SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

The U.S. Bureau of Labor Statistics released seemingly promising figures this morning -- boasting a decrease in the nation's unemployment rate to 8.3 percent, from 8.5 percent in December, totaling 243,000 jobs added. Unemployment is now at its lowest rate since February 2009; however, as these numbers appear to mark our path towards recovery, some economists are warning that we are far from out of the woods.

As Heidi Shierholz at Economic Policy Institute observes:

It's important to keep this growth in context, however - the jobs deficit is so large that even at January's growth rate, it would still take until 2019 to get back to full employment. We need reports this strong and stronger for the next several years to get back to good health in the labor market.

In particular, the numbers on the report do not represent 'long-term' unemployment overall, which has not improved. Fortune reports:

But all this is happening with six million fewer workers even as the population expands. If we delve into January's labor report a little deeper, prospects for the long-term unemployed (those jobless for six months or longer) didn't improve. The long-term unemployment rate was little changed at 5.5 million workers who account for 42.9% of the unemployed.

A new report by the Pew Charitable Trusts looked at the number of Americans unemployed longer than a year -- it's still higher than than in any previous recession since World War II and it roughly equals the population of Oregon. While the number of workers jobless for a year or longer has fallen after reaching historic highs in the aftermath of the Great Recession, there are still more workers in this group than those who had just been laid off. Specifically, 2.8% versus 1.7% of the total labor force.

This probably isn't too surprising. During the height of the latest recession, employers cut plenty of jobs. Today, the biggest U.S. companies sit on record levels of cash reserves as profits soar.

* * *

As Chad Stone at the Center on Budget and Policy Priorities urges, we must not celebrate too soon, as lawmakers should still be encouraged to advance unemployment benefits and support:

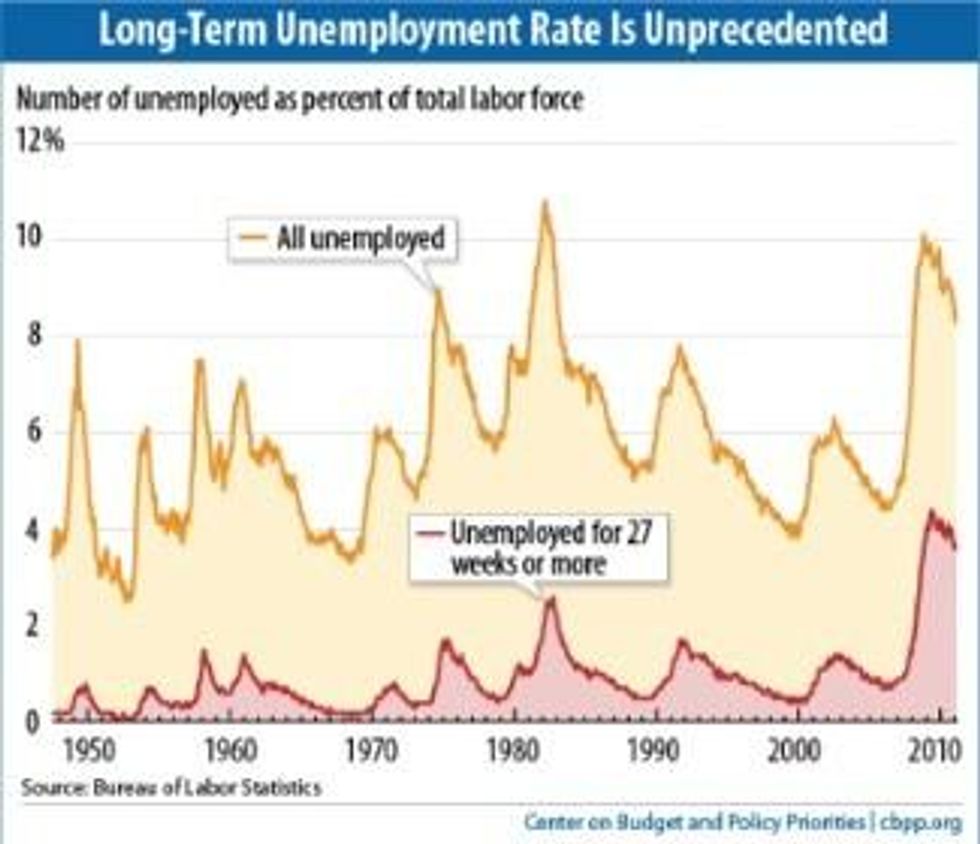

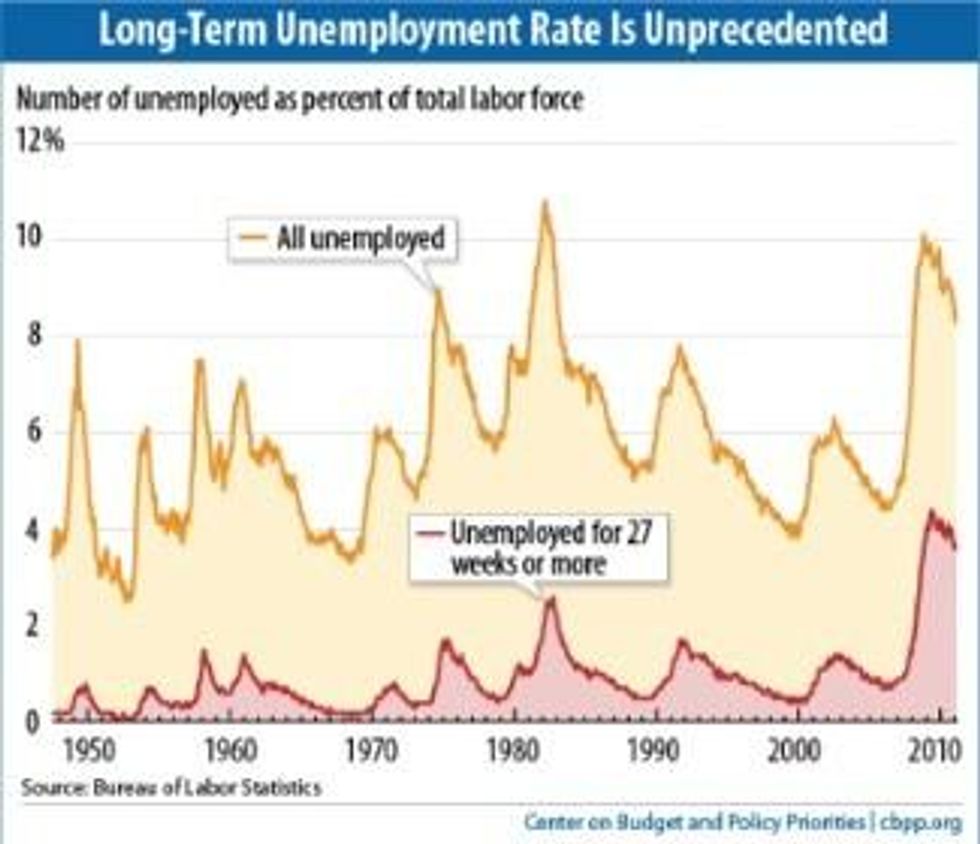

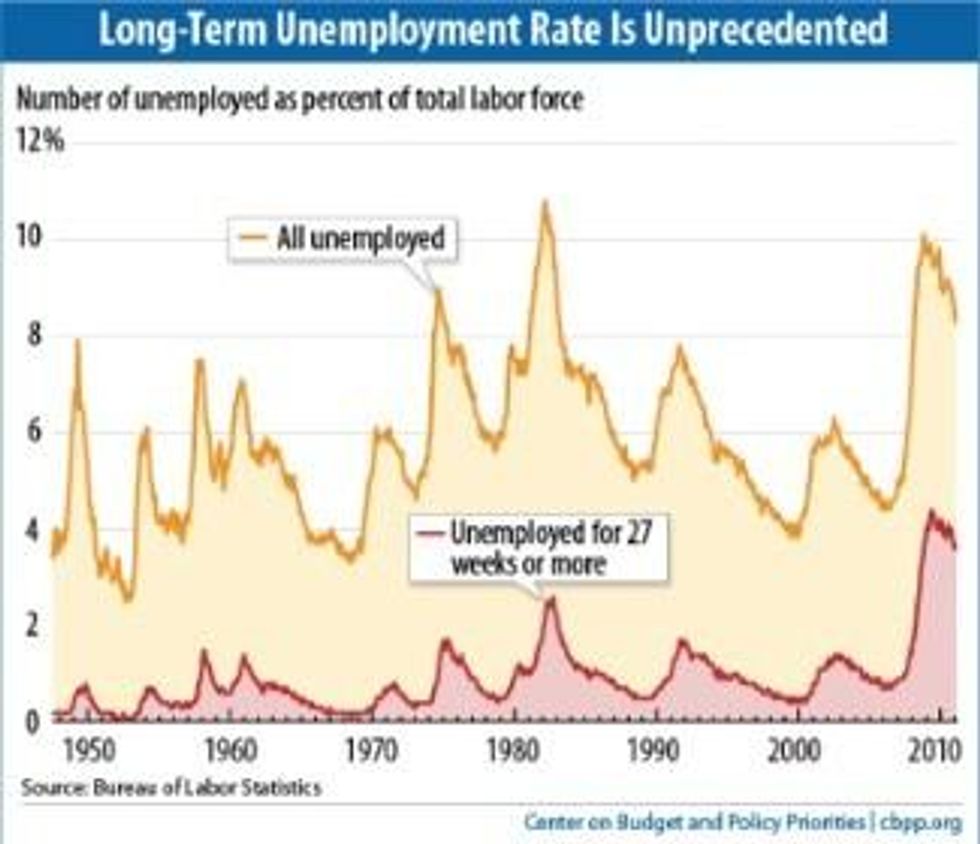

Today's jobs report is encouraging, but we should judge it against the overall sluggishness of the economic recovery and a persistently large jobs deficit that remains after 23 straight months of private-sector job creation. Payroll employment is still 5.6 million jobs short of where it was at the start of the Great Recession in December 2007, there are four jobless workers for every job opening, and long-term unemployment remains at an historic high level (see chart).

Forecasters do not expect a robust recovery anytime soon. The policymaking committee of the Federal Reserve said in its most recent statement that it "expects economic growth over coming quarters to be modest and consequently anticipates that the unemployment rate will decline only gradually." The Congressional Budget Office said in its latest The Budget and Economic Outlook that it "expects that, under current laws governing federal taxes and spending, economic activity will continue to grow slowly over the next two years." [...]

Current economic conditions justify continuing federal emergency [unemployment insurance] UI at the levels in place last year. Reducing the number of weeks of federal benefits, as proposed in the House-passed bill of December, would take purchasing power out of the economy and weaken the recovery. Other proposals in the House bill -- denying benefits to workers with the requisite work history because they lack a high school degree or equivalent, forcing recipients to submit to drug testing, and allowing states to use UI funds for purposes other than paying benefits -- are misguided. They should not be part of the extension of the payroll tax cut and UI now under consideration in Congress.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The U.S. Bureau of Labor Statistics released seemingly promising figures this morning -- boasting a decrease in the nation's unemployment rate to 8.3 percent, from 8.5 percent in December, totaling 243,000 jobs added. Unemployment is now at its lowest rate since February 2009; however, as these numbers appear to mark our path towards recovery, some economists are warning that we are far from out of the woods.

As Heidi Shierholz at Economic Policy Institute observes:

It's important to keep this growth in context, however - the jobs deficit is so large that even at January's growth rate, it would still take until 2019 to get back to full employment. We need reports this strong and stronger for the next several years to get back to good health in the labor market.

In particular, the numbers on the report do not represent 'long-term' unemployment overall, which has not improved. Fortune reports:

But all this is happening with six million fewer workers even as the population expands. If we delve into January's labor report a little deeper, prospects for the long-term unemployed (those jobless for six months or longer) didn't improve. The long-term unemployment rate was little changed at 5.5 million workers who account for 42.9% of the unemployed.

A new report by the Pew Charitable Trusts looked at the number of Americans unemployed longer than a year -- it's still higher than than in any previous recession since World War II and it roughly equals the population of Oregon. While the number of workers jobless for a year or longer has fallen after reaching historic highs in the aftermath of the Great Recession, there are still more workers in this group than those who had just been laid off. Specifically, 2.8% versus 1.7% of the total labor force.

This probably isn't too surprising. During the height of the latest recession, employers cut plenty of jobs. Today, the biggest U.S. companies sit on record levels of cash reserves as profits soar.

* * *

As Chad Stone at the Center on Budget and Policy Priorities urges, we must not celebrate too soon, as lawmakers should still be encouraged to advance unemployment benefits and support:

Today's jobs report is encouraging, but we should judge it against the overall sluggishness of the economic recovery and a persistently large jobs deficit that remains after 23 straight months of private-sector job creation. Payroll employment is still 5.6 million jobs short of where it was at the start of the Great Recession in December 2007, there are four jobless workers for every job opening, and long-term unemployment remains at an historic high level (see chart).

Forecasters do not expect a robust recovery anytime soon. The policymaking committee of the Federal Reserve said in its most recent statement that it "expects economic growth over coming quarters to be modest and consequently anticipates that the unemployment rate will decline only gradually." The Congressional Budget Office said in its latest The Budget and Economic Outlook that it "expects that, under current laws governing federal taxes and spending, economic activity will continue to grow slowly over the next two years." [...]

Current economic conditions justify continuing federal emergency [unemployment insurance] UI at the levels in place last year. Reducing the number of weeks of federal benefits, as proposed in the House-passed bill of December, would take purchasing power out of the economy and weaken the recovery. Other proposals in the House bill -- denying benefits to workers with the requisite work history because they lack a high school degree or equivalent, forcing recipients to submit to drug testing, and allowing states to use UI funds for purposes other than paying benefits -- are misguided. They should not be part of the extension of the payroll tax cut and UI now under consideration in Congress.

The U.S. Bureau of Labor Statistics released seemingly promising figures this morning -- boasting a decrease in the nation's unemployment rate to 8.3 percent, from 8.5 percent in December, totaling 243,000 jobs added. Unemployment is now at its lowest rate since February 2009; however, as these numbers appear to mark our path towards recovery, some economists are warning that we are far from out of the woods.

As Heidi Shierholz at Economic Policy Institute observes:

It's important to keep this growth in context, however - the jobs deficit is so large that even at January's growth rate, it would still take until 2019 to get back to full employment. We need reports this strong and stronger for the next several years to get back to good health in the labor market.

In particular, the numbers on the report do not represent 'long-term' unemployment overall, which has not improved. Fortune reports:

But all this is happening with six million fewer workers even as the population expands. If we delve into January's labor report a little deeper, prospects for the long-term unemployed (those jobless for six months or longer) didn't improve. The long-term unemployment rate was little changed at 5.5 million workers who account for 42.9% of the unemployed.

A new report by the Pew Charitable Trusts looked at the number of Americans unemployed longer than a year -- it's still higher than than in any previous recession since World War II and it roughly equals the population of Oregon. While the number of workers jobless for a year or longer has fallen after reaching historic highs in the aftermath of the Great Recession, there are still more workers in this group than those who had just been laid off. Specifically, 2.8% versus 1.7% of the total labor force.

This probably isn't too surprising. During the height of the latest recession, employers cut plenty of jobs. Today, the biggest U.S. companies sit on record levels of cash reserves as profits soar.

* * *

As Chad Stone at the Center on Budget and Policy Priorities urges, we must not celebrate too soon, as lawmakers should still be encouraged to advance unemployment benefits and support:

Today's jobs report is encouraging, but we should judge it against the overall sluggishness of the economic recovery and a persistently large jobs deficit that remains after 23 straight months of private-sector job creation. Payroll employment is still 5.6 million jobs short of where it was at the start of the Great Recession in December 2007, there are four jobless workers for every job opening, and long-term unemployment remains at an historic high level (see chart).

Forecasters do not expect a robust recovery anytime soon. The policymaking committee of the Federal Reserve said in its most recent statement that it "expects economic growth over coming quarters to be modest and consequently anticipates that the unemployment rate will decline only gradually." The Congressional Budget Office said in its latest The Budget and Economic Outlook that it "expects that, under current laws governing federal taxes and spending, economic activity will continue to grow slowly over the next two years." [...]

Current economic conditions justify continuing federal emergency [unemployment insurance] UI at the levels in place last year. Reducing the number of weeks of federal benefits, as proposed in the House-passed bill of December, would take purchasing power out of the economy and weaken the recovery. Other proposals in the House bill -- denying benefits to workers with the requisite work history because they lack a high school degree or equivalent, forcing recipients to submit to drug testing, and allowing states to use UI funds for purposes other than paying benefits -- are misguided. They should not be part of the extension of the payroll tax cut and UI now under consideration in Congress.