SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A new report from the Institute for Energy Economics and Financial Analysis noted that for the first time, utility-scale wind and solar last year made up more than 10% of the nation's total U.S. electricity generation. (Photo: Getty Images/Stock Images)

The nation's transition from dirty to renewable energy is "nearing exponential growth"--a shift set to usher in "transformative" impacts within a handful of years.

So declares the Institute for Energy Economics and Financial Analysis (IEEFA) in its "U.S. Power Sector Outlook 2021" report released Wednesday.

Among the key findings (pdf) are that wind and solar are the least costly power generation option in much of nation.

The analysis also points to President Joe Biden's announcement this week regarding efforts to boost offshore wind as set to "have a major impact on the speed of existing development efforts along the East Coast."

Expected new offshore wind capacity "will certainly undercut any need for new fossil fuel generation in the region, as well as vying for market share with existing fossil fuel generators," the publication finds.

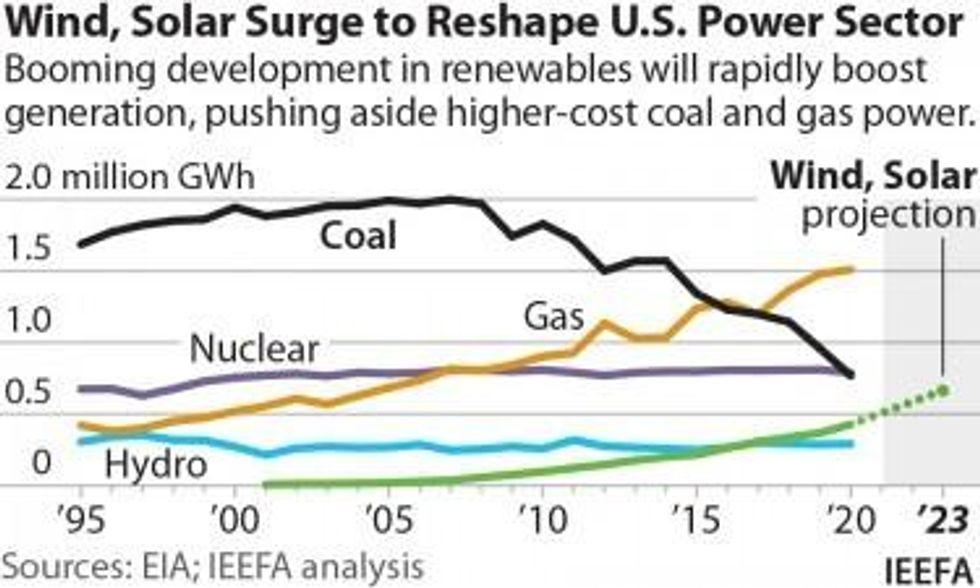

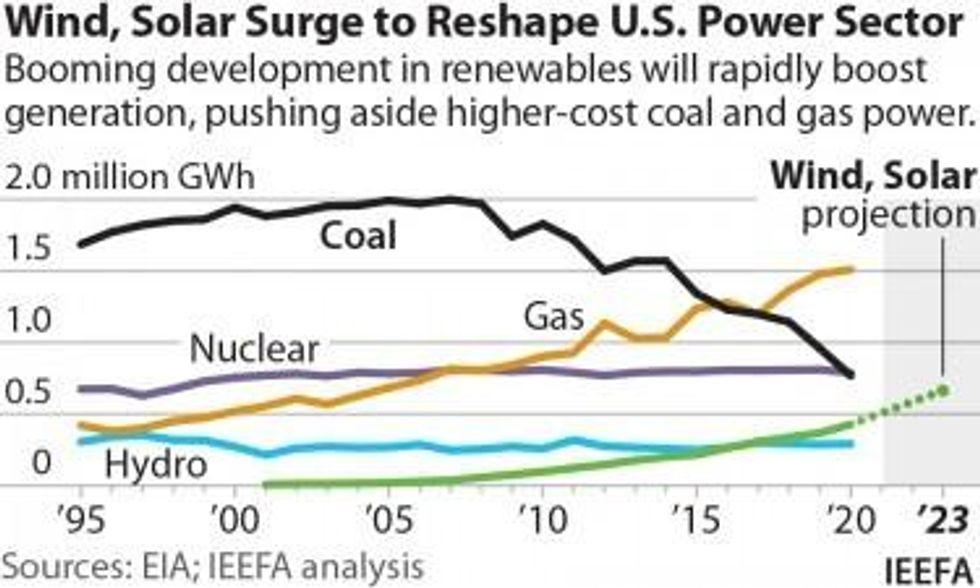

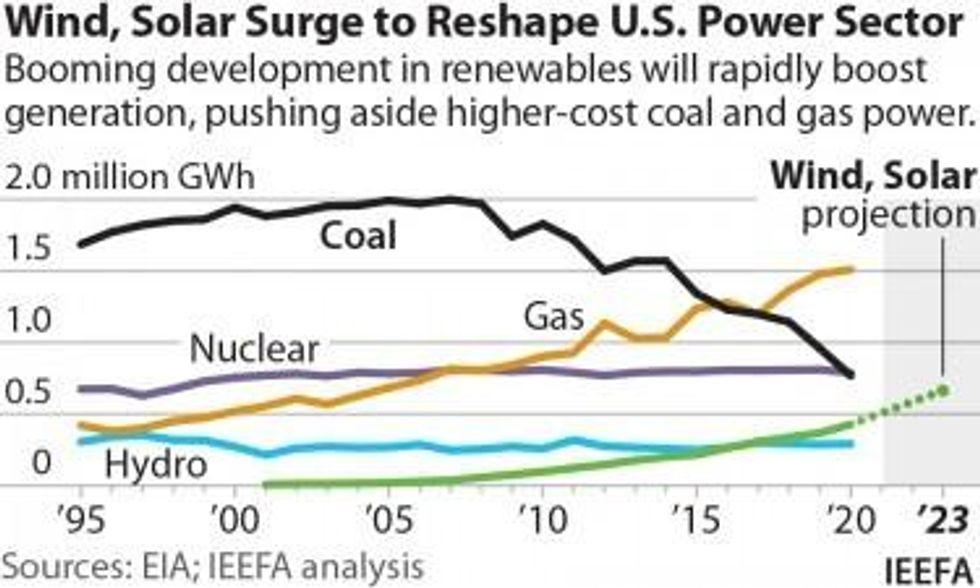

The fast decline of coal is projected to go into high gear, according to the report. Coal made up less than 20% of the U.S. electricity market in 2020, and coal generation capacity is in free-fall, dropping 32% from its peak 10 years ago. And while higher gas prices could tick coal generation upward this year, the analysis forecasts it would be "a short-lived reprieve" lasting a year at best.

What's more, a number of coal plants are already set for retirement, and that number "in the coming decade is going to climb sharply," the analysis forecasts.

Gas, meanwhile, has plateaued. The narrative of it serving as a so-called bridge, according to the report, "has now been closed"

Additionally noted in the analysis are the major strides wind and solar are making. Thanks to a surge in capacity, "utility-scale wind and solar accounted for more than 10% of total U.S. electricity generation in 2020 for the first time."

Industry predictions are for 54 gigawatts of new utility-scale solar for commercial operation by the end of 2023--which would mark a doubling of capacity.

Further aiding the U.S. move away from fossil fuel energy is that the Trump administration has ended. It's clear, the authors write, that "the new Biden administration is going to take a much more aggressive policy approach over the next four years to quickly push the U.S. electricity sector to be less carbon-intensive."

Tipping the scales more towards renewables is the strong growth in battery storage installations. No longer a "a niche product with limited applications," there are now "markets for storage across the board."

The bottom line, according to the analysis, is clear: "Cleaner and lower-cost wind and solar, coupled with battery storage, will drive fossil fuels out of the market."

As report co-author David Schlissel, sees it, the writing on the wall for fossil fuels is clear.

"This is just the start of a transition that is rapidly accelerating, driven by sharp declines in cost, stricter environmental regulations for coal generation, and mounting public concern about climate change," he said in a statement.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The nation's transition from dirty to renewable energy is "nearing exponential growth"--a shift set to usher in "transformative" impacts within a handful of years.

So declares the Institute for Energy Economics and Financial Analysis (IEEFA) in its "U.S. Power Sector Outlook 2021" report released Wednesday.

Among the key findings (pdf) are that wind and solar are the least costly power generation option in much of nation.

The analysis also points to President Joe Biden's announcement this week regarding efforts to boost offshore wind as set to "have a major impact on the speed of existing development efforts along the East Coast."

Expected new offshore wind capacity "will certainly undercut any need for new fossil fuel generation in the region, as well as vying for market share with existing fossil fuel generators," the publication finds.

The fast decline of coal is projected to go into high gear, according to the report. Coal made up less than 20% of the U.S. electricity market in 2020, and coal generation capacity is in free-fall, dropping 32% from its peak 10 years ago. And while higher gas prices could tick coal generation upward this year, the analysis forecasts it would be "a short-lived reprieve" lasting a year at best.

What's more, a number of coal plants are already set for retirement, and that number "in the coming decade is going to climb sharply," the analysis forecasts.

Gas, meanwhile, has plateaued. The narrative of it serving as a so-called bridge, according to the report, "has now been closed"

Additionally noted in the analysis are the major strides wind and solar are making. Thanks to a surge in capacity, "utility-scale wind and solar accounted for more than 10% of total U.S. electricity generation in 2020 for the first time."

Industry predictions are for 54 gigawatts of new utility-scale solar for commercial operation by the end of 2023--which would mark a doubling of capacity.

Further aiding the U.S. move away from fossil fuel energy is that the Trump administration has ended. It's clear, the authors write, that "the new Biden administration is going to take a much more aggressive policy approach over the next four years to quickly push the U.S. electricity sector to be less carbon-intensive."

Tipping the scales more towards renewables is the strong growth in battery storage installations. No longer a "a niche product with limited applications," there are now "markets for storage across the board."

The bottom line, according to the analysis, is clear: "Cleaner and lower-cost wind and solar, coupled with battery storage, will drive fossil fuels out of the market."

As report co-author David Schlissel, sees it, the writing on the wall for fossil fuels is clear.

"This is just the start of a transition that is rapidly accelerating, driven by sharp declines in cost, stricter environmental regulations for coal generation, and mounting public concern about climate change," he said in a statement.

The nation's transition from dirty to renewable energy is "nearing exponential growth"--a shift set to usher in "transformative" impacts within a handful of years.

So declares the Institute for Energy Economics and Financial Analysis (IEEFA) in its "U.S. Power Sector Outlook 2021" report released Wednesday.

Among the key findings (pdf) are that wind and solar are the least costly power generation option in much of nation.

The analysis also points to President Joe Biden's announcement this week regarding efforts to boost offshore wind as set to "have a major impact on the speed of existing development efforts along the East Coast."

Expected new offshore wind capacity "will certainly undercut any need for new fossil fuel generation in the region, as well as vying for market share with existing fossil fuel generators," the publication finds.

The fast decline of coal is projected to go into high gear, according to the report. Coal made up less than 20% of the U.S. electricity market in 2020, and coal generation capacity is in free-fall, dropping 32% from its peak 10 years ago. And while higher gas prices could tick coal generation upward this year, the analysis forecasts it would be "a short-lived reprieve" lasting a year at best.

What's more, a number of coal plants are already set for retirement, and that number "in the coming decade is going to climb sharply," the analysis forecasts.

Gas, meanwhile, has plateaued. The narrative of it serving as a so-called bridge, according to the report, "has now been closed"

Additionally noted in the analysis are the major strides wind and solar are making. Thanks to a surge in capacity, "utility-scale wind and solar accounted for more than 10% of total U.S. electricity generation in 2020 for the first time."

Industry predictions are for 54 gigawatts of new utility-scale solar for commercial operation by the end of 2023--which would mark a doubling of capacity.

Further aiding the U.S. move away from fossil fuel energy is that the Trump administration has ended. It's clear, the authors write, that "the new Biden administration is going to take a much more aggressive policy approach over the next four years to quickly push the U.S. electricity sector to be less carbon-intensive."

Tipping the scales more towards renewables is the strong growth in battery storage installations. No longer a "a niche product with limited applications," there are now "markets for storage across the board."

The bottom line, according to the analysis, is clear: "Cleaner and lower-cost wind and solar, coupled with battery storage, will drive fossil fuels out of the market."

As report co-author David Schlissel, sees it, the writing on the wall for fossil fuels is clear.

"This is just the start of a transition that is rapidly accelerating, driven by sharp declines in cost, stricter environmental regulations for coal generation, and mounting public concern about climate change," he said in a statement.