No one wants war, including the rich and powerful on all sides, in Beijing and Washington, in Berlin and Moscow, in Tehran and Tel Aviv. Yet the beating of the drums of war continues, and it grows louder. The appetite for war spreads like a vermillion fungus across the entire nation, with a military culture pushed through newspapers, movies, and television broadcasts. Preparation for war is a means of controlling the “little people” in a totalitarian manner.

The US government is pressuring every ally to rapidly increase defense spending, up to 5%, and to do so far more rapidly than can possibly be done in such a short time without massive corruption and waste. The military buildup is but a transfer of wealth, not an increase in security.

So, Why War?

The United States is collapsing as an economy, as a society, and as a civilization, weighed down by a massive debt, burdened by collapsing infrastructure and dying educational and research institutions, and strangled by a culture of pornography and narcissism. Above all, the extreme concentration of wealth over the last 20 years, since government was captured completely by the super rich, has meant that a handful of conceited frauds can determine the policy for the entire nation, and decide the fate of everyone. The basic interests of the vast majority of citizens are entirely ignored. The republic, and all traces of participatory democracy, have been consigned to the trash bin of history.

The international trade system and the embrace of “free trade” ideology played a major role in pushing the United States toward war around the world. Supply chains link together factories in loops that encircle the globe. Manufactured goods and agricultural products are brought into the United States from over the world, not because doing so is good for Americans, but because the multinational banks that control the economy seek out the cheapest labor and cheapest goods. Virtually all consumer goods in the United States go through logistics and distribution systems controlled by multinational corporations. Unlike the situation in 1945, a large part of the money that citizens (rebranded as “consumers”) spend at Walmart, Best Buy, or Amazon goes to the stockholders of those corporations and offers little or no benefit for the local economy.

The increase in military spending is a policy choice; it is the only way to avoid economic collapse.

Until the 1950s, most of what Americans ate came from local, family-owned farms. Clothes and furniture were also produced locally. Now that production and distribution have been spread all over the globe, events far away directly impact the US economy, and sometimes politicians feel pressure to use military threats, or responses, to protect American corporate interests (repackaged as “national security”).

So, too, US dependency on petroleum did not exist in the 1920s or dependency on rare earth metals in the 1980s. These are problems created by the decisions of corporations to introduce technologies that offered some conveniences, but at the price of extreme dependency of citizens on technology, which has generated large corporate profits.

The relocation of American manufacturing overseas also means that the only employment available in many regions, especially rural areas, is as police officers, guards at prisons, soldiers, or other positions in the military, police, or surveillance system. These days, security and the military are the only parts of the government budget that are growing.

The last decade has seen employment in defense surge by 40%, reaching 1.4% of the total employment base. In 2022-2023 alone the workforce expanded by 4.8% in contrast to an average of 1.7%.

No politician can oppose the increase in the military budget because, although constant foreign wars do great damage to the economy as a whole, the military has become the only part of government that increases opportunities for employment locally.

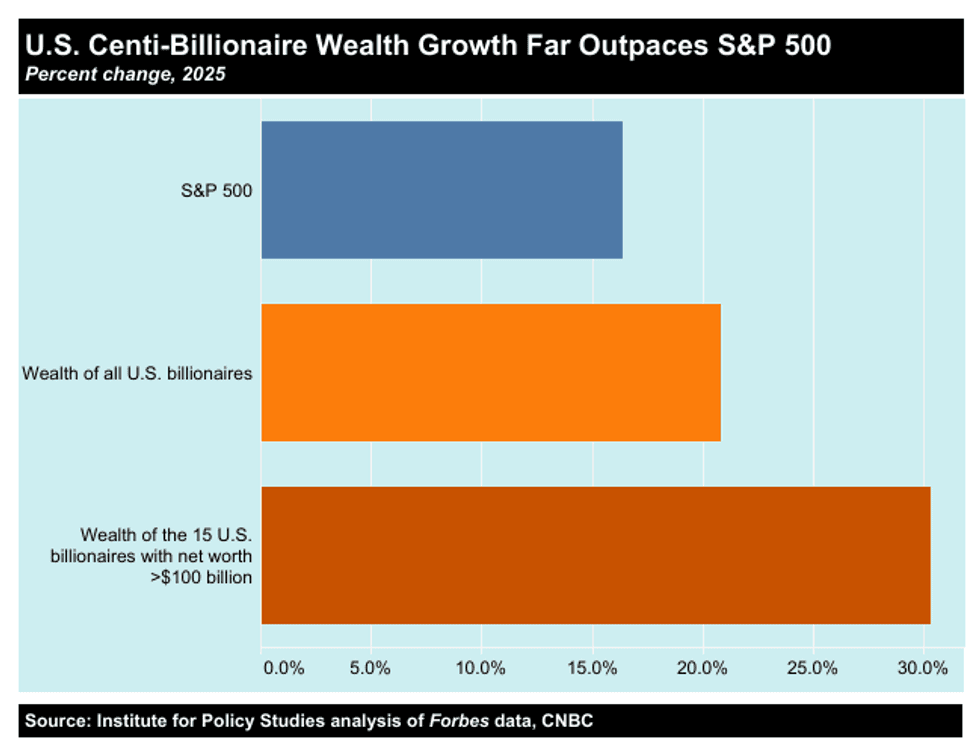

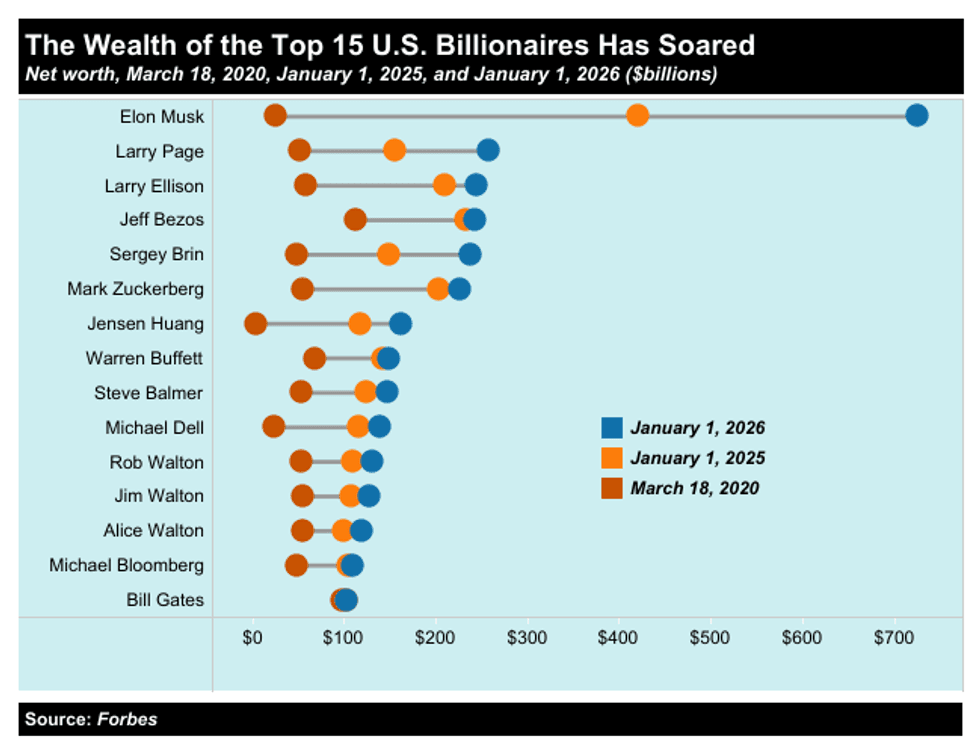

The US economy is increasingly controlled by a small number of rich families. The wages of American workers have been reduced, and the costs of living greatly increased for the profit of the few. The unprecedented concentration of wealth in the hands of a group of oligarchs has changed everything. This restructuring of society may not seem to be military in nature, but it pushes the United States toward a military economy.

The End of the Welfare State

The disposable income of workers increased beginning in the 1940s because of the redistribution of wealth forced by the reforms of the New Deal. These reforms also allowed for corporations to make enormous profits after the 1950s by selling consumer products to working people who had the disposable income to purchase them. From the 1960s on, consumption, growth, and the stock market became the primary tools for assessing the health of the economy.

Particularly from the 1970s on, this system effectively funneled wealth from working people to the wealthiest. But today consumption by workers, the middle class, and even the upper-middle class is no longer sufficient to generate profits for corporations because the people cannot spend any more. Banks have been forced to look for some other source of profit to pay off their debts. One direction they looked has been the military. Military spending creates steady demand that is not tied to market conditions, or economic booms and busts. It is funded by the people through taxes, or through the inflation created by the deficit spending that funds military expenditures.

The increase in military spending is a policy choice; it is the only way to avoid economic collapse. It must be justified by threats from China, Russia, and Iran, or terrorism. Intelligence agencies responding to the demands of banks to do everything they can to create trouble with those countries.

The true three branches of government are the politicians, the bankers, and the generals.

Companies like Oracle, Palantir, Google, and Amazon not only grow fat like ticks feeding on the military and intelligence budgets, they are merging with banks and using their control of the IT systems that power banks as a means to seize control of money itself through digitalization of the dollar, or the introduction of cryptocurrencies.

One of the most powerful billionaires, Larry Ellison, has launched a campaign to dominate media through the control of social media, entertainment, and news broadcasting. The Trump administration forced TikTok’s Chinese owner ByteDance to turn over its operations in the United States to a consortium headed by Ellison’s company Oracle in December 2025. Oracle grew to global influence as a major contractor for the CIA, and Ellison is a strong Trump supporter.

Since Ellison’s son David was installed as CEO in August 2025 of the new entertainment conglomerate Paramount Skydance—the merger of Paramount Global, Skydance Media, and National Amusements—father and son have been raising enormous funds for a hostile takeover of Warner Brothers that would give them unprecedented control over entertainment and journalism in the United States. Already CBS, under Ellison rule, has cancelled at the last minute a "60 Minutes" report on the notorious El Salvadorian prison CECOT.

These IT firms made those billions by taking out massive loans that they then used to buy back their own stock. They have nothing but debt and money in digital form. War, the threat of war, the buildup for war, is what keeps them going.

Impact on Governance

The United States government is a republic consisting of three branches: the executive, the legislative, and the judicial. The three branches complement each other, and they also regulate and balance out each other. This system ensures that power is not concentrated in any one place.

That was a long time ago. How does politics really work today?

There are three real branches of government today, and they are quite different than those described in the Constitution. The true three branches of government are the politicians, the bankers, and the generals. They are the ultimate powers behind the government, and they balance each other out because they operate at different levels and have different strengths.

The concentration of wealth has almost eliminated the impact of citizens on policy.

The politicians are able to form temporary alliances among interest groups in business, finance, and government and negotiate among them to determine policy. The bankers control money and have the power of financial manipulation to shut down the entire economy, or the activities of opponents. The generals possess a chain of command that cannot be easily broken by exterior forces, even by money, and they have the ability to use force directly, without relying on a third party, to achieve their goals.

In a healthy society, where citizens actually play a role in politics, the politicians rise to the top because their primary mission is serving the needs of their clients, whether they are bankers, businessmen, generals, or other interest groups in the general population. Politicians can play the central role because they reflect the needs of citizens. As long as politicians can effectively meet the needs of the bankers, the generals, and the citizens, and keep the money flowing to them, the system remains stable.

If wealth is too concentrated, however, to the degree that the bankers can pay off everyone and gain complete control of the economy, then they rise to the top because bankers need only service a small number of the super rich to obtain absolute power. The politicians become their puppets, and the generals are paid off by the bankers. That is what the political system in the United States has become today.

A political system run by bankers, however, will encounter enormous problems over time because everything will be decided on the basis of short-term profits, and no one will do anything for the sake of others, or follow an ideal greater than personal interest. As a result, the foundations of government, and of society, will crumble. Eventually the government will collapse into anarchy, or it will drift into war as a means of generating profits and enforcing the bankers’ iron-fisted rule over the people.

At that historical moment, the generals rise to the top because they have a viable chain of command that continues to function even as the government fails, and because they speak the language of force and violence, which will become the only language that has authority once the legitimacy of politicians and bankers has been destroyed.

The concentration of wealth has almost eliminated the impact of citizens on policy. The finance-driven speculative economy has brought trust in government and business to a new low. As a result, the only politicians in the Democratic Party who are able to take on the Trump administration are all former military and intelligence, and the election of a former CIA officer Abigail Spanberger as governor of Virginia suggests that the “CIA Democrats” have become the driving force in an ideologically bankrupt Democratic Party.

The financial kings, the bankers and billionaires, need make only one little mistake in order for the chain of command to be handed over to the military in the United States. Although military officers may not want war as individuals, once the order goes down, the entire process, especially in light of the massive increase in drones and robots in the military, will be literally on automatic.