan Horse.

Behind their moderate slogans is an extreme agenda focused on further reducing corporate taxes and shifting the burden onto the poor and elderly.

Take a look, for example, at a slideshow presentation the campaign has prepared as a "CEO tool" for wooing supporters. You can check it out right on their web site. It says flat out that the so-called "fiscal cliff" is an opportunity to push for "considerably less" spending on Medicare and Medicaid. It also calls for a shift to a "territorial tax system," which would permanently exempt U.S. corporations' foreign income from U.S. taxes.

At the Institute for Policy Studies, we analyzed how much the Fix the Debt member corporations would have to gain from this particular corporate tax break. The results are staggering.

We focused on the 63 Fix the Debt member companies that are publicly held and therefore must report how much they've amassed in overseas profits. Combined, these firms stand to gain as much as $134 billion in tax windfalls if the territorial system is adopted. That's $134 billion that won't go towards fixing the debt. To put that figure in perspective, it would be enough to cover the salaries of two million elementary school teachers for a year.

One of the biggest potential winners from a territorial tax system is Microsoft, which could reap a savings of $19.4 billion on its $60.8 billion in accumulated foreign earnings.

Why does Microsoft have so much dough stashed overseas? A Senate investigation this year shed light on this question. They found that Microsoft takes the patents for software developed at its U.S. research facilities and registers them in tax haven countries. That way, when a U.S. customer buys a copy of Microsoft Office, a hefty chunk of the profits is recorded in no-tax zones.

Under current rules, Microsoft would have to pay U.S. taxes on such foreign earnings if they bring them back to the United States to invest or pay shareholder dividends. But under Fix the Debt's favored territorial system, they would be permanently exempted.

The Fix the Debt campaign's CEOs are attempting to portray themselves as the reasonable compromisers. Some of them have even offered to give up the Bush-era tax cuts for the rich in exchange for other parts of their agenda. But given the massive windfalls they could get from a shift to a territorial tax system and other corporate tax breaks, this is hardly surprising. If their companies save billions in tax dollars, corporate profits will soar -- and their CEO pay will skyrocket too.

Beware of this Trojan horse. These CEOs may try to conceal their tired old agenda of more corporate tax breaks in a patriotic package. But if they're serious about helping America, they wouldn't be trying to balance the budget on the backs of the most vulnerable.

It's budget showdown time in Washington. With various tax increases and spending cuts set to kick in at the end of the year, the pressure is on for Republicans and Democrats to make a deal.

A major player in this hot debate is a new corporate coalition called "Fix the Debt." They've recruited more than 80 CEOs of America's most powerful corporations and raised $60 million for a big media and lobbying blitz.

Their ads call for what appears to be a moderate agenda of balancing spending cuts with some tax increases in order to bring down the deficit and ensure a bright future for the United States. But a closer look suggests the Fix the Debt campaign is a Trojan Horse.

Behind their moderate slogans is an extreme agenda focused on further reducing corporate taxes and shifting the burden onto the poor and elderly.

Take a look, for example, at a slideshow presentation the campaign has prepared as a "CEO tool" for wooing supporters. You can check it out right on their web site. It says flat out that the so-called "fiscal cliff" is an opportunity to push for "considerably less" spending on Medicare and Medicaid. It also calls for a shift to a "territorial tax system," which would permanently exempt U.S. corporations' foreign income from U.S. taxes.

At the Institute for Policy Studies, we analyzed how much the Fix the Debt member corporations would have to gain from this particular corporate tax break. The results are staggering.

We focused on the 63 Fix the Debt member companies that are publicly held and therefore must report how much they've amassed in overseas profits. Combined, these firms stand to gain as much as $134 billion in tax windfalls if the territorial system is adopted. That's $134 billion that won't go towards fixing the debt. To put that figure in perspective, it would be enough to cover the salaries of two million elementary school teachers for a year.

One of the biggest potential winners from a territorial tax system is Microsoft, which could reap a savings of $19.4 billion on its $60.8 billion in accumulated foreign earnings.

Why does Microsoft have so much dough stashed overseas? A Senate investigation this year shed light on this question. They found that Microsoft takes the patents for software developed at its U.S. research facilities and registers them in tax haven countries. That way, when a U.S. customer buys a copy of Microsoft Office, a hefty chunk of the profits is recorded in no-tax zones.

Under current rules, Microsoft would have to pay U.S. taxes on such foreign earnings if they bring them back to the United States to invest or pay shareholder dividends. But under Fix the Debt's favored territorial system, they would be permanently exempted.

The Fix the Debt campaign's CEOs are attempting to portray themselves as the reasonable compromisers. Some of them have even offered to give up the Bush-era tax cuts for the rich in exchange for other parts of their agenda. But given the massive windfalls they could get from a shift to a territorial tax system and other corporate tax breaks, this is hardly surprising. If their companies save billions in tax dollars, corporate profits will soar -- and their CEO pay will skyrocket too.

Beware of this Trojan horse. These CEOs may try to conceal their tired old agenda of more corporate tax breaks in a patriotic package. But if they're serious about helping America, they wouldn't be trying to balance the budget on the backs of the most vulnerable.