How Worried Should We Be About the Stock Market's Recent Declines?

The stock market has taken a hit in the past few days, with concern over the Chinese economy driving a big selloff. How worried should we be? The short answer is: not very.

My assessment of the underlying health of the U.S. economy hasn't really changed over the past week, even as the stock market has declined pretty spectacularly in recent days. Why this equanimity?

The stock market has taken a hit in the past few days, with concern over the Chinese economy driving a big selloff. How worried should we be? The short answer is: not very.

My assessment of the underlying health of the U.S. economy hasn't really changed over the past week, even as the stock market has declined pretty spectacularly in recent days. Why this equanimity?

A couple of things. First, stock market movements significantly change the wealth of only a small sliver of the U.S. population. Roughly 90 percent of stocks are held by the wealthiest 10 percent of the population. This means that the spending power of the vast majority of American households isn't significantly affected by changes in stock prices.

Second, while stocks were pretty expensive in the past week, it doesn't seem to me that there was an obvious market-wide bubble that would mean these declines were inevitable and will be enduring. Yes, some sectors and stocks (tech and "sharing economy" stocks) do look awfully bubbly. But when graded on things like price/earnings ratios--especially given today's very low interest rates--the market overall looks expensive but not like an obvious bubble. What all this means is that recent stock market declines are most likely to redistribute wealth from today's stock owners to tomorrow's stock owners (who are buying up cheap stocks today).

All in all, the stock market is a terrible gauge of overall economy-wide health, so even large swings in it by themselves do not provide much of a signal for how to assess this broader health.

Of course, what about the root causes of the market's slide--fears over China's growth and fears that the Fed might raise interest rates soon? Do these developments mean we should worry about future growth? Yes, but we have known about these issues for a while and smart observers had already baked them into their assessment of the economy's health. Further, the fears over the Chinese slowdown's impact on the U.S. economy seem overblown to me. Yes, China is a large economy. But it's actually not the large a market for U.S. exports. Exports to China in 2014 were $123 billion. Let's say a combination of a Chinese growth slowdown and further Chinese depreciation of their currency cut these exports in half next year (a pretty extreme supposition)--this would cut 0.3 percent off of U.S. growth next year. Not nothing, but hardly enough to spur the kind of freak out we've seen in recent days. Note that this is a smaller effect than the drag that would be created if Congress fails to undo the spending caps in the Budget Control Act that will bind next year--and yet nobody would think a full-on stock market meltdown would be a reasonable response to that debate.

The Fed's actions are, of course, another matter. If the Fed begins the process of raising short-term interest rates this fall, it will be abandoning yet another policy tool they've used to boost growth in recent years (they stopped outright purchases of long-term bonds at the end of 2014). This despite the fact that unemployment remains elevated relative to pre-Great Recession levels, prime-age employment rates have recovered barely half of the fall they experienced during the recession and early recovery, wage growth has been stuck at an anemic 2-2.5 percent growth since the recovery began, and overall price inflation is coming in significantly lower than even the Fed's conservative 2 percent target.

A premature rate hike would be bad for the economy, and September is way premature. In fact, absent an absolute explosion of wage and employment growth, anytime in 2015 is premature.

Does the recent stock market decline make it more likely the Fed holds off? Probably not. The Fed really shouldn't be reacting to bad financial market days in setting interest rates. But, the Fed should hold off regardless. A September rate hike was a bad idea a week ago, and remains a bad idea today.

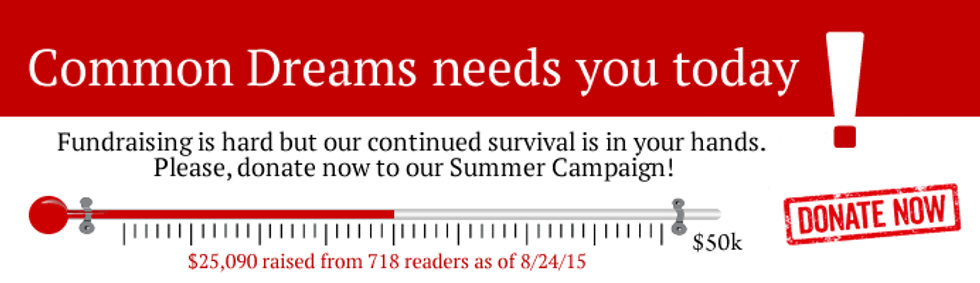

An Urgent Message From Our Co-Founder

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

The stock market has taken a hit in the past few days, with concern over the Chinese economy driving a big selloff. How worried should we be? The short answer is: not very.

My assessment of the underlying health of the U.S. economy hasn't really changed over the past week, even as the stock market has declined pretty spectacularly in recent days. Why this equanimity?

A couple of things. First, stock market movements significantly change the wealth of only a small sliver of the U.S. population. Roughly 90 percent of stocks are held by the wealthiest 10 percent of the population. This means that the spending power of the vast majority of American households isn't significantly affected by changes in stock prices.

Second, while stocks were pretty expensive in the past week, it doesn't seem to me that there was an obvious market-wide bubble that would mean these declines were inevitable and will be enduring. Yes, some sectors and stocks (tech and "sharing economy" stocks) do look awfully bubbly. But when graded on things like price/earnings ratios--especially given today's very low interest rates--the market overall looks expensive but not like an obvious bubble. What all this means is that recent stock market declines are most likely to redistribute wealth from today's stock owners to tomorrow's stock owners (who are buying up cheap stocks today).

All in all, the stock market is a terrible gauge of overall economy-wide health, so even large swings in it by themselves do not provide much of a signal for how to assess this broader health.

Of course, what about the root causes of the market's slide--fears over China's growth and fears that the Fed might raise interest rates soon? Do these developments mean we should worry about future growth? Yes, but we have known about these issues for a while and smart observers had already baked them into their assessment of the economy's health. Further, the fears over the Chinese slowdown's impact on the U.S. economy seem overblown to me. Yes, China is a large economy. But it's actually not the large a market for U.S. exports. Exports to China in 2014 were $123 billion. Let's say a combination of a Chinese growth slowdown and further Chinese depreciation of their currency cut these exports in half next year (a pretty extreme supposition)--this would cut 0.3 percent off of U.S. growth next year. Not nothing, but hardly enough to spur the kind of freak out we've seen in recent days. Note that this is a smaller effect than the drag that would be created if Congress fails to undo the spending caps in the Budget Control Act that will bind next year--and yet nobody would think a full-on stock market meltdown would be a reasonable response to that debate.

The Fed's actions are, of course, another matter. If the Fed begins the process of raising short-term interest rates this fall, it will be abandoning yet another policy tool they've used to boost growth in recent years (they stopped outright purchases of long-term bonds at the end of 2014). This despite the fact that unemployment remains elevated relative to pre-Great Recession levels, prime-age employment rates have recovered barely half of the fall they experienced during the recession and early recovery, wage growth has been stuck at an anemic 2-2.5 percent growth since the recovery began, and overall price inflation is coming in significantly lower than even the Fed's conservative 2 percent target.

A premature rate hike would be bad for the economy, and September is way premature. In fact, absent an absolute explosion of wage and employment growth, anytime in 2015 is premature.

Does the recent stock market decline make it more likely the Fed holds off? Probably not. The Fed really shouldn't be reacting to bad financial market days in setting interest rates. But, the Fed should hold off regardless. A September rate hike was a bad idea a week ago, and remains a bad idea today.

The stock market has taken a hit in the past few days, with concern over the Chinese economy driving a big selloff. How worried should we be? The short answer is: not very.

My assessment of the underlying health of the U.S. economy hasn't really changed over the past week, even as the stock market has declined pretty spectacularly in recent days. Why this equanimity?

A couple of things. First, stock market movements significantly change the wealth of only a small sliver of the U.S. population. Roughly 90 percent of stocks are held by the wealthiest 10 percent of the population. This means that the spending power of the vast majority of American households isn't significantly affected by changes in stock prices.

Second, while stocks were pretty expensive in the past week, it doesn't seem to me that there was an obvious market-wide bubble that would mean these declines were inevitable and will be enduring. Yes, some sectors and stocks (tech and "sharing economy" stocks) do look awfully bubbly. But when graded on things like price/earnings ratios--especially given today's very low interest rates--the market overall looks expensive but not like an obvious bubble. What all this means is that recent stock market declines are most likely to redistribute wealth from today's stock owners to tomorrow's stock owners (who are buying up cheap stocks today).

All in all, the stock market is a terrible gauge of overall economy-wide health, so even large swings in it by themselves do not provide much of a signal for how to assess this broader health.

Of course, what about the root causes of the market's slide--fears over China's growth and fears that the Fed might raise interest rates soon? Do these developments mean we should worry about future growth? Yes, but we have known about these issues for a while and smart observers had already baked them into their assessment of the economy's health. Further, the fears over the Chinese slowdown's impact on the U.S. economy seem overblown to me. Yes, China is a large economy. But it's actually not the large a market for U.S. exports. Exports to China in 2014 were $123 billion. Let's say a combination of a Chinese growth slowdown and further Chinese depreciation of their currency cut these exports in half next year (a pretty extreme supposition)--this would cut 0.3 percent off of U.S. growth next year. Not nothing, but hardly enough to spur the kind of freak out we've seen in recent days. Note that this is a smaller effect than the drag that would be created if Congress fails to undo the spending caps in the Budget Control Act that will bind next year--and yet nobody would think a full-on stock market meltdown would be a reasonable response to that debate.

The Fed's actions are, of course, another matter. If the Fed begins the process of raising short-term interest rates this fall, it will be abandoning yet another policy tool they've used to boost growth in recent years (they stopped outright purchases of long-term bonds at the end of 2014). This despite the fact that unemployment remains elevated relative to pre-Great Recession levels, prime-age employment rates have recovered barely half of the fall they experienced during the recession and early recovery, wage growth has been stuck at an anemic 2-2.5 percent growth since the recovery began, and overall price inflation is coming in significantly lower than even the Fed's conservative 2 percent target.

A premature rate hike would be bad for the economy, and September is way premature. In fact, absent an absolute explosion of wage and employment growth, anytime in 2015 is premature.

Does the recent stock market decline make it more likely the Fed holds off? Probably not. The Fed really shouldn't be reacting to bad financial market days in setting interest rates. But, the Fed should hold off regardless. A September rate hike was a bad idea a week ago, and remains a bad idea today.