SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

Having a steady and reliable supply of cheap labor to maintain high profits requires widespread poverty, ignorance, death, and disease. So their policy agenda is built around creating that.

Republicans in the House of Representatives voted out of committee early Wednesday morning legislation that would strip as many as 14 million Americans of their Medicaid-based healthcare, including millions of seniors in nursing homes and children living in poverty.

Ironically, red states will be hit harder by this than blue states, as they’re generally less capable of making up the loss of federal funds (Medicaid is administered at the state level with block grants from the feds).

Which provokes some serious head-scratching among the pundit class: Why would Republicans kneecap their own people? Do they really think they can get away with it, just to fund tax breaks for Elon, Mark, Jeff, and Donald? And, for that matter, why is it that red states are so vulnerable to this GOP perfidy?

Republicans are more than willing to tolerate massive, desperate levels of human suffering to make sure there’s a steady supply of cheap labor. In fact, they intentionally run their states that way to produce those results.

One of the enduring mysteries of America is why the citizens of red states are generally poorer, less educated, and sicker than the citizens of blue states. To that question, I step up as your hierophant with an answer to this deep mystery that you may not have previously considered.

First, that generalization is broadly true:

And, second, it’s undeniably true (and documented with each hotlink below) that Republican-controlled red states, almost across the board, have higher rates of:

But are all these things happening because Republicans simply hate their citizens and explicitly want high levels of poverty, ignorance, death, and disease?

Turns out there’s a much simpler answer.

The problem for red states is that Republicans worship cheap labor, because it drives up profits for the fat cats who own American businesses—and having a steady and reliable supply of cheap labor to maintain high profits requires widespread poverty, ignorance, death, and disease.

That poverty, of course, brings along with it the long list of social ills above, but Republicans are more than willing to tolerate massive, desperate levels of human suffering to make sure there’s a steady supply of cheap labor. In fact, they intentionally run their states that way to produce those results.

If you have any doubts about this, if that sounds like hyperbole, simply look at the policies the GOP has promoted for the past century:

So, the next time somebody asks why Republican policies so often hurt their own people, just tell them, “It’s all because of the cheap-labor Republicans and their loyalty to their greedy billionaire owners.”

A majority of voters are compassionate toward immigrants and understand that having 11 million people living and working without legal protections is not good for them or for working people in general.

In a recently conducted YouGov survey, designed by the Center for Working Class Politics and the Labor Institute, 63% of 2024 voters in Pennsylvania, Ohio, Michigan, and Wisconsin said they supported “granting legal status to all illegal immigrants who have held jobs and paid taxes for at least three years and have not been convicted of a felony.”

Supporters surprisingly included 36% of those who voted for U.S. President Donald Trump last year.

That wording was taken directly from the American National Election Studies survey (ANES) of 28,311 respondents between 1996 and 2020. In my book, Wall Street’s War on Workers, I used the ANES survey to zero in on white working-class voters’ opinions across the country. The results were startling:

In 2016, only 32% supported granting legal status to undocumented (“illegal”) residents. By 2020, support had jumped to 62%.

We expected that voters of all shades and persuasions may have turned against immigrants after Trump highlighted the issue in his three campaigns, focusing attention (with the often-relentless help of Fox News) on a number of horrific but rare violent crimes apparently committed by the undocumented. He threatened the mass deportation of undocumented residents in 2016 and 2020 and then began a campaign of highly visible deportations after winning the presidency in 2024. But as the chart below shows voters in key swing states, all of which voted for Trump, still supported legalization, as of April 2025. (3,000 voters were surveyed.)

Here are the results broken down by the 2024 presidential vote in the same four states.

By party identification:

By ideology:

By class:

And by ethnicity:

The survey also shows that support for legalization is highest among younger voters: 76% of those 30 years of age and younger support legalization.

But isn’t immigration the big right-wing issue?

There is a big difference between controlling immigration at the border and criminalizing hard-working undocumented residents. You can be for secure borders and restrained immigration while also supporting legalization of the 11 million undocumented workers now living in the shadows.

Our analysis shows that a majority of voters are compassionate toward immigrants and understand that having 11 million people living and working without legal protections is not good for them or for working people in general.

Undocumented workers find it very difficult to exercise their rights. They can be forced to work for lower wages in poor conditions and have no easy recourse to complain about it without fear of being reported by their employers to Immigration and Customs Enforcement. Those we surveyed clearly understand that this places downward pressure on wages in many occupational categories, hurting American workers as well as immigrants.

Arguing that undocumented workers do jobs that U.S. citizens no longer want to do completely misunderstands the labor market. If wages are pushed up, instead of down, good-paying jobs would be filled both by U.S. citizens as well as legalized immigrants.

So why aren’t the Democrats on it?

Honestly, I’m not entirely sure. But I suspect that the Democrats have drifted so far away from the working class that they don’t understand that legalization of undocumented workers is a working-class issue. I don’t know who does their polling, but I would bet they are not asking the kind of questions we are asking. They have long ago stopped trying to understand the needs and interests of working people.

For whatever reasons, the Democrats are letting Trump stomp all over undocumented workers. Yes, there is concern about specific immigrants who have been illegally detained and deported. Yes, there is mumbling about providing citizenship for Dreamers—those born here with undocumented parents. But there is radio silence about hard-working undocumented workers receiving legal status. This is a fight the Dems are choosing to avoid.

Trump’s weaponization of the immigration issue might have Democratic politicians on the defensive, but there might be another reason they’re choosing not to engage. The group that most wants immigrants to stay in the shadows are those who profit from low-wage labor.

There is a vast ecosystem of sub-contractors and temp agencies that supply undocumented workers for warehouse operations like Amazon’s and food-processing plants, like those of JBS and Tyson. Tens of billions of dollars in extra profits are made off the backs of these workers, few of whom have any way to exercise normal employee rights, much less fight to unionize. They can and are being exploited.

The employers who have their hooks into these undocumented workers also have their hooks into both political parties. They are not keen on uplifting their lowest-paid employees or having those who receive their political donations fighting for their rights.

The travesty of the two political parties not fighting the rights of these working people, even with strong polling supporting such a fight, is just one more reason why we need a new political entity, one that focuses on the needs and interests of all working people.

The billionaires have two parties: We need one of our own!

The Trump administration is functionally acting to rewrite the prevailing narratives of our past—a past of progress toward equal rights, fact-based education, and lessons learned from mistakes and achievements.

In these first 100-plus days of the nation’s 47th presidency, President Donald Trump and his sidekick Elon Musk have cast a frightful spell over the country. As if brandishing wands from inside their capes—poof!—offices and their employees, responsibilities and aims, norms and policies have simply disappeared. The two have decreed a flurry of acts of dismantlement that span the government, threatening to disappear a broad swath of what once existed, much of it foreshadowed by Project 2025, the Heritage Foundation’s blueprint for drastically reorganizing and even dismantling government as we know it during a second Trump administration.

To my mind, the recent massive removals of people, data, photos, and documents remind me of the words of Czech novelist Milan Kundera in his classic novel The Book of Laughter and Forgetting: “The struggle of man against power is the struggle of memory against forgetting.”

By the middle of March, the new administration had already eliminated dozens of departments and offices, as well as thousands of staff positions, with the supposed goal of “government efficiency.” Buyouts, layoffs, reassignments, and a flurry of resignations by those who preferred not to continue working under the new conditions all meant the elimination of tens of thousands of government workers—more than 121,000, in fact, across 30 agencies. The affected agencies included the Department of Energy, Veterans Affairs, the National Oceanic and Atmospheric Administration, and the Internal Revenue Service, as well as multiple offices within Health and Human Services, including the U.S. Food and Drug Administration, the Centers for Disease Control and Prevention (CDC), and the National Institutes of Health. The Department of Education lost nearly half its staff. And then there was the U.S. Agency for International Development (USAID). By the end of March, the administration had closed its offices and reduced its staff from approximately 10,000 personnel to 15.

The gutting of such offices and their employees is—I’m sure you won’t be surprised to learn—expected to cripple significant government services. At the Department of Education, for example, billions of dollars of institutional aid as well as student loans will be affected. Cuts at the Office of Veterans Affairs, which faced one of the largest staff reductions, are predicted to deprive veterans and their families of healthcare services. USAID’s end will cut programs that addressed poverty, food insecurity, drug trafficking, and human trafficking globally. At the Department of Health and Human Services, the availability of vaccines, the tracking of infectious diseases, and all too much more are threatened and could, according to the executive director of the American Public Health Association, “totally destroy the infrastructure of the nation’s public health system.”

But, as novelist Kundera reminds us, the toll won’t just be to government officials and the positions they’re leaving in the dust of history. The cuts also include a full-scale attack on the past.

As part and parcel of this bureaucratic house-clearing, an unprecedented attack on the records of government agencies has been taking place. Basic facts and figures, until recently found on government websites, are now gone. As I wandered the Internet researching this article, such websites repeatedly sent back this bland but grim message: “The page you’re looking for was not found.”

Many of the deletions of facts and figures have been carried out in the name of the aggressive anti-DEI stance of this administration. As you’ll undoubtedly recall, in the first days of his second term in office, Donald Trump declared DEI programs to be “illegal” and ordered the elimination of all DEIA (Diversity, Equity, Inclusion, and Accessibility) “policies, programs, preferences, and activities in the Federal Government, under whatever name they appear.” A Pentagon spokesperson then tried to explain such acts this way: “History is not DEI.”

The assault on the facts and figures of the past includes an adamant refusal to keep records for the future.

And indeed, at the Pentagon’s website, at least 26,000 portraits, ranging from a World War II Medal of Honor recipient to the first women to graduate from Marine infantry training, were scheduled for removal in the name of the administration’s anti-DEI agenda. In addition, articles were deleted from the site, including a story on baseball great Jackie Robinson, who had served in World War II, as well as mentions of women and minorities. On the website of Arlington National Cemetery, information about Blacks, Hispanics, and women went missing as well. At the Smithsonian Institution, where Vice President JD Vance was put in charge of the world’s largest museum enterprise, consisting of 21 separate museums and the National Zoo, the mandate similarly became to “remove improper ideology” from those museums, as well as from the education and research centers that its portfolio includes.

Following a storm of protest, some efforts at restoration have occurred, including the material on Jackie Robinson, The Washington Post reports that “the categories ‘African American History,’ ‘Hispanic American History,’ and ‘Women’s History’ no longer appear prominently.” Yet some information and artifacts, officials predict, have been lost forever.

The attack on history is perhaps most strikingly apparent in the disruption of the National Archives and Records Administration (NARA), the institution whose mission is precisely to preserve government records. As The Associated Press summed it up, “As the nation’s recordkeeper, the Archives tells the story of America—its founding, breakdowns, mistakes, and triumphs.” The attack on NARA has come in the form of staff reductions, including the firing of the Archivist of the United States and the departure, owing to firings, buyouts, or resignations, of half of that office’s staff. (Remember, NARA was central to the federal criminal case brought against Trump for his alleged mishandling of classified documents, a case which was eventually dismissed.) Notably, the Department of Justice reportedly removed a database which held the details surrounding the charges and convictions that stemmed from the January 6 attack on the U.S. Capitol.

At USAID, an agency founded more than 60 years ago and now utterly eviscerated, the destruction of past records has been a top-line item. As ProPublica first reported, and other news sources later detailed, employees at USAID were ordered to destroy classified and personnel records. “Shred as many documents first,” the order read, “and reserve the burn bags for when the shredder becomes unavailable or needs a break.” Meanwhile, massive layoffs at the Department of Health and Human Services (HHS) are expected to drastically curtail the access of Americans to public records. At the CDC, cuts have included gutting the public records staff (though HHS Secretary Robert F. Kennedy, Jr. has claimed that he plans to reverse that).

Perhaps not surprisingly, the assault on the facts and figures of the past includes an adamant refusal to keep records for the future, a tendency that also marked the first Trump administration and has already proved striking in the first 100 days of his second term.

The Signalgate scandal is a case in point. In the group chat held by then-National Security Adviser Mike Waltz on the Signal app, instead of a designated classified communications channel, discussing an imminent attack on Yemen, national security officials communicated classified information outside of approved channels. In addition to violating norms and laws governing communications involving classified information, the fact that the app was set to auto-delete ignored the law that mandates the preservation of official records.

Nor was Signalgate a one-off. Trump administration officials have reportedly taken to using Gmail, while Elon Musk’s Department of Government Efficiency( DOGE) has been relying on Google Docs for the drafting of government documents, in each case attempting to bypass laws regulating the archiving of public records by potentially “failing to preserve all iterations of its drafts as well as comments left on shared documents.”

Of course, the president’s aversion to creating records in the first place long predates the present moment. During his first term, for example, he had a tendency to rip up documents as he saw fit. “He didn’t want a record of anything,” a senior official told The Washington Post. Notably, he refused to have notes taken at several meetings with Russian President Vladimir Putin and, after one encounter with the Russian president at a Group of 20 meeting in Hamburg, Germany, in 2017, he confiscated the interpreter’s notes.

In such an ongoing obliteration of the records of government activities, the violations that have already taken place have essentially rendered the law invisible. The Federal Records Act, as Lawfare reminds us, requires any federal agency to ”make and preserve records containing adequate and proper documentation of the organization, functions, policies, decisions, procedures, and essential transactions of the agency.” And when it comes to presidential records, the Presidential Records Act categorizes them as the property of the United States and requires the president to take “all such steps as may be necessary” to preserve those records.

There is, however, a giant carve-out to that requirement. During his tenure in office, the president can seek to withhold certain records on the grounds that the documents have ceased to have “administrative, historical, informational, or evidentiary value.” In order to make such a decision, however, the president must first consult with the national archivist, a position that at present belongs to the now four-hatted Secretary of State Marco Rubio, who is currently the acting head of the National Security Agency (NSA) and USAID, as well as the National Archives. It’s worth noting that there is no enforcement mechanism in place to address a decision to dispose of documents, or to challenge the legality—or even the wisdom—of such a decision. The law, as one scholar argues, remains essentially “toothless.”

Historians like me are particularly sensitive to the destruction of government records. Archival materials are our bread and butter. Who knows what new information we might find and what new insights we might gain from a fresh look at the letters of John Adams on the eve of the outbreak of the American Revolution or the records of the dissenters in George W. Bush’s administration in the run-up to the War in Iraq? With the new insights that documents and records provide can come new understandings of who we are as a country, what ills our leaders have (or haven’t) addressed, what tragedies might (or might not) have been avoided, what successes might (or might not) have been more likely to come about. In sum, the records of the past hold innumerable lessons that could guide us into a more sustainable and just future.

That documentary record helps—or at least until this fragile moment, helped—us understand the pathways that have brought us here in both moments of glory and times of trouble. The record feeds us, inspires us, and allows us to feed and inspire others. It’s through the telling of history that we have come to understand our collective selves as a nation, our individual selves as actors, and our leaders’ decisions about the future.

Expunging history was an early tactic of the Nazis, who sought to turn the clock back to a time before the French Revolution and its values altered the course of history.

All that is, of course, now changing and the spell cast by the administration’s ongoing destruction of those records, the emptying or altering of the nation’s cache of documents, has been enhanced by another spell—that of suspicion over the contents of what documents remain, based on accusations that the record itself is partisan and tainted, and so deserving of eradication.

For historians and the public we serve, when record-keeping is marred or even annihilated by a political agenda, as is happening today, such acts can carry special interest for scholars of the past. After all, purposeful deletions from and false additions to the historical record offer a truly grim possibility: the creation of what could pass for a new history of this country. As of now, the Trump administration is functionally acting to rewrite the prevailing narratives of our past—a past of progress toward equal rights, fact-based education, and lessons learned from mistakes and achievements. In sum, to alter or erase the historical record amounts to erasing our knowledge of ourselves.

David Corn, in his newsletter Our Land, recently posted a piece entitled “Trump’s War on History.” In it, he quotes George Orwell from his classic dystopian novel 1984: “Who controls the past controls the future. Who controls the present controls the past.” As Corn points out all too ominously, expunging history was an early tactic of the Nazis, who sought to turn the clock back to a time before the French Revolution and its values altered the course of history. As Corn puts it, for the Nazis, “the animating ideas of the French Revolution, such as liberty, civic equality, and human rights, were to be crushed.”

For Orwell, as for Kundera, owning history with a firm grip is a power of immense consequence, never to be lightly dismissed. Memory and the records that sustain knowledge of the past are essential to humankind’s struggle against the worst sort of naked power grabs, never more so than now.

The richer you are, the smaller the portion of your investment gains you pay in tax and the greater the portion of those investment gains converted to permanent wealth. That’s how wealth concentrates.

The top tax rate wealthy Americans pay on their investment gains today runs barely half the top rate the rest of us pay on our wages. But that only begins to tell the story of how lightly taxed our richest have become compared to the rest of us.

On the surface, the nominal tax rate on long-term capital gains from investments seems somewhat progressive, even given the reality that this rate sits lower than the tax rate on ordinary income. Single taxpayers with $48,350 or less in taxable income face a zero capital gains tax rate. Taxpayers with over $533,400 in taxable income, meanwhile, face a 23.8% tax on their capital gains, a rate that includes a 3.8% net investment income tax..

But these numbers shroud the real picture. In reality, we tax the ultra-rich on their investment gains less, not more. The rates we see on paper only apply to gains taxpayers register in the year they sell their investments. But we get a totally different story when we calculate the effective annual tax rate for long-held investments, especially for America’s wealthiest who sit in that nominal 23.8% bracket.

Buffett and Bezos may be poster children for reforming our absurdly regressive capital gains tax policy. But the problem remains wider than a handful of billionaires who founded wildly successful businesses.

For members of America’s top echelon—the wealthiest 2% or so of American households—the effective annual tax rate on capital gains income, the rate that really matters in measuring the impact a tax has on wealth accumulation, actually rates as sharply regressive.

That sound complicated? Let’s just do the simple math.

The federal tax on capital gains doesn’t apply until the investment giving rise to those gains gets sold, be that sale comes two years after purchase or 20. During the time a wealthy American holds an asset, the untaxed gains compound, free of tax. In other words, as the growth in the investment’s value increases, the effective annual rate of taxation when the investment finally gets sold decreases.

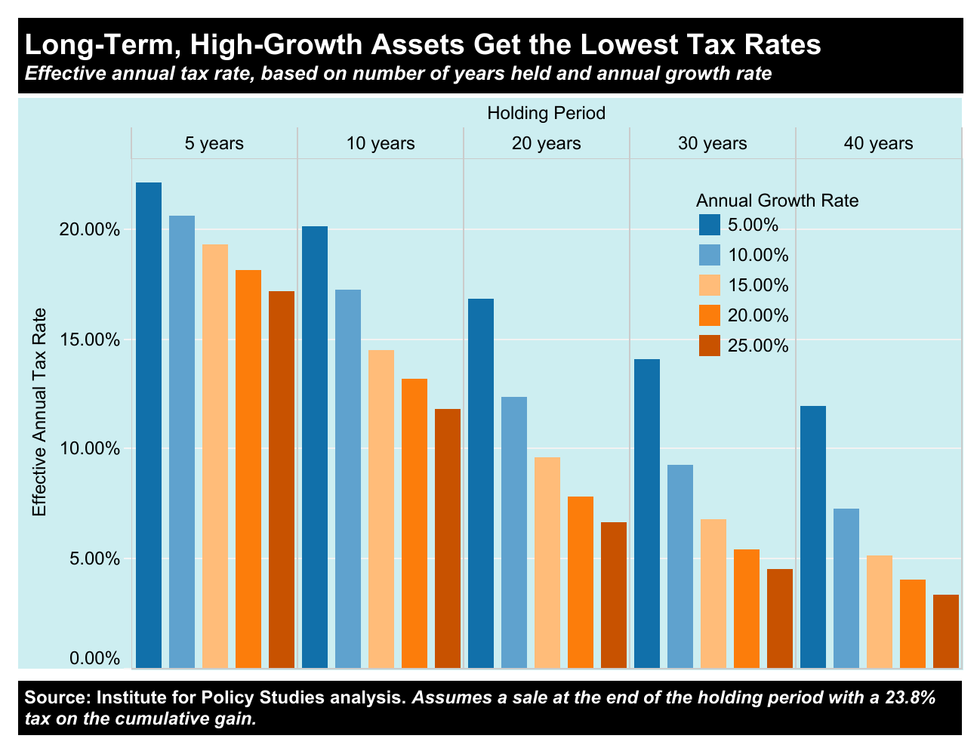

The graphic below shows how the effective annual tax rate on investment gains—all taxed nominally at 23.8%—varies dramatically with the rate of the gain and how long the taxpayer hangs on to the asset.

If an investor sells an asset that has averaged an annual growth of 5% after five years, the one-time tax of 23.8% on the total gain translates to an effective annual tax rate of 22.1%. In effect, paying tax at a 22.1% rate each year on investment gains that accrue at a 5% rate would leave the investor with about the same sum after five years as only paying a tax—of 23.8%—upon the investment’s sale.

In that sale situation, the tax-free compounding of gains over the five years causes a modest reduction in the effective annual tax rate, less than two percentage points. The 22.1% effective rate reduces the 5% pre-tax growth rate of the asset to a 3.9% rate after tax.

Let’s now compare that situation to an investment that grows at an average annual rate of 25% before its sale 40 years later. In this scenario, the tax-free compounding significantly reduces the effective annual tax rate to a meager 3.39%. That translates to a barely noticeable reduction in that 25% annual pre-tax rate of growth to 24.15% after tax.

Put simply, in our current tax system, the more profitable an investment proves to be, the lower the effective tax on the gains that investment generates. You could not design a more regressive tax system.

Who benefits from our regressive tax system for capital gains? We hear a lot from our politicians about some of those folks, the ones they want us to focus on.

Think of someone who starts a small business—with a modest investment of, say $100,000—that over three decades grows into a not-so-small business worth $25 million. Our culture celebrates small-business success stories like that, and political leaders in both parties seek to protect the owners of these businesses at tax time. Why punish, these lawmakers ask, small business people who started from humble beginnings and sacrificed weekends and vacations to build up their enterprises?

But do we get sound policy when we base our tax rates on high incomes on the assumption that certain high-earners have sacrificed nobly for their earnings? Think of a highly specialized surgeon who made huge personal sacrifices to develop the skills she now uses to save the lives of her patients. Should the annual income tax rate she pays on her wages be 10 times the effective annual income tax rate on the gain that the founder of a telephone solicitation call center realizes when he sells the business after 30 years?

We hear similar policy justifications for the ultra-light taxation of the gain realized upon the sale of a family’s farmland. But those who push these justifications rarely point out that the gain has little to do with the family’s decades of farming and far more to do with the land either sitting atop a recently discovered mineral deposit or sitting in the path of a major new suburban development.

Just as magicians get their audiences to focus on the left hand and pay no attention to the right, defenders of the lax tax treatment of investment gains heartily hail the hard work of farmers and small business owners, a neat move that diverts our attention from what simply can be windfall investment gains.

America’s taxation of capital gains runs regressive where it most needs to be progressive—to halt the concentration of our country’s wealth.

Those lucky farmers and business owners, you see, provide political cover for America’s billionaires, by far the biggest beneficiaries of the regressive taxation of capital gains. Consider Jeff Bezos, the founder of Amazon. His original investment in Amazon over 30 years ago, in the neighborhood of $250,000, has now grown close to $200 billion. And that’s after he’s sold off billions of dollars worth of shares. Or how about Warren Buffett, whose original investment in Berkshire Hathaway, the source of virtually all his wealth, dates back to 1962?

Bezos and Buffett, when they sell shares of their stock, face effective annual rates of tax similar to those in that far-right bar of the graphic above, under 4%.

Buffett and Bezos may be poster children for reforming our absurdly regressive capital gains tax policy. But the problem remains wider than a handful of billionaires who founded wildly successful businesses.

In 2022, for example, the top one-tenth of the top 1% of American taxpayers reported nearly one-half the total long-term capital gains of all American taxpayers. Average taxpayers in that ultra-exclusive group of just 154,000 tax-return filers had over $4.7 million of capital gains qualifying for preferential tax treatment, a sum that rates some 943 times the capital gains reported, on average, by taxpayers in the bottom 99.9% of America’s population. And this bottom 99.9%, remember, includes the bottom nine-tenths of the top 1%, who themselves boast some pretty healthy incomes,

The regressive taxation of capital gains drives the tax avoidance strategy I call Buy–Hold for Decades–Sell. The essence of this simple strategy: buy investments that will have sustained periods of growth, hold them for several decades, then sell.

The strategy works fantastically well if you happen to hit a home run with an investment and achieve sustained annual growth of 20% a year, like those who purchased shares in Microsoft in 1986 did. But you only need to do modestly well to benefit enormously from Buy–Hold for Decades–Sell. If, for instance, you only manage 10% a year growth, barely more than the average return on the S&P 500, your effective annual tax rate if you sell at the end of 30 years would be just 9.28%, leaving you with an after-tax pile of cash over 13 times the amount of your original investment.

If we dig into the data produced by economists Edward Fox and Zachary Liscow, we can see clearly that once we get to the upper levels of America’s economic pyramid, the tax avoidance benefit of Buy–Hold for Decades–Sell increases mightily as we progress to the pinnacle.

Fox and Liscow estimate, for the period between 1989 and 2022, the average annual growth in unrealized taxpayer gains at various levels in our economic pyramid [see their research paper’s second appendix table]. The clear pattern: The higher your ranking in our economic pyramid, the greater your average annual growth in unrealized gains.

And when the growth in unrealized gains is running at its highest rate, the annual effective rate of tax on those gains—when finally realized—is running at its lowest. Why? The same factors that drive the growth rate of unrealized gains higher—longer asset holding periods and higher rates of appreciation in value—also drive the annual effective tax rate lower, as the graphic above vividly shows

In short, thanks to Buy–Hold for Decades–Sell, America’s taxation of capital gains runs regressive where it most needs to be progressive—to halt the concentration of our country’s wealth. The higher we go on our wealth ladder, from the highly affluent to the rich to the ultra-rich, the lower the rate of tax. The upshot: The richer you happen to be, the smaller the portion of your investment gains you pay in tax and the greater the portion of those investment gains converted to permanent wealth. That’s how wealth concentrates.

Unless we reform the taxation of capital gains to shut down Buy–Hold for Decades–Sell, the concentration of our country’s wealth at the top—and the associated threat to our democracy—will worsen.

It’s just math.