SUBSCRIBE TO OUR FREE NEWSLETTER

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

5

#000000

#FFFFFF

To donate by check, phone, or other method, see our More Ways to Give page.

Daily news & progressive opinion—funded by the people, not the corporations—delivered straight to your inbox.

It would be strange for a news outlet to tell you that a story they're about to report isn't designed for a viewer like you. But maybe it'd be just as weird to pretend that it did mean something to you when it obviously does not.

It would be strange for a news outlet to tell you that a story they're about to report isn't designed for a viewer like you. But maybe it'd be just as weird to pretend that it did mean something to you when it obviously does not.

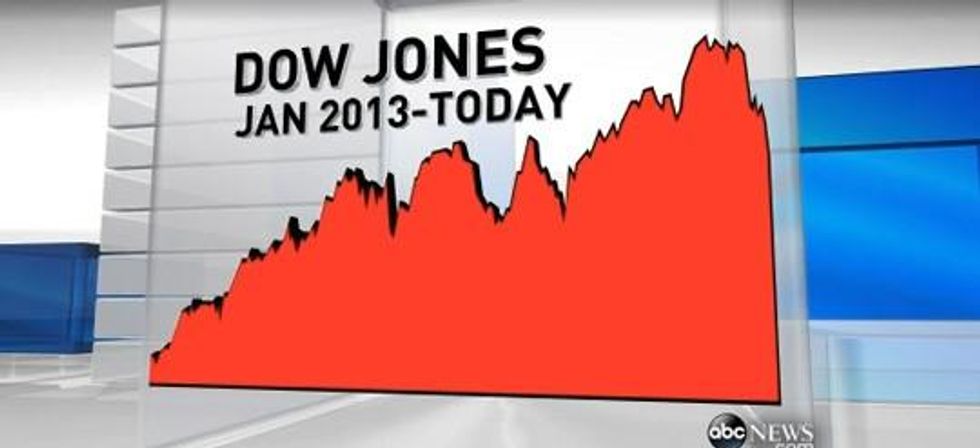

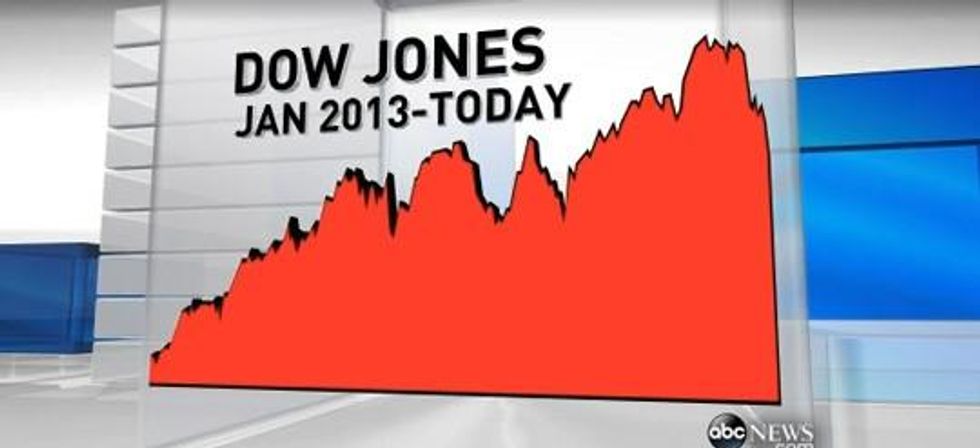

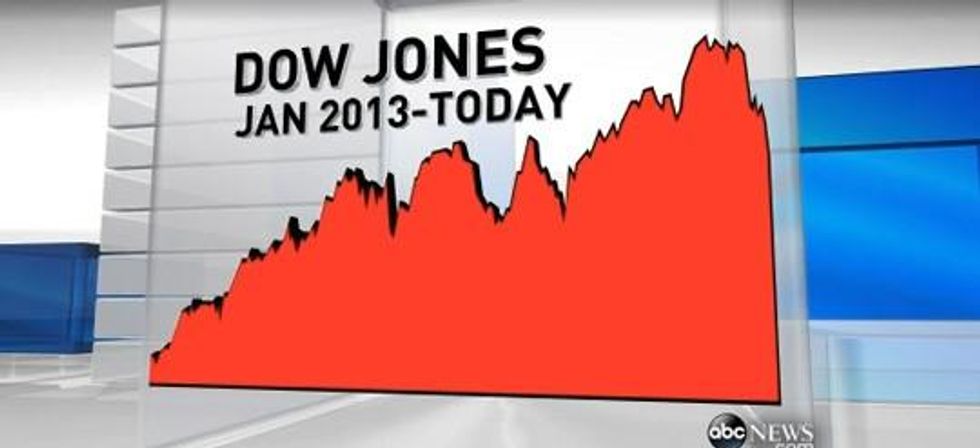

Take this ABC World News report (2/3/14) about the stock market. The news is that the market is down a little this year, after having a rather strong 2013. That in itself isn't all that revealing. But ABC had to try and make it seem like this matters to you, so they decided to adopt a favorite trick: What this is doing to your 401k retirement fund?

ABC business correspondent Rebecca Jarvis joined the show

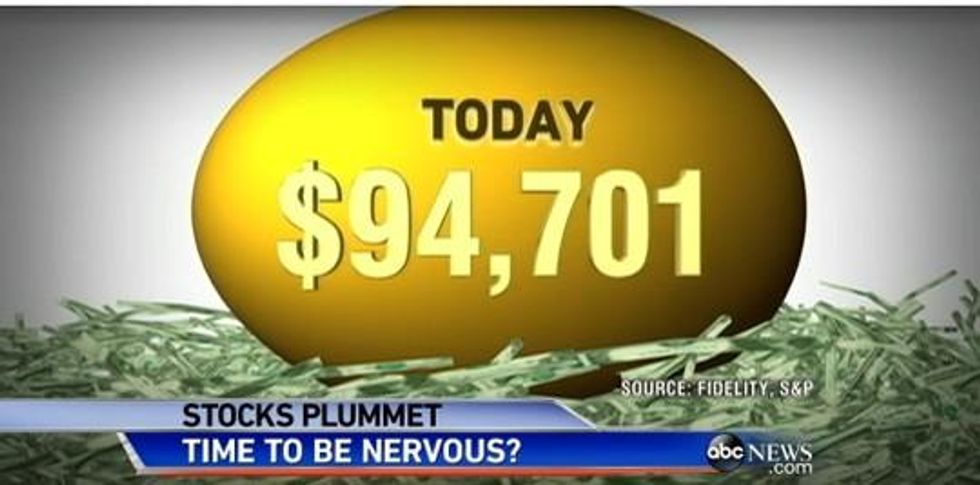

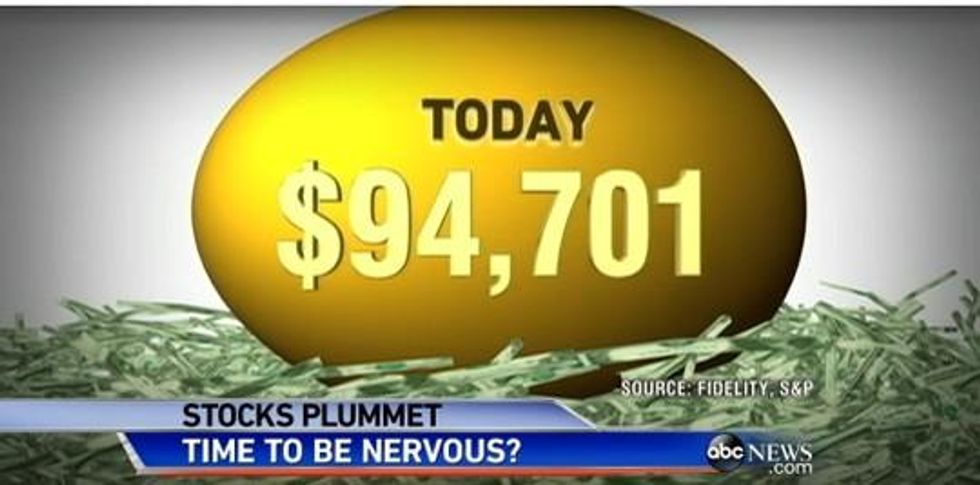

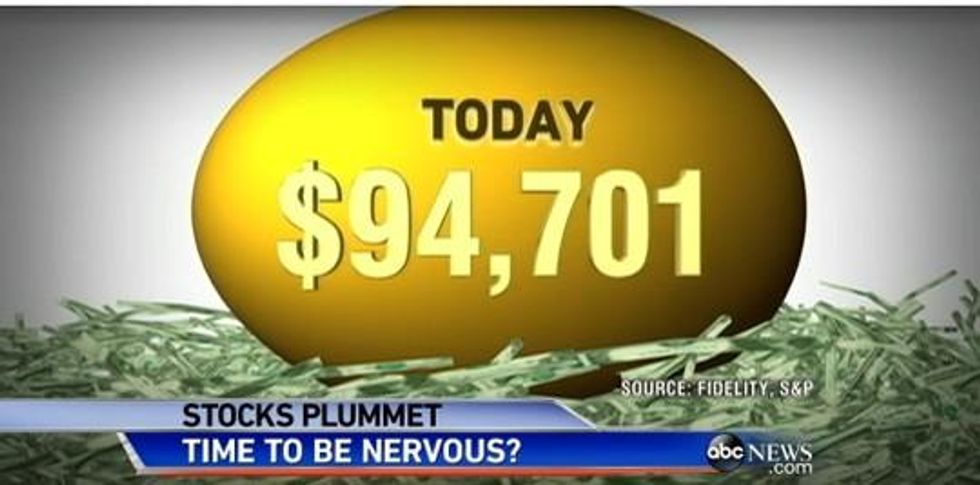

The average American family's 401 (k) hit hard. Now down as much as 5.8 percent this year. Which means that typical nest egg of over $100,000 has lost almost $6,000 in just is last month alone.

Besides stating the obvious-a 6 percent drop is about a 6 percent drop, it turns out-the real question is: Does this sound like a typical family's nest egg?

No. Most workers don't have a 401k at all, so hearing about a slight drop in the stock index means nothing to them. So ABC's "typical family" isn't so typical at all. But ABC has a hard time sorting out reality. The report references a retired couple watching the market-and because of the recent downturn, Jarvis explains, "now they join nearly 80 million boomers facing an uncertain future."

Is any of this typical? It wouldn't appear so. One estimate is that the median worker 10 years from retirement has saved about $12,000.

To make matters even more confusing, Jarvis closes the report by noting, accurately, that one down month hardly compares with the market's performance in 2013: "Last year, stocks were up record highs, up 30 percent for the year." That context is a bit like saying, "Never mind the rest of this report." So the news is that there's not much news for those who have retirement accounts. And for the majority of workers who have none of this? Well, who knows-maybe there'll be a story that relates to your life later on in the newscast.

Dear Common Dreams reader, The U.S. is on a fast track to authoritarianism like nothing I've ever seen. Meanwhile, corporate news outlets are utterly capitulating to Trump, twisting their coverage to avoid drawing his ire while lining up to stuff cash in his pockets. That's why I believe that Common Dreams is doing the best and most consequential reporting that we've ever done. Our small but mighty team is a progressive reporting powerhouse, covering the news every day that the corporate media never will. Our mission has always been simple: To inform. To inspire. And to ignite change for the common good. Now here's the key piece that I want all our readers to understand: None of this would be possible without your financial support. That's not just some fundraising cliche. It's the absolute and literal truth. We don't accept corporate advertising and never will. We don't have a paywall because we don't think people should be blocked from critical news based on their ability to pay. Everything we do is funded by the donations of readers like you. Will you donate now to help power the nonprofit, independent reporting of Common Dreams? Thank you for being a vital member of our community. Together, we can keep independent journalism alive when it’s needed most. - Craig Brown, Co-founder |

It would be strange for a news outlet to tell you that a story they're about to report isn't designed for a viewer like you. But maybe it'd be just as weird to pretend that it did mean something to you when it obviously does not.

Take this ABC World News report (2/3/14) about the stock market. The news is that the market is down a little this year, after having a rather strong 2013. That in itself isn't all that revealing. But ABC had to try and make it seem like this matters to you, so they decided to adopt a favorite trick: What this is doing to your 401k retirement fund?

ABC business correspondent Rebecca Jarvis joined the show

The average American family's 401 (k) hit hard. Now down as much as 5.8 percent this year. Which means that typical nest egg of over $100,000 has lost almost $6,000 in just is last month alone.

Besides stating the obvious-a 6 percent drop is about a 6 percent drop, it turns out-the real question is: Does this sound like a typical family's nest egg?

No. Most workers don't have a 401k at all, so hearing about a slight drop in the stock index means nothing to them. So ABC's "typical family" isn't so typical at all. But ABC has a hard time sorting out reality. The report references a retired couple watching the market-and because of the recent downturn, Jarvis explains, "now they join nearly 80 million boomers facing an uncertain future."

Is any of this typical? It wouldn't appear so. One estimate is that the median worker 10 years from retirement has saved about $12,000.

To make matters even more confusing, Jarvis closes the report by noting, accurately, that one down month hardly compares with the market's performance in 2013: "Last year, stocks were up record highs, up 30 percent for the year." That context is a bit like saying, "Never mind the rest of this report." So the news is that there's not much news for those who have retirement accounts. And for the majority of workers who have none of this? Well, who knows-maybe there'll be a story that relates to your life later on in the newscast.

It would be strange for a news outlet to tell you that a story they're about to report isn't designed for a viewer like you. But maybe it'd be just as weird to pretend that it did mean something to you when it obviously does not.

Take this ABC World News report (2/3/14) about the stock market. The news is that the market is down a little this year, after having a rather strong 2013. That in itself isn't all that revealing. But ABC had to try and make it seem like this matters to you, so they decided to adopt a favorite trick: What this is doing to your 401k retirement fund?

ABC business correspondent Rebecca Jarvis joined the show

The average American family's 401 (k) hit hard. Now down as much as 5.8 percent this year. Which means that typical nest egg of over $100,000 has lost almost $6,000 in just is last month alone.

Besides stating the obvious-a 6 percent drop is about a 6 percent drop, it turns out-the real question is: Does this sound like a typical family's nest egg?

No. Most workers don't have a 401k at all, so hearing about a slight drop in the stock index means nothing to them. So ABC's "typical family" isn't so typical at all. But ABC has a hard time sorting out reality. The report references a retired couple watching the market-and because of the recent downturn, Jarvis explains, "now they join nearly 80 million boomers facing an uncertain future."

Is any of this typical? It wouldn't appear so. One estimate is that the median worker 10 years from retirement has saved about $12,000.

To make matters even more confusing, Jarvis closes the report by noting, accurately, that one down month hardly compares with the market's performance in 2013: "Last year, stocks were up record highs, up 30 percent for the year." That context is a bit like saying, "Never mind the rest of this report." So the news is that there's not much news for those who have retirement accounts. And for the majority of workers who have none of this? Well, who knows-maybe there'll be a story that relates to your life later on in the newscast.