SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

A Balanced Budget Amendment (BBA), writes Kogan, "is a fundamentally unsound policy idea." (Photo: Bjorn Wylezich/Dreamstime)

Members of Congress have proposed almost a dozen constitutional amendments this year requiring a balanced budget, all of which share serious drawbacks. Rep. Ben McAdams introduced the latest balanced budget amendment (BBA), H.J. Res. 55, and it shows both that BBAs are fundamentally flawed and that attempts to fix them invariably don't succeed at doing that.

That's true mainly for five reasons:

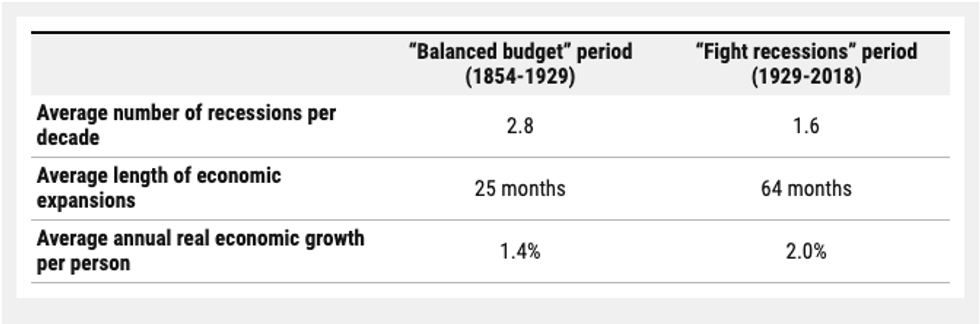

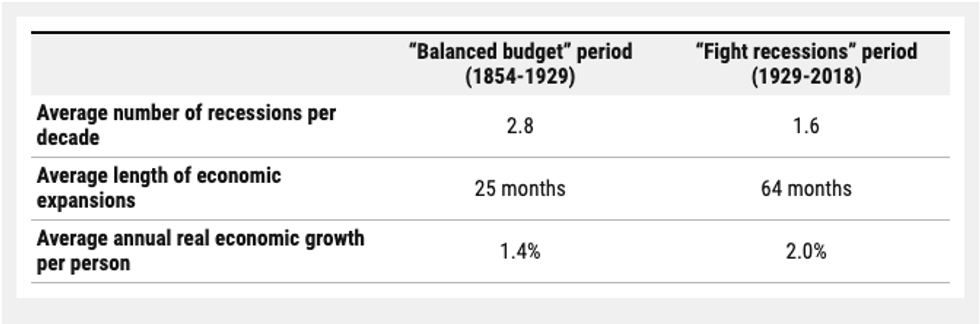

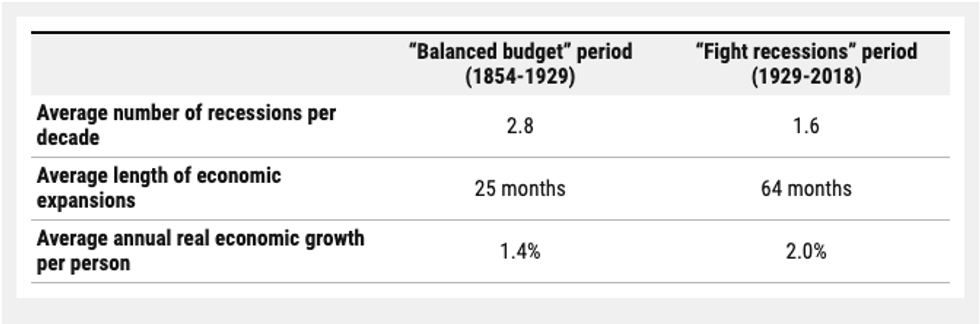

Before 1929, the budget was balanced or close to it in most years (except during major wars). From 1933 on, however, the federal government fought recessions by allowing deficits to grow when the economy was weak and then to shrink as it recovered. The latter approach worked better, with fewer recessions, longer expansions, and better growth, as the table shows:

H.J. Res. 55 acknowledges the problem but wouldn't fully solve it, and it would intensify the risk to other critical programs. It would exempt Social Security's trust fund and Medicare's Part A trust fund (which covers hospitalizations) from the balanced budget calculations. But that's only a partial solution; the FDIC, for instance, has almost $100 billion in reserves to protect checking and savings accounts against bank failures; H.J. Res. 55 would prohibit using those balances if that would throw the budget into deficit. Yet deposit insurance is needed most just when the economy is weakest and the budget is already in deficit.

Moreover, the Social Security and Medicare trust fund exclusions would put the rest of the budget in greater danger. Social Security and Medicare hospitalization are one-third of the budget. Suppose those two trust funds are in balance or surplus but the rest of the budget is not. A typical BBA, if it were in effect for next year, might then require an average cut of, say, 22 percent in all federal programs. But under H.J. Res 55, with Social Security and Medicare Part A protected, all remaining programs would face an average cut of 33 percent -- including Medicaid, SNAP (food stamps), Supplemental Security Income, unemployment insurance, assisted housing, national defense, veterans' benefits, law enforcement, education, and transportation.

A BBA is a fundamentally unsound policy idea. In its attempts to address its flaws, H.J. Res. 55 simply highlights that a BBA isn't fixable

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

Members of Congress have proposed almost a dozen constitutional amendments this year requiring a balanced budget, all of which share serious drawbacks. Rep. Ben McAdams introduced the latest balanced budget amendment (BBA), H.J. Res. 55, and it shows both that BBAs are fundamentally flawed and that attempts to fix them invariably don't succeed at doing that.

That's true mainly for five reasons:

Before 1929, the budget was balanced or close to it in most years (except during major wars). From 1933 on, however, the federal government fought recessions by allowing deficits to grow when the economy was weak and then to shrink as it recovered. The latter approach worked better, with fewer recessions, longer expansions, and better growth, as the table shows:

H.J. Res. 55 acknowledges the problem but wouldn't fully solve it, and it would intensify the risk to other critical programs. It would exempt Social Security's trust fund and Medicare's Part A trust fund (which covers hospitalizations) from the balanced budget calculations. But that's only a partial solution; the FDIC, for instance, has almost $100 billion in reserves to protect checking and savings accounts against bank failures; H.J. Res. 55 would prohibit using those balances if that would throw the budget into deficit. Yet deposit insurance is needed most just when the economy is weakest and the budget is already in deficit.

Moreover, the Social Security and Medicare trust fund exclusions would put the rest of the budget in greater danger. Social Security and Medicare hospitalization are one-third of the budget. Suppose those two trust funds are in balance or surplus but the rest of the budget is not. A typical BBA, if it were in effect for next year, might then require an average cut of, say, 22 percent in all federal programs. But under H.J. Res 55, with Social Security and Medicare Part A protected, all remaining programs would face an average cut of 33 percent -- including Medicaid, SNAP (food stamps), Supplemental Security Income, unemployment insurance, assisted housing, national defense, veterans' benefits, law enforcement, education, and transportation.

A BBA is a fundamentally unsound policy idea. In its attempts to address its flaws, H.J. Res. 55 simply highlights that a BBA isn't fixable

Members of Congress have proposed almost a dozen constitutional amendments this year requiring a balanced budget, all of which share serious drawbacks. Rep. Ben McAdams introduced the latest balanced budget amendment (BBA), H.J. Res. 55, and it shows both that BBAs are fundamentally flawed and that attempts to fix them invariably don't succeed at doing that.

That's true mainly for five reasons:

Before 1929, the budget was balanced or close to it in most years (except during major wars). From 1933 on, however, the federal government fought recessions by allowing deficits to grow when the economy was weak and then to shrink as it recovered. The latter approach worked better, with fewer recessions, longer expansions, and better growth, as the table shows:

H.J. Res. 55 acknowledges the problem but wouldn't fully solve it, and it would intensify the risk to other critical programs. It would exempt Social Security's trust fund and Medicare's Part A trust fund (which covers hospitalizations) from the balanced budget calculations. But that's only a partial solution; the FDIC, for instance, has almost $100 billion in reserves to protect checking and savings accounts against bank failures; H.J. Res. 55 would prohibit using those balances if that would throw the budget into deficit. Yet deposit insurance is needed most just when the economy is weakest and the budget is already in deficit.

Moreover, the Social Security and Medicare trust fund exclusions would put the rest of the budget in greater danger. Social Security and Medicare hospitalization are one-third of the budget. Suppose those two trust funds are in balance or surplus but the rest of the budget is not. A typical BBA, if it were in effect for next year, might then require an average cut of, say, 22 percent in all federal programs. But under H.J. Res 55, with Social Security and Medicare Part A protected, all remaining programs would face an average cut of 33 percent -- including Medicaid, SNAP (food stamps), Supplemental Security Income, unemployment insurance, assisted housing, national defense, veterans' benefits, law enforcement, education, and transportation.

A BBA is a fundamentally unsound policy idea. In its attempts to address its flaws, H.J. Res. 55 simply highlights that a BBA isn't fixable