Student Debt Hits Record 1 in 5 US Households

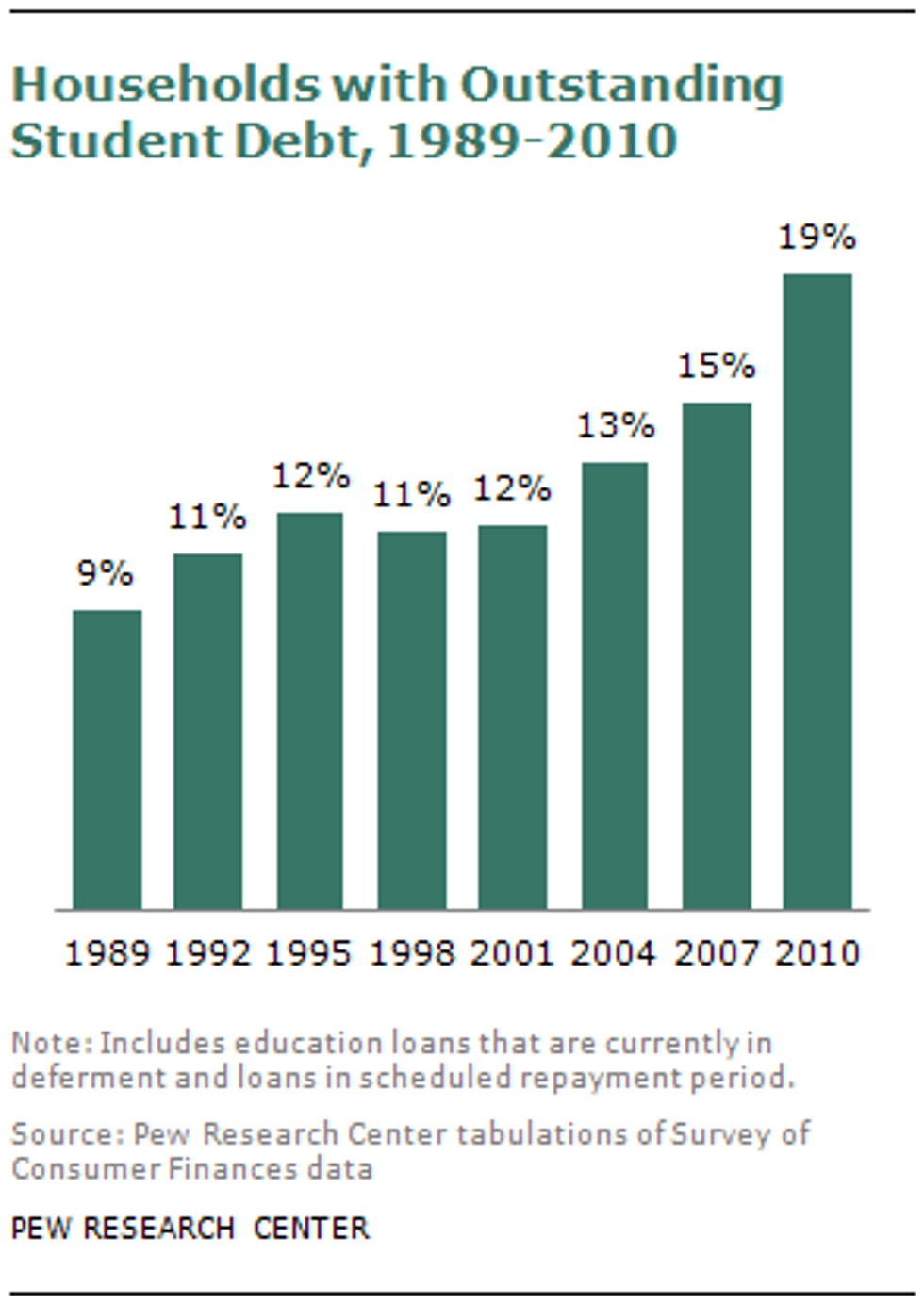

Nearly one in five American households are now strapped with student debt, a new record for the US public, according to a new report by the Pew Research Center.

According to the analysis, 22.4 million households, 19 percent, had college debt in 2010, double that of households in 1989, and 15 percent more than 2007, showing increased velocity. 2007-2010 showed the fastest three-year increase in student debt in more than two decades.

The report cites soaring tuition costs as well as a marked increase in college enrollment, due to a lack of jobs in the economic recession, as the major causes of the heavy increase in student debt.

Adding to the weight of the debt is the continued faltering of the economy, which supplies fewer college grads with jobs after graduation, making it difficult to begin payments on the high interest loans.

According to Pew, the biggest burdens of debt are falling on the young and poor. The documented debt burden, when compared with income, was the greatest for the poorest 20 percent of households, who make less than $21,044. Young U.S. households (age 35 and below) share the highest amount of college debt, making up 40 percent of debtors.

The report, released Wednesday, is based on the Survey of Consumer Finances, which is conducted every three years; thus, the latest data comes from 2010. The total amount of student debt in the US surpassed the $1 trillion mark in 2012. The next debt survey will be conducted between 2010 and 2013.

Noting that college enrollment has continued to climb since 2010, Richard Fry, a senior economist at Pew stated : "Until college enrollment peaks, I would not expect the amount of outstanding student debt to level off."

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

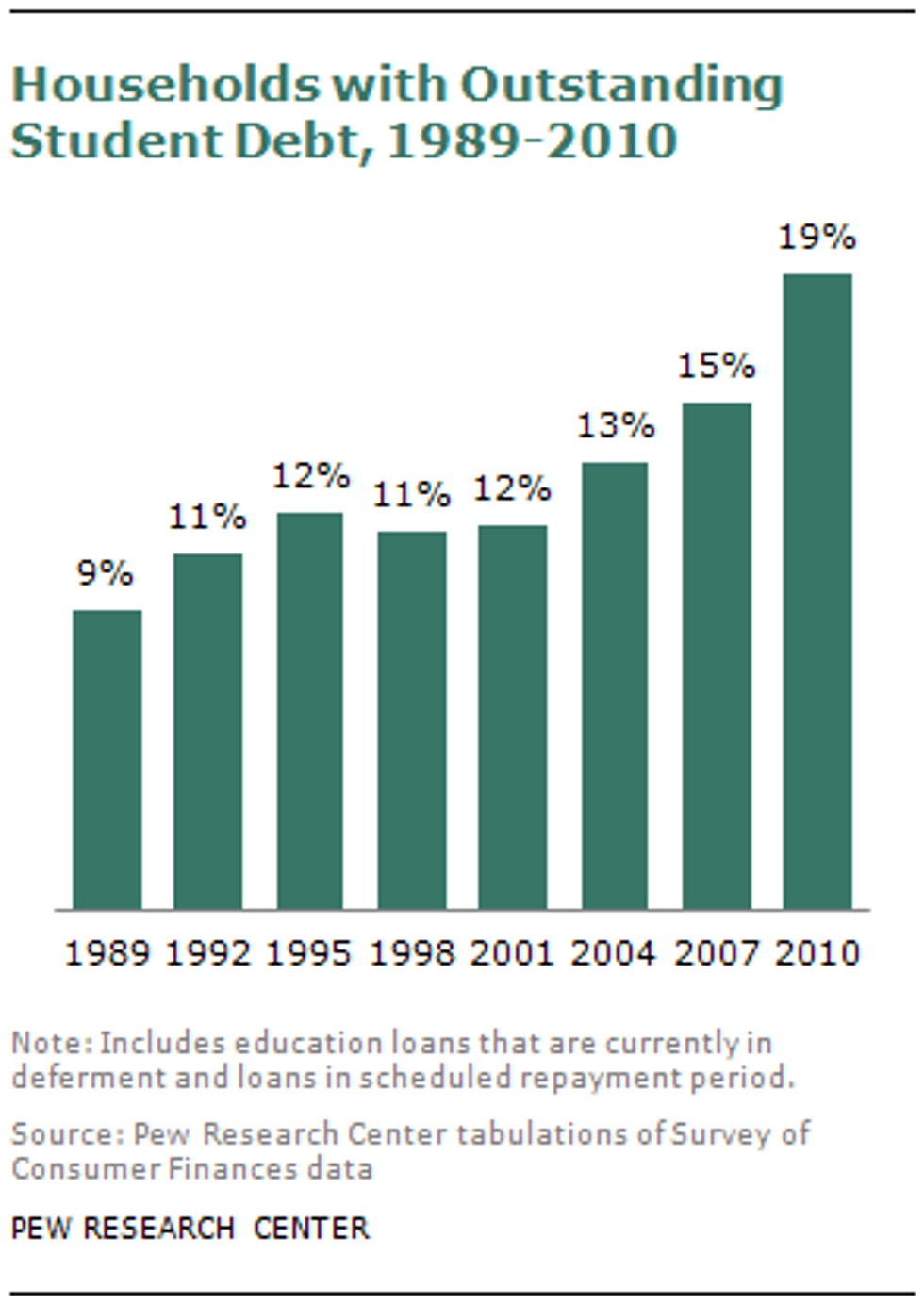

Nearly one in five American households are now strapped with student debt, a new record for the US public, according to a new report by the Pew Research Center.

According to the analysis, 22.4 million households, 19 percent, had college debt in 2010, double that of households in 1989, and 15 percent more than 2007, showing increased velocity. 2007-2010 showed the fastest three-year increase in student debt in more than two decades.

The report cites soaring tuition costs as well as a marked increase in college enrollment, due to a lack of jobs in the economic recession, as the major causes of the heavy increase in student debt.

Adding to the weight of the debt is the continued faltering of the economy, which supplies fewer college grads with jobs after graduation, making it difficult to begin payments on the high interest loans.

According to Pew, the biggest burdens of debt are falling on the young and poor. The documented debt burden, when compared with income, was the greatest for the poorest 20 percent of households, who make less than $21,044. Young U.S. households (age 35 and below) share the highest amount of college debt, making up 40 percent of debtors.

The report, released Wednesday, is based on the Survey of Consumer Finances, which is conducted every three years; thus, the latest data comes from 2010. The total amount of student debt in the US surpassed the $1 trillion mark in 2012. The next debt survey will be conducted between 2010 and 2013.

Noting that college enrollment has continued to climb since 2010, Richard Fry, a senior economist at Pew stated : "Until college enrollment peaks, I would not expect the amount of outstanding student debt to level off."

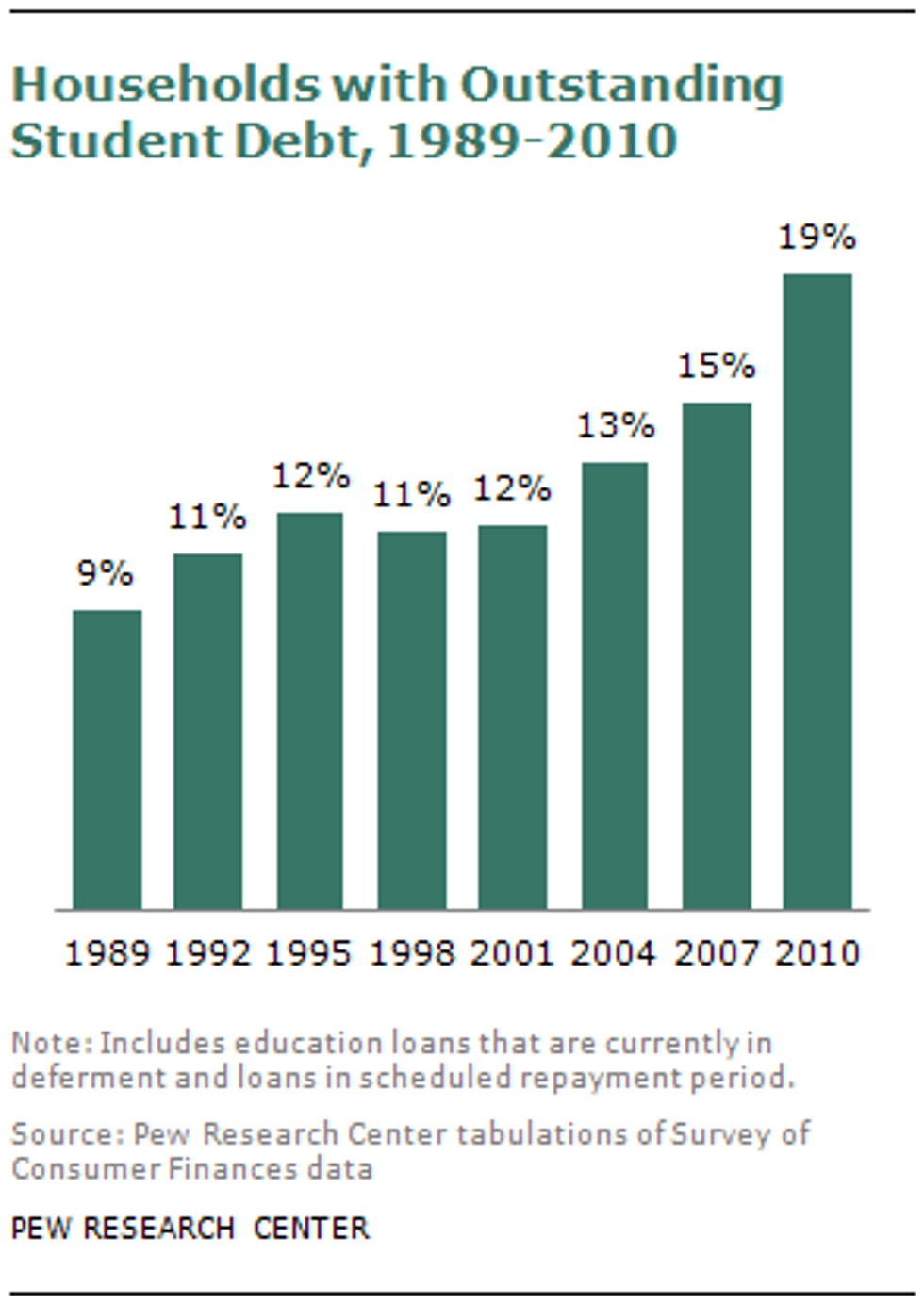

Nearly one in five American households are now strapped with student debt, a new record for the US public, according to a new report by the Pew Research Center.

According to the analysis, 22.4 million households, 19 percent, had college debt in 2010, double that of households in 1989, and 15 percent more than 2007, showing increased velocity. 2007-2010 showed the fastest three-year increase in student debt in more than two decades.

The report cites soaring tuition costs as well as a marked increase in college enrollment, due to a lack of jobs in the economic recession, as the major causes of the heavy increase in student debt.

Adding to the weight of the debt is the continued faltering of the economy, which supplies fewer college grads with jobs after graduation, making it difficult to begin payments on the high interest loans.

According to Pew, the biggest burdens of debt are falling on the young and poor. The documented debt burden, when compared with income, was the greatest for the poorest 20 percent of households, who make less than $21,044. Young U.S. households (age 35 and below) share the highest amount of college debt, making up 40 percent of debtors.

The report, released Wednesday, is based on the Survey of Consumer Finances, which is conducted every three years; thus, the latest data comes from 2010. The total amount of student debt in the US surpassed the $1 trillion mark in 2012. The next debt survey will be conducted between 2010 and 2013.

Noting that college enrollment has continued to climb since 2010, Richard Fry, a senior economist at Pew stated : "Until college enrollment peaks, I would not expect the amount of outstanding student debt to level off."