Corporate Tax Cuts: Profiteers Thrive As Local Budgets Dive

New report shows that while Main Street faces austerity, Wall Street gets tax cuts

Years after the "Great Recession" hit, 10 million people in the U.S are out of work, inequality is stuck at high levels, and vital public services are being cut nation-wide. Yet, according to a new study, corporations are making a killing during these hard times -- enjoying climbing profits yet lower corporate taxes.

Entitled The Disappearing Corporate Tax Base: How to Reclaim Lost Tax Revenue to Rebuild State Budgets, the report was published Thursday by the Center for Effective Government and National People's Action.

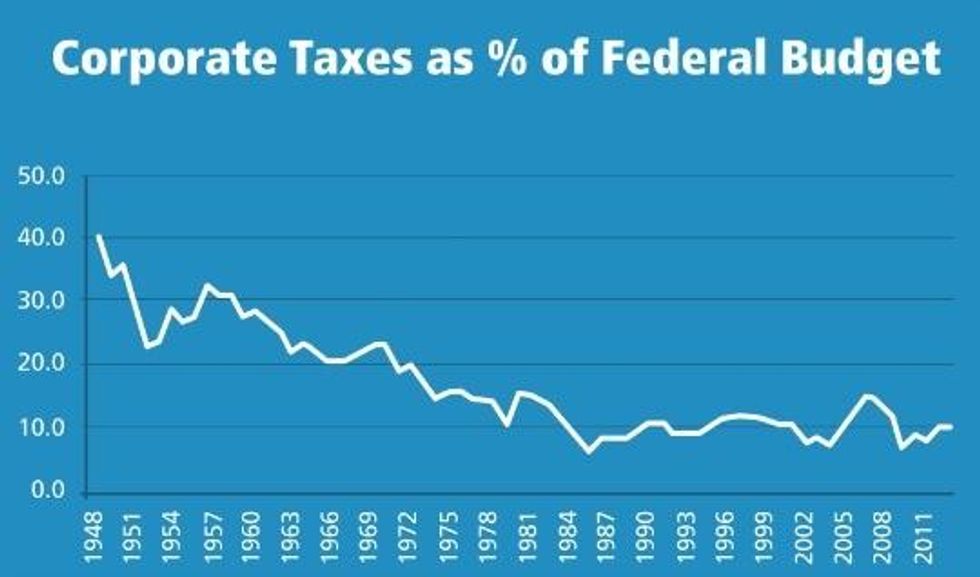

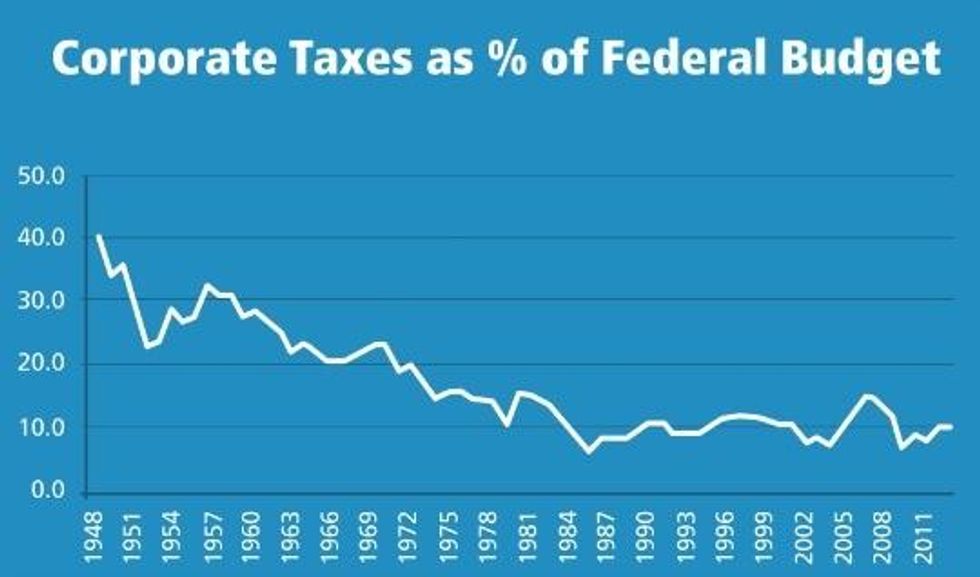

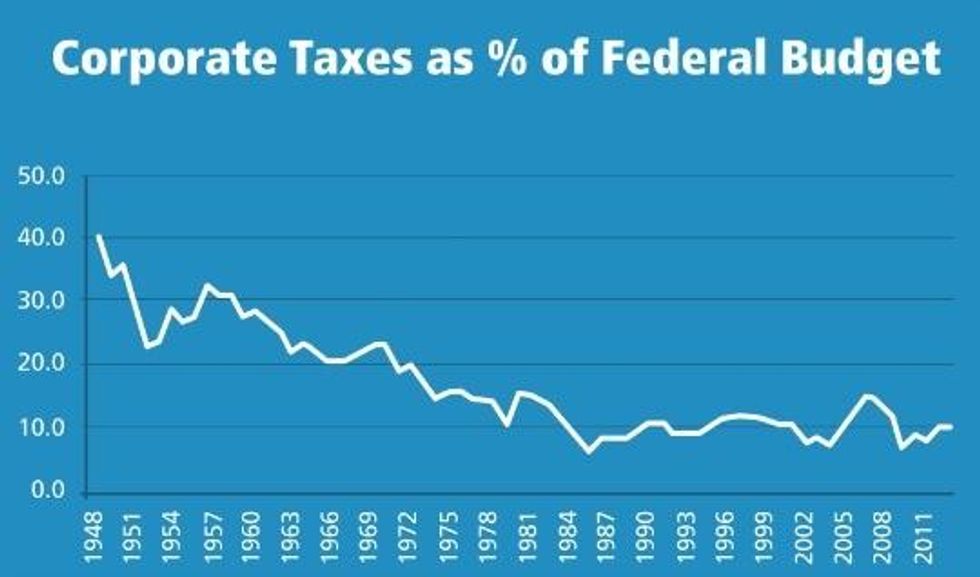

Its authors argue that the decreases in corporate income taxes since the beginning of the recession have "demonstrably harmed state and federal budgets and the provision of services those funds pay for." According to the report, this decline in corporate taxes is a long term trend that has continued throughout the great recession, as the following graph from the report shows. Between 2008 and 2012, corporate taxes decreased in 35 of the 46 states that have corporate income taxes, according to the report.

Meanwhile, since 2011, "federal aid to states for vital services like schools, roads, and environmental protection has been on a downward spiral," the report notes. This was accompanied by a decrease in taxes on rich people and corporations by right-wing governors and state legislators across the country.

These trends have been used to justify punishing austerity measures across the United States. Vital public goods have paid the price, and "[t]wo-thirds of the states now provide less educational funding per student than before the recession began," the report notes.

Yet, in 2013, corporate profits "reached record levels - more than 12 percent of GDP," the report notes. "At the same time, corporate taxes were 1.6 percent of GDP."

According to the report, $36 billion more in corporate revenue "could fund 667,000 school teachers, first responders, librarians, highway crews, caretakers of public parks, and other state and city workers."

"Millions of Americans have yet to see any economic recovery," said George Goehl, Executive Director of National People's Action. "They're struggling to find jobs, make ends meet, and provide for their families. This report shows that the revenue needed for recovery didn't just vanish, it was siphoned off by corporations who refuse to pay their fair share."

_____________________

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Years after the "Great Recession" hit, 10 million people in the U.S are out of work, inequality is stuck at high levels, and vital public services are being cut nation-wide. Yet, according to a new study, corporations are making a killing during these hard times -- enjoying climbing profits yet lower corporate taxes.

Entitled The Disappearing Corporate Tax Base: How to Reclaim Lost Tax Revenue to Rebuild State Budgets, the report was published Thursday by the Center for Effective Government and National People's Action.

Its authors argue that the decreases in corporate income taxes since the beginning of the recession have "demonstrably harmed state and federal budgets and the provision of services those funds pay for." According to the report, this decline in corporate taxes is a long term trend that has continued throughout the great recession, as the following graph from the report shows. Between 2008 and 2012, corporate taxes decreased in 35 of the 46 states that have corporate income taxes, according to the report.

Meanwhile, since 2011, "federal aid to states for vital services like schools, roads, and environmental protection has been on a downward spiral," the report notes. This was accompanied by a decrease in taxes on rich people and corporations by right-wing governors and state legislators across the country.

These trends have been used to justify punishing austerity measures across the United States. Vital public goods have paid the price, and "[t]wo-thirds of the states now provide less educational funding per student than before the recession began," the report notes.

Yet, in 2013, corporate profits "reached record levels - more than 12 percent of GDP," the report notes. "At the same time, corporate taxes were 1.6 percent of GDP."

According to the report, $36 billion more in corporate revenue "could fund 667,000 school teachers, first responders, librarians, highway crews, caretakers of public parks, and other state and city workers."

"Millions of Americans have yet to see any economic recovery," said George Goehl, Executive Director of National People's Action. "They're struggling to find jobs, make ends meet, and provide for their families. This report shows that the revenue needed for recovery didn't just vanish, it was siphoned off by corporations who refuse to pay their fair share."

_____________________

Years after the "Great Recession" hit, 10 million people in the U.S are out of work, inequality is stuck at high levels, and vital public services are being cut nation-wide. Yet, according to a new study, corporations are making a killing during these hard times -- enjoying climbing profits yet lower corporate taxes.

Entitled The Disappearing Corporate Tax Base: How to Reclaim Lost Tax Revenue to Rebuild State Budgets, the report was published Thursday by the Center for Effective Government and National People's Action.

Its authors argue that the decreases in corporate income taxes since the beginning of the recession have "demonstrably harmed state and federal budgets and the provision of services those funds pay for." According to the report, this decline in corporate taxes is a long term trend that has continued throughout the great recession, as the following graph from the report shows. Between 2008 and 2012, corporate taxes decreased in 35 of the 46 states that have corporate income taxes, according to the report.

Meanwhile, since 2011, "federal aid to states for vital services like schools, roads, and environmental protection has been on a downward spiral," the report notes. This was accompanied by a decrease in taxes on rich people and corporations by right-wing governors and state legislators across the country.

These trends have been used to justify punishing austerity measures across the United States. Vital public goods have paid the price, and "[t]wo-thirds of the states now provide less educational funding per student than before the recession began," the report notes.

Yet, in 2013, corporate profits "reached record levels - more than 12 percent of GDP," the report notes. "At the same time, corporate taxes were 1.6 percent of GDP."

According to the report, $36 billion more in corporate revenue "could fund 667,000 school teachers, first responders, librarians, highway crews, caretakers of public parks, and other state and city workers."

"Millions of Americans have yet to see any economic recovery," said George Goehl, Executive Director of National People's Action. "They're struggling to find jobs, make ends meet, and provide for their families. This report shows that the revenue needed for recovery didn't just vanish, it was siphoned off by corporations who refuse to pay their fair share."

_____________________