For Most Minorities, King's Dream of Economic Justice a 'Long Way from Home'

MLK's fight for equality 'remains unfinished' says new report

Fifty years after Martin Luther King Jr.'s "I Have a Dream" speech, the hope for economic justice and equality is still a long way off for most minorities in the U.S., says a new report released Monday.

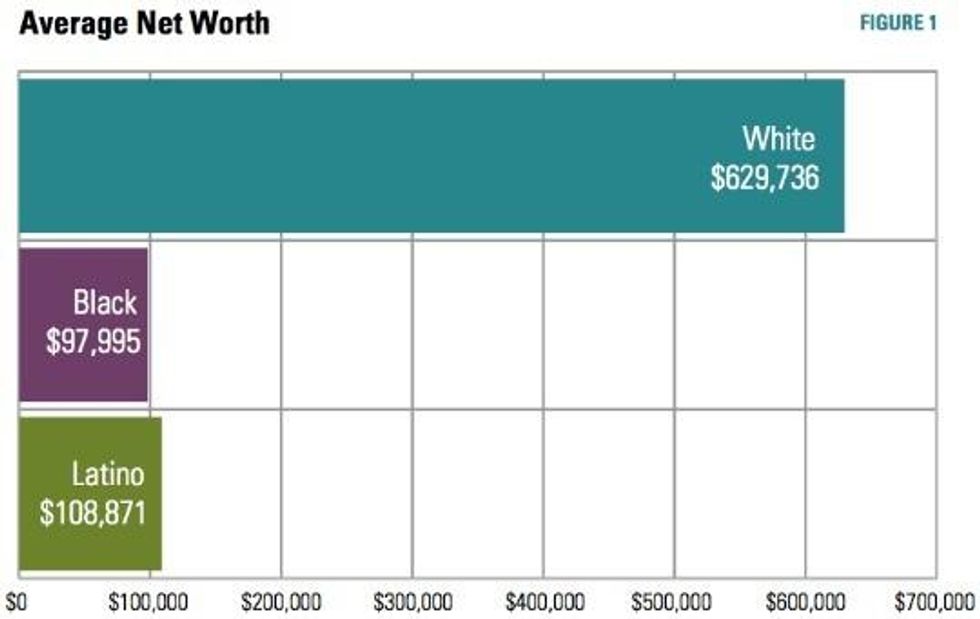

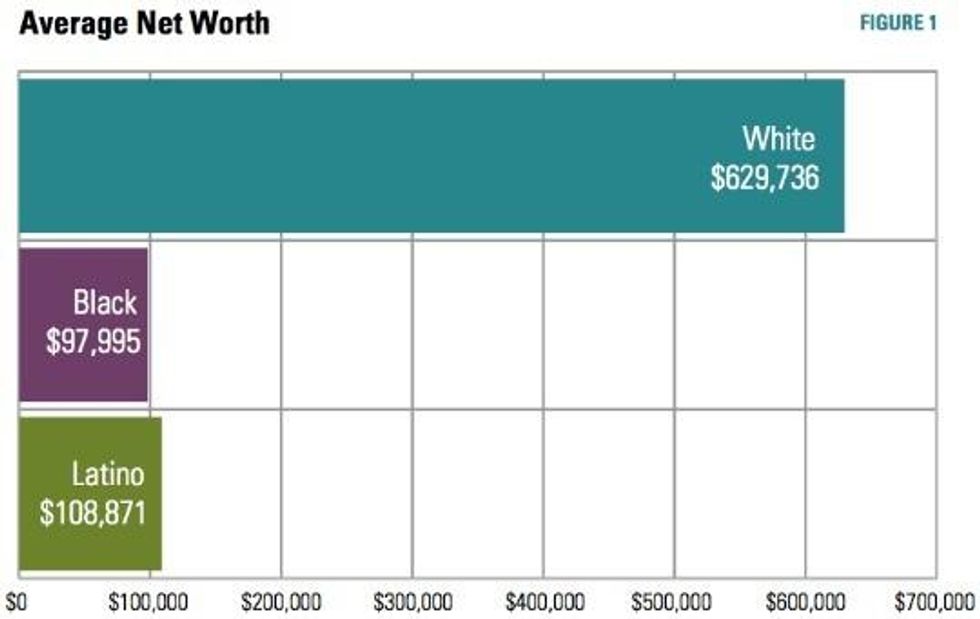

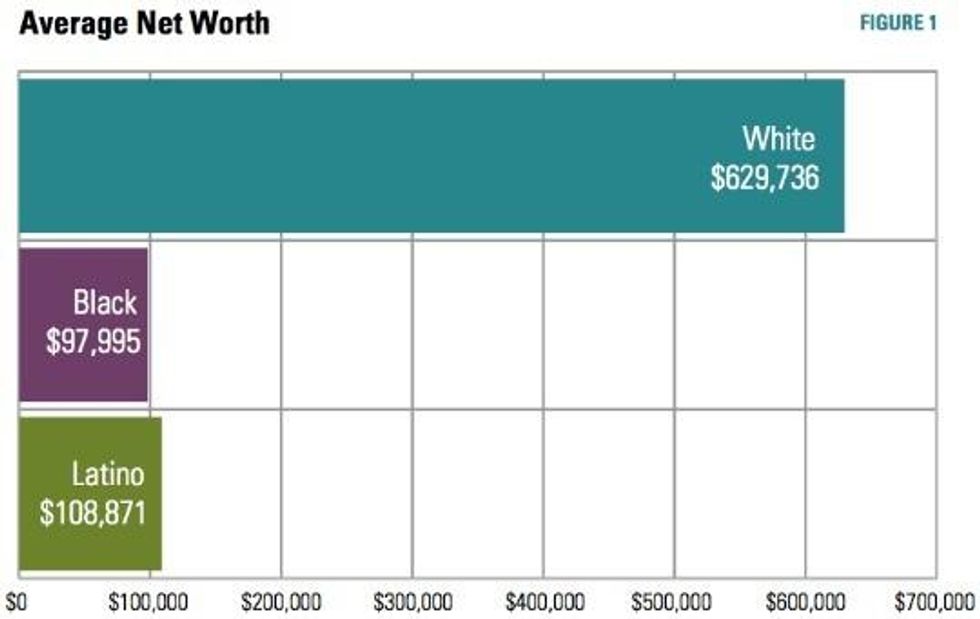

The average net worth of white families is more than six times higher than that of the average black family and 5.7 times greater than that of latino families, according to the tenth annual State of the Dream (pdf) report issued by the progressive economic group United For a Fair Economy.

"Dr. King devoted the last years of his life to challenging economic injustice and the vast racial economic divide, but his work remains unfinished," the study's executive summary states. "Black and latino families continue to face significant economic disadvantages relative to white families."

Black and latino families faced a "shocking" loss of wealth between 2007 and 2010: the average net wealth of white families decreased by 6.7 percent, but black families lost 27.1 percent of their average net wealth, and latino families 41.3 percent. Black and latino families also carry substantially more debt than white families.

"We focus on wealth disparities because it is linked to a host of other socioeconomic inequities - health, education, income, opportunities and economic security among them. If we seriously reduce wealth inequity, it would go a long way toward resolving many of the other inequities," says Brian Miller, Executive Director of UFE and co-author of the report.

The report describes how many aspects of financial inequality are largely due to the disparity in housing assets, where personal wealth is often held.

"The vast, overwhelmingly white middle class that emerged in the post-WWII period did so in large part because of public policies including the GI Bill and FHA-guaranteed loans the benefits of which were largely denied to people of color," says the report.

Furthermore, while many homeowners borrowed against the value of their homes during the "housing bubble" of 2007-2010, when the bubble burst, "predatory lenders increasingly targeted borrowers of color with higher cost loans than were necessary ... [leaving] black and latino families in a worse financial position than their white counterparts."

"The hemorrhaging of wealth in communities of color stems largely from treating housing policy as an asset-building policy, rather than as two distinct strategies," says co-author Tim Sullivan. "By trying to do housing and asset-building with the same policy, we're actually doing neither of them well."

The information contained in the report comes as no surprise. The 2012 "State of the Dream" reported that census figures predicted the although the US would be a majority minority nation by 2042, if the trends of the last 30 years continue, the economic racial divide would increase.

United for a Fair Economy advocates for, among other changes, wealth-building policies and tax breaks focused more on "those who need it most, regardless of whether or not they are homeowners."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Fifty years after Martin Luther King Jr.'s "I Have a Dream" speech, the hope for economic justice and equality is still a long way off for most minorities in the U.S., says a new report released Monday.

The average net worth of white families is more than six times higher than that of the average black family and 5.7 times greater than that of latino families, according to the tenth annual State of the Dream (pdf) report issued by the progressive economic group United For a Fair Economy.

"Dr. King devoted the last years of his life to challenging economic injustice and the vast racial economic divide, but his work remains unfinished," the study's executive summary states. "Black and latino families continue to face significant economic disadvantages relative to white families."

Black and latino families faced a "shocking" loss of wealth between 2007 and 2010: the average net wealth of white families decreased by 6.7 percent, but black families lost 27.1 percent of their average net wealth, and latino families 41.3 percent. Black and latino families also carry substantially more debt than white families.

"We focus on wealth disparities because it is linked to a host of other socioeconomic inequities - health, education, income, opportunities and economic security among them. If we seriously reduce wealth inequity, it would go a long way toward resolving many of the other inequities," says Brian Miller, Executive Director of UFE and co-author of the report.

The report describes how many aspects of financial inequality are largely due to the disparity in housing assets, where personal wealth is often held.

"The vast, overwhelmingly white middle class that emerged in the post-WWII period did so in large part because of public policies including the GI Bill and FHA-guaranteed loans the benefits of which were largely denied to people of color," says the report.

Furthermore, while many homeowners borrowed against the value of their homes during the "housing bubble" of 2007-2010, when the bubble burst, "predatory lenders increasingly targeted borrowers of color with higher cost loans than were necessary ... [leaving] black and latino families in a worse financial position than their white counterparts."

"The hemorrhaging of wealth in communities of color stems largely from treating housing policy as an asset-building policy, rather than as two distinct strategies," says co-author Tim Sullivan. "By trying to do housing and asset-building with the same policy, we're actually doing neither of them well."

The information contained in the report comes as no surprise. The 2012 "State of the Dream" reported that census figures predicted the although the US would be a majority minority nation by 2042, if the trends of the last 30 years continue, the economic racial divide would increase.

United for a Fair Economy advocates for, among other changes, wealth-building policies and tax breaks focused more on "those who need it most, regardless of whether or not they are homeowners."

Fifty years after Martin Luther King Jr.'s "I Have a Dream" speech, the hope for economic justice and equality is still a long way off for most minorities in the U.S., says a new report released Monday.

The average net worth of white families is more than six times higher than that of the average black family and 5.7 times greater than that of latino families, according to the tenth annual State of the Dream (pdf) report issued by the progressive economic group United For a Fair Economy.

"Dr. King devoted the last years of his life to challenging economic injustice and the vast racial economic divide, but his work remains unfinished," the study's executive summary states. "Black and latino families continue to face significant economic disadvantages relative to white families."

Black and latino families faced a "shocking" loss of wealth between 2007 and 2010: the average net wealth of white families decreased by 6.7 percent, but black families lost 27.1 percent of their average net wealth, and latino families 41.3 percent. Black and latino families also carry substantially more debt than white families.

"We focus on wealth disparities because it is linked to a host of other socioeconomic inequities - health, education, income, opportunities and economic security among them. If we seriously reduce wealth inequity, it would go a long way toward resolving many of the other inequities," says Brian Miller, Executive Director of UFE and co-author of the report.

The report describes how many aspects of financial inequality are largely due to the disparity in housing assets, where personal wealth is often held.

"The vast, overwhelmingly white middle class that emerged in the post-WWII period did so in large part because of public policies including the GI Bill and FHA-guaranteed loans the benefits of which were largely denied to people of color," says the report.

Furthermore, while many homeowners borrowed against the value of their homes during the "housing bubble" of 2007-2010, when the bubble burst, "predatory lenders increasingly targeted borrowers of color with higher cost loans than were necessary ... [leaving] black and latino families in a worse financial position than their white counterparts."

"The hemorrhaging of wealth in communities of color stems largely from treating housing policy as an asset-building policy, rather than as two distinct strategies," says co-author Tim Sullivan. "By trying to do housing and asset-building with the same policy, we're actually doing neither of them well."

The information contained in the report comes as no surprise. The 2012 "State of the Dream" reported that census figures predicted the although the US would be a majority minority nation by 2042, if the trends of the last 30 years continue, the economic racial divide would increase.

United for a Fair Economy advocates for, among other changes, wealth-building policies and tax breaks focused more on "those who need it most, regardless of whether or not they are homeowners."