In the wake of the financial crisis of 2008 and the recession that followed, huge numbers of US workers lost their jobs, homes were lost to foreclosure, and most found themselves in the most precarious economic shape of their lives. Now, in a new report, evidence shows that as an economic recovery (slight as it was) appeared on the scene, nearly all of it went, not to those struggling, but to the very wealthiest of Americans, many of whom helped lead the economy off the cliff in the first place.

According to a new report, nearly 93% of the economic gains made from 2009 to 2010 went to the wealthiest 1% of Americans. "Top 1% incomes grew by 11.6% while bottom 99% incomes grew only by 0.2%. Hence, the top 1% captured 93% of the income gains in the first year of recovery," reads the report by Emmanuel Saez titled Striking It Richer: The Evolution of Top Incomes in the United States (pdf).

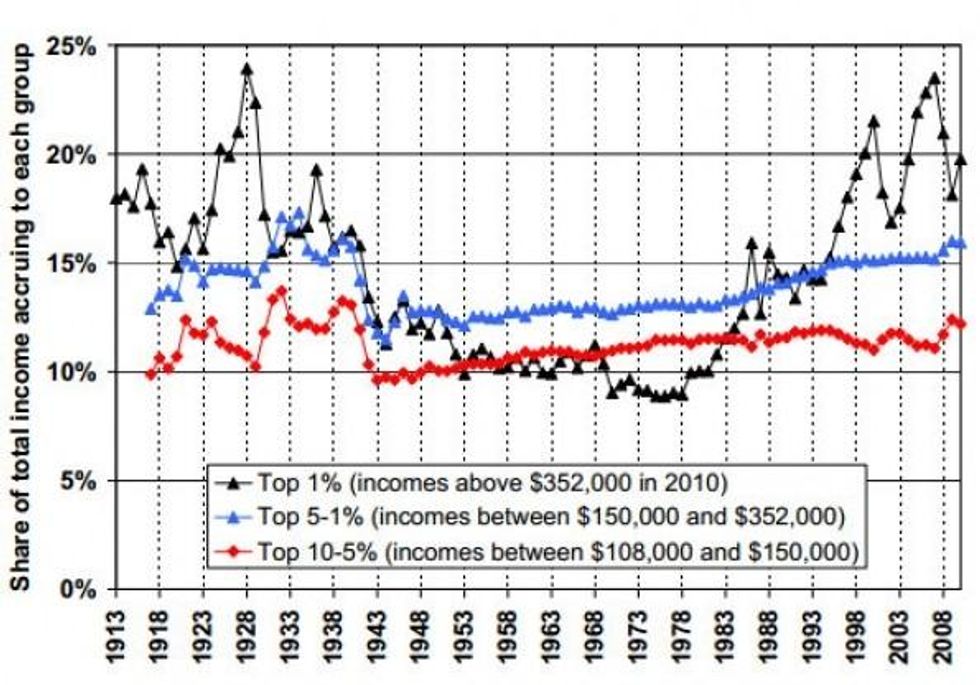

"Such an uneven recovery," writes Saez in the report, "can possibly explain the recent public demonstrations against inequality." And continues by detailing some of the historical context of wealth disparity in the United States, from early part of the 20th century to the present:

The top percentile share declined during WWI, recovered during the 1920s boom, and declined again during the great depression and WWII. This very specific timing, together with the fact that very high incomes account for a disproportionate share of the total decline in inequality, strongly suggests that the shocks incurred by capital owners during 1914 to 1945 (depression and wars) played a key role. Indeed, from 1913 and up to the 1970s, very top incomes were mostly composed of capital income (mostly dividend income) and to a smaller extent business income, the wage income share being very modest. Therefore, the large decline of top incomes observed during the 1914-1960 period is predominantly a capital income phenomenon.

Interestingly, the income composition pattern at the very top has changed considerably over the century. The share of wage and salary income has increased sharply from the 1920s to the present, and especially since the 1970s. Therefore, a significant fraction of the surge in top incomes since 1970 is due to an explosion of top wages and salaries. Indeed, estimates based purely on wages and salaries show that the share of total wages and salaries earned by the top 1 percent wage income earners has jumped from 5.1 percent in 1970 to 12.4 percent in 2007.

A telling chart:

Alexander Eichler, writing at Huffington Post, observes:

Saez's findings suggest that even though the recession dealt a blow to the 1 percent, it did little to push the U.S. off the path it's been on for decades -- that of a vast and growing disparity between the richest and poorest citizens.

Income for most workers has barely risen in the last 30 years, but the top 1 percent of earners have seen their income almost triple in the same amount of time. Economists and other experts say that could be the result of any number of factors, including the decline of labor unions, the explosion in capital gains during the middle part of the aughts, and tax policies put in place in recent years that favor the wealthy.

In his State of the Union address this past January, President Obama called economic fairness "the defining issue of our time," perhaps mindful of the growing number of voters who say they can't even afford basic necessities like food.

The wealth gap has been cited as a major concern for the nationwide Occupy movement, and research has suggested that income inequality might be associated with the kind of underwhelming economic growth the country has experienced for the past two years.

###