SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

National news media often broadcast misinformation when discussing the debt of the United States government, erroneously targeting Social Security as the main culprit whether intentionally or from genuine ignorance.

The coverage of the federal debt by news media generally considered credible often mirrors, unfortunately, the falsehoods heard from Republican lawmakers in blaming Social Security as a major driver of the federal debt. Such misleading news coverage was embedded in a recent segment aired during the week of Thanksgiving on the PBS NewsHour, which is an hour I watch regularly to typically be informed by sound journalism. But in the segment at issue here, I witnessed misinformation broadcast to the public that could shape public opinion into thinking, quite erroneously, that Social Security needs gutting because it is the culprit increasing the federal debt. It isn’t.

This particular segment on the federal debt on PBS NewsHour was introduced on Tuesday November 21 by coanchor Amna Nawaz stating how the “U.S. government remains open this Thanksgiving week, thanks to a temporary funding deal Congress passed last week.” But when that temporary funding starts expiring in January, Nawaz added, “conservatives are signaling they won’t pass another funding deal without addressing a bigger issue, the swelling U.S. national debt.”

Then coanchor Geoff Bennett and correspondent Lisa Desjardins, standing before a screen with varying charts, discussed the growing interest paid on the federal debt. As Desjardins put it, “just the interest on our debt is so large [in the past year] that it is almost [the size of} the entire Department of Defense budget.” That statement may be true, but that was not the punchline of the segment.

Social Security hasn’t reduced available general revenue nor been the reason why politicians are not funding programs for younger constituencies.

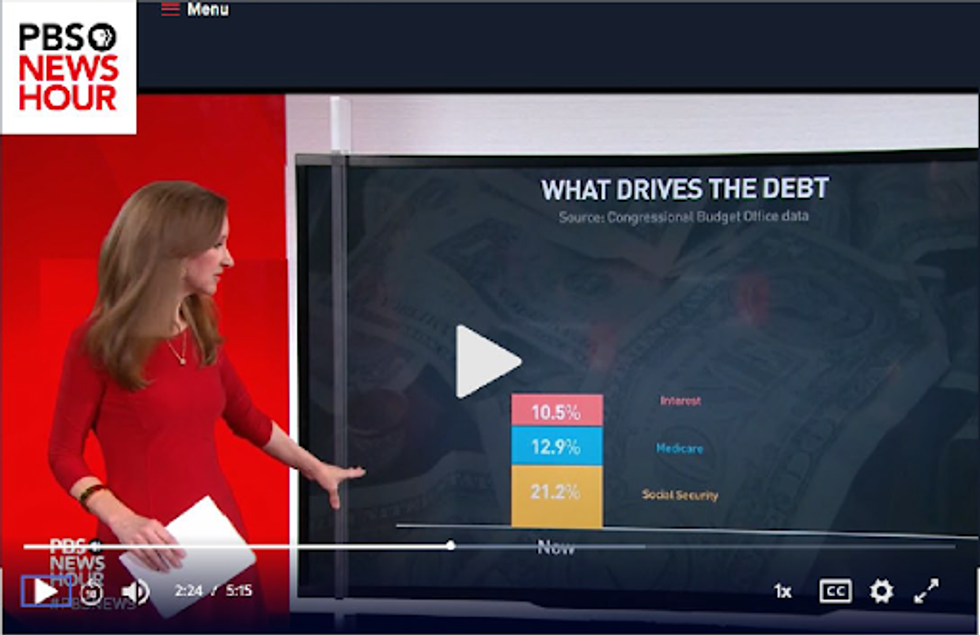

The NewsHour segment ended mirroring the Republican Party’s mantra that Social Security is the major driver of the federal debt. As Desjardins concluded “the three largest drivers of the debt are in reality” Social Security, Medicare, and interest on the debt, with each in the chart displayed indicated as accounting respectively for 21.2%, 12.9%, and 10.5% of total federal expenditures. Desjardins added, “Really what’s happening here is Congress is not addressing the big drivers of the debt at all.”

In a recent piece with misinformation embedded in its title alone, “Why We’re Borrowing to Fund the Elderly While Neglecting Everyone Else,” columnist Catherine Rampell also implied that borrowing to fund Social Security benefits will, as she wrote, “continue to crowd out future spending obligations in years ahead” on programs for the young like “pre-K, or child care, or paid parental leave, or a more generous child tax credit.”

One problem in such depictions exemplified by the NewsHour and in Rampell’s article is that Social Security, specifically, is funded almost exclusively by its own revenue source. Not by borrowing, as Ms. Rampell implies without providing supportive evidence for that contention (because there isn’t any). Nor funded by general revenue as likely many believe when seeing typical charts on federal spending (like that shown in the segment aired on PBS NewsHour) that include Social Security expenditures, which are not at all funded by general revenue but, rather, by its separate targeted payroll and income taxes.

Actually, as I have written about previously, Social Security is today the entity owning the most debt, $2.7 trillion in Treasury securities (Monthly Treasury Report, Table 6, Schedule D as of October 31, 2023). More than the two foreign governments owning the most U.S. debt, Japan today owning U.S. securities valuing $1.1 trillion and China with under $1 trillion.

Surpluses in Social Security revenue by law have to be invested in U.S. securities. And revenue surpluses have over the years been the norm in the program. Thus, Social Security for years, in essence, funded the debt with its surplus revenue, not caused it.

Social Security hasn’t reduced available general revenue nor been the reason why politicians are not funding programs for younger constituencies as Ms. Rampell alludes to in her piece. Tax cuts during the Trump and Bush administrations, however, did help do that. Growth in deficits and debt, as analysis by the Center for American Progress indicates, has largely been driven by those tax cuts. Tax cuts reducing general revenue applicable to programs like the earlier expanded child tax credit that, before expiring, lifted more children out of poverty.

The Social Security program has nevertheless, according to reports by the Board of Trustees overseeing the program, recently incurred shortfalls in its dedicated revenue stream. In 2022, a 4% shortfall noted in the trustees’ current report (Table II.B1, page 7). And those recent shortfalls have been met simply by just cashing in some U.S. securities the program acquired over the years with revenue surpluses.

But true enough, within current parameters of the program, the trustees predict the program’s reserves (i.e., securities) will be depleted by 2033. Then relying solely on Social Security’s separate tax revenue, it is predicted only 77% of benefits due will be payable. That’s not being totally broke, but it would have an adverse effect on the income many elderly depend upon.

Raising the Social Security retirement age to purportedly reduce costs also has adverse effects that, as I discussed earlier, the Congressional Research Service among others have outlined. For one, among those of lesser means who also on average have lower life expectancies, increasing the retirement age would reduce their lifetime Social Security benefits collected disproportionately relative to reductions among higher income earners with typically longer life expectancies. Increasing the retirement age would, furthermore, disproportionately harm those retiring early due to work-related health impairment suffered most prevalently in blue-collar occupations.

A different option some propose to increase revenue is eliminating the cap on the income subject to the Social Security payroll tax. In 2024 the limit on income taxed will be $168,600. Income above that limit would not currently be taxed.

However Social Security is made solvent for the future, one thing is quite clear. Social Security has not been the reason for incurred and increasing U.S. debt.

More than fifty years after their 'jail, no bail' strategy helped galvanize the fight against racial inequality, serving as a model for other protesters nationwide and spurring larger actions like the March on Washington for Jobs and Freedom in 1963 and the march from Selma to Montgomery in 1965, nine African-American civil rights activists will finally, later this month, have their names cleared.

On the morning of January 31, 1961, a group of African-American demonstrators, most of whom were students at nearby Friendship College, converged on the McCrory's Variety Store in downtown Rock Hill, South Carolina.

Ten young men went inside and sat down at the all-white lunch counter, while others--men and women--stayed outside with picket signs. The 10 activists at the lunch counter ordered hamburgers and soft drinks; they were denied service and asked to leave. When they refused to get up, the men were dragged from the establishment, arrested, taken to the city jail, and tried for trespassing.

According to a narrative at the website of Friendship College (which closed its doors in 1981):

These young men, along with many other Rock Hill demonstrators, had been arrested for trespassing several times during the previous year; each time they paid their bail and were released. But on this occasion in January 1961, they had decided ahead of time that if arrested, they would not accept bail but would serve out their sentences. By so doing they would not only break the cycle of continually paying money into an unfair legal system but also bring attention to the segregated nature of lunch counters and other public places in Rock Hill and elsewhere.

All but one of the men--who was concerned about possibly losing his athletic scholarship at Friendship--refused to allow the NAACP to pay their bail; on February 2, 1961, they began serving out 30-day sentences on the county prison farm.

Next week, 16th Circuit Solicitor Kevin Brackett will convene a special court hearing to have their records exonerated.

According to The Herald of Rock Hill:

Brackett will argue in court that the law in 1961 was unjust, so their convictions were unjust. He will ask that the convictions be vacated.

Circuit Court Judge John C. Hayes III--nephew of the Judge Hayes who convicted the Friendship Nine 54 years ago--will sign the order.

The Friendship Nine finally will have no criminal records.

While the 'Friendship Nine,' as they soon came to be known, served out their sentences, other protesters and supporters converged on the prison--including members of the influential Student Nonviolent Coordinating Committee, who were also arrested, jailed, and then refused bail. Over the course of the next year, further demonstrations and arrests followed in Rock Hill, as well as in other cities throughout the U.S., with protesters across the country adopting the 'jail, no bail' strategy--first utilized by the Nashville Student Movement--rather than helping to subsidize a system that supported segregation and inequality.

On Monday, the city of Rock Hill unveiled new street signs honoring the civil rights activists. The signs declare that Rock Hill has "No Room for Racism" and list the names of the Friendship Nine members: Willie Edward McCleod, James Frank Wells, Clarence Henner Graham, Thomas Walter Gaither, David 'Scoop' Williamson, Robert Lewis McCullough, Mack Cartier Workman, W.T. 'Dub' Massey, and John Alexander Gaines.

On Saturday, three members of the Friendship Nine were grand marshals in the Martin Luther King, Jr. Day parade in York, South Carolina, just a few miles from Rock Hill.

In a speech to the crowd, Willie 'Dub' Massey called on young people and organizers to take proactive steps against racism and injustice: "If you're still acting like somebody owes you something," he said, "you gotta stop that mess and you gotta get it right."

For more on the Friendship Nine and their momentous civil disobedience, watch an excerpt from the 'Jail, No Bail' documentary produced in 2011 by South Carolina ETV:

'Jail, No Bail' Idea Stymied Cities' Profiting From Civil Rights ProtestersRead the transcript: https://to.pbs.org/hMvAHq Fifty years ago, the "Jail, No Bail" strategy became a new tactic in the fight for civil ...