SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

In an affront to the status quo of debt collection, Strike Debt--the group behind the project--has so far raised $600,000 which it has used to purchase a total of $14.7 million in medical debt for "pennies on the dollar." Then, instead of trying to collect on it, the group graciously forgives the debt.

"We have shown that lenders are perfectly willing to write your debts off - they're just not willing to write them off to you... Unless you force them to," said the group. "We hope that this knowledge inspires debtors everywhere to not just do what the lenders demand of them, but instead to use their leverage to strike a better deal - or simply refuse payment altogether."

To celebrate a year since their kickoff telethon, on November 15th the group will be holding "jubilee" celebrations in cities across the U.S. including Austin, New York and Helena, Montana. Affiiliated groups in San Francisco and Portland, Ore. will be holding their events on the 23rd.

The project was initiated last year by a consortium of people looking to build popular resistance to predatory lending practices. Since that time, 3,801 debtors have received a letter from the Rolling Jubilee Fund informing them, "[Y]ou no longer owe the balance of this debt."

"People across the country [have] chipped in to help relieve some of the stress associated with the experience of being indebted," the letter states. "We do not think people should be forced to suffer twice, first from illness and then from medical debt."

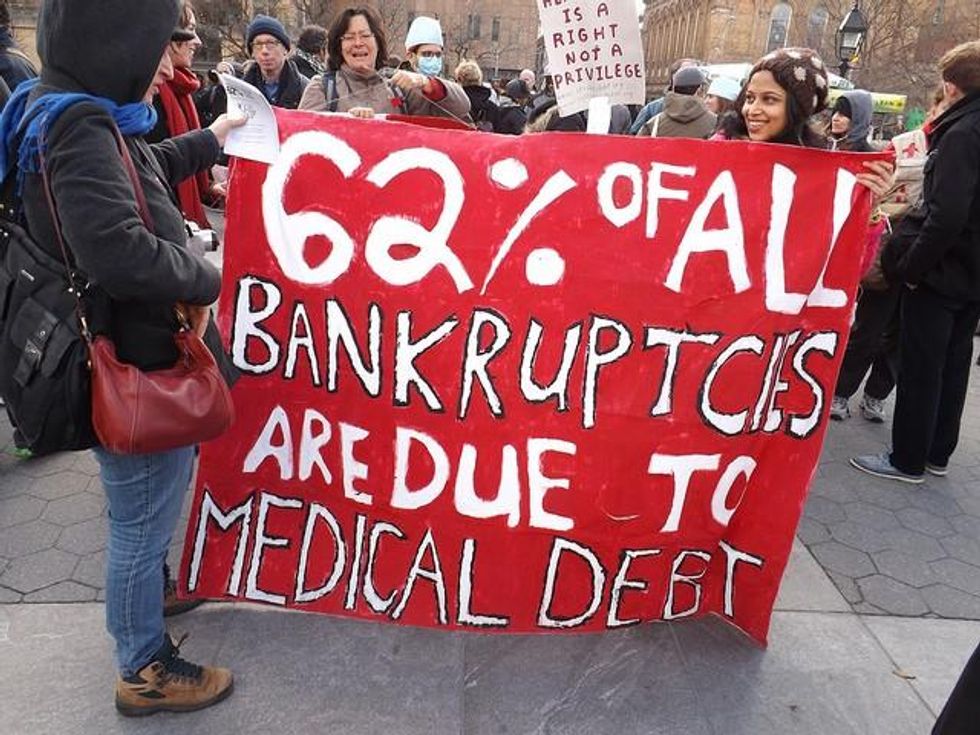

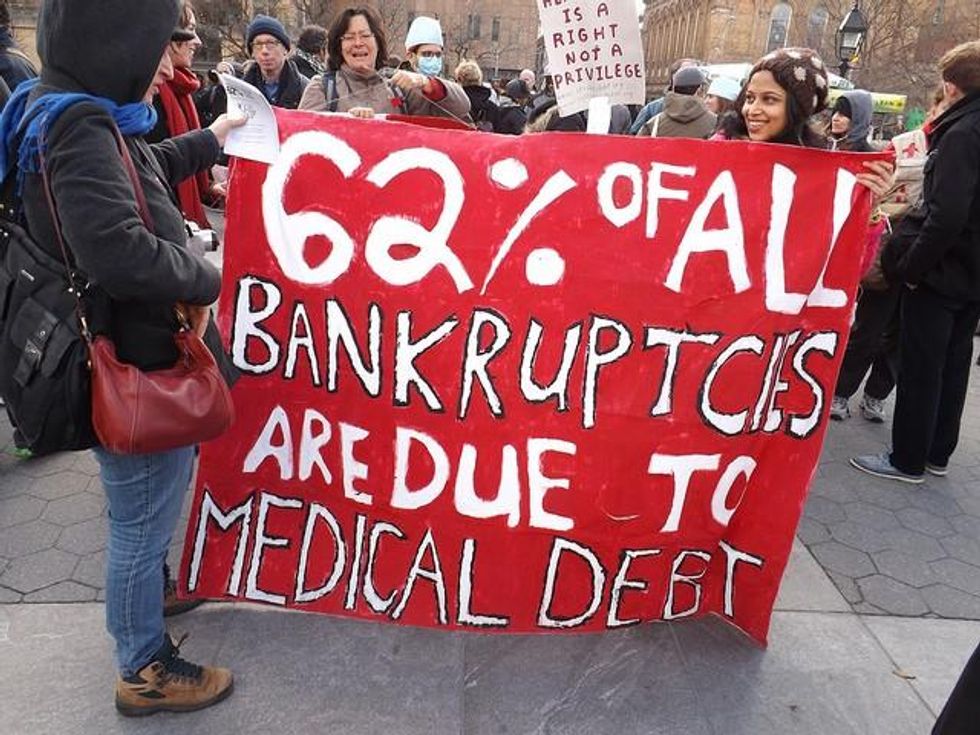

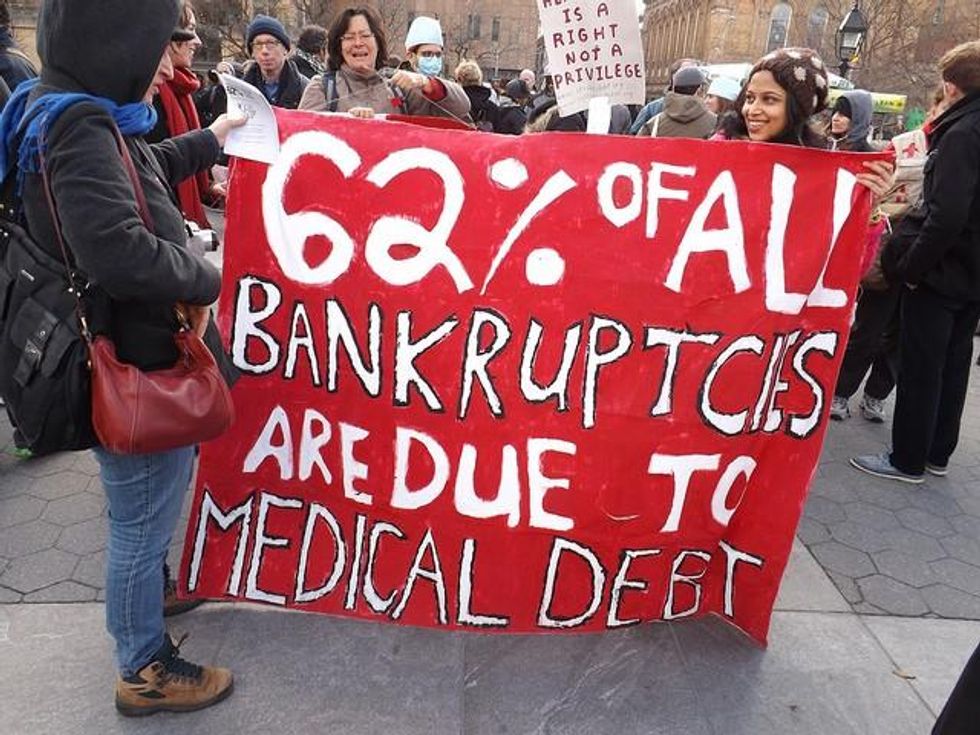

It continues, "Today one in every seven Americans is being pursued by a debt collector. 62% of all bankruptcies have medical debt as a contributing factor, 77.5% of American households are in debt and over 40% of credit card debt was used for basic needs. It doesn't have to be this way."

The Rolling Jubilee was conceived primarily as a "public education project," Andrew Ross, a member of Strike Debt and professor of social and cultural analysis at New York University, told the Guardian.

"Our purpose in doing this," he said, "aside from helping some people along the way, [...] was to spread information about the workings of this secondary debt market."

As the Guardian explains:

The group is able to buy debt so cheaply due to the nature of the "secondary debt market". If individuals consistently fail to pay bills from credit cards, loans, or medical insurance the bank or lender that issued the funds will eventually cut its losses by selling that debt to a third party. These sales occur for a fraction of the debt's true values - typically for five cents on the dollar - and debt-buying companies then attempt to recoup the debt from the individual debtor and thus make a profit.

"Very few people know how cheaply their debts have been bought by collectors," Ross continued. "It changes the psychology of the debtor, knowing this."

"So when you get called up by the debt collector, and you're being asked to pay the full amount of your debt, you now know that the debt collector has bought your debt very, very cheaply. As cheaply as we bought it. And that gives you moral ammunition to have a different conversation with the debt collector," he added.

_____________________

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

In an affront to the status quo of debt collection, Strike Debt--the group behind the project--has so far raised $600,000 which it has used to purchase a total of $14.7 million in medical debt for "pennies on the dollar." Then, instead of trying to collect on it, the group graciously forgives the debt.

"We have shown that lenders are perfectly willing to write your debts off - they're just not willing to write them off to you... Unless you force them to," said the group. "We hope that this knowledge inspires debtors everywhere to not just do what the lenders demand of them, but instead to use their leverage to strike a better deal - or simply refuse payment altogether."

To celebrate a year since their kickoff telethon, on November 15th the group will be holding "jubilee" celebrations in cities across the U.S. including Austin, New York and Helena, Montana. Affiiliated groups in San Francisco and Portland, Ore. will be holding their events on the 23rd.

The project was initiated last year by a consortium of people looking to build popular resistance to predatory lending practices. Since that time, 3,801 debtors have received a letter from the Rolling Jubilee Fund informing them, "[Y]ou no longer owe the balance of this debt."

"People across the country [have] chipped in to help relieve some of the stress associated with the experience of being indebted," the letter states. "We do not think people should be forced to suffer twice, first from illness and then from medical debt."

It continues, "Today one in every seven Americans is being pursued by a debt collector. 62% of all bankruptcies have medical debt as a contributing factor, 77.5% of American households are in debt and over 40% of credit card debt was used for basic needs. It doesn't have to be this way."

The Rolling Jubilee was conceived primarily as a "public education project," Andrew Ross, a member of Strike Debt and professor of social and cultural analysis at New York University, told the Guardian.

"Our purpose in doing this," he said, "aside from helping some people along the way, [...] was to spread information about the workings of this secondary debt market."

As the Guardian explains:

The group is able to buy debt so cheaply due to the nature of the "secondary debt market". If individuals consistently fail to pay bills from credit cards, loans, or medical insurance the bank or lender that issued the funds will eventually cut its losses by selling that debt to a third party. These sales occur for a fraction of the debt's true values - typically for five cents on the dollar - and debt-buying companies then attempt to recoup the debt from the individual debtor and thus make a profit.

"Very few people know how cheaply their debts have been bought by collectors," Ross continued. "It changes the psychology of the debtor, knowing this."

"So when you get called up by the debt collector, and you're being asked to pay the full amount of your debt, you now know that the debt collector has bought your debt very, very cheaply. As cheaply as we bought it. And that gives you moral ammunition to have a different conversation with the debt collector," he added.

_____________________

In an affront to the status quo of debt collection, Strike Debt--the group behind the project--has so far raised $600,000 which it has used to purchase a total of $14.7 million in medical debt for "pennies on the dollar." Then, instead of trying to collect on it, the group graciously forgives the debt.

"We have shown that lenders are perfectly willing to write your debts off - they're just not willing to write them off to you... Unless you force them to," said the group. "We hope that this knowledge inspires debtors everywhere to not just do what the lenders demand of them, but instead to use their leverage to strike a better deal - or simply refuse payment altogether."

To celebrate a year since their kickoff telethon, on November 15th the group will be holding "jubilee" celebrations in cities across the U.S. including Austin, New York and Helena, Montana. Affiiliated groups in San Francisco and Portland, Ore. will be holding their events on the 23rd.

The project was initiated last year by a consortium of people looking to build popular resistance to predatory lending practices. Since that time, 3,801 debtors have received a letter from the Rolling Jubilee Fund informing them, "[Y]ou no longer owe the balance of this debt."

"People across the country [have] chipped in to help relieve some of the stress associated with the experience of being indebted," the letter states. "We do not think people should be forced to suffer twice, first from illness and then from medical debt."

It continues, "Today one in every seven Americans is being pursued by a debt collector. 62% of all bankruptcies have medical debt as a contributing factor, 77.5% of American households are in debt and over 40% of credit card debt was used for basic needs. It doesn't have to be this way."

The Rolling Jubilee was conceived primarily as a "public education project," Andrew Ross, a member of Strike Debt and professor of social and cultural analysis at New York University, told the Guardian.

"Our purpose in doing this," he said, "aside from helping some people along the way, [...] was to spread information about the workings of this secondary debt market."

As the Guardian explains:

The group is able to buy debt so cheaply due to the nature of the "secondary debt market". If individuals consistently fail to pay bills from credit cards, loans, or medical insurance the bank or lender that issued the funds will eventually cut its losses by selling that debt to a third party. These sales occur for a fraction of the debt's true values - typically for five cents on the dollar - and debt-buying companies then attempt to recoup the debt from the individual debtor and thus make a profit.

"Very few people know how cheaply their debts have been bought by collectors," Ross continued. "It changes the psychology of the debtor, knowing this."

"So when you get called up by the debt collector, and you're being asked to pay the full amount of your debt, you now know that the debt collector has bought your debt very, very cheaply. As cheaply as we bought it. And that gives you moral ammunition to have a different conversation with the debt collector," he added.

_____________________