SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

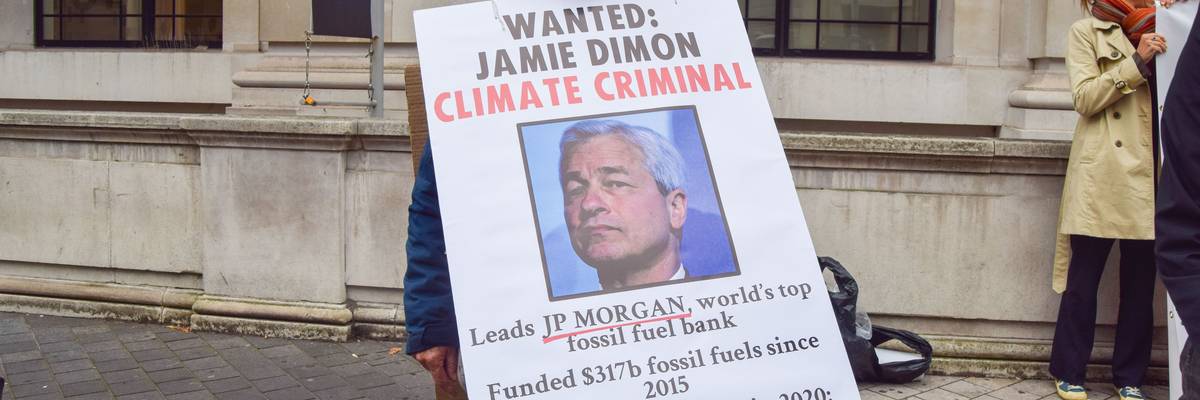

An activist holds a sign depicting JPMorgan Chase CEO Jamie Dimon and detailing information about the bank's fossil fuel financing at a protest in London on October 19, 2021.

"It's time for big banks to listen to the science and stop funding climate destruction," said one advocate.

As the fossil fuel-driven climate crisis continues to wreak havoc around the globe, more than 1,300 scientists and researchers on Monday published a letter imploring JPMorgan Chase shareholders to support a resolution that asks the financial giant's board of directors to "adopt a policy for a time-bound phaseout" of bankrolling new coal, oil, and gas projects.

The resolution in question is being proposed at the bank's annual meeting on May 16. If passed, "this resolution would encourage JPMorgan Chase to stop providing financing, including loans, bonds, and underwriting, to companies engaged in fossil fuel expansion," states the letter, which was led by prominent climate experts in partnership with the Union of Concerned Scientists (UCS) and Stop the Money Pipeline (STMP). "By making this commitment, JPMorgan Chase could signal its intention to advance the clean energy transition and help ensure a safer future for people and our planet."

Arielle Swernoff, U.S. Banks Campaign Manager at STMP, said in a statement that "the science is clear: in order to reduce emissions in line with the Paris agreement, fossil fuel expansion must stop now, yet JPMorgan Chase and other big banks like Citi, Wells Fargo, and Bank of America continue to pour money into new oil, gas, and coal."

"Big banks must be held accountable for their role in causing the climate crisis."

Despite pledging to put themselves and their clients on a path to "net-zero" greenhouse gas emissions, the world's 60 largest private banks pumped $4.6 trillion into coal, oil, and gas projects from 2016 to 2021. The four U.S. financial behemoths mentioned by Swernoff are responsible for a quarter of all fossil fuel financing identified since the Paris agreement entered into force. JPMorgan Chase alone provided more than $382 billion to coal, oil, and gas firms during the aforementioned six-year period, including $65.4 billion to the 20 corporations doing the most to ramp up the extraction of planet-heating fossil fuels.

"Over 1,300 scientists have come together to say: enough is enough," said Swernoff. "It's time for big banks to listen to the science and stop funding climate destruction."

Kathy Mulvey, director of the Climate Accountability Campaign at UCS, stressed that "as people around the world face climate-related extreme weather disasters, threats to public health, and systemic economic risk, big banks are choosing to ignore climate science by providing billions of dollars in financing to fossil fuel companies that continue to expand their production of oil and gas."

"JPMorgan Chase and other financial institutions are continuing to mislead shareholders about what is needed to reach global climate goals and instead seeking to maintain a dangerous status quo that prioritizes profit over people and the environment," said Mulvey. "To safeguard communities, investors, and the global economy, shareholders should insist that banks incentivize swift and deep cuts in heat-trapping emissions to limit climate change harms and facilitate a just transition to a clean energy economy."

Mulvey was echoed by Ayana Elizabeth Johnson, co-founder of the Urban Ocean Lab and a lead signatory of the letter.

"To avoid the most dangerous levels of planetary warming, we must rapidly end our reliance on fossil fuels and transition to a clean energy economy that meets the needs of all communities," said Johnson. "Meanwhile, financial institutions like JPMorgan Chase are funding continued expansion of the fossil fuel industry, even as all the warning signs for our planet are flashing red."

Last week, data from the U.S. National Oceanic and Atmospheric Administration showed that annual emissions of carbon dioxide, methane, and nitrous oxide increased again in 2022, pushing atmospheric concentrations of the three main heat-trapping gases to all-time highs.

The Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency have made clear that increasing fossil fuel supply is incompatible with limiting global warming to 1.5°C above preindustrial levels, beyond which the planetary emergency's consequences will grow worse.

Roughly 1.1°C of warming since the late 1800s is already fueling increasingly frequent and intense extreme weather across the globe. In 2022, the U.S. alone experienced 18 separate billion-dollar disasters turbocharged by climate change, including droughts, wildfires, and hurricanes. Together, these events killed 474 people and cost an estimated $172 billion. Such catastrophes disproportionately hurt low-income populations in the U.S., and the deleterious public health and economic impacts of unmitigated greenhouse gas pollution are even more severe in poor nations that bear the least responsibility for the crisis.

"JPMorgan Chase and other financial institutions are... seeking to maintain a dangerous status quo that prioritizes profit over people and the environment."

After the IPCC released its latest assessment report last month, U.N. Secretary-General António Guterres said that limiting global warming to 1.5°C is possible, "but it will take a quantum leap in climate action," including a prohibition on approving and financing new coal, oil, and gas projects as well as a phaseout of existing fossil fuel production.

Despite ample evidence that burning more coal, oil, and gas will exacerbate the deadly effects of the climate crisis, profit-hungry fossil fuel corporations—supported by trillions of dollars in annual subsidies and industry-friendly public policies—are moving ahead with plans to expand drilling.

A pair of scholars recently introduced the novel legal theory of "climate homicide," which aims to hold fossil fuel corporations criminally liable for deaths caused by the disasters they are knowingly unleashing.

Johnson insisted Monday that like Big Oil, "big banks must be held accountable for their role in causing the climate crisis."

"Shareholders," she added, "should insist that banks accelerate and deepen investment in a just, clean energy future."

According to the letter: "JPMorgan Chase is an internationally known and respected bank. By ending support for fossil fuel expansion, it could help set the global stage for a just transition to a more sustainable and livable future while acting decisively to protect its shareholders and the wider economy from the financial shocks associated with worsening climate change."

"This is no less than what science requires to keep our planet a livable place for current and future generations, including our children and grandchildren," the letter continues. "Please use your vote at this year's shareholder meeting to help protect people and our planet from climate chaos."

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

As the fossil fuel-driven climate crisis continues to wreak havoc around the globe, more than 1,300 scientists and researchers on Monday published a letter imploring JPMorgan Chase shareholders to support a resolution that asks the financial giant's board of directors to "adopt a policy for a time-bound phaseout" of bankrolling new coal, oil, and gas projects.

The resolution in question is being proposed at the bank's annual meeting on May 16. If passed, "this resolution would encourage JPMorgan Chase to stop providing financing, including loans, bonds, and underwriting, to companies engaged in fossil fuel expansion," states the letter, which was led by prominent climate experts in partnership with the Union of Concerned Scientists (UCS) and Stop the Money Pipeline (STMP). "By making this commitment, JPMorgan Chase could signal its intention to advance the clean energy transition and help ensure a safer future for people and our planet."

Arielle Swernoff, U.S. Banks Campaign Manager at STMP, said in a statement that "the science is clear: in order to reduce emissions in line with the Paris agreement, fossil fuel expansion must stop now, yet JPMorgan Chase and other big banks like Citi, Wells Fargo, and Bank of America continue to pour money into new oil, gas, and coal."

"Big banks must be held accountable for their role in causing the climate crisis."

Despite pledging to put themselves and their clients on a path to "net-zero" greenhouse gas emissions, the world's 60 largest private banks pumped $4.6 trillion into coal, oil, and gas projects from 2016 to 2021. The four U.S. financial behemoths mentioned by Swernoff are responsible for a quarter of all fossil fuel financing identified since the Paris agreement entered into force. JPMorgan Chase alone provided more than $382 billion to coal, oil, and gas firms during the aforementioned six-year period, including $65.4 billion to the 20 corporations doing the most to ramp up the extraction of planet-heating fossil fuels.

"Over 1,300 scientists have come together to say: enough is enough," said Swernoff. "It's time for big banks to listen to the science and stop funding climate destruction."

Kathy Mulvey, director of the Climate Accountability Campaign at UCS, stressed that "as people around the world face climate-related extreme weather disasters, threats to public health, and systemic economic risk, big banks are choosing to ignore climate science by providing billions of dollars in financing to fossil fuel companies that continue to expand their production of oil and gas."

"JPMorgan Chase and other financial institutions are continuing to mislead shareholders about what is needed to reach global climate goals and instead seeking to maintain a dangerous status quo that prioritizes profit over people and the environment," said Mulvey. "To safeguard communities, investors, and the global economy, shareholders should insist that banks incentivize swift and deep cuts in heat-trapping emissions to limit climate change harms and facilitate a just transition to a clean energy economy."

Mulvey was echoed by Ayana Elizabeth Johnson, co-founder of the Urban Ocean Lab and a lead signatory of the letter.

"To avoid the most dangerous levels of planetary warming, we must rapidly end our reliance on fossil fuels and transition to a clean energy economy that meets the needs of all communities," said Johnson. "Meanwhile, financial institutions like JPMorgan Chase are funding continued expansion of the fossil fuel industry, even as all the warning signs for our planet are flashing red."

Last week, data from the U.S. National Oceanic and Atmospheric Administration showed that annual emissions of carbon dioxide, methane, and nitrous oxide increased again in 2022, pushing atmospheric concentrations of the three main heat-trapping gases to all-time highs.

The Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency have made clear that increasing fossil fuel supply is incompatible with limiting global warming to 1.5°C above preindustrial levels, beyond which the planetary emergency's consequences will grow worse.

Roughly 1.1°C of warming since the late 1800s is already fueling increasingly frequent and intense extreme weather across the globe. In 2022, the U.S. alone experienced 18 separate billion-dollar disasters turbocharged by climate change, including droughts, wildfires, and hurricanes. Together, these events killed 474 people and cost an estimated $172 billion. Such catastrophes disproportionately hurt low-income populations in the U.S., and the deleterious public health and economic impacts of unmitigated greenhouse gas pollution are even more severe in poor nations that bear the least responsibility for the crisis.

"JPMorgan Chase and other financial institutions are... seeking to maintain a dangerous status quo that prioritizes profit over people and the environment."

After the IPCC released its latest assessment report last month, U.N. Secretary-General António Guterres said that limiting global warming to 1.5°C is possible, "but it will take a quantum leap in climate action," including a prohibition on approving and financing new coal, oil, and gas projects as well as a phaseout of existing fossil fuel production.

Despite ample evidence that burning more coal, oil, and gas will exacerbate the deadly effects of the climate crisis, profit-hungry fossil fuel corporations—supported by trillions of dollars in annual subsidies and industry-friendly public policies—are moving ahead with plans to expand drilling.

A pair of scholars recently introduced the novel legal theory of "climate homicide," which aims to hold fossil fuel corporations criminally liable for deaths caused by the disasters they are knowingly unleashing.

Johnson insisted Monday that like Big Oil, "big banks must be held accountable for their role in causing the climate crisis."

"Shareholders," she added, "should insist that banks accelerate and deepen investment in a just, clean energy future."

According to the letter: "JPMorgan Chase is an internationally known and respected bank. By ending support for fossil fuel expansion, it could help set the global stage for a just transition to a more sustainable and livable future while acting decisively to protect its shareholders and the wider economy from the financial shocks associated with worsening climate change."

"This is no less than what science requires to keep our planet a livable place for current and future generations, including our children and grandchildren," the letter continues. "Please use your vote at this year's shareholder meeting to help protect people and our planet from climate chaos."

As the fossil fuel-driven climate crisis continues to wreak havoc around the globe, more than 1,300 scientists and researchers on Monday published a letter imploring JPMorgan Chase shareholders to support a resolution that asks the financial giant's board of directors to "adopt a policy for a time-bound phaseout" of bankrolling new coal, oil, and gas projects.

The resolution in question is being proposed at the bank's annual meeting on May 16. If passed, "this resolution would encourage JPMorgan Chase to stop providing financing, including loans, bonds, and underwriting, to companies engaged in fossil fuel expansion," states the letter, which was led by prominent climate experts in partnership with the Union of Concerned Scientists (UCS) and Stop the Money Pipeline (STMP). "By making this commitment, JPMorgan Chase could signal its intention to advance the clean energy transition and help ensure a safer future for people and our planet."

Arielle Swernoff, U.S. Banks Campaign Manager at STMP, said in a statement that "the science is clear: in order to reduce emissions in line with the Paris agreement, fossil fuel expansion must stop now, yet JPMorgan Chase and other big banks like Citi, Wells Fargo, and Bank of America continue to pour money into new oil, gas, and coal."

"Big banks must be held accountable for their role in causing the climate crisis."

Despite pledging to put themselves and their clients on a path to "net-zero" greenhouse gas emissions, the world's 60 largest private banks pumped $4.6 trillion into coal, oil, and gas projects from 2016 to 2021. The four U.S. financial behemoths mentioned by Swernoff are responsible for a quarter of all fossil fuel financing identified since the Paris agreement entered into force. JPMorgan Chase alone provided more than $382 billion to coal, oil, and gas firms during the aforementioned six-year period, including $65.4 billion to the 20 corporations doing the most to ramp up the extraction of planet-heating fossil fuels.

"Over 1,300 scientists have come together to say: enough is enough," said Swernoff. "It's time for big banks to listen to the science and stop funding climate destruction."

Kathy Mulvey, director of the Climate Accountability Campaign at UCS, stressed that "as people around the world face climate-related extreme weather disasters, threats to public health, and systemic economic risk, big banks are choosing to ignore climate science by providing billions of dollars in financing to fossil fuel companies that continue to expand their production of oil and gas."

"JPMorgan Chase and other financial institutions are continuing to mislead shareholders about what is needed to reach global climate goals and instead seeking to maintain a dangerous status quo that prioritizes profit over people and the environment," said Mulvey. "To safeguard communities, investors, and the global economy, shareholders should insist that banks incentivize swift and deep cuts in heat-trapping emissions to limit climate change harms and facilitate a just transition to a clean energy economy."

Mulvey was echoed by Ayana Elizabeth Johnson, co-founder of the Urban Ocean Lab and a lead signatory of the letter.

"To avoid the most dangerous levels of planetary warming, we must rapidly end our reliance on fossil fuels and transition to a clean energy economy that meets the needs of all communities," said Johnson. "Meanwhile, financial institutions like JPMorgan Chase are funding continued expansion of the fossil fuel industry, even as all the warning signs for our planet are flashing red."

Last week, data from the U.S. National Oceanic and Atmospheric Administration showed that annual emissions of carbon dioxide, methane, and nitrous oxide increased again in 2022, pushing atmospheric concentrations of the three main heat-trapping gases to all-time highs.

The Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency have made clear that increasing fossil fuel supply is incompatible with limiting global warming to 1.5°C above preindustrial levels, beyond which the planetary emergency's consequences will grow worse.

Roughly 1.1°C of warming since the late 1800s is already fueling increasingly frequent and intense extreme weather across the globe. In 2022, the U.S. alone experienced 18 separate billion-dollar disasters turbocharged by climate change, including droughts, wildfires, and hurricanes. Together, these events killed 474 people and cost an estimated $172 billion. Such catastrophes disproportionately hurt low-income populations in the U.S., and the deleterious public health and economic impacts of unmitigated greenhouse gas pollution are even more severe in poor nations that bear the least responsibility for the crisis.

"JPMorgan Chase and other financial institutions are... seeking to maintain a dangerous status quo that prioritizes profit over people and the environment."

After the IPCC released its latest assessment report last month, U.N. Secretary-General António Guterres said that limiting global warming to 1.5°C is possible, "but it will take a quantum leap in climate action," including a prohibition on approving and financing new coal, oil, and gas projects as well as a phaseout of existing fossil fuel production.

Despite ample evidence that burning more coal, oil, and gas will exacerbate the deadly effects of the climate crisis, profit-hungry fossil fuel corporations—supported by trillions of dollars in annual subsidies and industry-friendly public policies—are moving ahead with plans to expand drilling.

A pair of scholars recently introduced the novel legal theory of "climate homicide," which aims to hold fossil fuel corporations criminally liable for deaths caused by the disasters they are knowingly unleashing.

Johnson insisted Monday that like Big Oil, "big banks must be held accountable for their role in causing the climate crisis."

"Shareholders," she added, "should insist that banks accelerate and deepen investment in a just, clean energy future."

According to the letter: "JPMorgan Chase is an internationally known and respected bank. By ending support for fossil fuel expansion, it could help set the global stage for a just transition to a more sustainable and livable future while acting decisively to protect its shareholders and the wider economy from the financial shocks associated with worsening climate change."

"This is no less than what science requires to keep our planet a livable place for current and future generations, including our children and grandchildren," the letter continues. "Please use your vote at this year's shareholder meeting to help protect people and our planet from climate chaos."