The US trend to continually lower tax rates for the country's wealthiest in the name of economic growth is deeply flawed, says an updated non-partisan government report that shows tax cuts for the rich--most recently exemplified by the Bush-era tax cuts--serve mostly to increase income inequality by redistributing wealth to the top while doing little or nothing to help the broader economy.

The government report is additionally interesting because an earlier version of it was met with protest when it was first released in the months just ahead of national elections. Ultimately the analysis was pulled because Republican members of Congress, unhappy with its findings, challenged the author's methodology.

Still, the updated report by the non-partisan Congressional Research Service, Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945 (pdf), eviscerates the redundant rhetoric of the nation's corporate and governing elite that says decreasing the tax rates for the wealthy is good for everyone and gives further support to progressive economic models that have shown such rates simply increase the distance between society's haves and have-nots.

Specifically designed to look for evidence of growth being positively impacted by tax cuts for the rich, the report says there was "no evidence" to be found that "the 65-year reduction in the top statutory tax rates" had done anything to improve wider economic growth.

As the report explains:

Throughout the late-1940s and 1950s, the top marginal tax rate was typically above 90%; today it is 35%. Additionally, the top capital gains tax rate was 25% in the 1950s and 1960s, 35% in the 1970s; today it is 15%. The real GDP growth rate averaged 4.2% and real per capita GDP increased annually by 2.4% in the 1950s. In the 2000s, the average real GDP growth rate was 1.7% and real per capita GDP increased annually by less than 1%.

"What this report demonstrates is at the core of the debate we're having right now," Maryland Rep. Chris Van Hollen, the top Democrat on the House Budget Committee, told the Huffington Post, referring to the ongoing fiscal talks in Washington. The report, he added, puts "a stake in the heart of the Republican argument that small increases in marginal tax rates for wealthy individuals somehow hurt economic growth."

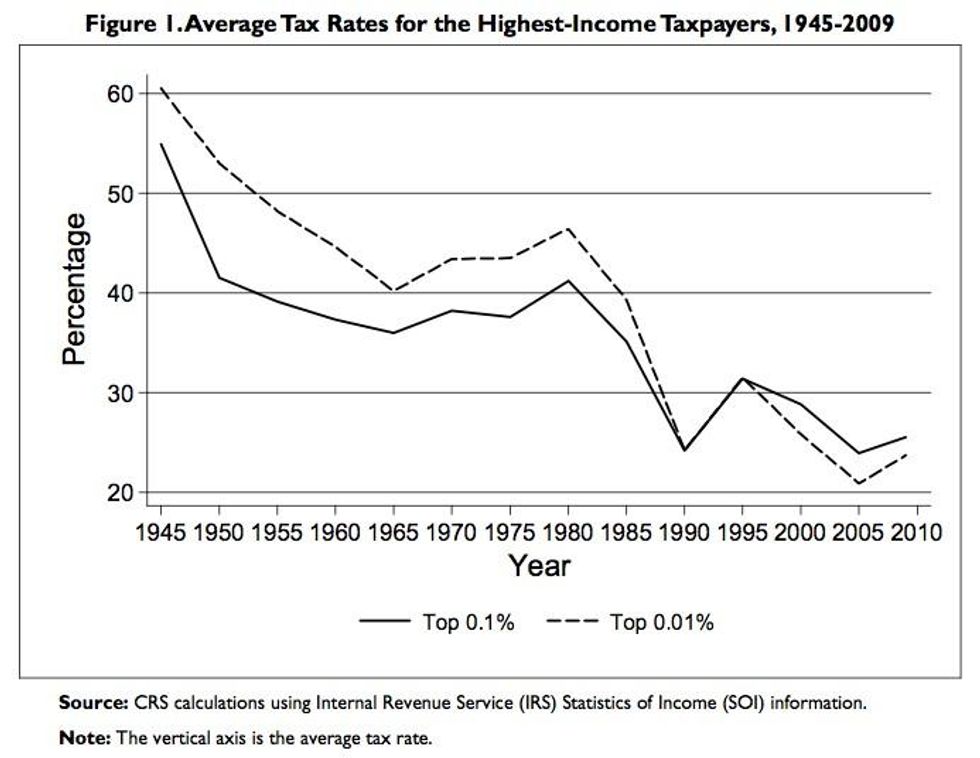

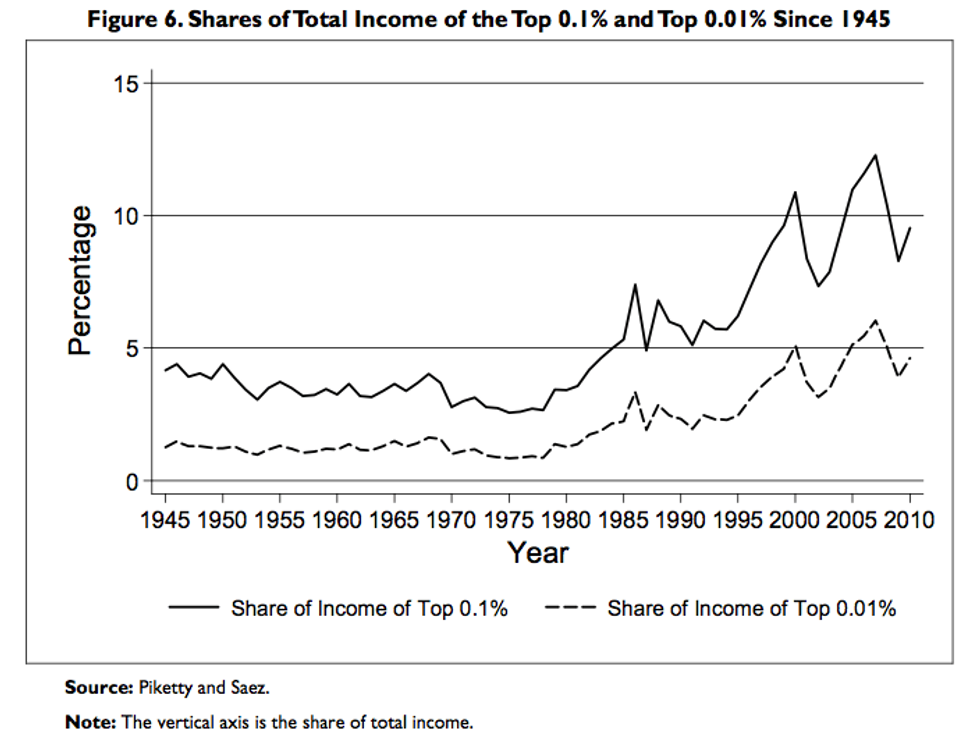

To the contrary, the report states: "The top tax rate reductions appear to be associated with the increasing concentration of income at the top of the income distribution."

As the following graphs from the report illustrate:

" Republicans tried to suppress this evidence," Van Hollen said. "They tried to prevent this report from seeing the light of day because they don't like any evidence that exposes the fiction of their economic theory."

Speaking to previous suppression of the report, the New York Times reported in early November, Nonpartisan Tax Report Withdrawn After G.O.P. Protest:

The Congressional Research Service has withdrawn an economic report that found no correlation between top tax rates and economic growth, a central tenet of conservative economic theory, after Senate Republicans raised concerns about the paper's findings and wording.

The decision, made in late September against the advice of the agency's economic team leadership, drew almost no notice at the time. Senator Charles E. Schumer, Democrat of New York, cited the study a week and a half after it was withdrawn in a speech on tax policy at the National Press Club.

But it could actually draw new attention to the report, which questions the premise that lowering the top marginal tax rate stimulates economic growth and job creation.

"This has hues of a banana republic," Mr. Schumer said. "They didn't like a report, and instead of rebutting it, they had them take it down."

Republicans did not say whether they had asked the research service, a nonpartisan arm of the Library of Congress, to take the report out of circulation, but they were clear that they protested its tone and findings.

_____________________