SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

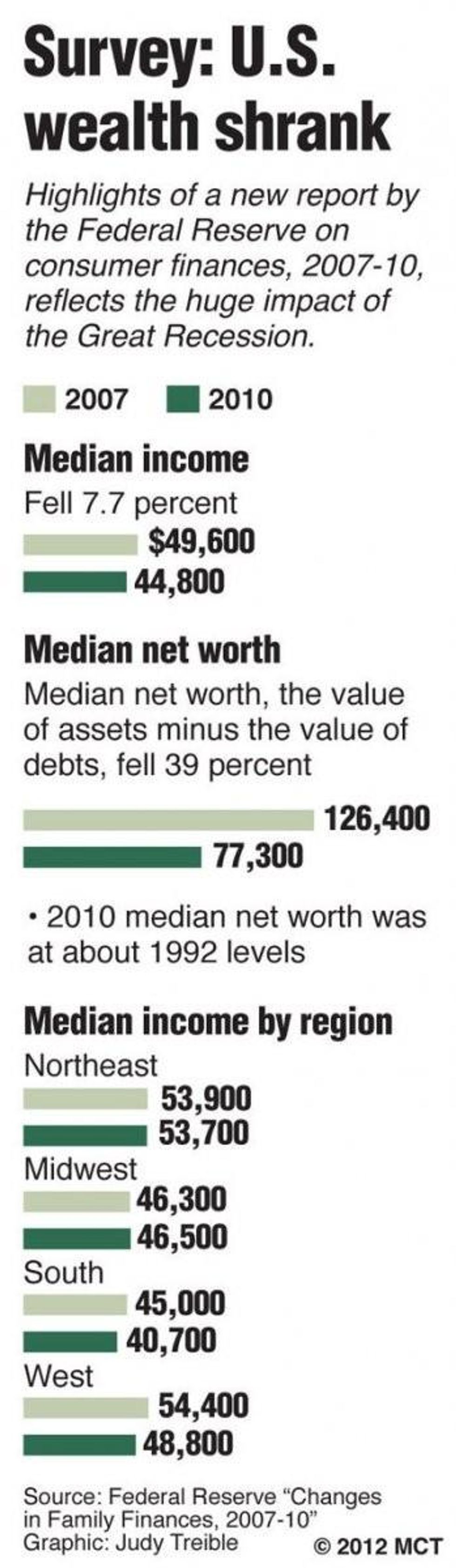

A survey released by Federal Reserve on Monday tells a grim story in numbers what millions of Americans have been feeling in reality for nearly ten years.

The Survey of Consumer Finances, conducted every three years and covering a span from 2007 to 2010, documents steep declines in family income and an overall loss of wealth, mostly fueled by the collapse of the housing market in the US following the subprime mortgage crisis caused by Wall Street in 2008.

The three year period covered by the report followed almost a decade of overall stagnant wages that stemmed from the collapse of the Dot.com bubble in the late nineties.

That, according to the Economic Policy Institute's Larry Mishel who spoke with McClatchy, marked the first time since the end of World War II that workers made almost no progress on wages throughout an entire business cycle.

"It's why I think about it as a lost decade for families," Mishel said.

* * *

McClatchy reports:

"The decline in median income was widespread across demographic groups, with only a few groups experiencing stable or rising incomes," the Fed survey said. "Most noticeably, median incomes moved higher for retirees and other non-working families. The decline in median income was most pronounced among more highly educated families ... and families living in the South and West regions."

The Fed found that median net worth fell 38.9 percent_ from $126,400 in 2007 to $77,300 in 2010. That essentially took net worth back to levels recorded in 1992, and reflects the steep erosion of housing wealth. Middle-class Americans have a greater proportion of net worth tied up in their home than do the rich.

The decline of incomes follows a period from 2000 to 2007 where incomes stayed flat from the end of the Dot.Com recession throughout recovery and until the December 2007 start of the Great Recession. It marked the first time since the end of World War II that workers made almost no progress on wages throughout an entire business cycle, said Larry Mishel, president of the liberal think tank Economic Policy Institute.

"It's why I think about it as a lost decade for families," he said.

The average income for U.S. families, called the mean, fell even more dramatically, by 11.1 percent in the latest Fed survey period. [...]

For the past quarter century, there's been a widening gap between the richest Americans and everyone else. The Fed noted this income disparity and said that the decline in average income of the richest 10 percent between 2007 and 2010 "stands in stark contrast to the generally steady pattern of rising mean incomes at the top of the income distribution over the past two decades."

# # #

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

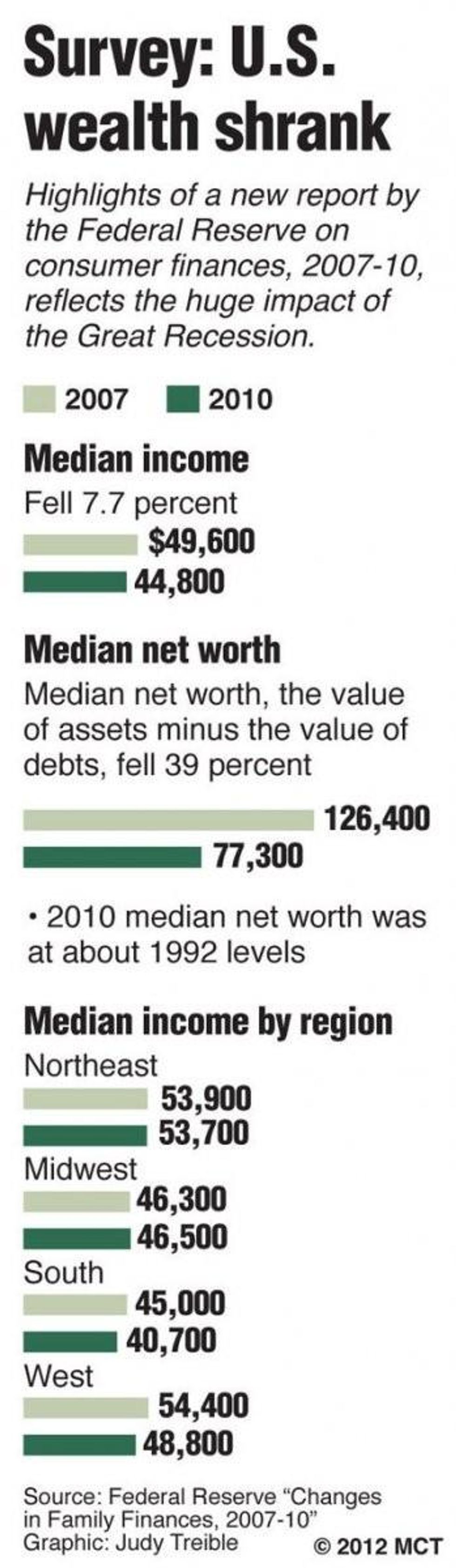

A survey released by Federal Reserve on Monday tells a grim story in numbers what millions of Americans have been feeling in reality for nearly ten years.

The Survey of Consumer Finances, conducted every three years and covering a span from 2007 to 2010, documents steep declines in family income and an overall loss of wealth, mostly fueled by the collapse of the housing market in the US following the subprime mortgage crisis caused by Wall Street in 2008.

The three year period covered by the report followed almost a decade of overall stagnant wages that stemmed from the collapse of the Dot.com bubble in the late nineties.

That, according to the Economic Policy Institute's Larry Mishel who spoke with McClatchy, marked the first time since the end of World War II that workers made almost no progress on wages throughout an entire business cycle.

"It's why I think about it as a lost decade for families," Mishel said.

* * *

McClatchy reports:

"The decline in median income was widespread across demographic groups, with only a few groups experiencing stable or rising incomes," the Fed survey said. "Most noticeably, median incomes moved higher for retirees and other non-working families. The decline in median income was most pronounced among more highly educated families ... and families living in the South and West regions."

The Fed found that median net worth fell 38.9 percent_ from $126,400 in 2007 to $77,300 in 2010. That essentially took net worth back to levels recorded in 1992, and reflects the steep erosion of housing wealth. Middle-class Americans have a greater proportion of net worth tied up in their home than do the rich.

The decline of incomes follows a period from 2000 to 2007 where incomes stayed flat from the end of the Dot.Com recession throughout recovery and until the December 2007 start of the Great Recession. It marked the first time since the end of World War II that workers made almost no progress on wages throughout an entire business cycle, said Larry Mishel, president of the liberal think tank Economic Policy Institute.

"It's why I think about it as a lost decade for families," he said.

The average income for U.S. families, called the mean, fell even more dramatically, by 11.1 percent in the latest Fed survey period. [...]

For the past quarter century, there's been a widening gap between the richest Americans and everyone else. The Fed noted this income disparity and said that the decline in average income of the richest 10 percent between 2007 and 2010 "stands in stark contrast to the generally steady pattern of rising mean incomes at the top of the income distribution over the past two decades."

# # #

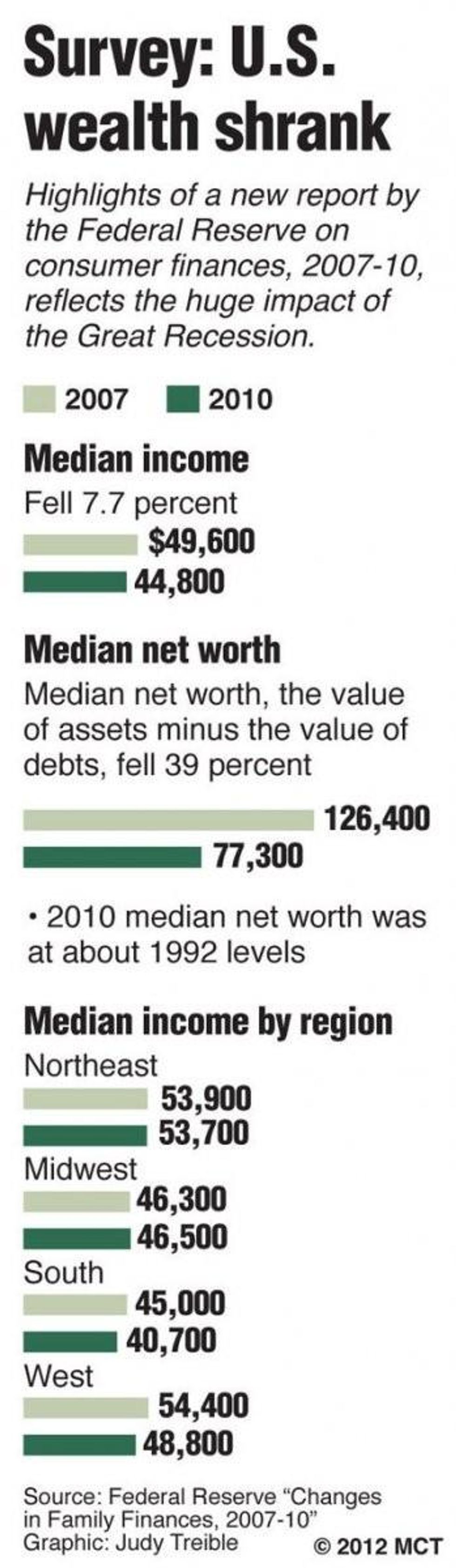

A survey released by Federal Reserve on Monday tells a grim story in numbers what millions of Americans have been feeling in reality for nearly ten years.

The Survey of Consumer Finances, conducted every three years and covering a span from 2007 to 2010, documents steep declines in family income and an overall loss of wealth, mostly fueled by the collapse of the housing market in the US following the subprime mortgage crisis caused by Wall Street in 2008.

The three year period covered by the report followed almost a decade of overall stagnant wages that stemmed from the collapse of the Dot.com bubble in the late nineties.

That, according to the Economic Policy Institute's Larry Mishel who spoke with McClatchy, marked the first time since the end of World War II that workers made almost no progress on wages throughout an entire business cycle.

"It's why I think about it as a lost decade for families," Mishel said.

* * *

McClatchy reports:

"The decline in median income was widespread across demographic groups, with only a few groups experiencing stable or rising incomes," the Fed survey said. "Most noticeably, median incomes moved higher for retirees and other non-working families. The decline in median income was most pronounced among more highly educated families ... and families living in the South and West regions."

The Fed found that median net worth fell 38.9 percent_ from $126,400 in 2007 to $77,300 in 2010. That essentially took net worth back to levels recorded in 1992, and reflects the steep erosion of housing wealth. Middle-class Americans have a greater proportion of net worth tied up in their home than do the rich.

The decline of incomes follows a period from 2000 to 2007 where incomes stayed flat from the end of the Dot.Com recession throughout recovery and until the December 2007 start of the Great Recession. It marked the first time since the end of World War II that workers made almost no progress on wages throughout an entire business cycle, said Larry Mishel, president of the liberal think tank Economic Policy Institute.

"It's why I think about it as a lost decade for families," he said.

The average income for U.S. families, called the mean, fell even more dramatically, by 11.1 percent in the latest Fed survey period. [...]

For the past quarter century, there's been a widening gap between the richest Americans and everyone else. The Fed noted this income disparity and said that the decline in average income of the richest 10 percent between 2007 and 2010 "stands in stark contrast to the generally steady pattern of rising mean incomes at the top of the income distribution over the past two decades."

# # #